© 2024 Blaze Media LLC. All rights reserved.

As someone who never had my heart in the GOP’s tax plan, I have no reason to defend the tax bill. Spending, health care, regulations, market distortions, entitlements, immigration, judicial tyranny, and national security are much more important at this point than taxes, and we will never fix the tax code under the current progressive system anyway.

Moreover, the original House bill actually raised taxes on some people and the GOP has already screwed up the messaging on the entire effort.

Nonetheless, I’m not going to pile on by joining with the lying brigades that somehow suggest this Senate bill raises taxes on the poor or middle income. This is a dastardly lie and is transparently refuted by simple arithmetic.

The first rule any consumer of media reporting on tax policy must understand is that in the parlance of the sanctimonious elites, “a tax cut is a handout and a handout is a tax cut.” Or, put another way, elimination of a handout is theft and elimination of theft is a handout. Finally, not giving more entitlement subsidies in the tax code is tantamount to raising taxes.

With these rules in mind, it’s easy to cut through the hot air behind the phony numbers and statistics touted by left-wing groups.

The great health care lie that is getting mixed into tax policy

The most pervasive hit against the tax bill, buttressed by a CBO report, is that the plan will massively raise taxes on families earning less than $30,000.

Now, any thinking person should immediately ask: How could any family at that level be paying federal income taxes on net anyway? The answer is, “They don’t,” and even more people will be exempt under the bill because of the doubling of the standard deduction.

The CBO is dishonestly conflating its voodoo health care analysis with tax rates. It’s asserting that because of the repeal of the individual mandate, a provision in the broader tax bill, lower-income earners will pay more for insurance. This is transparently inaccurate for many reasons.

Number one, the CBO conflates welfare subsidies with tax rates. Even if it would be true that they’d receive fewer subsidies for insurance, it’s dishonest to call that a “tax increase,” especially when they are actually getting a tax cut under this bill.

Second, the families are not receiving less in subsidy money. The CBO is merely projecting that by not forcing people to purchase insurance, some will voluntarily not purchase it and will, by definition, no longer receive a handout.

But of course, if they want to purchase it, they will still get 100 percent of it covered at that income level. Frankly, this is in part what is driving the erratic price inflation that causes people who are not getting handouts to pay $2,000-plus in monthly premiums. But who cares about those people? We already know that the CBO believes everything that promotes Obamacare will lower prices and repealing it will raise prices.

How prices already jumped from $450 to over $2,000 while doing everything they suggest would lower prices remains a big mystery.

$75,000 income earners with $200,000 income lifestyles

Next are those contending that because this bill gets rid of some itemized deductions (although not nearly as many important ones as the House bill), particularly the deduction for state and local taxes, middle-income families will see a tax increase.

