![]()

I did not arrive at this argument as a theorist or as a commentator looking for a clever angle. I arrived at it through the wreckage of 2020.

After I investigated the November 2020 election in Arizona and Nevada, the Department of Justice subpoenaed me. In February 2023, I spent six and a half hours testifying before a federal grand jury in Washington, D.C. That experience did not change my political outlook. It changed my sense of how exposed the country has become — and how unwilling key institutions have been to confront the exposure directly.

Do Americans still govern themselves, or do we merely perform self-government while hostile forces — foreign and domestic — shape outcomes behind a screen?

The debate returned with new urgency this week. The Washington Post reported Thursday that election integrity activists are urging the Trump administration to issue an executive order on elections. It’s about time. Executive action has become the only plausible instrument for a rapid national response, because the states have entrenched incentives to resist meaningful reform and foreign enemies have worked diligently to undermine and defeat us.

For anyone with eyes to see, war has come. It has not arrived in the form Americans expect when they hear the word. It does not always appear wearing uniforms, wielding declarations, or mobilizing divisions. It arrives through political warfare, cyber capabilities, influence operations, and domestic agitation. It arrives through a border that stops functioning, a culture that stops teaching civic loyalty, and an election system that produces outcomes a large share of the country considers illegitimate.

A global conflict now runs through the heart of America’s public life. Communist China and other hostile regimes mean the destruction of the United States, and they pursue that goal with patience, strategy, and resources.

Alongside that global conflict, a domestic conflict has hardened into something close to open civil war, with one side committed to sovereignty, law, and national continuity, and the other side increasingly willing to use institutional leverage, street agitation, and demographic transformation to break the existing order.

This domestic conflict matters for a practical reason: It makes free and fair elections difficult if not impossible to conduct in 2026 and 2028 absent radical steps to secure them.

Can America have a fair election in 2026?

Three fronts define the challenge. First, the United States must conduct elections that Americans can recognize as legitimate. Second, Immigration and Customs Enforcement must regain the ability to deport the millions of illegal aliens who entered the country during the Biden years, despite organized resistance. Third, foreign enemies must be denied the ability to wage war on America through cyber sabotage, influence operations, and electoral interference.

These fronts converge on one question: Do Americans still govern themselves, or do we merely perform self-government while hostile forces — foreign and domestic — shape outcomes behind a screen?

Start with elections, because everything else depends on them.

Self-government requires two things that cannot be faked. First, a border defines citizenship. Second, an election defines consent.

A republic cannot survive without both. Yet Americans now live under conditions that invite doubt about each: a border that failed catastrophically, and an election system that many citizens no longer trust.

