![]()

The post-colonial grievance industry successfully infected the worlds of academia, entertainment, and politics over the past century with its anti-Western brand of revisionist victim politics. As a result, various middling individuals who were not personally injured by perceived historical injustices found it possible and even lucrative to exploit the guilt of the faultless many.

Following the recent revelation that the Sacramento native dubbed by Canadian state media as "one of the most influential indigenous writers and scholars of his generation" was never an Indian to begin with, Blaze News has finalized its top-five list of fake Indians in North America.

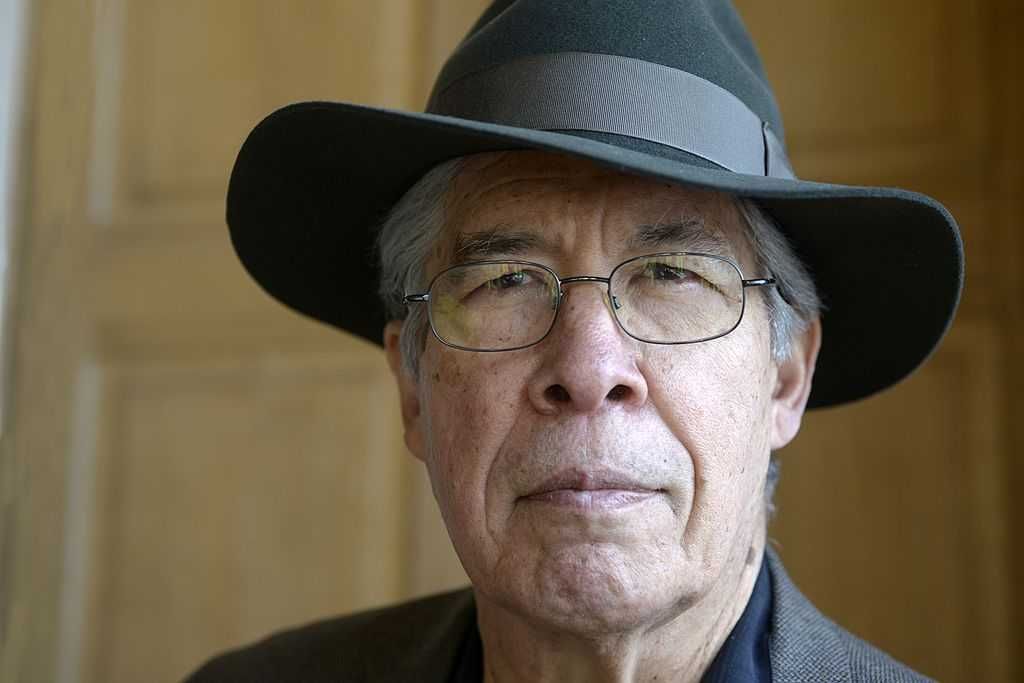

1. Thomas King

Since obtaining his doctorate in English/American studies from the University of Utah in the late 1980s, Sacramento-born Thomas King has made his supposed Cherokee heritage the center of his identity and output.

He taught native studies courses across the United States and Canada; lectured extensively on the subject of Native American identity, rights, history, and grievances; penned numerous books on theme, including "The Inconvenient Indian," "The Truth About Stories: A Native Narrative," and "A Short History of Indians in Canada"; had a comedy radio show on Canadian state radio where he periodically mocked white people and their supposed misconceptions about Indians; and spent decades engaged in Indian-related political activism.

For his efforts, King has been showered with numerous lucrative awards — including the National Aboriginal Achievement Award — and government grants. He was not only made a member of the Order of Canada but promoted to companion of the Order of Canada for exposing "the hard truths of the injustices of the indigenous peoples of North America."

The 82-year-old writer turns out to have been of European stock all along.

Late last month, King, whose mother's side of the family is Greek, told the Globe and Mail that in a Nov. 13 meeting with the director of the North Carolina-based Cherokee group Tribal Alliance Against Frauds and a supposedly Indian professor at the University of British Columbia, he was confronted with genealogical evidence indicating there was no Cherokee ancestry on either side of his family.

RELATED: The campus left’s diversity scam exposed in 30 seconds flat

![]() Thomas King, an influential writer of European heritage. Photo by Ulf Andersen/Getty Images.

Thomas King, an influential writer of European heritage. Photo by Ulf Andersen/Getty Images.

