![]()

Many assume conservative principles belong to the past. They don’t. The debate over cryptocurrency regulation — including the House GOP’s Clarity Act — offers a chance to apply those principles to a 21st-century frontier.

Cryptocurrency and decentralized finance reflect core American values: free speech, free markets, and innovation from the ground up. Across the country, developers are building protocols that move money in microseconds, create new investment tools, and expand access to capital like never before.

With a Republican-led Congress considering landmark cryptocurrency legislation, we have a historic opportunity to apply time-tested conservative values to the cutting edge of financial innovation.

Blockchain technology provides a means to secure property rights in the digital era. The most transformative products likely haven’t even launched yet.

The potential benefits are massive. In 2024 alone, decentralized finance grew to more than $114 billion. Even more capital — billions of dollars — stands ready to enter the space through pension funds and institutional investors.

But that money won’t move without guardrails.

Institutional investors need transparency. That means audit requirements they can trust, legally accountable custodians, clear reporting on asset health, and safeguards against manipulation.

They also need legal certainty. Defined rules give investors confidence. Without them, they’ll stay away — or invest elsewhere.

That’s where Washington plays a role.

The Trump administration shifted U.S. regulatory policy toward digital assets, elevating crypto to a national priority through executive order. Now, with a Republican-led Congress weighing landmark crypto legislation, conservatives have a real opportunity.

This moment demands more than slogans. It calls for applying time-tested conservative principles — rule of law, market discipline, and individual liberty — to the future of finance.

Don’t be afraid

Some treat cryptocurrency as a threat. Fair enough — the collapse of FTX still casts a long shadow over the current debate in Congress.

Sam Bankman-Fried, a Democratic megadonor, didn’t just run a failed company. He ran a cautionary tale — a playbook for what lawmakers must never allow again.

The FTX scandal highlights two enduring conservative truths:

- Human nature is flawed. Left unchecked, individuals will act out of greed and self-interest. Conservatives have never pretended otherwise — and that’s why we build systems of accountability.

- The rule of law matters. Pre-established standards prevent chaos. Waiting for disaster or making policy on the fly only magnifies the damage.

FTX didn’t collapse because of cryptocurrency. It failed because no one held Bankman-Fried accountable. He amassed influence through backroom politics and ran a tangled network of private firms without meaningful oversight. The result: billions vaporized and public trust shattered.

Thoughtful legislation can prevent the next meltdown — not by stifling innovation, but by setting clear, enforceable rules rooted in transparency, responsibility, and the rule of law.

A remedy with room to improve

The bill now before Congress offers a rare chance to get crypto regulation right.

It tackles the custodial vulnerabilities exposed by the FTX collapse and establishes a framework that allows digital asset projects to integrate into the broader financial system. Just as important, it does so under a unified set of rules.

The bill follows conservative logic. It exempts infrastructure providers — such as blockchain validators and payment processors — from regulatory burdens that don’t apply. These actors don’t make governance decisions, and the law should reflect that.

It also classifies participants based on their actions, rather than the extent of their political influence.

But the bill still needs one critical fix.

Lawmakers need to include decentralized autonomous organizations as eligible cryptocurrency issuers. These DAOs, the opposite of central banks, operate through user-led governance. Crypto users vote on the rules of the system they help create.

DAOs have become common in decentralized finance. Yet the current bill overlooks them. That omission could block the very groups driving innovation from entering the regulated space.

RELATED: Trump’s Bitcoin masterstroke puts America ahead in digital assets

![]() Photo by Anna Moneymaker/Getty Images

Photo by Anna Moneymaker/Getty Images

If a project follows the rules, discloses information, and acts responsibly, it should qualify, regardless of how it governs itself. Whether the issuer is a DAO, a startup, or a traditional bank, one standard should apply.

That’s the conservative way: equal rules, fair enforcement, and space for innovation to thrive.

What if we get it wrong?

Leaving the bill unamended carries real risks:

- Overreaching compliance rules could smother the best of American innovation — now and in the future.

- Narrow legal definitions might force decentralized finance into the hands of a few massive exchanges, recreating the same “too big to fail” system that burned taxpayers in 2008.

- Ongoing regulatory ambiguity could drive developers and infrastructure providers offshore, into the arms of authoritarian regimes eager to benefit from America’s hesitation.

The biggest danger? Watching capital and talent flee to countries that welcome decentralized commerce while the United States — its origin point — falls behind.

Decentralized finance leaders aren’t calling for lawlessness. They want smart policy.

Joe Sticco, co-founder of Cryptex and a White House Crypto Summit participant, put it this way: “In DeFi, it’s not about evading rules — it’s about building better ones.”

Sticco believes today’s innovators want a seat at the table. “We believe open financial systems can coexist with responsible oversight,” he told me. “We have to show up, we have to explain the tech, and we have to help shape the rules.”

Congress still has time to get this right. But the window is closing.

The path forward

Republicans now hold both chambers of Congress. That means the window to act is wide open.

This isn’t about growing government. It’s about setting the rules so innovation can thrive, fraud gets stopped, and people are held accountable. Here's what that looks like:

- Clear rules that apply fairly to both traditional companies and decentralized projects;

- Basic protections like audits, secure custody of funds, and anti-fraud measures;

- Freedom for developers to build new tools without unfair roadblocks;

- And clear standards for when crypto projects are considered stable enough to ease up on oversight.