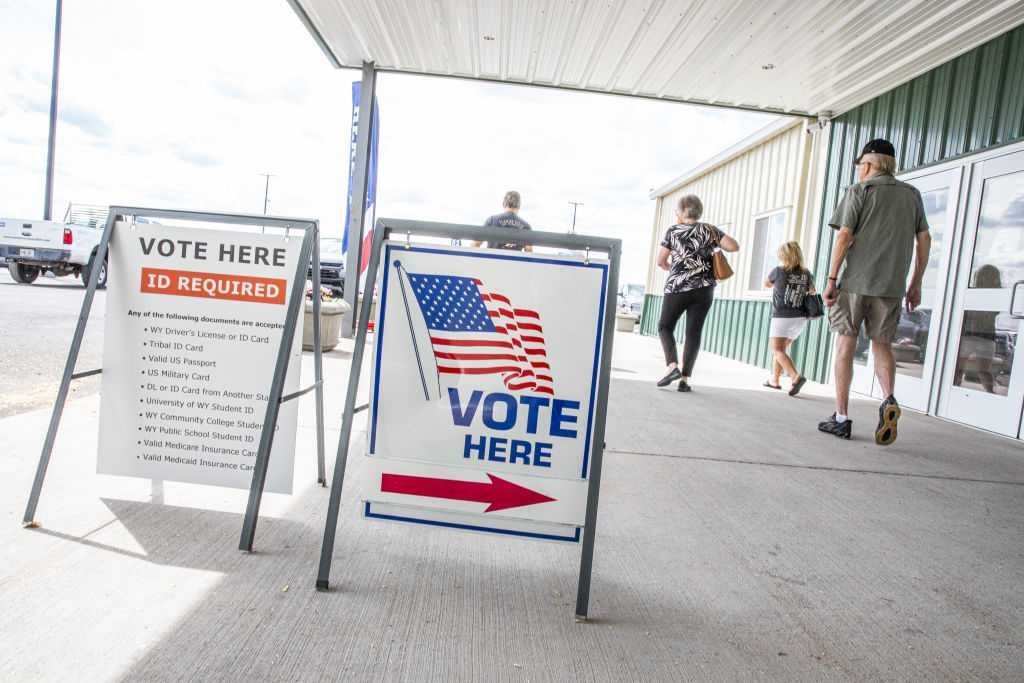

Fair elections demand friction. They demand procedures that annoy activists and frustrate bureaucrats. They demand a system that ordinary citizens can understand. A voter should show identification, vote on a paper ballot, and watch that ballot be counted by human beings under observation by other human beings.

Perfection will never exist. The point is not perfection. The point is transparency, auditability, and public confidence grounded in procedures citizens can see and grasp.

For most of American history, paper ballots provided that confidence. Americans knew what happened in the counting room because the counting room did not function like a proprietary black box. Election modernizers sold the country a different idea: Computers make things fast, efficient, and secure. The experience of the last decade, culminating in 2020, has left that promise in ruins.

RELATED: ‘Dead on arrival’: Chuck Schumer says Dems will ‘go all out’ to defeat voter ID bill

![]() Photo by Bill Clark/CQ Roll Call/Getty Images

Photo by Bill Clark/CQ Roll Call/Getty Images

A massive intelligence failure

Since November 2020, the corporate legacy media has insisted that the U.S. election system operates as “absolutely secure” and that widespread fraud does not exist. That claim collides with common sense.

The vast majority of Americans now vote through an election ecosystem built on machines, scanners, tabulators, centralized databases, and software layers that few officials can explain and fewer citizens can independently audit. This ecosystem does not eliminate fraud. It relocates fraud into places the public cannot easily see.

Electronic voting systems invite manipulation because they rely on computers. Computers obey code. Code gets written, altered, updated, patched, and maintained by people with incentives, biases, and vulnerabilities. Any system dependent on code and opaque tabulation invites distrust — and it invites actors with resources to exploit it.

Hardware alone raises the first national security issue. Election machines rely on electronic components manufactured in communist China or Taiwan. China is an enemy nation. A hostile regime’s manufacturing ecosystem should not sit inside critical infrastructure, and elections sit at the heart of critical infrastructure. When Americans hear that the parts driving their voting system originate in China, many react with disbelief. That reaction is rational.

Software raises a second issue. Major election technology has been developed, maintained, or designed across foreign jurisdictions — Venezuela, Canada, Serbia — with American developers in the mix. Even when parts of that reporting prove disputed or exaggerated in public debate, the broader fact remains: A modern electronic election system creates a sprawling supply chain of hardware and software dependencies that pushes election integrity far outside the direct control of any voter, precinct worker, or local official.

An enemy regime does not need to ‘flip votes’ to win. It can accomplish its goals by shredding trust, delegitimizing outcomes, and pushing Americans toward internal conflict.

Ownership and investment raise a third issue. The purchase and financing structures surrounding major election vendors have generated persistent public questions, including questions about foreign investment exposure and the presence of overseas investors with legal obligations to their own regimes. The press largely refused to investigate those questions in any serious way after 2020. Instead, it treated the questions themselves as illegitimate — which encouraged distrust rather than resolving it.

How did such systems enter American elections in the first place?

The answer points to intelligence and counterintelligence failure.

Modern warfare is not limited to bombs and bullets. Modern warfare includes political warfare, cyber operations, influence campaigns, and the exploitation of social fractures. Any hostile regime with the ability to damage American legitimacy has an interest in doing so. An enemy regime does not need to “flip votes” to win. It can accomplish its goals by shredding trust, delegitimizing outcomes, and pushing Americans toward internal conflict.

U.S. counterintelligence should treat election seasons as high-value windows for hostile activity, because elections present the most valuable target in American political life. Yet the United States behaved as if such threats belonged in the realm of conspiracy rather than standard national-security planning.