"I didn't know I didn't have Cherokee on my father's side of the family until I saw the genealogical evidence," said King. "As soon as I saw it, I was fairly sure it was accurate. It's pretty clear."

'Indians don't cry.'

King indicated he had previously heard rumors that he was not an Indian but that nothing came of them.

"No Cherokee on the King side. No Cherokee on the Hunt side. No Indians anywhere to be found," King subsequently noted in an op-ed. "At 82, I feel as though I’ve been ripped in half, a one-legged man in a two-legged story. Not the Indian I had in mind. Not an Indian at all."

2. Iron Eyes Cody

The group Keep America Beautiful's iconic "Crying Indian" anti-litter public service announcement, which debuted on television in 1971, shows a supposed Indian, Iron Eyes Cody, dressed in beaded moccasins and buck-skin attire paddling his canoe down a river, past a dockyard, and onto a beach covered in garbage, where he sheds a tear at the sight of a vehicle passenger throwing a paper bag full of fast food out a car window.

This was hardly the first or only time Cody wore his feathers in front of cameras.

![]() Iron Eyes Cody with President Jimmy Carter. Getty Images.

Iron Eyes Cody with President Jimmy Carter. Getty Images.

Cody, who the New York Times indicated initially resisted doing the commercial because "Indians don't cry," played an American Indian in numerous movies, engaged in Indian-related activism, and long maintained that he was the genuine article.

Although Cody claimed he was born in Oklahoma territory to a Cherokee Indian father and a Cree mother, he was in fact the son of Italian immigrants, Francesca Salpietra and Antonio DeCorti, who arrived in the U.S. two years before his birth in Louisiana. His original name was Espera DeCorti.

According to Snopes, he changed his name from DeCorti to Cody after moving to Hollywood in the 1920s and began masquerading as an American Indian.

3. Sacheen Littlefeather

Sacheen Littlefeather, Marlon Brando's stand-in at the 1973 Academy Awards, refused the Oscar for Best Actor on behalf of the "Godfather" star, citing "the treatment of American Indians today by the film industry ... and on television in movie re-runs, and also with recent happenings at Wounded Knee."

RELATED: No more stiff upper lip: My fellow Brits are fed up with 'diversity'

![]() Sacheen Littlefeather. Photo by Frazer Harrison/Getty Images.

Sacheen Littlefeather. Photo by Frazer Harrison/Getty Images.

Throughout her life, Littlefeather claimed that she was an Apache Indian. Her sisters revealed, however, that Littlefeather, who died in October 2022, was the daughter of a Spanish-American and a woman of European descent.

The activist's real name was Marie Louise Cruz.

'Being Native American has been part of my story, I guess.'

Jacqueline Keeler, a member of the Navajo Nation who undertook genealogical research for Cruz's sister, reportedly found that "all of the family's cousins, great-aunts, uncles, and grandparents going back to about 1880 (when their direct ancestors crossed the border from Mexico) identified as white, Caucasian, and Mexican on key legal documents in the United States."

4. Buffy Sainte-Marie

Buffy Sainte-Marie is an Academy Award-winning folk singer who has claimed Native American heritage since the early 1960s.

In her agitprop and activism, Sainte-Marie has spoken from what Teen Vogue called an "indigenous perspective," repeatedly condemning colonization and referring to America's founding and the supposed erasure of American Indians as "genocide." She also has touted herself as a "survivor" of an allegedly racist government welfare program that placed certain Native American kids in foster homes.

After five decades of claiming to have Indian heritage — at one stage claiming she was a "full-blooded Algonquin Indian," at another that she was "half-Micmac by birth," and finally that she was Cree, born on the Piapot First Nation reserve in Saskatchewan — she was outed by Canadian state media as a fraud.

Documents obtained by the Canadian Broadcast Corporation, including her birth certificate, revealed that Buffy Sainte-Marie was born in Stoneham, Massachusetts; that her original name was Beverly Jean Santamaria; and that her parents were Albert and Winifred Santamaria, who were of Italian and English backgrounds, respectively.

The singer's sister stated, "She's clearly not indigenous or Native American."

Sainte-Marie, who like Thomas King had been made a member of the Order of Canada, had her membership revoked after it was revealed she was another fake Indian. She was also stripped of her Juno Awards and Polaris Music Prizes, although she was reportedly able to keep the substantial cash prizes they came with.

