‘Sparkle Beach Ken’ Is Too Kind To Gavin Newsom

The California governor correctly figures that if he stays on offense, his own dismal record will be ignored — even if that offense is odd.

The California governor correctly figures that if he stays on offense, his own dismal record will be ignored — even if that offense is odd.My high school history teacher, back in 1989, asked our class to name the single biggest problem facing the United States. We wrote our answers anonymously, and he tallied the results. When he read mine aloud — “the federal government’s debt” — he rolled his eyes, as if I’d said something idiotic.

I didn’t name debt nearly 40 years ago just because I think borrowing is bad. I named it because elected officials were already pretending deficit spending wasn’t a problem — and because no one seemed willing to hold the government accountable for it.

The more the Fed prints, the weaker the dollar becomes. The weaker the dollar becomes, the more the world doubts it.

Almost four decades on, nothing has changed. The problem has only grown — as every neglected problem does.

In 1989, the budget deficit was $153 billion. The total national debt stood at $2.86 trillion.

By 2024, the annual deficit had exploded to $1.8 trillion, and the total debt hit $35 trillion. Interest payments now consume 3% of GDP, and they’re still climbing. Meanwhile, the country faces $210 trillion in unfunded liabilities, mostly Social Security and Medicare.

The United States is broke. And Americans act as if it doesn’t matter.

The federal government has been shut down for three weeks. Republicans want to keep spending at ruinous levels. Democrats want to spend even more ruinously. Both sides ignore the obvious: We’re bankrupt. And nobody in America seems to care.

Congress hasn’t passed a real budget since 1996. For nearly 30 years, lawmakers have funded everything through “continuing resolutions,” which automatically renew old spending and add new layers on top. Every “temporary” increase becomes permanent.

The 2009 “one-time” $831 billion stimulus? Still baked in. The $4.6 trillion COVID “relief” binge? Never rolled back. Dozens of other “emergency” expenditures have quietly become fixtures of federal spending.

Year after year, Washington keeps the faucet open — and the debt grows.

By 2024, U.S. GDP was $29.2 trillion. Federal debt was $35 trillion. That’s a debt-to-GDP ratio of 123%. And Washington keeps spending as if it can print reality.

No one in America seems to care.

The rest of the world is starting to notice.

To fund its deficits, the U.S. Treasury sells bonds — IOUs that investors buy with the promise of repayment plus interest. Lately, those auctions have gone poorly. The world’s appetite for American debt is fading.

As one financial analysis put it: “Given the poor state of the American fiscal situation, auctions will likely remain large for the foreseeable future. The risk that markets will push back is rising.”

Another report warned that persistent $2 trillion deficits during peacetime raise “important questions about what might happen during a recession or war.”

When investors balk, the Federal Reserve steps in, printing money to buy the debt. That fuels inflation — the same inflation that has already stripped 87% of the dollar’s value since we abandoned the gold standard in 1971.

The more the Fed prints, the weaker the dollar becomes. The weaker the dollar becomes, the more the world doubts it.

The only thing still propping up the dollar is its role as the world’s reserve currency — the global default for trade and central bank holdings since 1944. That status lets America keep spending money it doesn’t have. But the illusion can’t last forever.

RELATED: The American dream now comes with 23% interest

The BRICS nations — Brazil, Russia, India, China, and South Africa — are challenging the dollar’s dominance. They’ve added members such as Iran, Egypt, Ethiopia, and the United Arab Emirates. Saudi Arabia, the world’s second-largest oil producer, has been invited to join. At least 40 other nations are lining up.

As Business Insider put it, “BRICS is consolidating its global power and influence. This should be a key cause of concern for the U.S., as new members could amplify de-dollarization.”

So what has Washington done? Cut spending? Tighten the money supply? Restore fiscal sanity? Of course not.

Instead, the government rattles sabers. President Donald Trump recently threatened a 100% tariff on the BRICS bloc countries if they move to undermine the dollar — as if bluster could paper over decades of reckless spending.

The United States is broke but still pretending otherwise. Washington spends like a drunk who keeps ordering drinks on a canceled credit card. The world is beginning to call the bluff.

And the American people? They’re still sleepwalking — as they have been for decades.

President Donald Trump blasted India with 50% tariffs, which are set to take effect August 27. These tariffs reflect Trump’s instinct that India is becoming the next China — and he’s spot-on.

Unfortunately, the tariffs will do little to stop this. Why? Because India isn’t coming for our manufacturing. They’re coming for our technology sector — and they’ve been remarkably successful both at scooping up jobs and flying under the radar.