With these fixes, the Clarity Act can do what no other crypto bill has: protect investors, promote innovation, and keep America in the lead.

We can build the future of finance right here — on American terms, with American values. But we have to act now.

subodhsathe via iStock/Getty Images

subodhsathe via iStock/Getty Images

Photo by Anna Moneymaker/Getty Images

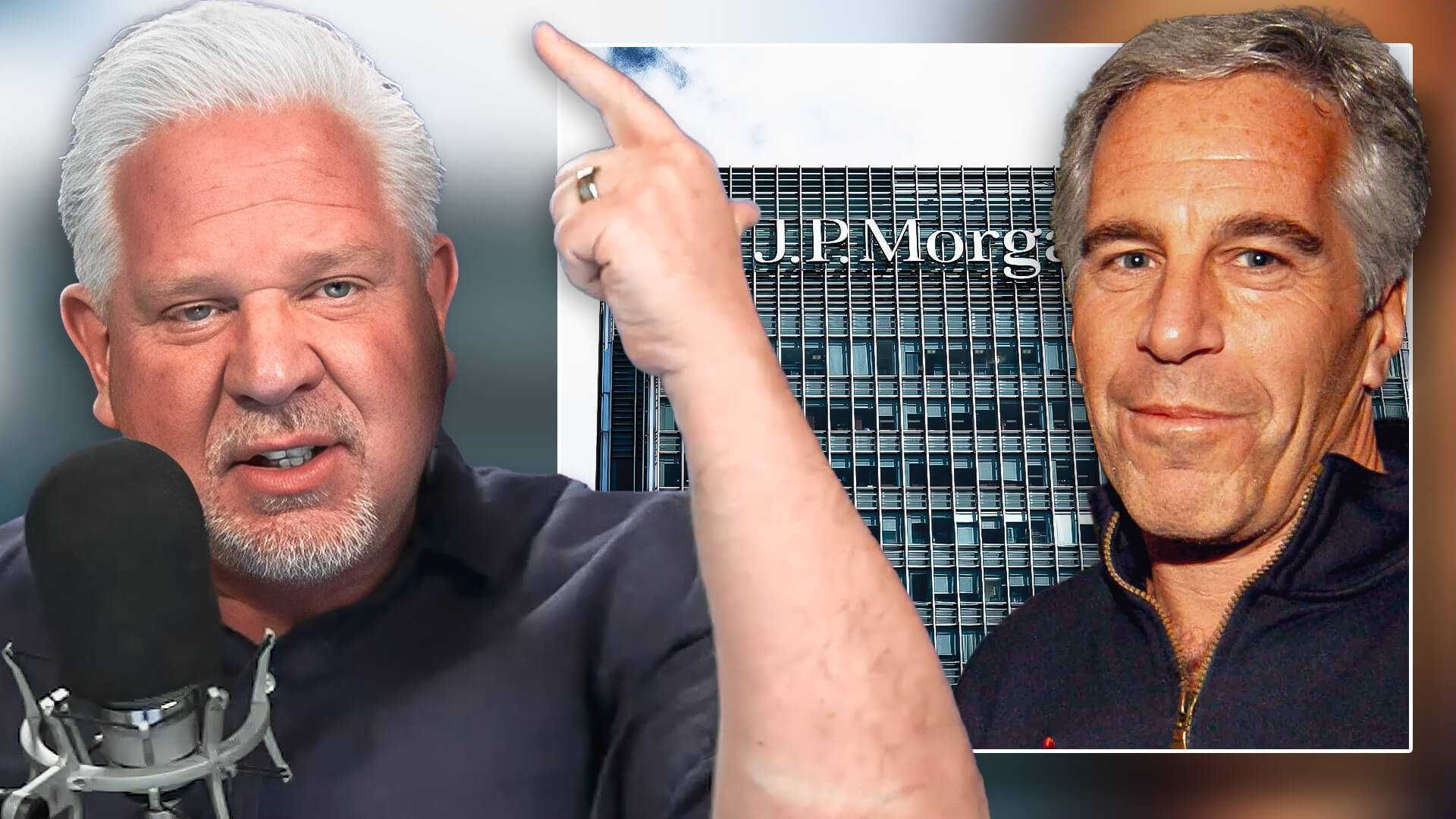

Photo by Anna Moneymaker/Getty Images The banking industry is attempting to take programs from Indiana's state treasurer because he works to protect Christians and conservatives.

The banking industry is attempting to take programs from Indiana's state treasurer because he works to protect Christians and conservatives. Indiana's treasurer helped push banks to back down on canceling conservatives, and now a banker-backed bill would strip his office's powers.

Indiana's treasurer helped push banks to back down on canceling conservatives, and now a banker-backed bill would strip his office's powers.

After President Trump publicly called out Bank of America’s CEO, the company strenuously denies it has ever refused service to Americans who disagree with Democrats.

After President Trump publicly called out Bank of America’s CEO, the company strenuously denies it has ever refused service to Americans who disagree with Democrats.