Private equity’s losing streak is coming for your 401(k)

One of the late comedian George Carlin’s most famous rants gave us the line, "It's a big club ... and you ain't in it.” That sentiment rings especially true when it comes to the financial services industry, where wealthy investors and insiders gatekeep the most lucrative opportunities for themselves and their friends.

So what should you think when they suddenly want to let you in?

The private equity party is a bit dim right now, and that’s why they are sending out more invitations. Be careful before you RSVP.

There's no red flag bigger than when someone wants to let you in on something very exclusive — especially if it’s from people who’ve spent decades keeping you out of the club.

Case in point: the private equity industry’s latest push to open its funds to everyday retail investors.

The private equity world is one I know well, as a recovering investment banker who works with a firm to evaluate deals. My husband also worked in the sector. Like any other industry, it has both good and bad players.

Private equity involves deploying capital to buy ownership stakes in private companies, distinct from equity invested through the public markets in publicly traded companies. These firms are often actively involved with the company, as opposed to the more passive investing in public market companies. Their stakes are typically substantial, often including majority ownership.

The good players in private equity provide capital, professionalization of businesses, governance, business insights, and capital for growth. They may reward employees with an ownership stake to align incentives.

Some private equity players, however, focus on financialization — that is, playing around with the capital structure of a company and not adding a lot of value otherwise. Private equity is rife with examples of firms that have ruined businesses with too much leverage and engaged in a variety of greedy — and often, outright abhorrent — behaviors.

But this latest trend isn’t about good firms versus bad firms. It’s about the broader industry’s poor performance — and desperation.

The returns are drying up

Private equity has a problem. Too much money has flooded the space in recent years, driving up valuations and pushing down returns. Funds are struggling to find new investors to cover their high management fees. So now they’re turning to you.

They aren’t suddenly being generous. They’re just trying to survive.

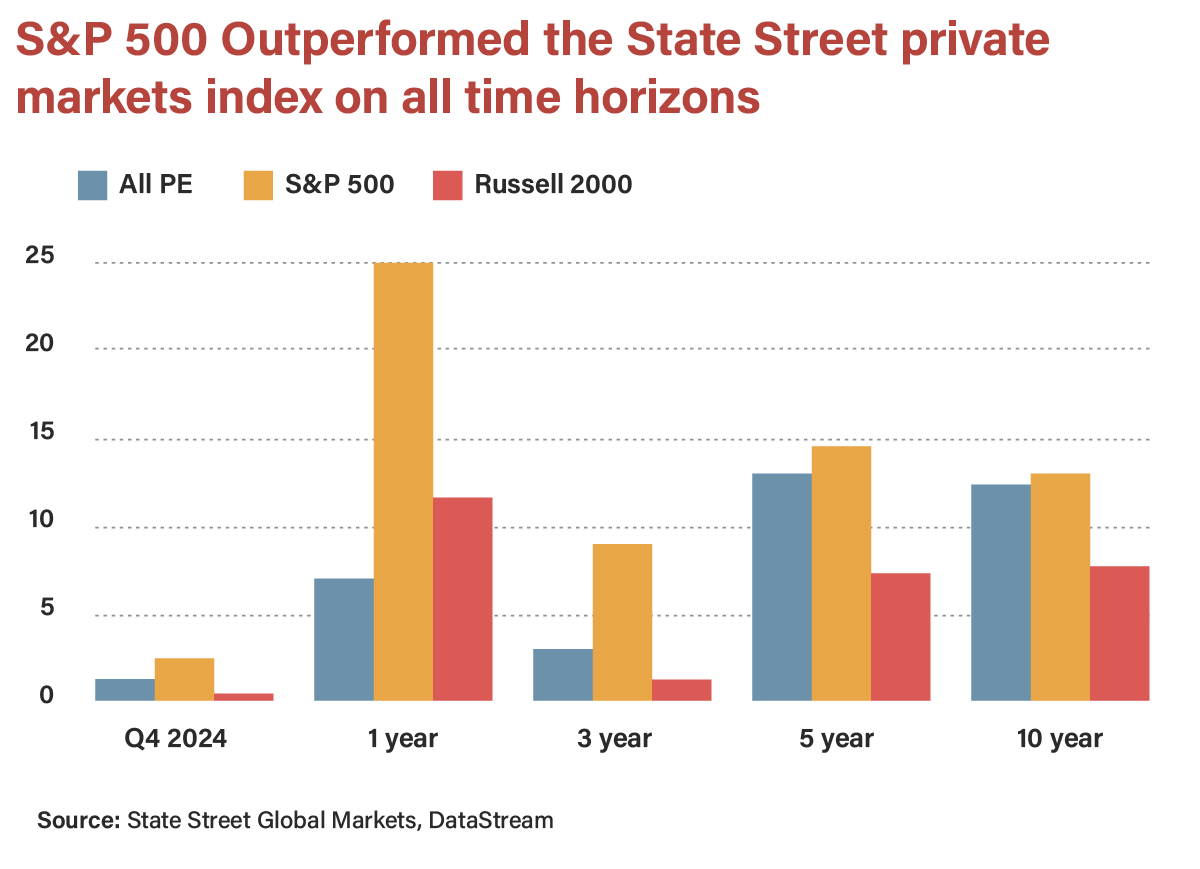

According to the Financial Times, a major private market index has underperformed the S&P 500 over the past one-, three-, five-, and 10-year periods. Any outperformance was skewed toward earlier years — and even then, it came with significantly higher fees and far less liquidity.

This underperformance comes with heavy fees and a lack of liquidity for your investment. It's not a coincidence that you are seeing private equity opening up to retail now when it is struggling from deal competition, higher valuations, higher capital costs, and slower deal exits.

RELATED: Red states get it: Economic freedom beats blue-state gimmicks

Speaking of slower exits, the Wall Street Journal noted that “private equity remains the biggest fee generator for the broader Wall Street ecosystem of banks and advisers” and that private equity firms are sitting on a record number of companies that they are waiting to exit — that is, sell and record a profit ... or a loss. Longer hold times for private equity firms mean they are not returning capital to their investors, and, in turn, the investors are not reinvesting in the latest and greatest fund.

Whether it’s the new push to allow private investments into your 401(k) or your financial planner calling you with “new, exciting alternative investment opportunities,” please be appropriately skeptical. Always probe a fund’s track record (especially over the past several years), fee structure, and whether it is a fit for your objectives and goals.

The private equity party is a bit dim right now, and that’s why they are sending out more invitations. Be careful before you RSVP.

Photo by Kent Nishimura/Bloomberg via Getty Images

Photo by Kent Nishimura/Bloomberg via Getty Images