Trump’s SEC pick would blow up Biden’s lawless financial agenda

The media’s narrative has done its job. Many Americans now see Donald J. Trump not as a reformer but as a symbol of corruption. That perception is both dishonest and deeply misleading.

The reality? The first 100 days of Trump’s second term leave no doubt about his goal: to reform and remake the federal government.

Reform should mean growing the economy, not growing the bureaucracy.

It’s about time. Too many unelected bureaucrats accountable to no one infest the federal government like roaches, wielding unchecked power over our lives, liberty, and happiness. They treat the mandate for reform as a nuisance. Their mission: obstruct Trump’s appointees and protect the status quo.

Organizations like the U.S. Agency for International Development and the Voice of America have deservedly drawn the president’s attention. But many others deserve the same scrutiny. One that stands out is the Securities and Exchange Commission, which repeatedly overstepped its authority during the Biden years, using vague regulatory powers to impose sweeping social mandates under the guise of financial oversight.

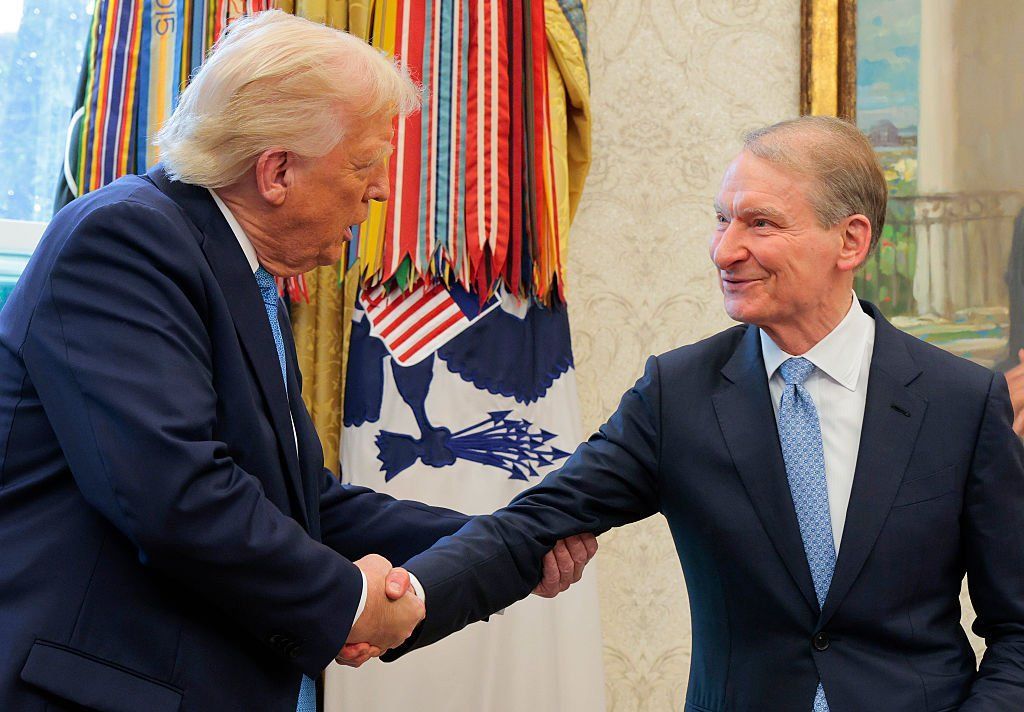

Trump tapped former SEC Commissioner Paul Atkins to fix it. As chairman, Atkins can be counted on to take a best-practices approach to administrative responsibilities and to ensure that the SEC conducts its mission as described by the law: “facilitate capital formation; maintain fair, orderly, and efficient markets; and protect investors.”

That’s a welcome clarification of responsibility. Gary Gensler, who ran the SEC for Joe Biden, was often accused of having a reach that exceeded legitimate bounds, as when, for example, he tried to regulate the market for precious metals.

Gold and silver are not securities. Neither are individual retirement accounts. Yet the Gensler-era SEC attempted to assert authority over companies offering precious-metals IRAs to individuals and families who wish to own gold and silver.

As the Heritage Foundation’s David Burton told the House Financial Services Committee in March 2024, “The commission is statutorily required to promote efficiency, competition, and capital formation by responsible participants in the capital markets.” Still, under the Biden administration, “it increasingly does the opposite.”

John Gulliver of the Committee on Capital Markets Regulation told the same committee that Gensler’s SEC had “an unprecedented rulemaking agenda that will radically redesign the regulation of our securities markets and will have a major impact on the cost of being a public company and investing in our markets.”

RELATED: DOGE isn’t dead — it’s growing beyond Elon Musk

Atkins can and must guide the SEC away from such nonsense. As CEO of Patomak Global Partners, Atkins oversaw the development of best practices for managing digital assets. Congress should follow his lead wherever it may go, solidifying his reforms into law and preventing the agency from trying to regulate financial instruments that are not securities.

The overreach matters. The United States is in a race with China for cryptocurrency dominance. The winner gets to establish the terms under which everyone else must live. It’s no surprise that the SEC’s failure to establish what Burton called “basic rules for responsible actors to follow” undermines America’s ability to take the lead.

“I am not entirely sure whether this irresponsible failure to provide basic rules is a function of the limited understanding of those charged with regulating in this area or their desire to simply have no rules so that the commission can engage in regulation by enforcement,” Burton told the committee.

Regulation by enforcement doesn’t just stifle innovation — it cripples the economy. It may also violate new limits the U.S. Supreme Court just imposed on federal agencies in Loper Bright Enterprises v. Raimondo, which ended the Chevron deference doctrine.

But Atkins can’t fix the SEC alone. Congress must step in and rewrite the law to bar the commission from using backdoor tactics to seize authority over emerging markets and financial technologies.

If lawmakers fail, they’ll guarantee a future where financial technology innovation gets strangled in red tape while real fraudsters skate by untouched. That’s bad news not just for entrepreneurs, but for America’s investors — roughly half the population — who rely on strong markets to secure their retirements.

Reform should mean growing the economy, not growing the bureaucracy. With Atkins at the helm, the SEC finally has a chance to get back to doing what it was meant to do.

Prepper Bar

Prepper Bar Biden's executive order gives away the left’s objective. It says digital currency has 'profound implications for ... the ability to exercise human rights; financial inclusion and equity; and energy demand.'

Biden's executive order gives away the left’s objective. It says digital currency has 'profound implications for ... the ability to exercise human rights; financial inclusion and equity; and energy demand.'