Warnings existed before 2020. HBO’s 2020 documentary “Kill Chain: The Cyber War on America’s Elections,” produced primarily in 2019 by Finnish computer programmer and documentarian Harri Hursti, laid out vulnerabilities in electronic voting systems.

The film included Senators Elizabeth Warren (D-Mass.), Amy Klobuchar (D-Minn.), and Ron Wyden (D-Ore.), each of whom criticized election technology and raised concerns about trust, auditability, and system integrity. The documentary’s premise focused on the fear that Russia would steal the election for Donald Trump. In other words, prominent Democrats publicly argued that electronic systems could not be trusted — right up until those arguments became politically inconvenient.

The documentary’s partisan framing does not matter. The underlying point does: A computer-based system can be manipulated, and the mere possibility of manipulation creates a legitimacy crisis for any contested outcome. A republic cannot function when half the country believes the outcome was engineered by an opaque system.

The ‘most secure election’ canard

So did the 2020 election turn on electronic manipulation?

Many Americans concluded that it did, and they did so because 2020 produced anomalies too glaring to ignore. Yet a thorough federal investigation never followed.

The federal government had rightful authority to investigate election-system vulnerabilities. The FBI could have pursued fraud and foreign interference. The DHS, through its Cybersecurity and Infrastructure Security Agency, treated election systems as critical infrastructure. Yet a week after the election — during a national outcry over procedures, chain of custody, observation access, and statistical anomalies — CISA Director Chris Krebs declared 2020 “the most secure election in American history.” Even granting him good faith, that claim outpaced what any official could responsibly know so soon.

Other institutions looked away. Attorney General Bill Barr declined to pursue serious claims. Trump’s White House lawyers and advisers, even those acting in good faith, lacked the expertise and institutional leverage needed to conduct a forensic inquiry across multiple states with complex systems. Many figures around Trump seemed unwilling to risk their careers or reputations on a fight that would trigger institutional retaliation. Conventional thinking did the rest: Americans struggle to imagine a national election stolen in plain sight, so they default to official assurances.

That vacuum created a predictable outcome: Private citizens stepped in.

Some acted from patriotic concern for the republic and a desire to find the truth. Others took advantage of the crisis. Some appeared to function as disinformation agents — whether knowingly or not — by flooding the public with claims so sensational that they discredited serious inquiry. The “satellite” stories and overseas melodrama that circulated after 2020 served that function. They distracted from real questions and gave the establishment an easy excuse to dismiss anyone demanding transparency as a crank.

RELATED: 3 debunked Democrat claims about the SAVE America Act

![]() Photo by Michael M. Santiago/Getty Images

Photo by Michael M. Santiago/Getty Images

Private efforts did surface real issues, and three of those deserve attention because they remain unresolved and because they point to reforms that do not depend on proving any single theory about 2020.

First, Americans learned how foreign-linked, opaque, computer-based voting systems had become standard. Citizens do not need a technical degree to grasp the problem. A system that depends on foreign supply chains, foreign-linked software development, and proprietary tabulation cannot command broad public trust. That fact alone constitutes a crisis for a republic.

Second, the 2020 election demonstrated how mail voting can be exploited at scale. Universal mail ballots moved through broken voter rolls, weak chain-of-custody practices, and uneven signature verification. COVID became an excuse for suspending or weakening procedures that existed for a reason: they protect legitimacy.

Clark County, Nevada, offers an example. Under normal settings, its signature-verification system rejected large numbers of ballots. Election officials reportedly lowered the resolution settings, contrary to accepted procedures, until nearly any signature could pass. That decision converted signature verification into a formality. Officials then treated this relaxation as a practical necessity. Citizens experienced it as a violation of the rules.

Third, private investigators in several states identified batches of paper ballots that did not match standard stock or standard folding patterns consistent with mailed ballots. Ballots that arrive flat, unfolded, and printed on different paper invite suspicion of outside mass printing. Even when officials insist on benign explanations, the failure to address the optics and the forensics with urgency undermines trust.

Taken together, these issues required an information campaign to persuade Americans that 2020 was conducted fairly. That campaign did not succeed. Large numbers of Americans believed the election was stolen or unfair. The Biden administration governed under a cloud of contested legitimacy, and the country absorbed four years of anger, cynicism, and institutional fracture.

