‘Taking The Advice Of A Nun About Sex’: John Kennedy Dismisses Washington Insiders’ Takes On Economy

'You’ve really got to be careful who you listen to'

The USS Titanic — our ship of state — is headed straight for a fiscal iceberg. And Americans are still rearranging the deck chairs.

Complacency has become our gravest threat. We cling to a false sense of invincibility, comforted by the size and legacy of the U.S. economy. After all, we’re the United States of America. What could possibly go wrong?

Pundits love to say we’ve carried debt for decades without a crisis. That logic belongs in a casino, not a government.

Everything — if history’s any guide. Ask the Romans. Ask the British. Every great power that believed it was immune to long-term mismanagement eventually ran aground.

Let’s stop pretending. The federal government sits on a collision course with economic disaster. And unless we act, we’ll suffer the same fate as the Titanic — not too big to fail, but too big to save when the water starts pouring in.

In November 2023, Fitch Ratings downgraded America’s credit rating — joining Standard & Poor’s, which did the same in 2011. Moody’s followed suit. These weren’t partisan potshots. They were alarms backed by math.

The national debt has passed $37 trillion — 125% of gross domestic product. That ratio continues climbing and could exceed 200% within a few decades, if not sooner. At current trajectory, the federal government will owe more than $70 trillion by 2035.

This isn’t theory. It’s arithmetic.

Yes, the United States carried significant debt after World War II. But back then, we had a plan. The federal government remained lean. Policymakers promoted growth through low taxes, fewer regulations, and real fiscal restraint. Debt-to-GDP dropped below 40% within a generation.

Today, Washington does the opposite. More spending. Higher taxes. Heavier regulation. All while the clock ticks louder.

RELATED: Debt spiral looms as Trump tests tariffs to tame rates

And that’s just the official debt. Add unfunded liabilities from Social Security and Medicare, and the real figure shoots above $130 trillion. That’s not a typo — it’s a debt bomb that dwarfs anything in our history.

Pundits love to say we’ve carried debt for decades without a crisis. That logic belongs in a casino, not a government. As Hemingway put it: Bankruptcy happens “gradually, then suddenly.”

The economy may look calm on the surface. But underneath, the pressure builds. Interest payments on the debt already surpass defense spending. Every dollar wasted on interest is a dollar unavailable for education, infrastructure, emergency relief — or even national security.

While the debt swells, politicians on both sides make it worse. Congress lurches from one bloated proposal to another, piling on $3-$5 trillion more in new borrowing under the guise of stimulus, "investments," or political horse-trading.

Printing money doesn’t create prosperity. Borrowing to fund political promises is economic malpractice.

Washington’s not just borrowing dollars. It’s borrowing time, trust, and prosperity from future Americans.

What kind of legacy will we leave our children?

A nation once defined by opportunity, self-reliance, and innovation now leads the world in debt and dysfunction. That’s not just policy failure — it’s moral failure. It’s a betrayal of the American promise.

Why does this keep happening? Because politicians chase the next election, not the next generation. And voters let them.

We reward short-term handouts over long-term discipline. We elect people who promise benefits without explaining the bill. And we pretend this can go on forever.

It can’t.

Americans must reclaim their role as stewards of the republic. That means asking tough questions, demanding truth from politicians, and supporting leaders who offer hard choices over easy lies.

We still have time. But not much.

Fiscal reform doesn’t require slashing everything or dismantling safety nets. It requires honesty, cooperation, and courage. We need to restructure entitlements, simplify the tax code, and eliminate programs that waste billions.

A leaner government, closer to what the Founders envisioned, would grow the economy and lift all incomes. That path still exists — if we’re brave enough to take it.

The alternative? A debt crisis that makes the Great Depression look tame. And no one will be able to say they weren’t warned.

The iceberg looms. The hull leaks. The music still plays — for now.

But the moment for change won’t last. The wheel is still in our hands.

Turn it.

The Department of Commerce released the first GDP report of President Donald Trump's second term on Wednesday, sending critics into a frenzy.

The legacy media's coverage of the report reiterates the same claim: The economy "shrank." But between the lines, the report paints a different, more promising picture.

On its face, the report shows that the economy contracted at a 0.3% rate in the first quarter as a result of the ongoing trade war and tariff uncertainty. Despite this, former Vice Chair of the Federal Reserve Richard Clarida argued that this figure was "distorted" and predicted it would be revised upward.

