World Economic Forum anoints BlackRock CEO after investigation into Klaus Schwab goes nowhere

German economist Klaus Schwab founded the World Economic Forum in 1971 with the aim of engaging "the foremost political, business, and other leaders of society to shape global, regional, and industry agenda."

During his tenure, the WEF founder made no secret of his desire to radically reshape the world, pushing for a "Great Reset" of capitalism, pressuring businesses to commit to eliminating carbon emissions, grooming a network of future politicians, and characterizing "misinformation and disinformation" as two of the greatest threats facing humanity.

'You have to force behaviors. At BlackRock we are forcing behaviors.'

Under Schwab's leadership, the WEF also informed the masses in 2018, "You'll own nothing. And you'll be happy."

After five decades in the role, Klaus Schwab announced on April 1 that he was stepping down as chairman.

The WEF originally indicated that Schwab would complete his departure by January 2027; however, he stepped down on April 21 after his organization launched an investigation into allegations that he engaged in financial and ethical misconduct.

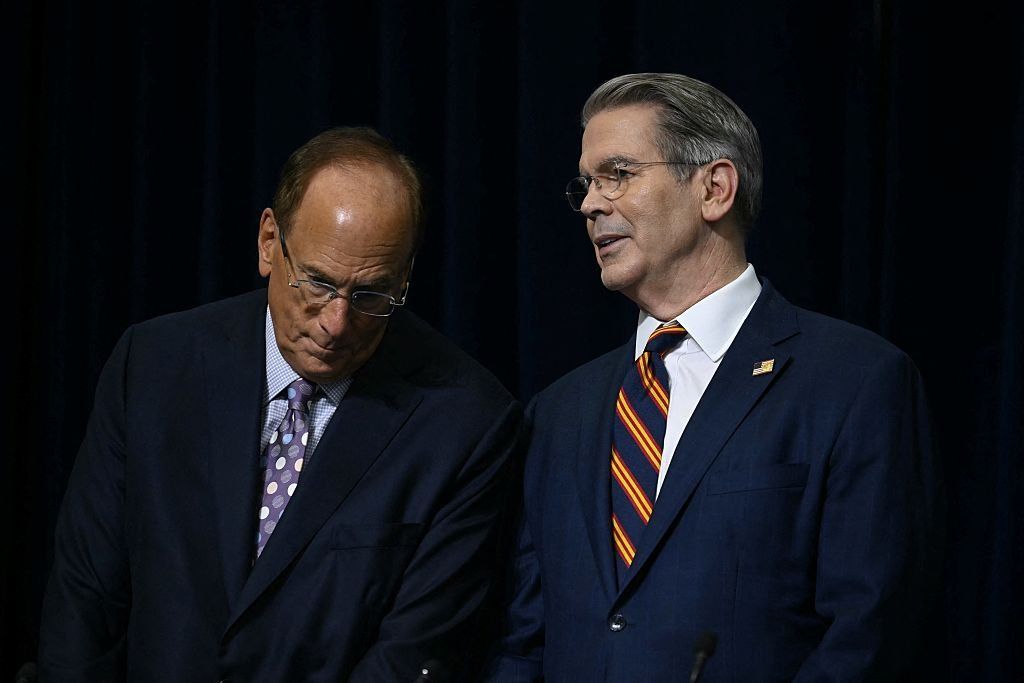

The forum announced on Friday that the investigation found "no evidence of material wrongdoing by Klaus Schwab" as well as who would replace him: Larry Fink, CEO of BlackRock, and André Hoffmann, vice chairman of the Swiss drug company Roche. The billionaire duo will serve as co-chairs.

"This moment marks a pivotal transition for the World Economic Forum. The board will now focus its attention on institutionalizing the Forum as a resilient International Organization for Public-Private Cooperation," the forum said in a statement. "This next chapter will be guided by the original mission developed by Klaus Schwab: Bringing together government, business, and civil society to improve the state of the world."

Schwab's mission might be easier to accomplish with Fink at the helm, given that he also runs the world's largest asset manager, which reported $11.58 trillion in assets under management in the first quarter of this year and has offices in 30 countries.

Fink, like his predecessor, was an early champion of handcuffing investing to liberal environmental, social, and governance agendas and has evidenced a willingness to socially engineer human behavior.