That experience leads to a basic conclusion: An election system that requires a nationwide propaganda effort to sustain credibility is not a healthy system.

‘Too big to rig’

A common retort now surfaces: If the system was rigged in 2020, how could Trump possibly have won in 2024?

Two explanations fit what Americans saw.

First, a second theft risked systemic crisis. The country watched what happened after 2020. Many Americans believed the election had been stolen. They watched the anger. They watched the institutional crackdown. A repeat in 2024 could have produced a political breakdown that would have paralyzed governance across the country. Even actors with capacity to manipulate outcomes would have had to consider the consequences.

Americans should not have to live in a state of permanent suspicion, asking whether unseen forces fought over tabulation pipelines and database integrity.

Second, unprecedented monitoring and deterrence efforts likely raised the costs of misconduct. Trump predicted a victory “too big to rig.” That line became a strategy: Overwhelm the system with turnout, recruit and train observers, litigate in advance, pressure states for reforms, and limit the number of ballots floating through the mail. Even if 2020 did not turn on cyber manipulation, the mere perception that it might have done so forced new defensive measures in 2024.

Either way, the central point stands: Americans should not have to live in a state of permanent suspicion, asking whether unseen forces fought over tabulation pipelines and database integrity. A free people deserves an election system that does not invite that question.

The Constitution assumes a union of one people with a functioning constitutional order. That assumption is now strained. Progressive states increasingly treat federal authority as illegitimate on immigration and law enforcement. Elected officials in California, Illinois, New York, Washington, Oregon, and other states have signaled hostility toward the Trump government and toward the idea of enforcing border sovereignty. Those attitudes bleed into election administration, because election administration has become another front in political warfare.

Congress has taken partial steps. The Safeguard American Voter Eligibility Act, requiring proof of citizenship, and the Make Elections Great Again Act, mandating voter ID, move in the right direction. Yet those steps do not remove the core vulnerability: electronic voting systems and electronic tabulation.

A system without electronics removes entire classes of risk. It also restores something modern reformers discount: visible legitimacy.

RELATED: Running out the clock won’t save the majority

![]() stuartmiles99 via iStock/Getty Images

stuartmiles99 via iStock/Getty Images

A common-sense proposal

The country needs a clean national standard for federal elections: paper ballots, Election Day voting, transparent counting, and credible oversight.

Congress could impose such a standard. Congress likely will not, at least not in time for 2026. That reality pushes attention toward executive action.

One option is direct and blunt: The president should prohibit electronic voting machines and electronic tabulation in federal elections, invoking national security and foreign-interference risk.

President Trump already recognized the danger of foreign interference. Executive Order 13848, issued Sept. 12, 2018, declared a national emergency with respect to foreign interference in U.S. elections and authorized sanctions. That framework is triggered after an election. Americans learned in 2020 that post hoc remedies come too late. The country needs preventive action before the next vote.

A new executive order should declare that foreign supply-chain exposure and the risk of foreign cyber and influence operations make electronic voting systems unacceptable for federal elections. The goal is not to accuse every state of corruption. The goal is to remove the tool that makes corruption scalable and invisible.

A second executive action should mandate a uniform protocol for federal elections across the states:

- Paper ballots, printed and secured under strict chain-of-custody rules.

- Photo identification for in-person voting.

- Voter rolls audited and cleaned to reflect real voters.

- Election Day voting as the norm.

- Absentee ballots limited to military voters and genuinely confined citizens.

- Counting conducted by humans under observation by credentialed observers.

- Transparent reporting at the precinct level in real time.

- Livestreamed counting wherever feasible to increase confidence and deter misconduct.

This system is not fancy. That’s part of its appeal. It replaces complexity with clarity. It makes manipulation difficult because manipulation requires people, presence, and risk.

Blue states will resist. Some on the left and right might scream about “states’ rights.” The very idea that states have rights has lingered far too long in American politics.

Election integrity cannot be separated from immigration enforcement. Both turn on the same principle: citizenship and sovereignty.

States do not have rights. Natural rights belong to citizens, not state governments. State governments hold delegated powers and duties. When state systems undermine citizens’ rights — including the right to participate in a credible election — the federal government has a duty to protect the constitutional order.

