Federal Reserve obliges Trump, cuts interest rates for the third time this year

In a move championed by President Donald Trump, the Federal Reserve cut its key interest rate by 0.25% to a range of 3.5% to 3.75% on Wednesday, the third cut this year, lowering borrowing costs and giving some lift to a flagging job market.

Only three members of the Federal Reserve Board of Governors voted against the cut: Stephen Miran, who wanted to lower the target range for the federal funds rate by 0.5%, and Austan Goolsbee and Jeffrey Schmid, who both figured it was presently best not to have any cuts at all.

'Available indicators suggest that economic activity has been expanding at a moderate pace.'

Joseph Brusuelas, chief economist for the financial services firm RSM US, noted in a Tuesday analysis that the Fed was faced with the "difficult choice of either aggressively fighting inflation or hoping to revive a sluggish labor market and slowing economic activity when it meets on Tuesday and Wednesday."

Rate cuts can help boost the stock market — encouraging spending, investing, and business activity by lowering savings rate and borrowing costs. However, by increasing the supply of money, they can also exacerbate inflation.

The annual inflation rate was around 3% for the 12 months ending September, according to U.S. Labor Department data. The Fed's inflation target is 2% over the longer run — hence the resistance to another cut by some policymakers.

"The [Federal Open Market Committee] seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. Uncertainty about the economic outlook remains elevated," the Fed said in a statement on Wednesday. "The Committee is attentive to the risks to both sides of its dual mandate and judges that downside risks to employment rose in recent months."

In light of its goals and "the shift in the balance of risks," the FOMC determined that a drop in the rate by 0.25% was worthwhile.

"Available indicators suggest that economic activity has been expanding at a moderate pace. Job gains have slowed this year, and the unemployment rate has edged up through September," the Fed noted further. "Inflation has moved up since earlier in the year and remains somewhat elevated."

The rate-cut decision on Wednesday comes months after the Fed similarly lowered its benchmark interest rate by 25 basis points in September to a range of 4% to 4.25%, and after weeks of disagreement on the central bank's 12-member policy committee regarding the prudent way forward.

Chris Brigati, chief investment officer at the financial services company SWBC, told the Financial Post ahead of the announcement that the Federal Reserve was divided on how to proceed with rate cuts in 2026 "given the delicate balance between job market weakness and still-elevated inflation."

"There is also uncertainty about the new Fed chair, and that may also add to the central bank's reluctance to make any major rate moves in the months leading up to Chair Powell's term ending," Brigati added.

In search of someone suitable to replace Fed Chairman Jerome Powell, whose term ends in May, the president has been interviewing various candidates, including Christopher Waller and Michelle Bowman, both members of the Federal Reserve Board of Governors; former Fed governor Kevin Warsh; and BlackRock fixed-income chief Rick Rieder. Top White House economic adviser Kevin Hassett is, however, reportedly regarded as the frontrunner.

The president told reporters on Air Force One on Tuesday, "We're going to be looking at a couple of different people, but I have a pretty good idea who I want."

When asked in his interview with Politico the previous day whether it is "a litmus test that the new chair lower interest rates immediately," Trump said yes and noted, "We're fighting through interest rates."

The Federal Reserve also released on Wednesday its regional bank presidents and governors' quarterly set of economic projections. They anticipate a rise in the unemployment rate from 4.4% in September to 4.5% by year's end; the GDP to grow by 2.3% in 2026; and inflation to sink, but nowhere below their 2% target.

Like Blaze News? Bypass the censors, sign up for our newsletters, and get stories like this direct to your inbox. Sign up here!