'What's emerging now is globalization's second draft.'

When discussing the imagined importance of diversity, equity, and inclusion in a 2017 interview, Fink said that "behaviors are going to have to change. This is one thing we’re asking companies. You have to force behaviors. At BlackRock we are forcing behaviors."

Years later, Fink vowed in a letter to shareholders to "embed DEI into everything we do."

While BlackRock dropped its DEI goals earlier this year, citing "significant changes to the U.S. legal and policy environment related to Diversity, Equity, and Inclusion (DEI) that apply to many companies," the WEF could afford Fink another vehicle to push the divisive agenda abroad.

Fink also apparently shares Schwab's globalist outlook.

Fink noted in a recent op-ed in the Financial Times that "globalization is now coming apart," thanks in part to the Trump administration's "backlash to the era of what might be called 'globalism without guardrails.'" The BlackRock CEO, evidently not a fan of nationalism, expressed cautious optimism that "what's emerging now is globalization's second draft."

Fink suggested in a joint statement with Hoffmann that the need for the forum is greater than ever and that it "can serve as a unique catalyst for cooperation, one that fosters trust, identifies shared goals, and turns dialogue into action."

Like Blaze News? Bypass the censors, sign up for our newsletters, and get stories like this direct to your inbox. Sign up here!

Red states deal huge blow to BlackRock and Vanguard, impose strict rules on investment firms

More than 25 state financial officers have drawn a line in the sand with corporate giants including BlackRock and Fidelity.

The group, made up of mostly treasurers, represents 21 states, 16 of which are governed by Republicans and five by Democrats. Together, they sent a damning letter to BlackRock CEO Larry Fink, along with other major financial firms like JPMorgan Chase and Vanguard, announcing that their states are willing to cut off ties if certain stipulations are not met.

The letter is in reaction to a recent decision by Texan authorities to remove BlackRock from its state blacklist after the investment firm announced it would roll back its climate change initiatives. The other 21 states say, however, that BlackRock and others have not done enough.

'These financial officers are doing the right thing for their states.'

The state reps, all of whom are Republican, said that these companies must return to a "traditional fiduciary duty" in which they focus 100% on financial return, instead of using capital to advance left-wing social and political agendas.

In their letter to Fink, the financial officers said that while some companies have started moving in the right direction by withdrawing from global climate coalitions, there is still more work to be done.

The treasurers outlined five actions the firms must take to demonstrate a "commitment to a fiduciary model grounded in financial integrity, not political advocacy."

RELATED: BlackRock and friends may soon control your digital wallet

The first term called for the end of "framing deterministic future outcomes as long-term risks to justify immediate ideological interventions through corporate engagement or proxy votes." Climate change initiatives are listed as the most common example of this issue.

Other requirements demanded that companies "abstain from embedding international political agendas" within their company framework, which included "net-zero climate mandates" and the "EU's Corporate Sustainability Reporting Directive (CSRD)."

Additionally, in order to work with these states, firms must also divulge all "affiliations and collaborative initiatives" that could influence investment strategies or priorities.

"Participation in such groups must not compromise a fiduciary's obligation to act solely on behalf of beneficiaries," the state representatives declared.

RELATED: This investor is wiping out white-collar jobs

"Actions always speak louder than words. Requiring America's financial giants to prove their independence from woke ideology with concrete steps before doing business with a state's dollars is fully necessary and just makes sense," OJ Oleka, CEO of State Financial Officers Foundation, said in a statement provided to Blaze News.

Oleka added, "These financial officers are doing the right thing for their states and the taxpayers whose financial security they've been entrusted to protect."

In total, 18 companies received a letter from the state financial officers: Amundi, BlackRock Inc., BNY Mellon, Capital Group, Fidelity Investments, Franklin Templeton Investments, Geode Capital Management, Goldman Sachs, Invesco, JPMorgan Chase, Legal & General, Morgan Stanley, Northern Trust, Nuveen, State Street Corporation, T. Rowe Price, Vanguard, and Wellington Management Company.

The states represented in the letter to investment firms were as follows: Alabama, Alaska, Arizona, Idaho, Indiana, Iowa, Kansas, Kentucky, Louisiana, Mississippi, Missouri, Nebraska, North Carolina, North Dakota, Oklahoma, Pennsylvania, South Carolina, South Dakota, Utah, West Virginia, and Wyoming.