Article I, Section 4 assigns states authority over the “times, places and manner” of congressional elections, subject to congressional alteration. That clause presumes good-faith administration inside a stable union. It did not anticipate election systems dependent on foreign-linked technology, hostile supply chains, and opaque software. Remember: The Constitution is not a suicide pact.

A third, indispensable step must follow: federal oversight.

State election boards disqualified themselves in 2020 by treating citizen observation as illegitimate and by creating closed systems that blocked transparency. Americans watched officials cover windows during counting in Philadelphia. That image damaged confidence more than any argument could repair. When officials treat observation as an enemy, they signal that legitimacy is negotiable.

Federal oversight should include well-constituted teams of observers with legal authority to monitor chain of custody, ballot handling, and counting procedures. Those teams should include lawyers, trained observers, and experienced election administrators. Federalized law enforcement can provide security and enforce access rules.

One drastic but increasingly necessary option is the federalization of each state’s National Guard during federal elections, with a narrow and disciplined mission: secure facilities, protect chain of custody, enforce lawful observer access, and deter intimidation or obstruction by any side. The goal is not militarization. The goal is legitimacy in a period when legitimacy has become a target.

Critics will call this authoritarian. Critics will say it overrides federalism. Critics will claim it inflames tension. Those critics miss the current reality: The existing system inflames tension precisely because it generates doubt.

Paper ballots counted in public calm tension. Electronic systems managed behind bureaucratic walls inflame tension.

RELATED: ‘Prove it’ isn’t an insult. It’s a standard.

![]() Photo by David Williams/Bloomberg via Getty Images

Photo by David Williams/Bloomberg via Getty Images

Why this is absolutely necessary

Election integrity cannot be separated from immigration enforcement. Both turn on the same principle: citizenship and sovereignty.

Over four years, the Biden administration facilitated an invasion of the United States by an estimated 15 to 25 million illegal immigrants. Blue-state governors aided and abetted this effort through sanctuary policies and open defiance of federal enforcement. This was not a routine policy dispute. It was a deliberate attempt to transform the country politically and culturally. The strategy had a clear political logic: create a new demographic reality, then use that reality to entrench power.

No serious person doubts the long-term plan behind mass illegal migration: regularize the status, grant legal residency, and push toward citizenship. Even if that path takes time, the political intent is obvious. A massive new voting population would permanently alter the political balance of power in favor of open borders and against national continuity.

If the illegal immigrants are not made citizens, the next phase follows: turn deportation into a trigger for civil conflict. That conflict is already taking shape in the resistance to ICE operations. Activists and political officials treat immigration enforcement as illegitimate. They mobilize street pressure to block lawful federal action. They use the language of “human rights” to justify lawlessness.

In parallel, American culture has produced generations of citizens who no longer see themselves as heirs of a constitutional republic. Many now see themselves as political actors engaged in permanent struggle against “systems.” They do not treat citizenship as a loyalty. They treat it as a tool. When pop figures declare that no illegal immigrants exist on “stolen land,” they echo a narrative taught for decades: America is an illegitimate country that must be dismantled or reduced.

This ideology fuels the street-level insurrection now forming around immigration enforcement. Add professional agitators — Antifa networks, hard-left organizations, Islamist activist groups such as the Council on American-Islamic Relations, and communist organizations — and the result is predictable: chaos, intimidation, and violence in major cities.

Americans can argue about policy outcomes for the rest of their lives. They cannot argue forever about whether votes were counted honestly and still remain one country.

ICE faces a logistical reality. Deporting tens of millions requires manpower, detention capacity, transport capacity, and employer enforcement that makes illegal employment untenable. The current number of ICE agents cannot accomplish this alone. Even if the administration doubles agent capacity to 44,000, success depends on collapsing the job market for illegal labor. Without employer enforcement, millions of illegal immigrants will bet on survival in the underground economy until 2028, hoping for amnesty under the next Democrat administration.

This reality intersects with elections. A country cannot run a credible election while tens of millions of illegal immigrants remain embedded in communities — including key swing congressional districts — while activists and elected officials defy enforcement, and while the meaning of citizenship erodes. Election integrity becomes a secondary casualty of a deeper sovereignty crisis.

National security magnifies the urgency further.

