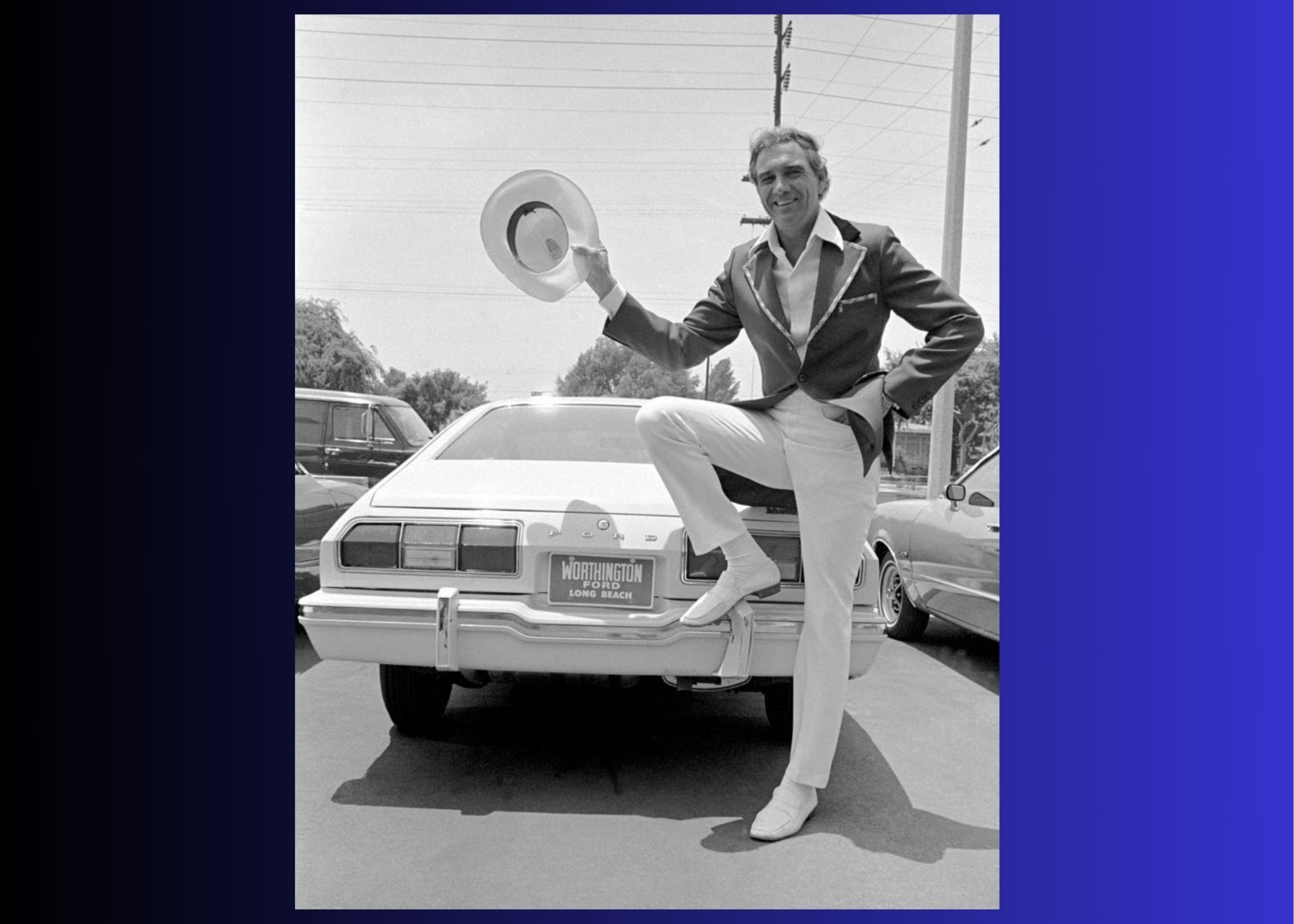

Why used cars are getting so expensive — and what you can do about it

The dream of driving off in an affordable used car is slipping away fast.

If you’ve been browsing used car lots or checking online listings, you’ve likely noticed prices are climbing rapidly. According to Cox Automotive’s Manheim Used Vehicle Value Index, wholesale used car prices in April 2025 hit their highest level since October 2023, with the index surging 4.9% year over year to 208.2.