Like Blaze News? Bypass the censors, sign up for our newsletters, and get stories like this direct to your inbox. Sign up here!

BlackRock drops DEI goals, citing US policy shift

BlackRock, the world's largest asset manager, announced in a Friday memo that it dropped its diversity, equity, and inclusion goals, citing a shift in policy under President Donald Trump.

A company-wide email from senior executives — CEO Larry Fink, President Robert Kapito, and global head of human resources Caroline Heller — noted "significant changes to the U.S. legal and policy environment related to Diversity, Equity and Inclusion (DEI) that apply to many companies, including BlackRock."

'These values have been fundamental.'

BlackRock stated that, as a result, it would conduct an ongoing review of its "global practices and announc[e] several changes today."

The company explained that it would not renew its "aspirational workforce representation" targets, dropping requirements for hiring managers to interview a diverse pool of candidates.

Additionally, BlackRock announced that its existing DEI staff would merge into a "Talent and Culture" team.

"Our employee networks, which are open to all employees and to which over 90% of employees belong, will continue to serve as important resources for our colleagues," the memo stated. "Last year, we welcomed more than 3,000 new colleagues and we are adding many more in 2025. Our connected and inclusive culture is imperative to achieving our commercial objectives and delivering performance for our clients."

In a 2021 letter to shareholders, Fink previously vowed to "embed DEI into everything we do."

In 2020, the asset manager established a goal to boost U.S. black and Latino employees by 30% and double the leadership numbers of those individuals by 2024. It has since abandoned these goals.

The company's 2023 annual report previously disclosed the percentage of its U.S.-based employees who identified as black and Latino. It also provided a breakdown of gender demographics. However, BlackRock's latest 2024 report did not disclose these stats.

Despite committing to ditching DEI-related practices, BlackRock reaffirmed its commitment to maintaining a diverse workforce and avoiding "groupthink."

The memo read, "We are committed to creating a culture that welcomes diverse people and perspectives to foster creative solutions and avoid groupthink. These values have been fundamental to our One BlackRock culture since our founding 37 years ago."

BlackRock has also been gradually retreating from woke practices, including environmental, social, and governance objectives. The company exited the United Nations-sponsored Net Zero Asset Managers coalition earlier this year.

Other corporations, including Goldman Sachs Group Inc., Citigroup Inc., McDonald's, Ford, and Walmart, have likewise recently walked back their DEI objectives following Trump's directive to investigate such programs for potential civil rights violations.

Like Blaze News? Bypass the censors, sign up for our newsletters, and get stories like this direct to your inbox. Sign up here!

BlackRock: The puppet master behind Kamala Harris

Kamala Harris is not a comedian, but you could be forgiven for thinking otherwise.

During the recent presidential debate, the tireless TikToker somehow managed to maintain a straight face while pledging to create an "opportunity economy" for the middle class. Yet, this promise rings hollow when both she and President Biden are deeply entangled with BlackRock, a firm notorious for crushing the very group she claims to uplift.

BlackRock’s CEO, Larry Fink, openly praises the efficiency of totalitarian regimes; what does this say about where the firm’s loyalties lie?

In short, BlackRock has used its vast financial influence to sway political decisions, control market outcomes, and prioritize profits over the interests of everyday people.

Master of puppets

It's the puppet master behind the scenes, shaping policies that favor the elite while leaving the middle class to foot the bill. Harris' cozy relationship with BlackRock exposes her "opportunity economy" as nothing more than a smokescreen for serving the powerful.

The facts speak for themselves.

Harris' two top economic advisers, Michael Pyle and Brian Deese, were key players at BlackRock. Both weredrafted last month, likely to help her craft policies in anticipation of a potential presidency.

As for Joe Biden, since taking office, he has surrounded himself with former BlackRock executives, embedding the financial giant's influence at the highest levels of government.

Take Michael Pyle, once BlackRock’s global chief investment strategist, who recently served as U.S. deputy national security adviser for international economics. In this critical role, Pyle directed the administration's international economic policy and acted as Biden’s key representative, or “sherpa,” at the G7 and G20 summits. His sway over global economic strategy was significant.