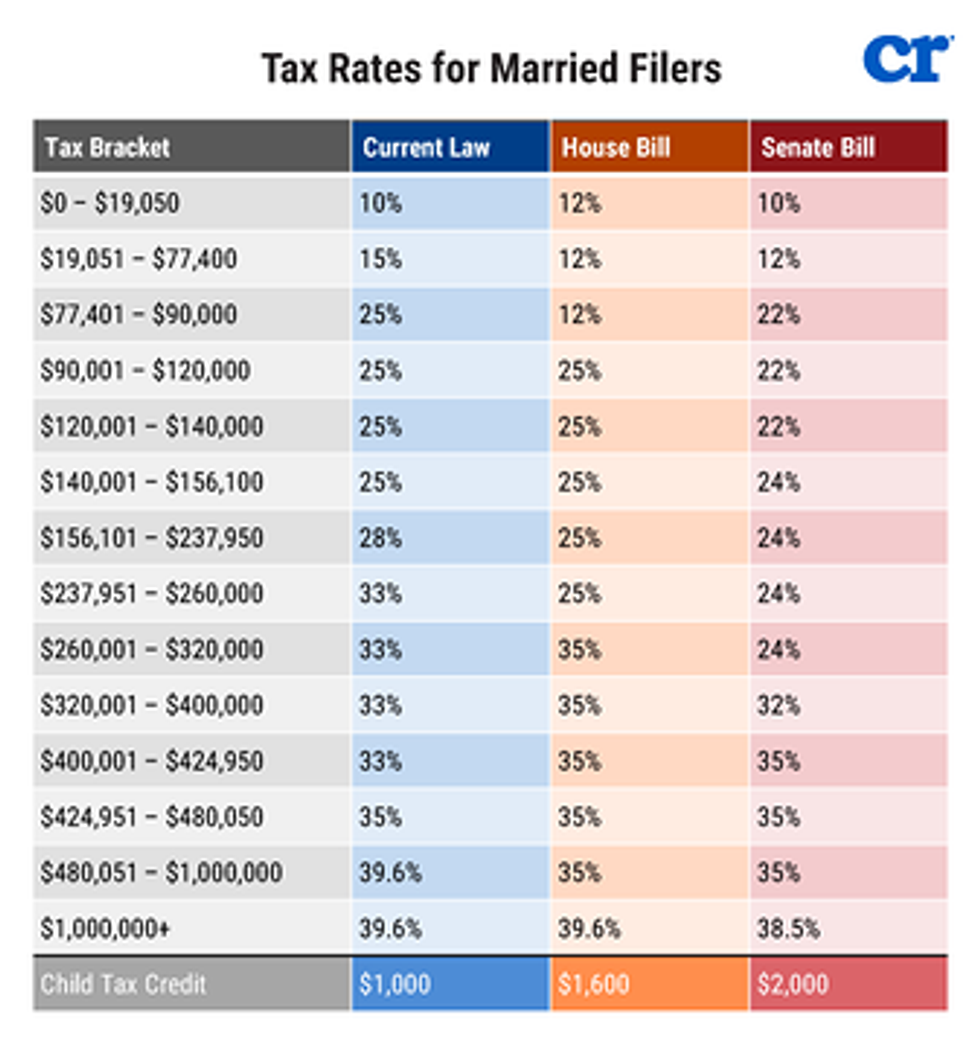

I was a very vocal critic of the House version precisely because the rate cuts were not deep enough to offset the elimination of deductions. But critics of the Senate bill are wrong because the Senate bill cuts the rates even deeper and doubles the child tax credit.

Also, to the extent elimination of deductions would result in a net tax increase, it would be for upper-middle income families who have larger homes, a bigger state-tax liability, and can give more charity — not those earning $40,000-$90,000, as this chart from the NYT suggests.

But even those families will clearly receive a tax cut under the revised Senate version (many of them a substantial one because they are already not eligible for the personal exemption but would now get the full expanded child tax credit plus lower rates). A typical family of four earning between $150,000 and $200,000 will easily net $2,000-$4,000 under this bill.

First, anyone with children will clearly come out ahead. Remember, in the current 15 percent tax bracket (the bracket opponents of the bill are saying would get hit), the personal exemption, which is eliminated under this bill, is only worth about $600 per person, whereas the expansion of the child tax credit is worth $1,000.

Between the lowered marginal rate and the doubling of the standard deduction to $24,000, there is no way itemized deductions at this income level (and the lifestyle it could sustain) would be substantial enough to cancel out the tax cut.

What about those who don’t have dependents or are empty-nesters but still own a home and itemize their deductions? Obviously, the cut will be less for them, but the chart from the NYT makes no sense, as it suggests a substantial number of families earning between $40-$90,000 would see a tax increase of up to $2,000 a year.

Barring anomalous circumstances, it’s hard to imagine families at this income level accruing so many itemized deductions. Even those in high-tax, high-priced areas should come out ahead, because, by definition, it’s hard for people at that income level to sustain such a liability to begin with.

Sure, many people in New York and California have high SALT and mortgage interest, but most of them would be earning more than this income range. All but the most insane tax jurisdictions should benefit.

I asked one of the authors of the NYT article on Twitter how people in that income range could lose out under the bill. He responded that one example from the Census data they pulled would work out as follows:

Here's one example pulled from the data: Married couple, one child, $75k AGI. Take $33k in deductions: $7k SALT, $10k MID, $7k charitable, some others. Lose personal exemption, gain $1k CTC. Nets out to +$650 in taxes in 2018.

— Ben Casselman (@bencasselman) November 28, 2017

This example proves my point; 33k worth of deductions is associated more with family income of $150,000-$200,000. Then again, that income level will benefit from the substantial rate cut. For those earning less than $75,000, it is hard to see how one has so much charity and mortgage interest on their tax return.

Yes, I personally try to tithe and know many others who do. But the reality is that the level of charity given by those in that income bracket is less than half the amount in this hypothetical example.

Also, the sum of 10k for the mortgage interest deduction is highly unusual for that income level, especially with today’s interest rates. According to the Tax Foundation, the average mortgage interest deduction for families earning below $75,000 is in the ballpark of $5,000.

