Why Republican victories keep delivering Democratic policies

Conservatives often imagine that winning statewide elections means gaining control over the machinery of government. But this is wrong — and dangerously so. For far too long, red states have confused the two. The assumption that political victory automatically confers political authority is one of the chief falsehoods circulating on the right. It is the reason Republican states often look like Democrat ones, only with different bumper stickers.

This is an uncomfortable but necessary message for conservatives to hear: Red states are facing a major crisis of governance.

Red states have built conservative brands on progressive machinery.

The State Leadership Initiative’s new “Index Report” lays out the evidence in extensive detail. By the most basic measures of lean, accountable, and ideologically grounded government, red states are failing. Many of the policies their representatives are voting for and their governors are signing into law are profoundly out of step with the wishes of voters. Bureaucracies are bloated, universities multiply administrators faster than scholars, schools have fewer teachers than administrators, New York-style regulations pile up in red states like Texas, and seven of the 10 most federally dependent states wear the Republican label.

The key takeaway is not just that red states are doing poorly — it is that red states are almost indistinguishable from blue states on the metrics that matter.

This is not conservative governance. It is branding atop the chassis of managerial progressivism. Governors may cut a ribbon, sign a bill, or post a slogan, but beneath the surface, the operating code of their states is indistinguishable from California’s.

How can this be the case?

The bureaucratic cartel

The deeper reason for this unfortunate reality is explored in the State Leadership Initiative’s second major publication, the “Shadow Government Report.” It shows how state bureaucracies have been colonized — quietly, methodically — by a cartel of national associations and professional guilds no voter ever approved. These groups wield more influence over daily governance than most state legislatures, yet they are invisible to the public, untethered from electoral accountability, and drenched in progressive orthodoxy.

These associations are neither think tanks nor trade associations in the old sense. Yet they wield massive powers: They write standards, provide training, host conferences, and broker grants. These guilds credential personnel and tell agencies what “best practice” means.

Because legislators rarely read the fine print in the legislation they pass, the blueprints crafted by these associations become the law of the land by default. When the public wonders why every state suddenly adopts the same jargon, the same metrics, and the same “tool kits” on climate, equity, and inclusion, the answer is almost always because the same group of associations decided it.

The depth of ideological capture in these associations is astounding. The examples border on parody. The National Association of State Treasurers insists that environmental, social, and governance investing is a fiduciary duty and trains treasurers in diversity, equity, and inclusion.

The National Association of Medicaid Directors declares equity — not health outcomes — the “foundational principle” of Medicaid reform and pushes race-based service priorities.

The Association of State and Territorial Health Officials maintains that “structural racism” is a public health emergency and coordinates messaging on abortion, climate, and even online speech with the White House.

The National Association of State Procurement Officials encourages states to embed race- and gender-based scoring rubrics into contracting, turning neutral bidding into an ideological loyalty test.

The National Governors Association, which is supposedly a bipartisan forum of executives, functions as a relay for the left, peddling DEI and ESG tool kits like a traveling salesman.

These examples are far from exhaustive.

National associations operate outside democratic oversight while having a greater influence over shaping state policy than most legislatures. They are the Trojan horses of managerial progressivism. While legislators debate property-tax rates or curriculum, these associations push a suite of prepackaged policies — procurement guidelines, Medicaid waivers, regulatory thresholds — that heavily favor the status quo.

Protecting progressives

Civil service rules protect progressive careerists from political oversight. University boards rubber-stamp DEI because accreditation bodies — another arm of the cartel — say so. Procurement officers copy and paste National Association of State Procurement Officials templates. Medicaid directors take their orders from the National Association of Medicaid Directors rather than the governor.

The bureaucrats Republican governors inherit have been trained in association doctrine, are credentialed by association certifications, and are acculturated in association conferences. Even the vocabulary their agencies use — “resilience,” “inclusion,” “climate readiness,” “public-private partnership” — is imported from slide decks in Washington, D.C.

Our adversaries built the shadow government that now runs the states. The only question is whether conservatives will summon the courage to challenge it.