Before this, Pyle helped shape domestic policy as Harris’ chief economic adviser during the administration's disastrous first year. His deep ties to BlackRock underscore the firm’s growing grip on the Biden administration's decision-making, further aligning government policy with Wall Street’s interests.

Last week BlackRock announced that it was rehiring Pyle as deputy head of it's $3.2 trillion portfolio management group.

And let’s not forget Adewale "Wally" Adeyemo, another key player in the Biden administration. Currently serving as deputy secretary of the treasury, the 43-year-old was once Larry Fink'sright-hand man at BlackRock. During his time at the investment giant, Adeyemo acted as a senior adviser and led the firm's public policy team, directly shaping BlackRock’s strategy in navigating government relations and regulatory frameworks. His current role places him in a powerful position to influence U.S. financial policy.

You break it, you bought it

Then there's Eric Van Nostrand, a former BlackRock executive now serving as a senior adviser under Biden on economic issues related to Russia and Ukraine,as reported by Bloomberg. Since Van Nostrand’s appointment, BlackRock’s interest and involvement in Ukraine have suspiciously intensified, with the firm advising on reconstruction efforts and channeling investment into critical sectors.

BlackRock's history suggests this support is far from altruistic. The firm has a notorious track record of capitalizing on geopolitical crises for financial gain, rather than genuinely aiding nations in need. Much like itsexploitative role during the 2008 financial crisis, when BlackRock profited from the collapse it helped precipitate, the firm now stands to benefit from Ukraine’s instability. Its influence over Kyiv’s policies, including the deregulation of urban planning, paves the way for corporate interests to exploit a rather dire situation.

Chinese democracy

It doesn’t stop at Ukraine. BlackRock isn’t just funding the destabilization of democracies abroad — it’s actively helping China, a regime that poses an existential threat to American interests.

The Coalition for a Prosperous America has revealed how BlackRock funnels billions into Chinese companies, many linked to the Chinese Communist Party and the People's Liberation Army. This raises alarming questions about national security and America’s economic sovereignty.

BlackRock’s CEO, Larry Fink, openly praises the efficiency of totalitarian regimes; what does this say about where the firm’s loyalties lie? Certainly not with the average American family struggling to make ends meet.

As if that weren't enough, BlackRock’s involvement in the U.S. military-industrial complex adds another layer to its nefarious influence. As highlighted by researchers at Corporate Accountability, an organization committed to exposing corporations that undermine democracy, BlackRock holds tens of billions in investments in major defense contractors such as Lockheed Martin, Raytheon, and Boeing. By profiting directly from never-ending wars, BlackRock reaps enormous financial rewards while American taxpayers are left to foot the bill.

Which brings us back to Kamala Harris. For all her posturing, the flip-flopper-in-chief is not here to challenge this system. She’s here to safeguard it. If elected, Harris' economic policies will be molded by the same firm responsible for widening income inequality and eroding democracy. The Wall Street Journal has shed light on how BlackRock has amassed entire residential neighborhoods, turning these homes into rental properties. This aggressive acquisition strategy fuels bidding wars and drives up home prices, directly disadvantaging the middle class.

As Jeffrey Sonnenfeld, a Yale professor, has pointed out, Kamala Harris’ ties to Wall Street are even more intimate than Biden’s. And when Wall Street speaks, it’s really BlackRock’s voice you’re hearing. Harris’ campaign promises to support the middle class appear to be nothing more than a boldfaced lie. But this is what she excels at: bending the truth.

Make no mistake about it: BlackRock’s interests are diametrically opposed to those of the American people. A Harris presidency would mean more policies that enrich the few at the expense of the many. Kamala Harris isn’t the answer; on the contrary, she’s part of the problem.

Texas divests $8.5 billion from BlackRock, citing firm's 'destructive' ESG push

Texas notified investment management company BlackRock on Tuesday that it plans to yank a $8.5 billion investment, citing the firm's "destructive" environmental, social, and governance push, Fox Business reported.

Texas State Board of Education Chairman Aaron Kinsey told the news outlet that the Texas Permanent School Fund, which has previously placed investments with BlackRock, will pull the funds. Kinsey explained that the move ensures the PSF, a fund created to support public schools, complies with state law.