Bottom line: There is a tremendous amount of room to deviate far from the average on charity and housing and still come out ahead under this tax plan.

Yes, if someone in the 50k-100k range utilizes deductions and lives a lifestyle of someone earning 200-300k, then he might come out slightly behind. And yes, I would have rather the bill cut spending and cut rates even deeper. But if we all officially agree on the need to lower rates and flatten deductions, we can’t account for every anomalous circumstance that benefits from the current system.

My criticism of the House bill was that it wasn’t only anomalous tax returns that would lose out but many families who owned homes in even slightly above-average cost-of-living areas.

“Unless you give me a permanent tax cut it must be a tax increase”

The next myth is that many people will see a tax increase by 2027. This is ridiculous on its face because, yes, the tax cuts expire after 2025.

Again, I’d rather they cut spending and pay for a permanent tax cut on the individual side. But it’s better to get some tax cut. Plus, history has shown that tax cuts will never be allowed to expire on people at the income level the Left is focused on. Sure, they will soak the rich, but we have all become progressives anyway and don’t care about that.

According to the Joint Committee on Taxation, 20 percent of all those earning more than $1 million will see a tax increase under this bill already by 2019. And unlike its estimates with lower income, there are no health care subsidy gimmicks in that equation. The Bush tax cuts were set to expire in 2010 but were extended for the bottom 99 percent.

So, if the entire focus is on lower-income or lower-middle to middle-income families – with no regard to broader fairness and economic growth for everyone – there is absolutely no truth to the claim that they will see a tax increase.

Common Core math is clouding simple arithmetic

Finally, there is the age-old deception being peddled that most of the benefits of the tax cut are going to the wealthy. This is how progressivity begets progressivity. It’s sort of like Common Core math.

Say one individual pays $1 million in taxes every year. Another individual pays just $100 in taxes a year. Even if we give the low-income earner a larger tax cut of 10 percent instead of 5 percent, which has always been the case under GOP tax proposals, the dollar amount of the cut will be infinitesimal compared to the cut for the high-income earner.

The problem is that our political class uses the progressive system as if it is a natural baseline without any regard for the fact that the wealthy are already paying almost all of the taxes. There isn’t much to cut for those below a certain income until and unless we cut the hidden taxes of regulations (which are born by all consumers and are quite regressive).

What are we to do? Give more handouts in the tax code? The reality is that most families earning below $40,000 pay no income tax and many receive enough refundable credits to zero out or dramatically diminish their payroll tax liability, too. And yet, they still receive the same Social Security benefits as if they paid the full FICA. Plus, many get health insurance fully paid for, along with many other programs.

Can anyone really make a serious argument that we need to add more means-tested programs to the tax code? This is why, although I support Sens. Mike Lee, R-Utah, and Marco Rubio, R-Fla., in their effort to expand the child tax credit, I oppose the fact that they take it to such an extreme that they want to make the full extension completely refundable as a handout to those who don’t have a positive tax liability.

Either we believe in property rights or we believe in socialism. We most certainly shouldn’t exacerbate the existing unconstitutional system.

Overall, this is not the bill I would have written. Conservatives would cut spending, repeal Obamacare, and offer deeper and more certain and permanent cuts so that everyone would unquestionably be better off. I would never have adopted the “chained CPI” for bracket creep. But it is dishonest to say that the Senate bill is worse than current law when in fact most families would see several thousand dollars in savings.

It’s dishonest for people who don’t give a darn about the deficit when it comes to spending and health care to suddenly find budget religion when it comes time to allow people to keep the fruits of their labor.

Let’s FIGHT BACK together …

… against the mainstream media's biased reporting, selective facts, and outright propaganda. Sign up now for the daily dose of sunlight you need to disinfect the media's lies. It's free!

Want to leave a tip?

We answer to you. Help keep our content free of advertisers and big tech censorship by leaving a tip today.

Want to join the conversation?

Already a subscriber?

Blaze Podcast Host

Daniel Horowitz is the host of “Conservative Review with Daniel Horowitz” and a senior editor for Blaze News.

RMConservative

more stories

Sign up for the Blaze newsletter

By signing up, you agree to our Privacy Policy and Terms of Use, and agree to receive content that may sometimes include advertisements. You may opt out at any time.

© 2024 Blaze Media LLC. All rights reserved.

Get the stories that matter most delivered directly to your inbox.

By signing up, you agree to our Privacy Policy and Terms of Use, and agree to receive content that may sometimes include advertisements. You may opt out at any time.