'It's no surprise the leftovers of Biden's economic disaster have been a drag on economic growth, but the underlying numbers tell the real story of the strong momentum President Trump is delivering.'

"Not really much of a surprise," Clarida said. "I do think the Q1 numbers were probably distorted by that huge surge in imports to front-run the tariffs, and I think could be revised up slightly. So the final number may be closer to zero."

"I do think probably that the Fed will probably try to look through this number because of those distortions. ... Maybe the headline number is a bit misleading this time," Clarida added.

As Clarida pointed out, these distortions are overshadowing key indicators that would suggest the economy is actually building momentum.

For example, consumer spending outpaced government spending by 3.2 percentage points, which has been the strongest figure since the Q2 report back in 2022. Consumer spending is a strong indicator of economic health that can lead to several positive outcomes like GDP growth, increasing demand, and job creation.

The report found that inflation has also halted, with the PCE price index showing zero increase in costs from February to March. This is a promising figure compared to the 0.3% increase in costs in January.

"It's no surprise the leftovers of Biden's economic disaster have been a drag on economic growth, but the underlying numbers tell the real story of the strong momentum President Trump is delivering," press secretary Karoline Leavitt said in a statement Wednesday.

While the GDP has contracted overall, the core GDP grew a robust 3%, which the administration said "signals strong underlying economic momentum." Gross domestic investment also soared 22% in the first quarter, which was the highest in four years.

"Robust core GDP, the highest gross domestic investment in four years, job growth, and trillions of dollars in new investments secured by President Trump are fueling an economic boom and setting the stage for unprecedented growth as President Trump ushers in the new golden age," Leavitt said.

Like Blaze News? Bypass the censors, sign up for our newsletters, and get stories like this direct to your inbox. Sign up here!

Following the market’s reaction to Donald Trump’s recent tariff hikes, many investors remain fixated on short-term stock declines. But I’m less concerned about the immediate drop in equities and more focused on the broader ripple effects — especially given the current state of U.S. fiscal policy.

The Trump administration inherited serious economic challenges from the last four years of Bidenomics, a mess made much worse by unsustainable levels of deficit spending.

A stock market downturn could cut tax revenue significantly. In that case, any interest savings might be wiped out — or worse.

U.S. debt has surpassed 120% of GDP. Deficits now resemble those of a wartime economy. The government’s interest payments exceed defense spending — a major warning sign for any nation. Meanwhile, inflation remains stubbornly high.

The new administration took office facing high interest rates — not historically high, but elevated relative to recent norms, especially given the nearly $37 trillion in national debt — and a strong U.S. dollar. That hinders Trump’s policy options.

Given that context, are tariffs a strategic move to lower interest rates, refinance the debt, and buy the administration some breathing room? If so, can that approach work — and at what cost?

Roughly $7 trillion in U.S. debt is scheduled for refinancing this year. Add a projected $2 trillion deficit, and the government faces an enormous financing challenge.

The administration may be betting that aggressive tariff policy triggers a “flight to safety,” prompting investors to move money out of equities and into long-term government bonds. Greater demand for bonds would push their prices higher and yields lower, since bond prices and yields move in opposite directions.

We saw some evidence of this last week when the 10-year Treasury yield dipped below 4%, though it rebounded above 4% by Monday.

A stock market sell-off could pressure the Federal Reserve to cut short-term interest rates. So far, Fed Chairman Jerome Powell has shown no willingness to step in — but that could change.

The strategy carries significant risk. Federal tax revenue depends heavily on both economic growth and stock market performance. If markets continue to tumble, government revenue could shrink, adding further strain to an already fragile fiscal outlook.

Even if yields on the 10-year Treasury dropped by 100 basis points (or 1%), and the government managed to refinance all $9 trillion in scheduled debt, the interest savings would total only about $90 billion.

But that scenario is unlikely. Issuing more Treasury bonds increases supply, which typically pushes yields higher — unless some outside force steps in. And if such intervention is possible, it raises a larger question: why pursue this risky strategy in the first place?

There are also other risks to consider. A stock market downturn could cut tax revenue significantly. In that case, any interest savings might be wiped out — or worse, deficits as a percentage of GDP could grow even larger.

On top of that, a declining market can trigger the “reverse wealth effect.” When portfolios shrink, consumers tend to spend less. Since consumer spending makes up about 70% of the U.S. economy, that kind of pullback can slow growth. Businesses may also become more cautious, further weakening economic activity.