At minimum, roughly 200,000 Chinese nationals entered the country during the Biden-era migration surge. The vast majority of them were military-age men. Some of these men have the appearance of members of a military force. Communist China has declared political warfare against the United States and has the capability to sabotage critical infrastructure, from power grids to water systems. If hostile operatives sit inside the country at scale, what stops them from targeting soft points in civil life: malls, theme parks, public events, transport nodes?

A nation cannot treat this as a hypothetical. America must treat this as an operational planning problem.

A lack of decisive action sends signals. It signals to illegal immigrants that they can wait out enforcement. It signals to the insurrectionist left that street violence will succeed. It signals to hostile states that the United States lacks the will to defend its own sovereignty.

In this environment, President Trump’s insight that elections may need to be “nationalized” deserves serious consideration.

RELATED: If Fulton County ran clean elections in Georgia, it should welcome sunlight

![]() Yuri Gripas/CNP/Bloomberg via Getty Images

Yuri Gripas/CNP/Bloomberg via Getty Images

A final consideration

Communist China spends tens of billions annually on intelligence and influence operations inside the United States. It has declared a people’s war against the United States and has built a cyber force tied to the People’s Liberation Army that approaches 1 million personnel. It operates through partners and proxies — including cyber-capable regimes such as Iran — and it has relationships with authoritarian governments that have served as nodes in the election-technology ecosystem, including Venezuela.

Even if every component of the U.S. election system were designed and built inside the United States, electronic systems would still carry unacceptable vulnerabilities. Any networked system can be penetrated. Any tabulation system can be targeted. Any system that produces outcomes through proprietary code and opaque databases invites distrust — and provides adversaries with leverage.

Director of National Intelligence Tulsi Gabbard has taken a keen interest in election vulnerability, including the ongoing investigation in Georgia. Her mandate includes preventing foreign intelligence services from influencing American elections. Her recommendations will matter. So will the willingness of the administration to act on the principle that legitimacy is not a public-relations problem. It is a national security problem.

America’s enemies wage political warfare to undermine confidence in the U.S. political system. America must respond with counter-political warfare and with reforms that deny adversaries their most useful tool: doubt.

This returns us to the war framing because the war framing describes the stakes without exaggeration.

The United States is not drifting through a normal partisan season. The United States is fighting for continuity as a sovereign republic. Foreign enemies want Americans to lose confidence in their own system. Domestic radicals want Americans to lose confidence in their own inheritance. Both sides benefit when elections produce outcomes that half the country cannot accept.

A republic cannot survive repeated legitimacy collapse.

The remedy is not complicated. It is common sense.

Paper ballots. Election Day, not week. Photo ID. Clean voter rolls. Human counting under observation. Transparent reporting that citizens can verify. Federal oversight strong enough to deter obstruction and fraud. An executive posture that treats election integrity as national defense, not as a procedural hobby left to 50 different bureaucracies.

Americans can argue about policy outcomes for the rest of their lives. They cannot argue forever about whether votes were counted honestly and still remain one country.

It is clear that our enemies engage in political warfare to undermine the confidence Americans have in our political system. We must wage a robust counter-political warfare campaign to thwart our enemies. This has not been a consideration of American policymakers in the past. No large-scale challenge such as the vulnerability of our voting system existed during the Cold War. This challenge exists now, and how America addresses it over the coming months may well decide the future of our republic. Let us pray that common sense prevails.

Photo by Mario Tama/Getty Images

Photo by Mario Tama/Getty Images

Photo by Bill Clark/CQ Roll Call/Getty Images

Photo by Bill Clark/CQ Roll Call/Getty Images Photo by Michael M. Santiago/Getty Images

Photo by Michael M. Santiago/Getty Images stuartmiles99 via iStock/Getty Images

stuartmiles99 via iStock/Getty Images Photo by David Williams/Bloomberg via Getty Images

Photo by David Williams/Bloomberg via Getty Images Yuri Gripas/CNP/Bloomberg via Getty Images

Yuri Gripas/CNP/Bloomberg via Getty Images

gorodenkoff / Getty Images

gorodenkoff / Getty Images

Photo by Brett Carlsen/Getty Images

Photo by Brett Carlsen/Getty Images

Photo by Alessandro Rampazzo/AFP via Getty Images

Photo by Alessandro Rampazzo/AFP via Getty Images Photo by Simon Bruty/Anychance/Getty Images

Photo by Simon Bruty/Anychance/Getty Images