Bangalore is booming. Boston is becoming a bust. What’s going on?

Since 2001, America has lost roughly 5 million jobs to China. During the same period, America lost up to 4 million technology jobs to India. Moreover, India now has access to sensitive American technology and information.

This is beyond an economic issue; it’s a silent national emergency.

If we are serious about reshoring American industry, then tariffs on Indian products won’t cut it. We should also tariff Indian services.

India’s technology industry is bustling. In 2024, technology made up approximately 7% of India’s GDP. The industry employs 5.4 million people and added 126,000 new jobs last year alone. Revenue was up 5.1% year over year.

Technology is transforming India. Cities like Bangalore boast newly minted billionaires and skyscrapers. Meanwhile, technology employment in many major American cities, like Boston, is stagnating.

Bangalore is booming. Boston is becoming a bust. What’s going on?

One word: offshoring.

Increasingly, American companies are moving their production of digital services to India. Why? Because Indian labor is cheap. Consider that the average American technology worker earns $110,000 per year. Meanwhile, their Indian counterparts earn about $32,000 — Indians work for one-third the price.

Why hire an American when you can hire an Indian to do the same job for a fraction of the price?

Offshoring explains the rapid growth of India’s technology sector, 80% of which comes from exports alone — far more than China at the same stage of its rise in 2001.

Interestingly, America’s trade deficit in services with India was just $3.2 billion — fairly small when compared with other countries. This has given the false impression that offshoring is not a problem.

The reality is much more grim. The scale of offshoring is obscured by the fact that Indian services — which are largely “branch plants” of American technology companies — also service non-American markets.

RELATED: Why tariffs beat treaties in a world that cheats

America’s tech giants rake in large profits by offshoring production to India. In turn, India’s government collects the tax revenue, and Indian people benefit from new jobs. But as usual, the American people don’t factor into this equation — yet another example of Wall Street screwing over ordinary Americans.

In my book “Reshore: How Tariffs Will Bring Our Jobs Home and Revive the American Dream,”I explain how offshoring hurts American workers in three main ways.

First, it relocates American jobs abroad, causing unemployment. Second, it suppresses wages by flooding the labor market with laid-off workers and by putting Americans in direct wage competition with cheaper foreign workers. Third, it redirects investment — especially in education — from the United States to India.

How many technology jobs have been lost to India? Although the exact number is impossible to calculate, we can estimate. A good starting point is to look at the number of Indian jobs supported by U.S. dollars. Remember, 5.4 million Indians work in the technology sector, and 80% of the revenue comes from exports — mostly purchased by the United States.

Why hire an American when you can hire an Indian to do the same job, for a fraction of the price?

If we assume a one-to-one corollary between an Indian job and an American job, then we can guess that 4.3 million jobs have been displaced. In reality, this is probably too generous — Americans are more productive than their Indian counterparts. Either way, the number of lost jobs are in the millions.

And those job losses ripple through the labor market.

Displaced workers compete for fewer domestic jobs, driving down wages. At the same time, employers can offshore tech services to India with ease, which drags wages down further.

It’s a global race to the bottom — and American workers have the farthest to fall.

But an even more nefarious cost of offshoring hits directly at our kids’ futures. Offshoring reduces the demand for skilled labor in America and increases it in India, incentivizing investment ineducation abroad while neglecting our own schools. It’s not only cheaper to hire Indians, it’s also cheaper to train them.

The proof is in the pudding. In 2004, 51,000 Americans graduated with computer science degrees and 4,000 in software engineering. By 2024, these numbers had doubled to approximately 100,000 and 8,000 respectively — not bad.

RELATED: Read it and weep: Tariffs work, and the numbers prove it

However, when compared to India, 80,000 Indian students graduated with computer science degrees in 2004 and 5,000 in software engineering. By 2024, these numbers had tripled to over 250,000 and 15,000 respectively. Despite having a much smaller technology industry that is entirely dependent on American investment, India now trains more people for the technology industry than the country that hires them — and the number of graduates is increasing faster.

American technology companies demand educated Indians rather than educated Americans. As such, major American technology companies pour money into Indian universities.

The United States has been pillaged for decades. The inability to manufacture basic goods poses a stark threat to the nation. The same is increasingly true of technology services: Americans are taking the back seat in education, employment, and innovation.

President Trump’s instincts on tariffs are correct, but regarding India, the reality is that tariffs are akin to fighting last year’s war. We need to either tariff offshored services or tax the wages paid to foreigners so that there is no cost advantage to hiring Indians (or anyone else). If not, America will depend on foreigners for goods and services — and there will be nothing left at home.