Luke Gromen of Forest for the Trees recently pointed out that in 2022, a 20% drop in the stock market led to a $400 billion decline in federal tax receipts. If the same happens in 2025, the financial impact would far outweigh any gains from refinancing debt.

In a recent report, Luke Gromen noted that the last three recessions pushed the U.S. deficit higher by 6%, 8%, and 12% of GDP, respectively. In today’s terms, that would mean increases of $1.6 trillion, $2.1 trillion, and $3.2 trillion during a recession.

Yet, Congress has offered no serious plan to cut spending. Any reductions that do happen would likely shrink GDP, which makes solving the problem even more challenging. That leaves the administration with very little room to maneuver.

While the White House denies any intent to trigger a market crash, some economists believe the administration’s aggressive tariff strategy may be designed to lower interest rates by creating financial stress.

If true, it’s a high-risk approach to managing the government’s rising interest burden. The longer it takes to deliver results, the greater the danger it backfires — potentially triggering a debt spiral instead of relief.

Let’s hope for a resolution before those risks materialize.

The United States economy posted a record-breaking rebound in the third quarter and has gone a long way toward recovering from the devastation reaped by the coronavirus-related shutdowns, according to new data released by the Commerce Department.

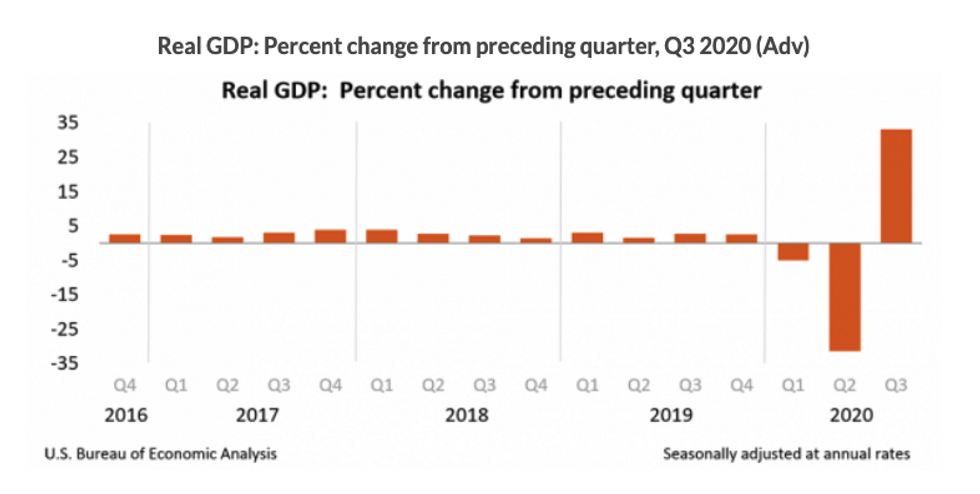

From July through September, the U.S. gross domestic product grew by 7.4%, which equals an annualized rate of 33.1%, the Bureau of Economic Analysis announced in a news release on Thursday. It's the largest quarterly GDP gain ever recorded.

The news, which comes just five days before the election, could provide a boost to President Donald Trump's re-election chances. The president will undoubtedly tout the new numbers as evidence that he has successfully led the country through difficult economic times.

Though economists largely expected the GDP to rebound at an unprecedented rate in the third quarter, Bloomberg News noted that the increase still managed to top economists' most recent prediction of a 32% increase, and blew away their forecast of an 18% increase from a few months ago.

The third-quarter gains were powered by major increases in consumer spending and business and residential investment, according to the BEA news release. The industries that benefitted most from increased consumer spending were health care, food services, motor vehicles, and clothing and footwear.

While the latest update is certainly good news for the economy, it should be noted that the third quarter gains followed the second quarter's 31.4% plunge, which was also a record-breaking number. The economy is still climbing out of the deep hole it plunged into in April and May as the pandemic thrust the nation into an economic standstill.

According to The Hill, about 10.7 million of the more than 20 million jobs lost during the pandemic have yet to be recovered. The nation's unemployment rate has improved to 7.9% over the last several months, but that figure is still more than double its pre-pandemic level.

"This is going to be seized upon by both ends of the political spectrum as either evidence of the strength of the post-lockdown economic rebound or a cursory warning that the gains could be short-lived," James McCann, senior global economist at Aberdeen Standard Investments, told CNBC.

"[But] the reality is that the GDP numbers demonstrate that the U.S. economy did indeed rebound strongly as lockdown measures were lifted," he added.