You may elect a conservative governor. But if his health agency still sends staff to Association of State and Territorial Health Officials trainings, his Medicaid office still uses National Association of Medicaid Directors templates, and his treasury department still follows the National Association of State Treasurers guidelines, the day-to-day governance is leftist by default.

Even if personnel are swapped out, the new trainees will be accepting “best practices,” model regulation, and training seminars from supposedly neutral industry experts. But this neutrality is a farce.

The result is a peculiar kind of political theater. Voters think they have chosen a government. Governors think they are in command. But the machinery hums along, indifferent to election returns and guided by national bodies whose values are taken from the faculty lounge and the federal bureaucracy. It is government by autopilot — and the autopilot was programmed by the left.

Rooting out the cartel

The cartel of leftist national associations needs to be dealt with in order for red states to prosper. The remedy is not tinkering around the edges but an aggressive structural overhaul.

First, states must begin by auditing and restricting association membership. Every agency should disclose its dues, trainings, grant pipelines, and template adoptions. Sunshine is a good disinfectant.

Second, agencies should be barred from importing association policies without legislative approval. If a procurement office wants to adopt National Association of State Procurement Officials rubrics, let it defend that choice in front of elected representatives in open hearings.

Third, association-led DEI trainings should be prohibited outright; they are not professional development but bureaucratic catechism.

Fourth, rival associations must be built, as the State Financial Officers Foundation has already done, to provide training and credentials aligned with republican self-government.

Finally, and most importantly, political leadership must penetrate the bureaucracy — more appointed positions, stronger sunset rules, and the restructuring of state agencies that resist accountability.

Some will protest that this sounds radical. It is not — it is the work of self-government. The radicalism lies in the present arrangement, in which anonymous guilds in a faraway capital dictate to sovereign states what their procurement contracts should look like or what principles guide their Medicaid systems. The radicalism lies in states whose constitutions enshrine republican rule yet whose daily operations are outsourced to entities their people cannot name.

This reform in red states is not optional if conservatives mean to govern.

Changing the machinery

The Index reveals the failures; the Shadow Government Report reveals the cause. Paired together, they teach a crucial lesson: Red states have built conservative brands on progressive machinery. They talk like Jefferson but regulate like Albany. They thump their chests about liberty while paying dues to organizations that smuggle equity quotas into their hiring manuals.

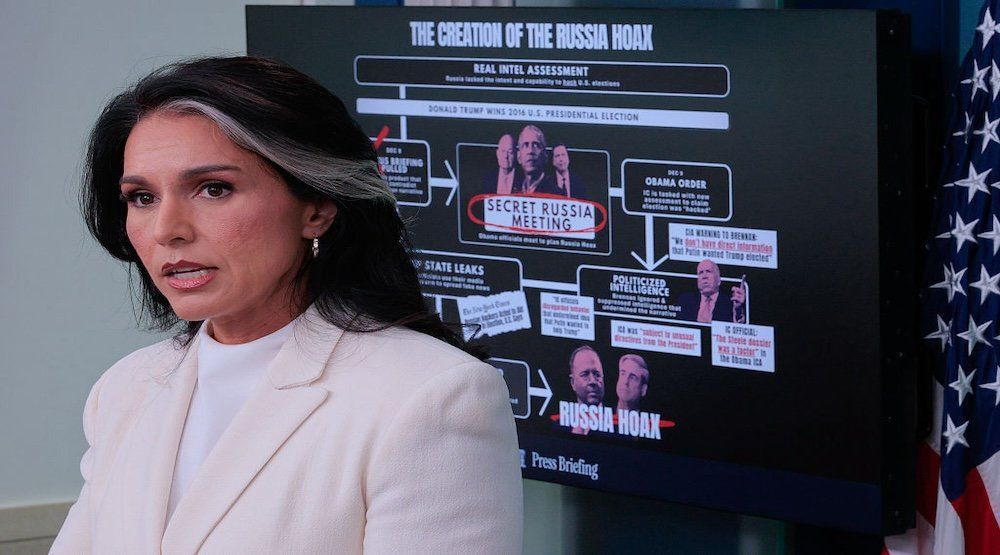

RELATED: The deep state is no longer deniable — thanks to Tulsi Gabbard

To continue on this path is to win hollow victories, mistaking campaign slogans for statecraft. It is to send governors into battle armed with speeches while the other side controls the maps, the supply lines, and the ammunition. The work ahead is not to shout louder but to actually govern — to tear down the scaffolding of association rules and build institutions that are faithful to the people they’re supposed to serve. Until that is done, every red state risks being a blue state in disguise.

