Horowitz: McConnell’s ‘wartime’ COVID investments come home to roost

“Bidenflation” existed before he staggered into office on January 20, 2021. It was catalyzed when nearly every Republican supported the worst piece of legislation in American history on March 25, 2020, which set off a cascade of several other pieces of legislation underwriting, incentivizing, and consummating COVID lockdowns. The chief cheerleader of the bill at the time was none other than Senate Majority Leader Mitch McConnell, the man whom Republicans are pining to see become floor leader once again next year to solve the inflation crisis. But in order to solve it, don’t we need to first acknowledge the cause and who was responsible?

Last week, Sen. Mitch McConnell tossed out the same tired bromide about Biden causing inflation with his $1.9 trillion reckless spending “on party line” last year.

\u201cOne clear reason we're suffering from 40-year high inflation: The $1.9 trillion reckless spending this all-Democratic government passed on a party-line basis last year. \n\nNow, after spending us into inflation, they want to tax us into a recession.\u201d— Leader McConnell (@Leader McConnell) 1657833072

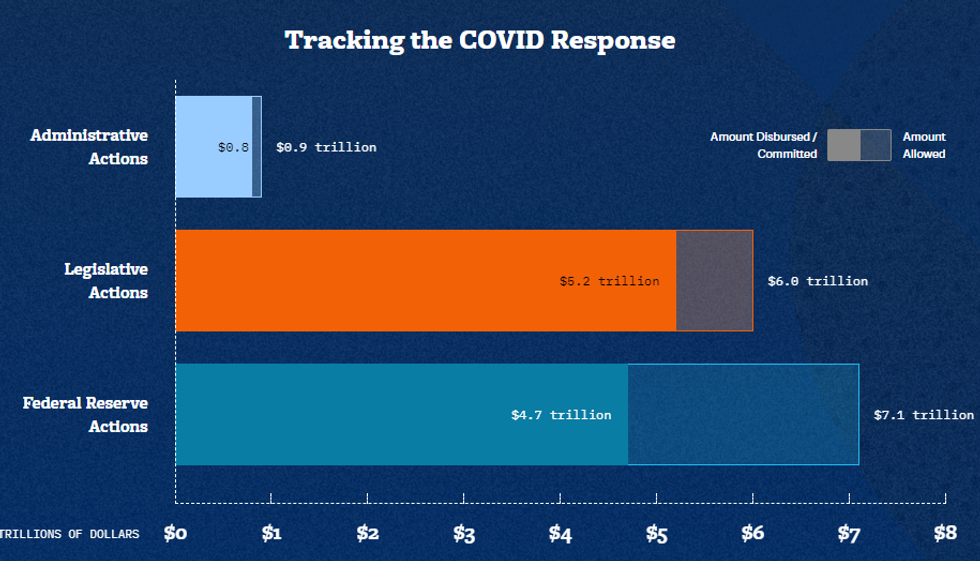

What he forgets to tell you is that the bulk of the unfathomable levels of spending came from the worst legislation in American history: the $2.2 trillion COVID lockdown/Big Pharma bill that he ardently pushed for in March 2020, which at the time, represented half of the entire federal budget! That bill led to a cascading effect of unconscionable spending and tyranny that, between Congress and the Federal Reserve, unleashed more than $10 trillion on the economy.

At the time, McConnell praised it as “a wartime level of investment into our nation.” “The men and women of the greatest country on Earth are going to defeat this coronavirus and reclaim our future," said Majority Leader Mitch McConnell when announcing the deal that morning. "The Senate's going to make sure that they have the ammunition they need to do it."

Except, it wasn’t a wartime investment in production, it was an investment in lockdown, paying people not to work, imposing tyranny, and inducing a vicious cycle of Big Pharma failure that perpetuated both the pandemic and the economic misery. Milton Friedman famously described inflation as the result of "too much money chasing too few goods.” Never was there a time in history when Congress voted to spend so much money to simultaneously shut down production and make goods scarce while lining the pockets of individuals and corporations with endless cash. As the San Francisco Federal Reserve Bank conceded in March when groping in the dark for the culprit of the history inflation, “In seeking an explanation, we turn to the combination of direct fiscal support introduced to counteract the economic devastation caused by the pandemic."

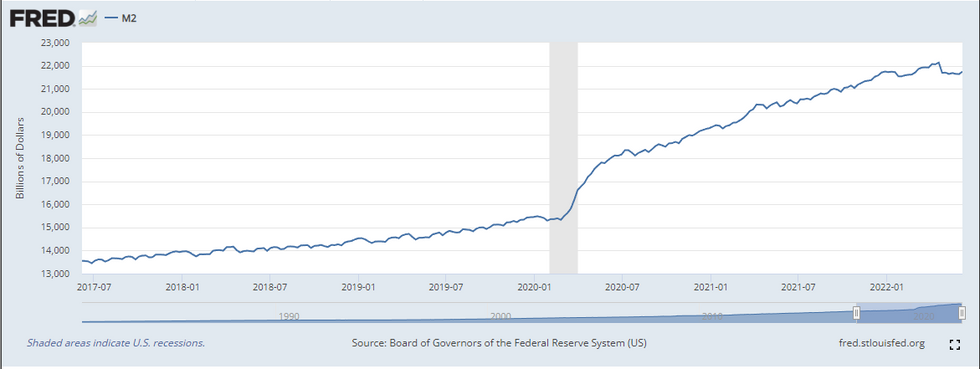

Because of the terrible COVID policies Republicans still refuse to acknowledge, the federal reserve went on such a bond buying spree that it literally increased the money supply by 40% and did this all while the same policies were shrinking output.

Hence, a lot of money suddenly chasing diminishing quantities of products.

What’s worse, these same Republicans then immediately jumped on the bandwagon of the “next current thing” by criticizing Biden for not giving enough money to Ukraine. It wasn’t just the over $50 billion we sent there without an understanding of the outcome we hoped to achieve, but it perpetuated a war and sanctions that are crushing supply chains, which further exacerbates the inflation. McConnell famously said in May that “the most important thing going on in the world right now is the war in Ukraine.”

Hence, McConnell carping about inflation now is akin to the arsonist lamenting the heat of the fire and dressing up as the firefighter. Obviously, Biden has done things on the regulatory side and through exacerbating the war on fossil fuels that aggravated this crisis, particularly as it relates to energy. But the foundation for this crisis was set in stone with the bills shepherded by McConnell when he was in the majority. And that date was not January 2021, but March 2020, when Republicans controlled two of the three branches.

Since March 2020, the gross debt has increased by over $7 trillion. It took from George Washington’s day to the first half of 2004 to accrue our first $7 trillion in debt. What is particularly jarring is that $6.5 trillion of that increase is composed of the “public debt,” not the “intragovernmental debt,” which we supposedly owe ourselves (most prominently the Social Security Trust Fund).

Which brings us back to the GOP senators and congressmen. Which programs would they cut or devolve to the state? What exactly would they do to combat the inflation and what systemic governmental reforms will they push that would address the enormity of the crisis? Combatting “waste, fraud, and abuse” or eliminating “pork” won’t cut it.

At least in 2010 during the Tea Party era, they claimed to oppose spending and then betrayed their promise. Today, they are not even acknowledging the issue of our time that caused the inflation. As such, how are we to believe anything would change on the other side of an auspicious election result?