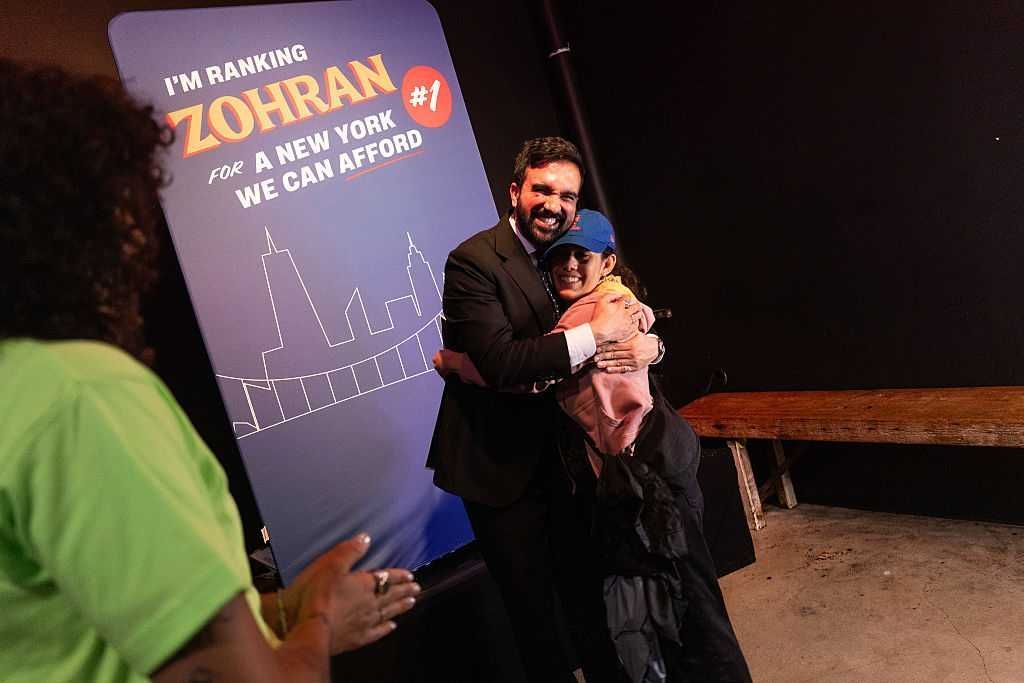

Photo by Michael M. Santiago/Getty Images

Photo by Michael M. Santiago/Getty Images

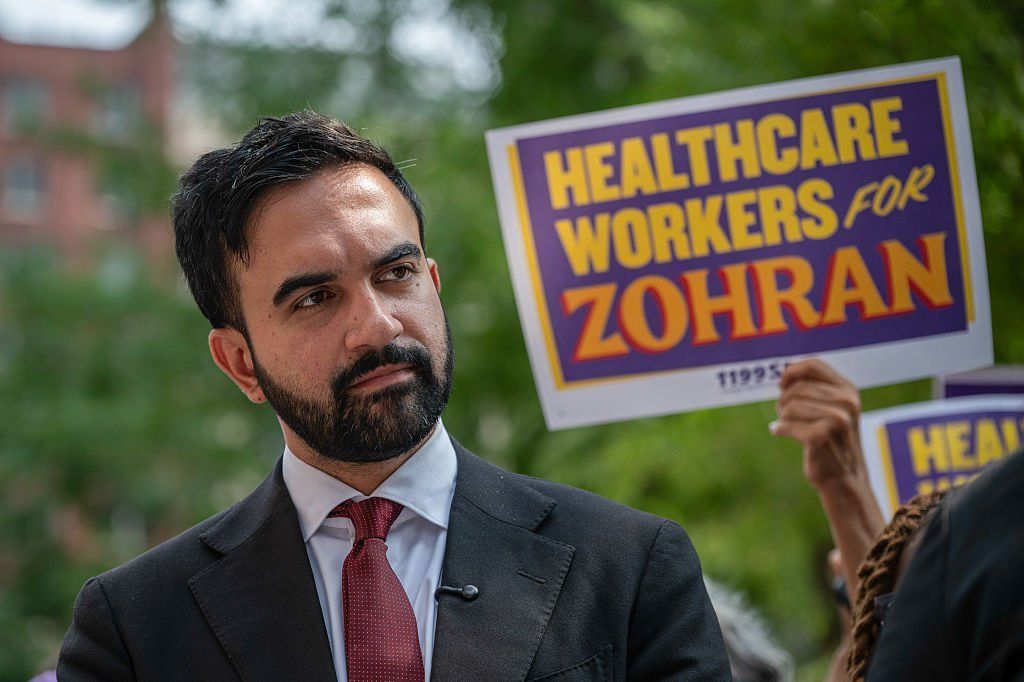

Photo by Andrew Lichtenstein/Corbis via Getty Images

Photo by Andrew Lichtenstein/Corbis via Getty Images Congress should do its job and keep restricting the growth of exploding federal spending.

Congress should do its job and keep restricting the growth of exploding federal spending.