Charles Payne Says Kamala Harris’ Proposed Business Tax Hike Will ‘Make The Lives Of Workers Harsher’

Happy Tax Day! Your Earnings Paid For Cats On Treadmills And Egyptian Tourists

Plus 30 percent of our individual income taxes are merely paying the interest on federal debt.

Plus 30 percent of our individual income taxes are merely paying the interest on federal debt.Did California’s $25B Budget Deficit Just Tank Gavin Newsom’s Presidential Dreams?

California Gov. Gavin Newsom just saw his path to the White House become even more difficult as a $25 billion budget deficit was announced.

California Gov. Gavin Newsom just saw his path to the White House become even more difficult as a $25 billion budget deficit was announced.G7’s Collusion On Higher Corporate Tax Rates Won’t Save US From Disastrous Effects Of Biden’s Plan

Study Calculates How Many Jobs Could Be Lost If Biden Hikes Corporate Tax Rate, Reverses Trump-Era Tax Cuts

Biden's infrastructure bill hits major road block as Sen. Manchin comes out against it

Swing vote Democratic Sen. Joe Manchin (W.Va.) announced on Monday he does not support President Biden's $2 trillion infrastructure bill as it currently stands, effectively killing the legislation's prospects until changes are made.

The massive spending package, characterized by the administration as an infrastructure bill — despite the bulk of its funding going toward numerous progressive policy priorities — has virtually no chances of earning a single vote from Republicans in Congress. So in order for the bill to pass in the gridlocked Senate, it will need support from every Democratic-voting senator.

With Manchin and potentially other Democrats out on the bill, its chances of passing are bleak, unless significant alterations are made to how the bill is funded.

The moderate senator reportedly broke the news during a radio interview with West Virginia Metro News on Monday, saying, "As the bill exists today, it needs to be changed."

He told host Hoppy Kercheval that he could not support raising the corporate tax rate to 28% from 21%, which has been outlined by Biden's team. The change to the corporate tax rate is just one of several proposed changes slated to amount to the nation's largest federal tax hike in nearly 30 years.

Former President Donald Trump slashed the corporate tax rate to 21% from 35% — a global high — during his time in office, arguing that the rate disadvantaged the U.S. on the global stage and led many American business to relocate offshore.

During the interview, Manchin suggested that while he's against raising the corporate tax rate to 28%, he may be able to support raising it to 25%, citing the need to maintain America's market competitiveness. The worldwide average corporate tax rate is currently just under 24%, according to conservative tax group, the Tax Foundation.

"If I don't vote to get on it, it's not going anywhere," Manchin asserted before adding that he's not the only Democratic lawmaker wary of the economic consequences of the present bill.

"It's more than just me, Hoppy," he said. "There's six or seven other Democrats who feel very strongly about this. We have to be competitive, and we're not going to throw caution to the wind."

News of Manchin's opposition comes after Energy Secretary Jennifer Granholm didn't rebuff claims over the weekend that the tax hikes associated with the infrastructure plan could have a devastating economic impact on middle-class Americans.

Biden admin to call for worldwide tax hike so that US businesses don’t leave country following its corporate tax increase

Treasury Secretary Janet Yellen will reportedly call for a global minimum corporate tax rate to prevent U.S. companies from relocating offshore in response to the Biden administration's forthcoming tax hikes, Axios reported on Monday.

The news outlet made clear that "by trying to convince other countries to impose a global minimum tax, Yellen is acknowledging the risks to the American economy if it acts alone in raising corporate rates."

The administration has proposed initiating the largest tax hike in almost 30 years to pay for President Biden's more than $2 trillion American Jobs Act — a bill slated to fund America's "infrastructure" but that also finances major policy progressive policy initiatives such as climate research, green energy, and free education in addition to highways, bridges, and roads.

The tax changes include raising the country's corporate tax rate from 21% to 28%, a move that conservatives and moderate congressional Democrats have argued could be devastating for the American middle class.

In a speech to the Chicago Council on Global Affairs on Monday, Yellen is expected to push for all other industrialized nations to raise their corporate tax rates to a minimum standard, as well, to ensure economic "competitiveness" worldwide. However, she will reportedly argue that the tax rate minimum is for the main purpose of ensuring those foreign countries have enough revenue to maintain their own governments.

"Competitiveness is about more than how U.S.-headquartered companies fare against other companies in global merger and acquisition bids," the secretary plans to say, according to an excerpt of her prepared remarks obtained by Axios. "It is about making sure that governments have stable tax systems that raise sufficient revenue to invest in essential public goods and respond to crises, and that all citizens fairly share the burden of financing government."

"We are working with G20 nations to agree to a global minimum corporate tax rate that can stop the race to the bottom," she will state.

During Donald Trump's presidency, the business-minded Republican slashed the U.S. rate from 35% — a global high — to 21%, arguing the previous rate put American companies at a global disadvantage and resulted in many of them moving their businesses abroad.

According to the Tax Foundation, a conservative tax group, the worldwide average corporate tax rate is just under 24%.