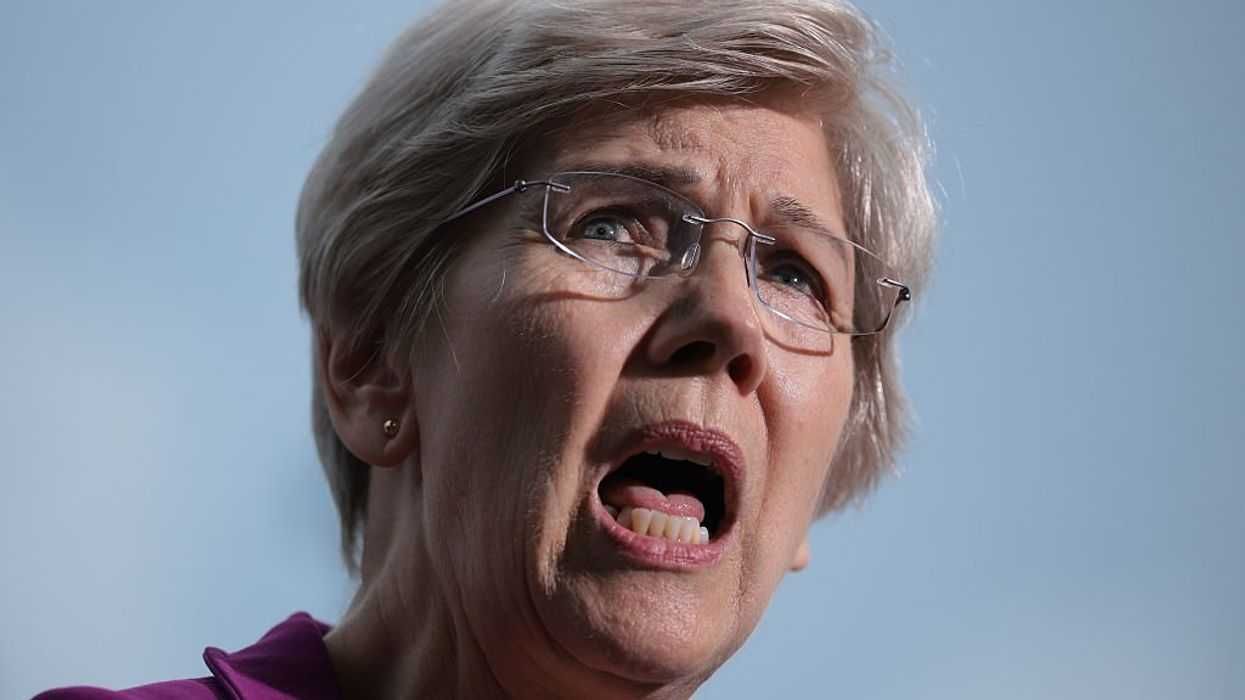

5. Elizabeth Warren

Sen. Elizabeth Warren (D-Mass.) is another affluent liberal woman who masqueraded for decades as an American Indian for apparent personal gain, going so far as to contribute five recipes to a 1984 cookbook characterized as "recipes passed down through the Five Tribes families" called "Pow Wow Chow."

Warren told reporters in 2012, "Being Native American has been part of my story, I guess, since the day I was born."

While working at the University of Texas School of Law, Warren not only claimed "American Indian" status on her State Bar of Texas registration card but listed herself in the Association of American Law Schools annual directory as a minority law professor. Since she did not bother correcting her minority identification after the release of the 1986-1987 edition, it appeared that way in the next eight editions, reported the Boston Globe.

Just after she began formally identifying as a minority in the late 1980s, Warren landed a full-time job offer from the University of Pennsylvania Law School.

Three years after securing the job, university records reportedly indicated that Warren leaned on the university to ensure that her ethnicity was listed as "Native American" instead of "white."

![]() Photo by Kayla Bartkowski/Getty Images

Photo by Kayla Bartkowski/Getty Images

UPenn's April 2005 Minority Equity Report clearly lists Warren was a "minority." According to the Boston Globe, for at least three of the years Warren taught at the law school, she was listed as the solitary American Indian female professor.

In the 1990s, Warren moved on to work at Harvard Law School, which was sure to note her supposedly Indian heritage. The Globe indicated that Harvard Law School used Warren's fake minority status to justify not hiring more minorities.

'I am a white person who has incorrectly identified as native my whole life.'