Just about every influencer, economist, and politician predicted President Trump’s tariffs would unleash an inflation tsunami. Prices would spike and consumers would drown in a rising tide of costs.

Yet here we are, deep into summer, enjoying beach days and backyard barbecues. The price of lawn chairs and beach balls remains well within reach. So where’s the inflation?

Is it worth surrendering political and economic independence just to shave a few cents off the price of some Chinese-made junk?

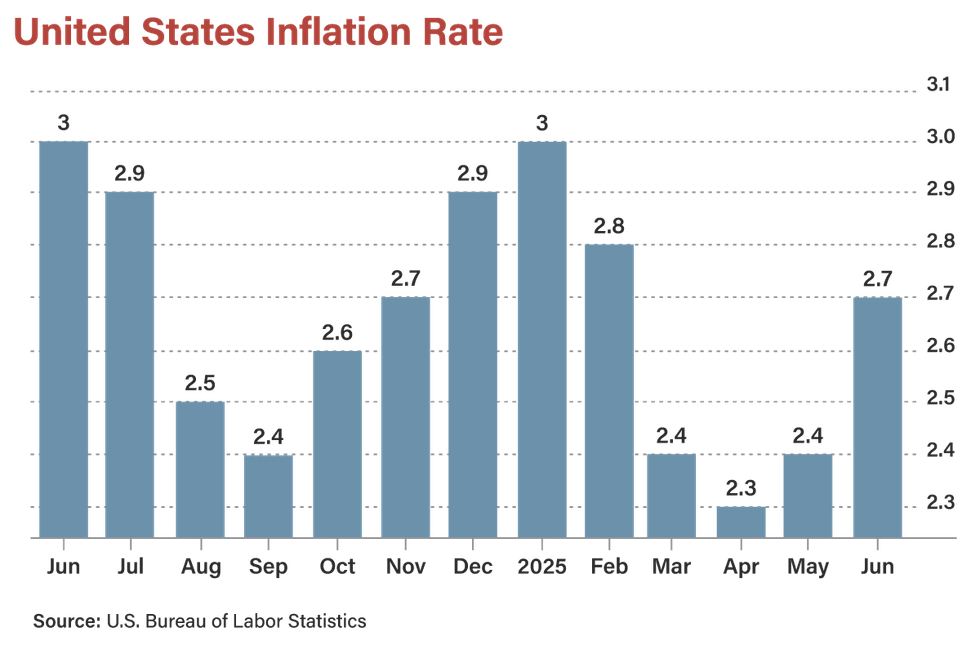

According to the latest government data, inflation hasn’t surged. In fact, it’s lower than it was this time last year. The experts missed again. Why?

The short answer: Tariffs don’t necessarily drive inflation.

Think about how Walmart keeps its prices low. It’s the biggest store in town, so it sets the terms. Producers either cut their costs or lose shelf space. Everyone wants access to Walmart customers, so they play along — and prices fall.

Now scale that logic up. America is the biggest consumer market in the world. In 2024, Americans spent more than $19 trillion on consumer goods, including over $4 trillion on imports.