Governance is not automatic. It is not the inevitable byproduct of winning elections. It is the patient, disciplined, steady construction of institutions aligned with the people’s will. Our adversaries have known this for decades. They built the shadow government that now runs the states. The only question left is whether conservatives will summon the courage to challenge it.

Editor's note: This article was published originally at the American Mind.

Brian Kaiser/Bloomberg via Getty Images

Brian Kaiser/Bloomberg via Getty Images Trial lawyers and the left deserve a good thrashing (policy-wise), but that isn’t what these bills do.

Trial lawyers and the left deserve a good thrashing (policy-wise), but that isn’t what these bills do.

Photo by Al Drago/Bloomberg via Getty Images

Photo by Al Drago/Bloomberg via Getty Images

Indiana's treasurer helped push banks to back down on canceling conservatives, and now a banker-backed bill would strip his office's powers.

Indiana's treasurer helped push banks to back down on canceling conservatives, and now a banker-backed bill would strip his office's powers.

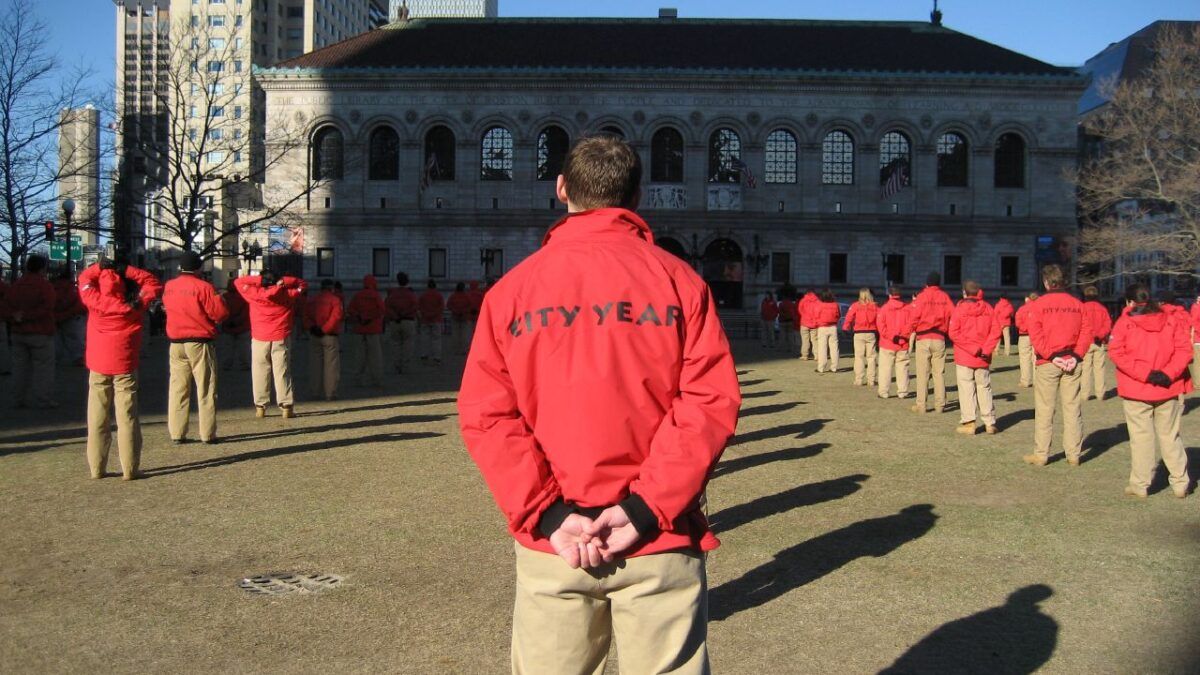

Training programs to enter AmeriCorps have been indoctrinating participants into having an anti-American worldview.

Training programs to enter AmeriCorps have been indoctrinating participants into having an anti-American worldview.