Fake money fuels real pain as elites cash in and families fall behind

Think for a moment about the “speed of life.” Two centuries ago, it took months to cross the Atlantic on a wooden ship. Today, it takes five hours by plane. The Pony Express once needed weeks to deliver a message. The telegraph shrank that to seconds.

Human ingenuity has always accelerated life, but it was still bound by reality — the limits of earth’s raw materials.

On August 15, 1971, America traded reality for illusion.

Technology built from those natural parts is real, sustainable, and grounded. But when systems detach from the real world, they become artificial. They may run for a time, but they cannot endure.

Now consider money as a form of energy. Once, it was tangible: gold coins, silver dollars, bills you could hold in your hand. Even when transactions became electronic, they were still tethered to reality, with gold as their anchor. Cotton became fabric, chickens became food, gold became money. Nature set the limits.

That changed on August 15, 1971.

Faced with economic pressures, President Richard Nixon severed the dollar from gold. In doing so, he handed America’s financial energy supply to the Federal Reserve and the political class — a system now untethered from nature. Money no longer reflected real value. It was conjured from nothing. Now the government, once dependent on the real economy, had the power to create its own artificial economy.

You can’t print money to pay your bills. You live in reality. Washington escaped it — at least temporarily. The result is a false economy where the supply of “financial energy” outruns the natural world.

The treadmill effect

That’s why ordinary Americans feel like they are running on a treadmill that only speeds up. The $37 trillion in so-called “debt” isn’t debt at all. Debt requires repayment. It is the measure of money created out of thin air. When fake energy collides with real commodities, prices rise.

Look around you. Everything in your home — your chair, your phone, your groceries — is either a commodity or built from one. Oil powers the machinery that produces and delivers them. Since 2000, the cost of commodities has risen about 8% every year. Wages, in contrast, have only risen about 3% annually. That gap explains why families can’t keep up, why the middle class shrinks, and why frustration mounts. And because the dollar is the world’s reserve currency, this inflation doesn’t just punish Americans — it ripples out to every nation on earth.

The burnout economy

Think of the human body. It runs on about six volts of electricity. Plug it into 220 volts and you’ll get incredible output — briefly — before the system burns out. That’s what the Federal Reserve and political elites have done to our economy: forced humanity into hyper-speed, compressing decades of natural economic activity into a few frantic years. The result is burnout — social unrest, inequality, rage, endless wars, and declining health.

Even environmental strain ties back to this misalignment. Artificial money fuels artificial demand, driving overproduction and overconsumption. Elites congratulate themselves for “managing” the system while ordinary citizens pay the price — in higher bills, weaker wages, and a constant sense of instability.

This was not inevitable. For nearly two centuries, the dollar was worth 100 cents, because it was tied to gold. Today, it’s worth about three cents. The rest has been stolen — not from us, but from the future. Tomorrow’s dollars are being dragged into yesterday’s spending. But eventually, nothing will be left to plunder. That is the endgame of artificial money: a collision between illusion and reality.

RELATED: Is Fort Knox still secure?

Most Americans don’t fully understand this, but they feel it in their bones. They sense that something is wrong, that they work harder only to fall farther behind. Artificial money creates artificial problems — and artificial problems have no real solutions. Only a reckoning with reality can set them right.

Reclaim reality

Elites in Washington and on Wall Street will not save us. They are the ones benefiting from the distortion. The rest of us are left to adapt. For many, that means simplifying life, rediscovering the virtues of family, community, and localism — the parts of America still tethered to reality. In the countryside, where life is slower, you can still glimpse the America that once was.

On August 15, 1971, America traded reality for illusion. The day Nixon closed the gold window, government and elites unshackled themselves from the limits the rest of us still live under. Until we recognize that truth, we will keep chasing solutions to problems that can’t be solved — because they were never real to begin with.

Moor Studio via iStock/Getty Images

Moor Studio via iStock/Getty Images The bachelorette industrial complex is bleeding friendships dry and draining thousands of dollars along with them.

The bachelorette industrial complex is bleeding friendships dry and draining thousands of dollars along with them. Lawmakers of all parties keep thinking that some magic bullet will solve all of the country’s fiscal problems. It won’t.

Lawmakers of all parties keep thinking that some magic bullet will solve all of the country’s fiscal problems. It won’t.

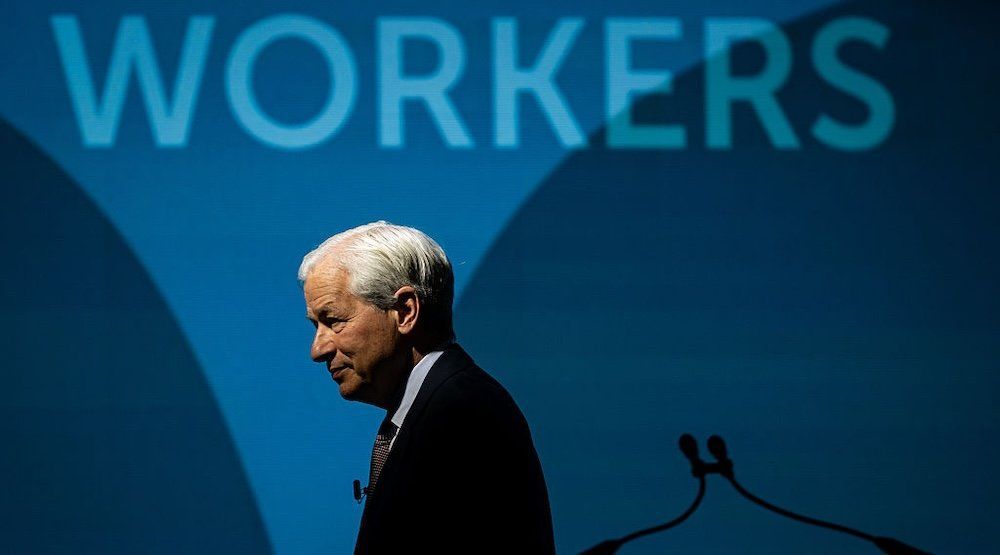

Photo by Al Drago/Bloomberg via Getty Images

Photo by Al Drago/Bloomberg via Getty Images

American Babies Need Not Apply | 5/13/22