Elizabeth Warren Yells ‘Soak The Rich’ While Making Millions On Wall Street

Financial records examined by RealClearInvestigations show that Warren has hardly followed the path of socialism in her personal finances.

Financial records examined by RealClearInvestigations show that Warren has hardly followed the path of socialism in her personal finances.More than 25 state financial officers have drawn a line in the sand with corporate giants including BlackRock and Fidelity.

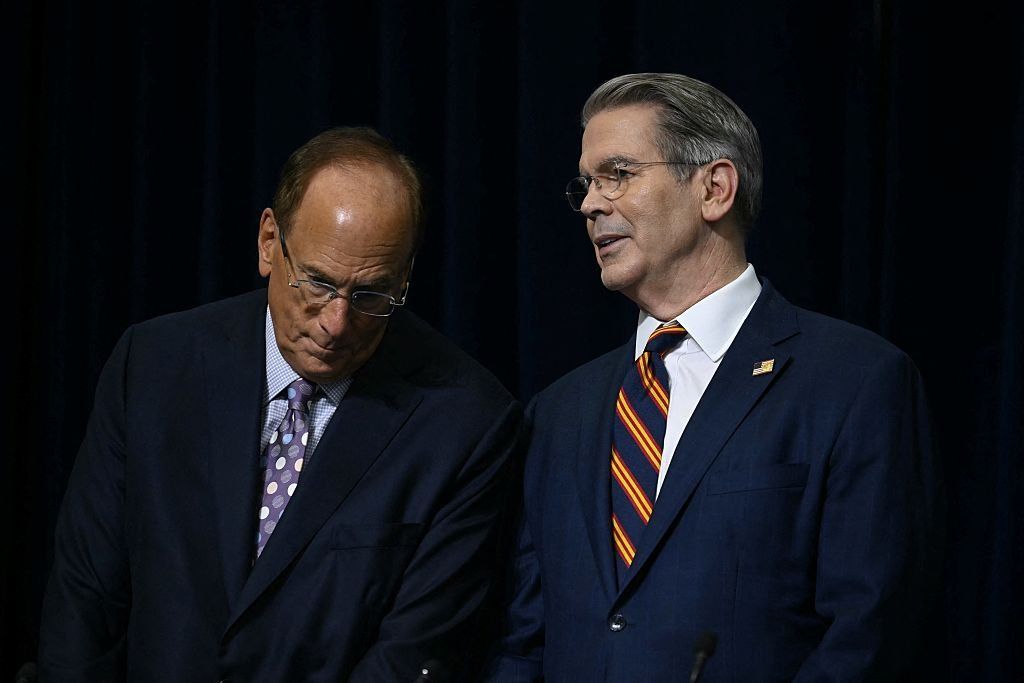

The group, made up of mostly treasurers, represents 21 states, 16 of which are governed by Republicans and five by Democrats. Together, they sent a damning letter to BlackRock CEO Larry Fink, along with other major financial firms like JPMorgan Chase and Vanguard, announcing that their states are willing to cut off ties if certain stipulations are not met.

The letter is in reaction to a recent decision by Texan authorities to remove BlackRock from its state blacklist after the investment firm announced it would roll back its climate change initiatives. The other 21 states say, however, that BlackRock and others have not done enough.

'These financial officers are doing the right thing for their states.'

The state reps, all of whom are Republican, said that these companies must return to a "traditional fiduciary duty" in which they focus 100% on financial return, instead of using capital to advance left-wing social and political agendas.

In their letter to Fink, the financial officers said that while some companies have started moving in the right direction by withdrawing from global climate coalitions, there is still more work to be done.

The treasurers outlined five actions the firms must take to demonstrate a "commitment to a fiduciary model grounded in financial integrity, not political advocacy."

RELATED: BlackRock and friends may soon control your digital wallet

The first term called for the end of "framing deterministic future outcomes as long-term risks to justify immediate ideological interventions through corporate engagement or proxy votes." Climate change initiatives are listed as the most common example of this issue.

Other requirements demanded that companies "abstain from embedding international political agendas" within their company framework, which included "net-zero climate mandates" and the "EU's Corporate Sustainability Reporting Directive (CSRD)."

Additionally, in order to work with these states, firms must also divulge all "affiliations and collaborative initiatives" that could influence investment strategies or priorities.

"Participation in such groups must not compromise a fiduciary's obligation to act solely on behalf of beneficiaries," the state representatives declared.

RELATED: This investor is wiping out white-collar jobs

"Actions always speak louder than words. Requiring America's financial giants to prove their independence from woke ideology with concrete steps before doing business with a state's dollars is fully necessary and just makes sense," OJ Oleka, CEO of State Financial Officers Foundation, said in a statement provided to Blaze News.

Oleka added, "These financial officers are doing the right thing for their states and the taxpayers whose financial security they've been entrusted to protect."

In total, 18 companies received a letter from the state financial officers: Amundi, BlackRock Inc., BNY Mellon, Capital Group, Fidelity Investments, Franklin Templeton Investments, Geode Capital Management, Goldman Sachs, Invesco, JPMorgan Chase, Legal & General, Morgan Stanley, Northern Trust, Nuveen, State Street Corporation, T. Rowe Price, Vanguard, and Wellington Management Company.