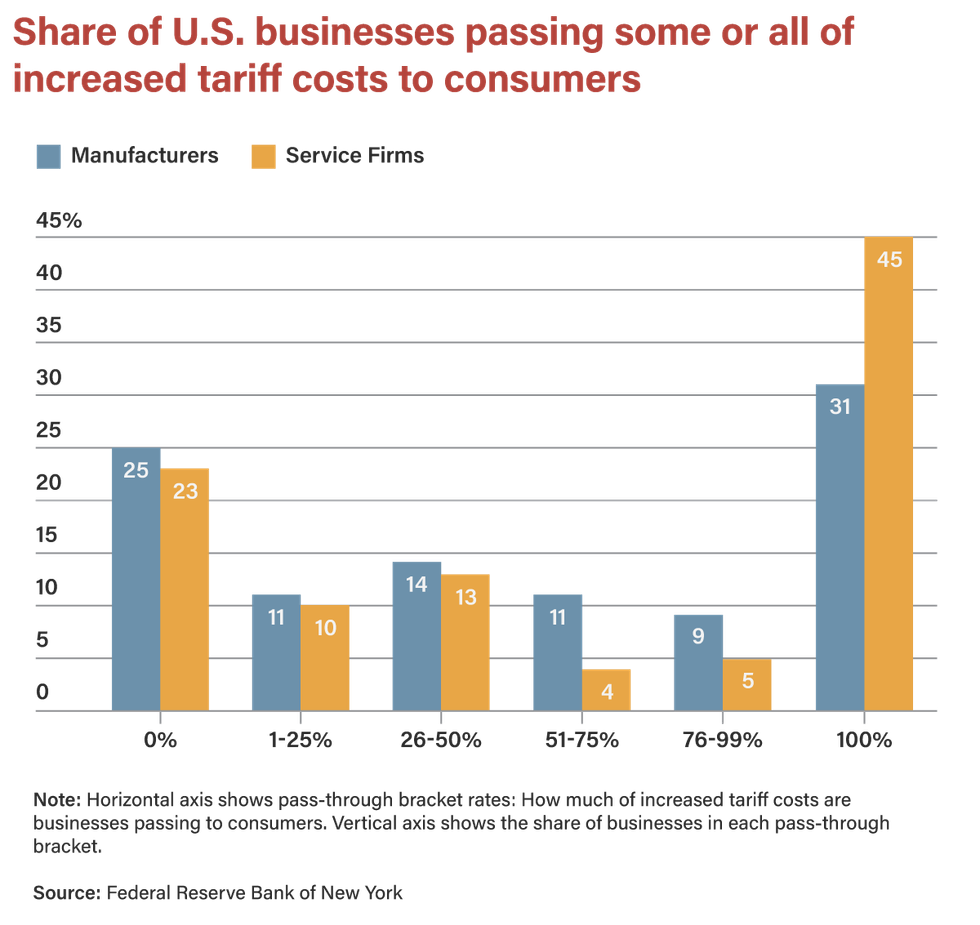

This gives us leverage. When America slaps tariffs on foreign goods, those producers face a choice: Eat the cost or risk losing access to our market. And they know they’ll get outcompeted if they try to pass the full cost on to American buyers.

That’s exactly what’s happening. Recent surveys show about two-thirds of manufacturers expect their foreign suppliers to eat the tariff costs instead of raising prices on U.S. consumers.

Here’s the other thing the panic-peddlers don’t say: Tariffs are avoidable. They’re a tax on imports. Buy American, and you don’t pay.

And while $4 trillion in imports sounds massive, it only accounts for about 13% of the U.S. economy. That’s not nothing, of course, but it hardly amounts to the kind of widespread pressure needed to trigger across-the-board inflation.

RELATED: Trump’s latest tariff could tank the very industries he wants to protect

Instead, tariffs apply pressure in the right places. They force foreign competitors to compete with American producers or lose market share. That creates new opportunities for domestic manufacturers — and when they scale up, costs per unit drop. It’s basic economics — and it just happens to be a win for sovereignty.

The media talk about consumer prices like they’re the only prices that matter. But they ignore the other kind of inflation — the kind tariffs can help tame.

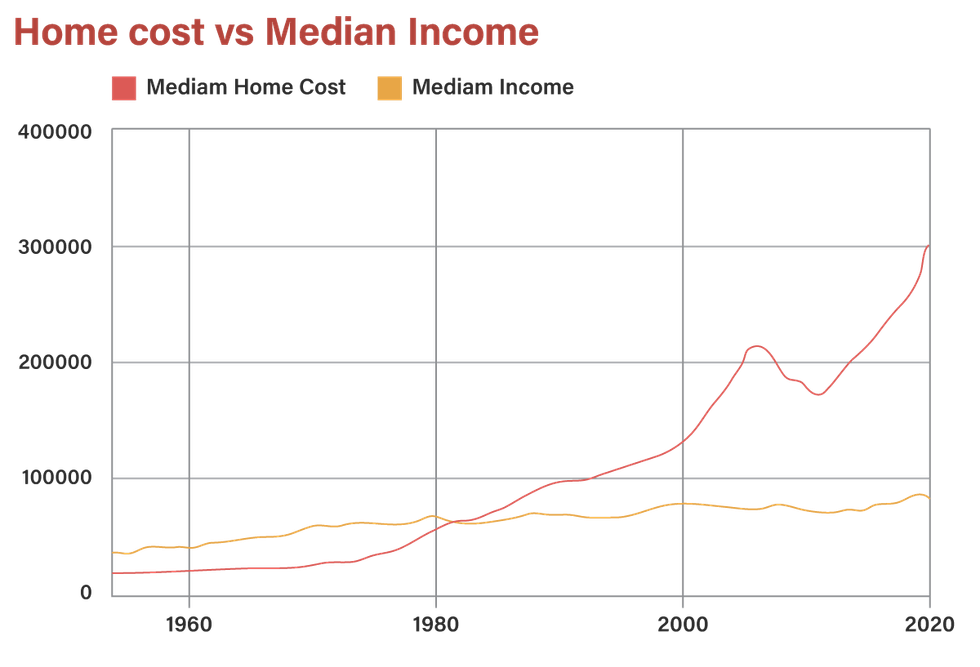

Every year, we import more than we export. That trade deficit doesn’t just disappear. We pay for it by selling off our assets and racking up debt. Foreigners now hold trillions in American real estate, farmland, and commercial property.

