Trump Avoids Drama To Focus on Foreign Imminent Threats

State of the Union addresses are usually sedate affairs, but the Supreme Court turned this year’s into must-see TV. The 6-3 decision invalidating the Liberation Day tariffs landed like a bomb last Friday. Many expected President Trump to train his ire on Chief Justice John Roberts and his colleagues on Tuesday night, especially after his post-ruling outbursts.

The post Trump Avoids Drama To Focus on Foreign Imminent Threats appeared first on .

On the same day congressional Democrats refused to publicly affirm their commitment to American citizens over illegal aliens, the Department of Homeland Security (DHS) arrested illegal aliens convicted of murder, sexual assault, and other brutal crimes. During President Donald Trump’s State of the Union address, he invited “every legislator to join with my administration in […]

On the same day congressional Democrats refused to publicly affirm their commitment to American citizens over illegal aliens, the Department of Homeland Security (DHS) arrested illegal aliens convicted of murder, sexual assault, and other brutal crimes. During President Donald Trump’s State of the Union address, he invited “every legislator to join with my administration in […] The president and his executive power alone can’t secure Republicans re-election come November. The GOP will have to act fast.

The president and his executive power alone can’t secure Republicans re-election come November. The GOP will have to act fast. The Washington Post’s Isaac Arnsdorf wrote that President Donald Trump’s State of the Union address took a “darker” turn when the president asked members of Congress to affirm that the federal government’s primary responsibility is to protect Americans rather than illegal aliens. During the address, Trump invited members of Congress to stand if they agreed […]

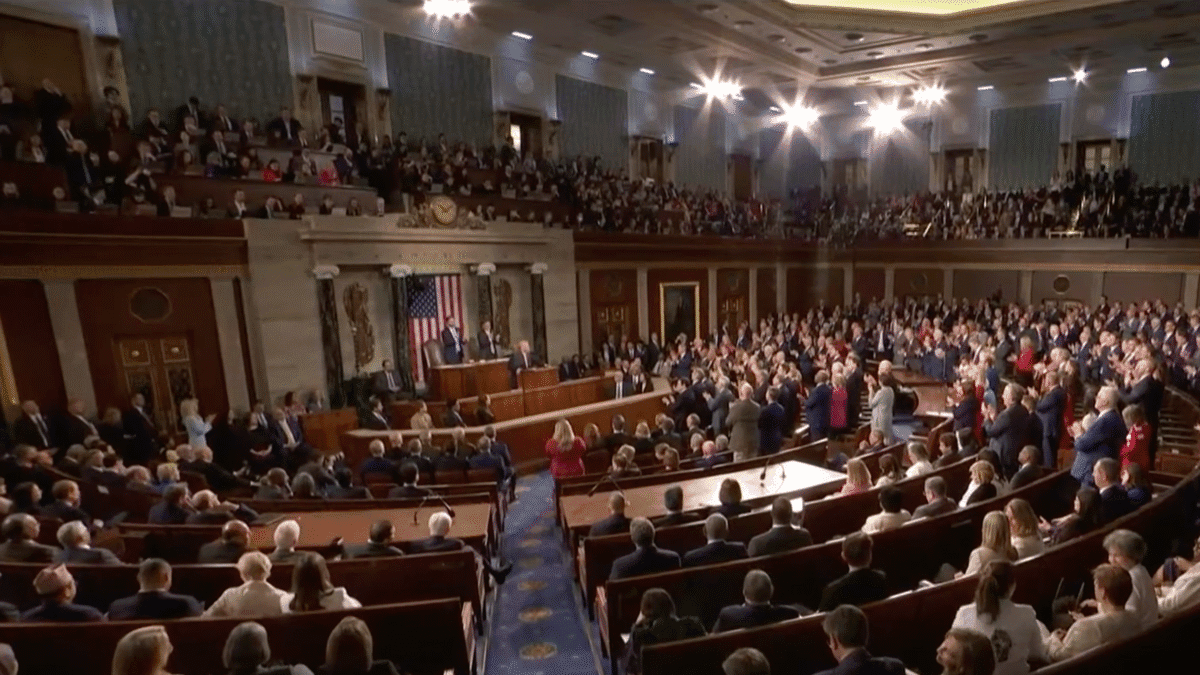

The Washington Post’s Isaac Arnsdorf wrote that President Donald Trump’s State of the Union address took a “darker” turn when the president asked members of Congress to affirm that the federal government’s primary responsibility is to protect Americans rather than illegal aliens. During the address, Trump invited members of Congress to stand if they agreed […] When President Donald Trump invited members of Congress to stand and affirm that the “first duty of American government is to protect American citizens, not illegal aliens,” not a single Democrat stood. And the speed with which the propaganda press moved to reframe and obscure the visual, that is, the entire Democrat caucus refusing to […]

When President Donald Trump invited members of Congress to stand and affirm that the “first duty of American government is to protect American citizens, not illegal aliens,” not a single Democrat stood. And the speed with which the propaganda press moved to reframe and obscure the visual, that is, the entire Democrat caucus refusing to […] By associating symbols of Western civilization with Nazism, leftists like Tom Nichols are carrying on the work of actual Nazi propaganda.

By associating symbols of Western civilization with Nazism, leftists like Tom Nichols are carrying on the work of actual Nazi propaganda.