In 2018, President Donald Trump, who had long derided Warren as "Pocahontas," challenged the senator to get a DNA test to prove she was Native American. The test results came back showing that she was only 1/1,024th Native American if at all.

When Warren ran unsuccessfully for president in 2020, over 200 Cherokee and other Native Americans signed an open letter to the senator noting, "Whatever your intentions, your actions have normalized white people claiming to be native, and perpetuated a dangerous misunderstanding of tribal sovereignty. Your actions do not exist in a vacuum but are part of a long and violent history."

Dishonorable mentions

Among the others who have benefited greatly from pretending to be Indians are:

- Jamake Highwater was an award-winning writer and journalist who penned over 30 books, including "Anpao: An American Indian Odyssey" and "The Primal Mind: Vision and Reality in Indian America," usually from an American Indian perspective. Highwater led the public to believe that he was born to an illiterate Blackfoot mother and a Cherokee father, who dumped him in an orphanage, where a couple in Southern California picked him up and raised him. However, Assiniboine activist Hank Adams and Washington Post columnist Jack Anderson exposed Highwater as another fraud. Highwater's original name was Jackie Marks. He was apparently the Jewish son of a Russian mother and a father of Eastern European descent who worked as an actor in Hollywood.

- Elizabeth Hoover is an associate professor at the University of California, Berkeley, who long claimed to be of Mohawk and Mi’kmaq descent. Hoover admitted in May 2023, "I am a white person who has incorrectly identified as native my whole life." The Berkeley professor confirmed that had she not been "perceived as a native scholar," she may not have received some academic fellowships, opportunities, and material benefits. Despite admitting to causing harm and benefiting from her fraudulent identity, she did not resign.

- Heather Rae is an award-winning producer who served on the Academy of Motion Pictures' Indigenous Alliance and previously led the Sundance Institute’s Native American program. She was accused by the Tribal Alliance Against Frauds in 2023 of lying about being Cherokee. Rae told the Hollywood Reporter in a puff piece that appeared to vex the Tribal Alliance Against Frauds, "I think there's a lot of nuance to this identity."

- Joseph Boyden is a prominent Canadian novelist who was regarded at one point as "arguably the most celebrated indigenous author in Canadian history." His writing largely centered on Indian characters and their experiences. Boyden, the recipient of numerous awards and grants, claimed over the years that there was Métis, Mi’kmaq, Ojibway, and/or Nipmuc blood in his family's mix. In one instance, when buying a significant portion of land, he reportedly claimed to be Metis and showed a photocopied tribal card. When he was first exposed as another fraud in 2016, he claimed that his family's Indian roots had been "whitewashed" due "to the destructive influences of colonialism." While Boyden later admitted he was a "white kid from Willowdale," he maintained that he had "native roots" on his Irish Catholic father's side as well as on his mother's side.

Like Blaze News? Bypass the censors, sign up for our newsletters, and get stories like this direct to your inbox. Sign up here!

Photo by SAUL LOEB/AFP via Getty Images

Photo by SAUL LOEB/AFP via Getty Images Photo by Andrew Harnik/Getty Images

Photo by Andrew Harnik/Getty Images

Photo by Mandel NGAN/AFP via Getty Images

Photo by Mandel NGAN/AFP via Getty Images

Photo by Andrew Lichtenstein/Corbis via Getty Images

Photo by Andrew Lichtenstein/Corbis via Getty Images

Photo by RYAN MCBRIDEDON EMMERTDON EMMERTKENA BETANCURROBYN BECKANGELA WEISSROBYN BECKROBYN BECKROBYN BECK/AFP via Getty Images

Photo by RYAN MCBRIDEDON EMMERTDON EMMERTKENA BETANCURROBYN BECKANGELA WEISSROBYN BECKROBYN BECKROBYN BECK/AFP via Getty Images

Thomas King, an influential writer of European heritage. Photo by Ulf Andersen/Getty Images.

Thomas King, an influential writer of European heritage. Photo by Ulf Andersen/Getty Images. Iron Eyes Cody with President Jimmy Carter. Getty Images.

Iron Eyes Cody with President Jimmy Carter. Getty Images. Sacheen Littlefeather. Photo by Frazer Harrison/Getty Images.

Sacheen Littlefeather. Photo by Frazer Harrison/Getty Images. Photo by Kayla Bartkowski/Getty Images

Photo by Kayla Bartkowski/Getty Images