Even older cars are commanding higher prices, as buyers focus on value over low mileage.

That’s a 2.7% jump from March alone, far exceeding the typical 0.2% monthly increase.

Surge ahead

What’s driving this price surge? A combination of new auto tariffs, shrinking supply, and changing consumer behavior is shaking up the used car market.

The main trigger is a 25% tariff on new imported vehicles and parts, introduced in April 2025, which is impacting the entire auto industry.

While these tariffs don’t directly affect used cars, they’re pushing new car prices — averaging $48,000 — out of reach for many buyers. As a result, more Americans are turning to the used market, where prices average around $25,000.

Cox projects retail used car sales will reach 20.1 million in 2025, a 1.2% increase from 2024, partly due to consumers shifting to used vehicles. April’s retail sales were up 13% year over year, despite a 1.7% dip from March, showing strong demand for used cars.

This increased demand has dealers competing fiercely at wholesale auctions to stock their lots. As Cox Automotive’s Jeremy Robb, senior director of economic and industry insights, explains, “The ‘spring bounce’ usually ends by mid-April, but this year, wholesale appreciation trends continued for the entire month and were much stronger than we typically observe.”

The result is clear: Wholesale prices are soaring, and retail prices are following, with used car listings up 2% in just four weeks.

Price hikes

Let’s look at what this means for your budget. According to iSeeCars.com, the average used car now costs $31,400, a $317 increase from last month.

Their analysts calculated the potential impact of further price hikes on popular models: A 10% increase could add $1,700 to a Kia Forte or $5,000 to a Chevy Tahoe.

That’s a significant burden for families already dealing with inflation and high interest rates. ISeeCars.com compares this to the pandemic, when used car prices rose 8.95% in eight months due to supply chain issues.

Supply shortages are worsening the situation. A key issue is the decline in off-lease vehicles returning to the market. Many lessees are buying out their leases instead of returning their cars, leaving dealers with fewer vehicles to sell.

Higher mileage

Cox reports that wholesale inventory in April was at 41 days’ supply, down from 46 days a year ago. To fill the gap, dealers are selling higher-mileage vehicles — cars with over 90,000 miles are now common, as modern engineering allows vehicles to last up to 250,000 miles.

This means even older cars are commanding higher prices, as buyers focus on value over low mileage. Tariffs are cutting into new car margins, so dealers are raising prices across the board — used cars included. The data confirm this, creating a tough environment for bargain hunters.

Electric slide

One segment is avoiding this price surge: electric vehicles, or EVs.

While gas-powered used cars see steady price increases, used EV prices dropped by $3,865 year over year.

One reason for this exception is that used car buyers tend to prioritize cost-efficiency over environmental goals, reducing demand for EVs despite their increased presence on dealer lots. EVs made up 3.4% of Manheim’s auction sales in April. For EV enthusiasts, this could be an opportunity to find a deal, but for most buyers, the used car market is increasingly expensive.

Looking ahead, the future is uncertain. Cox economists predict a volatile summer, with high prices and interest rates possibly slowing sales. However, slower sales could lead to dealer incentives, which might boost demand again.

ISeeCars.com analysts are cautious, noting that even auto industry leaders like Elon Musk are avoiding firm predictions in this unpredictable market. One thing is certain: With limited supply and strong demand, used car prices are unlikely to drop soon. Cox expects less depreciation than usual in the second quarter, so buyers should prepare for higher costs.

Plan ahead

For those shopping for a used car, strategic planning is essential.

Consider less popular models or EVs to avoid the steepest price increases. Timing can also help — waiting for potential dealer incentives later this year might save money.

However, the low prices of a few years ago are unlikely to return. The Conference Board Consumer Confidence Index fell 8.4% in April, reaching its lowest level since 2009, as concerns about inflation and rising costs grow.

With gas prices down 13% year over year but still fluctuating, and inflation expectations rising to 6.7%, buyers are rushing to secure deals before prices climb further. This urgency is driving the price surge, with tariffs adding to the pressure.

The used car market in 2025 is a challenging landscape, shaped by tariffs, supply shortages, and shifting consumer priorities. Whether you’re looking for a reliable sedan or a rugged SUV, expect to pay more — and plan carefully. By staying informed and choosing wisely, you can still find value amid all the rising prices.