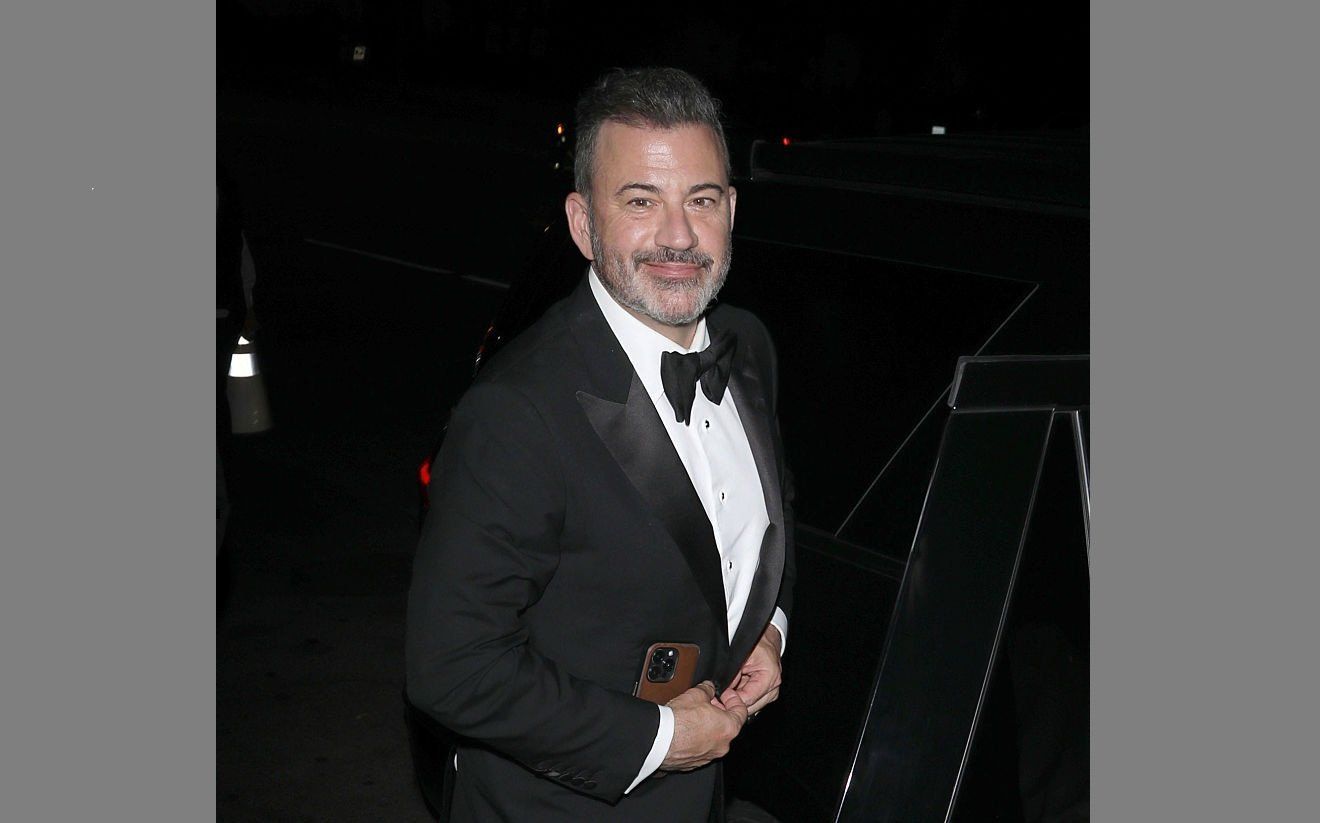

The forces behind the suspension of Jimmy Kimmel

In the wake of Charlie Kirk's assassination, Jimmy Kimmel delivered a monologue, still available on YouTube, in which he insinuated that the accused assassin was part of the "far-right."

“We hit some new lows over the weekend with the MAGA gang trying to characterize this kid who killed Charlie Kirk as anything other than one of them,” Kimmel said during his monologue. He added that the "MAGA gang" was trying to "score political points" following the shooting.

On Wednesday night, Sinclair and Nexstar Media Group, two of the largest ABC affiliate networks, said that Kimmel's show would be pre-emptively taken off air, effective immediately.

'This incident highlights the critical need for the FCC to take immediate regulatory action to address control held over local broadcasters by the big national networks.'

“Mr. Kimmel’s remarks were inappropriate and deeply insensitive at a critical moment for our country,” said Sinclair Vice Chairman Jason Smith. “We believe broadcasters have a responsibility to educate and elevate respectful, constructive dialogue in our communities. We appreciate FCC Chairman [Brendan] Carr’s remarks today, and this incident highlights the critical need for the FCC to take immediate regulatory action to address control held over local broadcasters by the big national networks.”

“Mr. Kimmel’s comments about the death of Mr. Kirk are offensive and insensitive at a critical time in our national political discourse, and we do not believe they reflect the spectrum of opinions, views, or values of the local communities in which we are located,” said Andrew Alford, president of Nexstar’s broadcasting division. “Continuing to give Mr. Kimmel a broadcast platform in the communities we serve is simply not in the public interest at the current time, and we have made the difficult decision to pre-empt his show in an effort to let cooler heads prevail as we move toward the resumption of respectful, constructive dialogue.”

RELATED: Jimmy Kimmel's show pulled off the air after Charlie Kirk comments

Nathan Leamer, a former FCC official in the first Trump administration, told Blaze News that Sinclair and Nexstar forced ABC's hand in a "rebellion" against the network. Leamer also praised Carr's approach, saying that the FCC is not forcing any action but rather "creating a lane for companies to make good decisions."

Sinclair will be airing a special tribute to Charlie Kirk on Friday. In addition, Sinclair asked Kimmel to issue a "direct apology" to the Kirk family and to give them and Turning Point USA a "meaningful personal donation."

Like Blaze News? Bypass the censors, sign up for our newsletters, and get stories like this direct to your inbox. Sign up here!

Rep. Chip Roy (R-Texas). Photo by Tom Brenner for the Washington Post via Getty Images

Rep. Chip Roy (R-Texas). Photo by Tom Brenner for the Washington Post via Getty Images Alex Wroblewski/Bloomberg via Getty Images

Alex Wroblewski/Bloomberg via Getty Images

Kent Nishimura/Bloomberg via Getty Images

Kent Nishimura/Bloomberg via Getty Images Bill Clark/CQ-Roll Call Inc. via Getty Images

Bill Clark/CQ-Roll Call Inc. via Getty Images

Photo by Kayla Bartkowski/Getty Images

Photo by Kayla Bartkowski/Getty Images Tierney L. Cross/Bloomberg via Getty Images

Tierney L. Cross/Bloomberg via Getty Images

Photo by Andrew Harnik/Getty Images

Photo by Andrew Harnik/Getty Images Photo by Anna Moneymaker/Getty Images

Photo by Anna Moneymaker/Getty Images

Smith says that "Hunter Biden repeatedly lied to Congress ... to distance his involvement in ... a clear scheme to enrich the Biden family."

Smith says that "Hunter Biden repeatedly lied to Congress ... to distance his involvement in ... a clear scheme to enrich the Biden family."