Axios reported that Biden has tasked Yellen with convincing the business community that the massive infrastructure proposal and subsequent tax increases won't lead to inflation, a tall order by all accounts. Apparently, in the face of pressure, Yellen will look for significant international assistance.

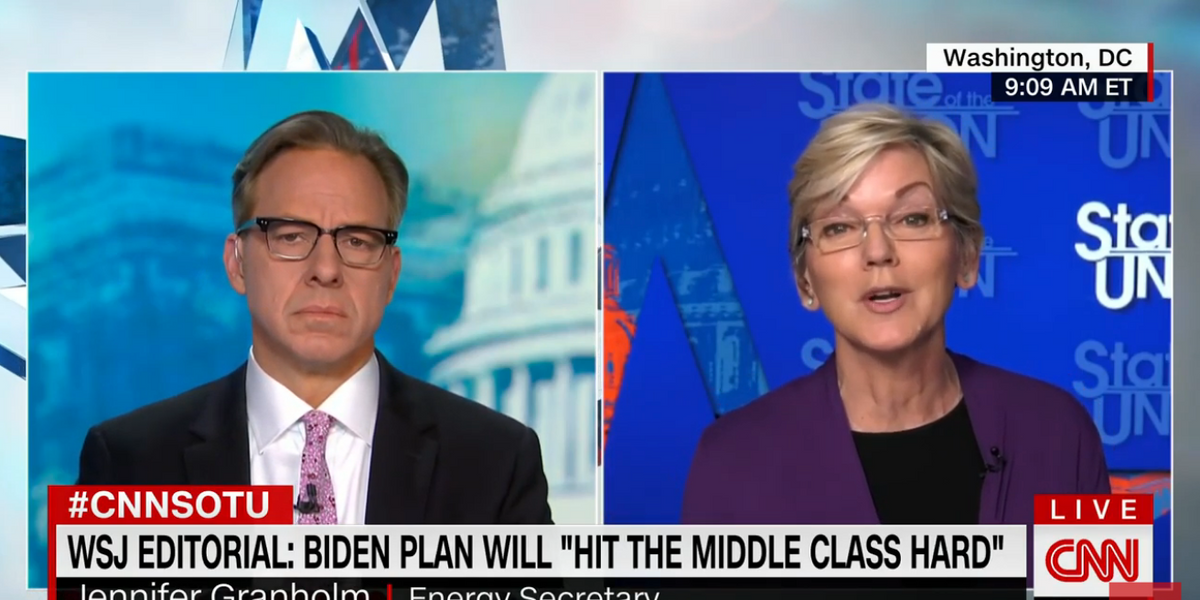

Biden's energy secretary doesn't deny tax hikes to pay for massive infrastructure plan will 'hit the middle class hard'

Secretary of Energy Jennifer Granholm didn't deny claims over the weekend that tax hikes associated with the Biden administration's more than $2 trillion infrastructure plan could have a ruinous economic effect on middle-class Americans.

During an interview on Sunday, CNN host Jake Tapper confronted the energy secretary on the issue, citing concerns among Republicans and moderate congressional Democrats about the economic impact of raising taxes.

In the lead-up to his question, Tapper specifically referred to a recent Wall Street Journal editorial that asserted the taxes would "hit the middle class hard — in the value of their 401(k)s, the size of their pay packets, and what they pay for goods and services." He added that the U.S. Chamber of Commerce called the tax increases "dangerously misguided."

To pay for the massive spending package — which goes far beyond funding highways, bridges, and roads to finance a laundry list of progressive political priorities — the administration has proposed the largest tax hike in almost three decades. One of the major changes getting media attention is a proposed increase of the corporate tax rate from 21% to 28%.

Biden Energy Sec Doesn't Deny Biden's Tax Hikes Will “Hit The Middle Class Hard" When Confronted youtu.be

In response, Granholm remarkably didn't raise an objection to the specific claim. Rather, she dodged the question by claiming the administration's corporate tax rate figure is "fair" and a "reasonable middle."

"You recall that just a few years ago the tax rate for corporate taxes was 35%," Granholm said. "When Donald Trump passed his corporate and tax cuts for the wealthy package, he dropped it to a point that nobody was even asking for, which was 21%. So what Joe Biden is saying is, let's put it to a reasonable middle. Let's put us in line with other industrial nations, which is 28%."

The energy secretary then hit back at criticisms by saying, "If you don't like this, then come and tell us how you would pay for it."

"Of the polling that's been done out there on this, more people support paying for infrastructure rather than racking up deficits than not, and that includes Republicans," she argued. "People know that you can't just continue to spend without paying for it. And so what Joe Biden wants to do is to do it in a fair way."

Earlier in the interview, Granholm made it clear that the administration would be perfectly happy to move the legislation through Congress without a single Republican vote, much like Democrats did with Biden's $1.9 trillion coronavirus relief package. You can watch the full interview here:

Tapper presses Granholm on new infrastructure bill | CNN International www.youtube.com