The states represented in the letter to investment firms were as follows: Alabama, Alaska, Arizona, Idaho, Indiana, Iowa, Kansas, Kentucky, Louisiana, Mississippi, Missouri, Nebraska, North Carolina, North Dakota, Oklahoma, Pennsylvania, South Carolina, South Dakota, Utah, West Virginia, and Wyoming.

Like Blaze News? Bypass the censors, sign up for our newsletters, and get stories like this direct to your inbox. Sign up here!

Many assume conservative principles belong to the past. They don’t. The debate over cryptocurrency regulation — including the House GOP’s Clarity Act — offers a chance to apply those principles to a 21st-century frontier.

Cryptocurrency and decentralized finance reflect core American values: free speech, free markets, and innovation from the ground up. Across the country, developers are building protocols that move money in microseconds, create new investment tools, and expand access to capital like never before.

With a Republican-led Congress considering landmark cryptocurrency legislation, we have a historic opportunity to apply time-tested conservative values to the cutting edge of financial innovation.

Blockchain technology provides a means to secure property rights in the digital era. The most transformative products likely haven’t even launched yet.

The potential benefits are massive. In 2024 alone, decentralized finance grew to more than $114 billion. Even more capital — billions of dollars — stands ready to enter the space through pension funds and institutional investors.

But that money won’t move without guardrails.

Institutional investors need transparency. That means audit requirements they can trust, legally accountable custodians, clear reporting on asset health, and safeguards against manipulation.

They also need legal certainty. Defined rules give investors confidence. Without them, they’ll stay away — or invest elsewhere.

That’s where Washington plays a role.

The Trump administration shifted U.S. regulatory policy toward digital assets, elevating crypto to a national priority through executive order. Now, with a Republican-led Congress weighing landmark crypto legislation, conservatives have a real opportunity.

This moment demands more than slogans. It calls for applying time-tested conservative principles — rule of law, market discipline, and individual liberty — to the future of finance.

Some treat cryptocurrency as a threat. Fair enough — the collapse of FTX still casts a long shadow over the current debate in Congress.

Sam Bankman-Fried, a Democratic megadonor, didn’t just run a failed company. He ran a cautionary tale — a playbook for what lawmakers must never allow again.

The FTX scandal highlights two enduring conservative truths:

FTX didn’t collapse because of cryptocurrency. It failed because no one held Bankman-Fried accountable. He amassed influence through backroom politics and ran a tangled network of private firms without meaningful oversight. The result: billions vaporized and public trust shattered.

Thoughtful legislation can prevent the next meltdown — not by stifling innovation, but by setting clear, enforceable rules rooted in transparency, responsibility, and the rule of law.

The bill now before Congress offers a rare chance to get crypto regulation right.

It tackles the custodial vulnerabilities exposed by the FTX collapse and establishes a framework that allows digital asset projects to integrate into the broader financial system. Just as important, it does so under a unified set of rules.

The bill follows conservative logic. It exempts infrastructure providers — such as blockchain validators and payment processors — from regulatory burdens that don’t apply. These actors don’t make governance decisions, and the law should reflect that.

It also classifies participants based on their actions, rather than the extent of their political influence.

But the bill still needs one critical fix.

Lawmakers need to include decentralized autonomous organizations as eligible cryptocurrency issuers. These DAOs, the opposite of central banks, operate through user-led governance. Crypto users vote on the rules of the system they help create.

DAOs have become common in decentralized finance. Yet the current bill overlooks them. That omission could block the very groups driving innovation from entering the regulated space.

RELATED: Trump’s Bitcoin masterstroke puts America ahead in digital assets

If a project follows the rules, discloses information, and acts responsibly, it should qualify, regardless of how it governs itself. Whether the issuer is a DAO, a startup, or a traditional bank, one standard should apply.

That’s the conservative way: equal rules, fair enforcement, and space for innovation to thrive.

Leaving the bill unamended carries real risks:

The biggest danger? Watching capital and talent flee to countries that welcome decentralized commerce while the United States — its origin point — falls behind.

Decentralized finance leaders aren’t calling for lawlessness. They want smart policy.

Joe Sticco, co-founder of Cryptex and a White House Crypto Summit participant, put it this way: “In DeFi, it’s not about evading rules — it’s about building better ones.”

Sticco believes today’s innovators want a seat at the table. “We believe open financial systems can coexist with responsible oversight,” he told me. “We have to show up, we have to explain the tech, and we have to help shape the rules.”

Congress still has time to get this right. But the window is closing.

Republicans now hold both chambers of Congress. That means the window to act is wide open.

This isn’t about growing government. It’s about setting the rules so innovation can thrive, fraud gets stopped, and people are held accountable. Here's what that looks like:

With these fixes, the Clarity Act can do what no other crypto bill has: protect investors, promote innovation, and keep America in the lead.

We can build the future of finance right here — on American terms, with American values. But we have to act now.