In 2024 alone, foreigners bought $42 billion in residential real estate, $8 billion in farmland, and $12 billion in commercial properties. That drives up housing costs and shuts American families out of the market.

Then there’s the debt. Foreign entities hold more than $8.6 trillion in U.S. Treasury securities. We owe them interest. Every year, we ship more than $150 billion abroad just to service that debt. We’re borrowing money from our rivals to buy their products. That’s suicidally stupid.

Even if tariffs raised prices slightly — which the data says they haven’t — so what? Cheap isn’t the mission. National survival is.

That’s the argument I make in my book, “Reshore: How Tariffs Will Bring Our Jobs Home and Revive the American Dream.” America isn’t just an economy. It’s a nation — a people, a language, a culture, a way of life.

We can’t offshore everything and expect to remain free. Tariffs are essential to keep our economy self-sufficient. They secure our borders, protect our workers, and defend our future.

Ask yourself: Is it worth surrendering political and economic independence just to shave a few cents off the price of some Chinese-made junk?

I didn’t think so.

President Trump’s tariffs are set to snap back to the “reciprocal” rates on Wednesday — unless foreign countries can cut deals. So far, the only major players to reach agreements in principle are the United Kingdom and, ironically, China.

Others aren’t so lucky. The European Union, Japan, and India all risk facing a sharp increase in tariffs. Each claims to support free trade. India has even offered a so-called zero-for-zero deal. Vietnam offered similar terms.

Free trade is a myth. Tariffs are reality. The Trump administration should raise them proudly and without apology.

The Trump administration should be skeptical. These deals sound good in theory, but so does communism. In practice, “true” free trade — like true communism — has never existed. It’s impossible. The world’s legal systems, business norms, and levels of development differ too much.

Economists may still chase unicorns. But the Trump administration should focus on tilting the board in our favor — because someone else always will.

Start with the basics: Different countries are different. Their economies aren’t equal, their wages aren’t comparable, and their regulations certainly aren’t aligned.

Wages may be the most obvious example. In 2024, the median annual income for Americans was around $44,000. In India, the median annual income was just $2,400. That means American labor costs nearly 20 times more. And since labor accounts for roughly a third of all production costs, the math practically begs U.S. companies to offshore work to India.

RELATED: Trump’s tariffs take a flamethrower to the free trade lie

It’s China in 2001 all over again.

Back then, the average U.S. wage was about $30,000. China’s? Just $1,100. When China joined the World Trade Organization, American manufacturers fled en masse. Since 2001, more than 60,000 factories have disappeared — and with them, 5 million jobs.

The result: decimated towns, stagnant wages, and hollowed-out industrial capacity. And don’t blame robots or automation. This was policy-driven — an elite obsession with free trade that delivered real pain to working Americans.

We’ve run trade deficits every single year since 1974. The inflation-adjusted total? Roughly $25 trillion. And while U.S. workers produce more value than ever, their wages haven’t kept up. They’ve been undercut by cheap foreign labor for decades.

What if the other country is rich? Can free trade work between economic peers?

Not necessarily. Even when GDP levels match, hidden differences remain. Take regulation. America enforces labor standards, environmental protections, and workplace safety rules. All of those raise production costs — but for good reason. American-made goods reflect those costs in their price tags.

Meanwhile, competitors like China or Mexico cut corners. They dump waste, abuse workers, and sidestep accountability. The result? Cheaper products — on paper. But those costs don’t vanish. They just get pushed onto others: polluted oceans, exploited laborers, sicker consumers.

This is why the sticker price on a foreign good doesn’t reflect its true cost. The price is a lie. Cheapness is often just corner-cutting with a smile.

Rather than debating whether free trade is possible, we should ask whether it’s good for America.

Should we outsource core industries to foreign nations with no loyalty to us? Should we depend on countries like China for our pharmaceuticals, our electronics, or even our food?

The founders didn’t think so. The Tariff Act of 1789 wasn’t about boosting exports — it was about building an independent industrial base. A sovereign nation doesn’t beg for favors. It builds.

We aren’t just an economy. We are a people — a nation united by heritage, language, faith, and trust. That matters more than quarterly profits.

Free trade is a myth. Tariffs are reality. The Trump administration should raise them proudly — and make no apologies for putting America first.