The state passed Senate Bill 13 in 2021, prohibiting "investments in companies that boycott certain energy companies." The measure requires the state comptroller to maintain a list of investment firms boycotting fossil fuel energy companies. In November, Texas Comptroller Glenn Hegar announced the addition of five financial companies to the list.

"Texas has been a leader in calling out investment firms that have been playing politics with the retirement money of hard-working Americans. Our goal has always been to bring some honesty to what has really been a one-sided and intellectually dishonest discussion," Hegar stated at the time.

"I wanted to end the doublespeak by so many companies and show the critical impact that fossil fuels have on our daily lives," he added.

Fox Business reported that Hegar urged the PSF and five state pension funds to end their relationships with BlackRock.

"The Texas Permanent School Fund has a fiduciary duty to protect Texas schools by safeguarding and growing the approximately $1 billion in annual oil and gas royalties managed by the Texas General Land Office," Kinsey said Tuesday. "Terminating BlackRock's contract ensures PSF's full compliance with Texas law."

Kinsey argued, "BlackRock's dominant and persistent leadership in the ESG movement immeasurably damages our state's oil and gas economy and the very companies that generate revenues for our PSF."

He accused the company of having a "destructive approach toward the energy companies that this state and our world depend on [which] is incompatible with our fiduciary duty to Texans."

The $8.5 billion represents a significant portion of the PSF's $53 billion fund. Kinsey noted that the state and the PSF "have worked hard to grow this fund to build Texas' schools."

Texas' decision to pull the funds marks the largest divestment from BlackRock.

"Today represents a major step forward for the Texas PSF and our state as a whole. The PSF will not stand idle as our financial future is attacked by Wall Street," Kinsey remarked. "This bold action helps ensure our PSF remains in fact permanent and will continue to support bright futures and opportunities for generations of Texas students."

A BlackRock spokesperson told Fox Business, "BlackRock is helping millions of Texans invest and save for retirement."

"On behalf of our clients, we've invested more than $300 billion in Texas-based companies, infrastructure and municipalities, including $125 billion invested in the energy sector, including a $550 million joint venture with Occidental. We recently hosted an energy summit in Houston designed to explore how to strengthen Texas' power grid," the company added.

"Today's unilateral and arbitrary decision by Board of Education Chair Aaron Kinsey jeopardizes Texas schools and the families who have benefited from BlackRock's consistent long-term outperformance for the Texas Permanent School Fund," BlackRock continued. "The decision ignores our $120 billion investment in Texas public energy companies and defies expert advice. As a fiduciary, politics should never outweigh performance, especially for taxpayers."

Last year, BlackRock CEO Larry Fink declared that he would no longer use the "weaponised" term "ESG," stating that it has become too politicized on both sides of the aisle, Reuters reported. He noted he was "ashamed of being part of this conversation."

Arizona, Arkansas, Florida, Louisiana, Missouri, South Carolina, Utah, and West Virginia have made similar divestments.

Like Blaze News? Bypass the censors, sign up for our newsletters, and get stories like this direct to your inbox. Sign up here!

Biden’s Natural Gas Shutdown Won’t Help The Environment, But It Will Make You Poor, Cold, And Miserable

The leftist war on energy is all about control.

The leftist war on energy is all about control.Tennessee Sues Blackrock For ‘Deceiving Consumers’ About Its Radical Climate Agenda

In the 'first-of-its-kind' lawsuit, Tennessee sued BlackRock for harming Tennessee consumers via radical ESG commitments.

In the 'first-of-its-kind' lawsuit, Tennessee sued BlackRock for harming Tennessee consumers via radical ESG commitments.

BlackRock CEO Larry Fink just revealed his plan to 'FORCE behaviors'

Surely by now you’ve heard of BlackRock, the largest money management company on the planet, that is spearheading ESG scores and driving up the price of homes in the U.S.

And even though the firm has $10 trillion in assets under its management, Larry Fink, the chairman and CEO, isn’t satisfied.

He also needs to control you.

Here are a few things Mr. Fink said at a recent conference:

“Behaviors are going to have to change.”

“You have to force behaviors, and at BlackRock, we are forcing behaviors.”

“If you don’t achieve these levels of impact, your compensation could be impacted.”

Pat Gray is outraged by the flagrant overreach.

“Force is the plan of Satan,” he says. “It is the opposite of God's plan for us, and it's the opposite of everything this nation was founded on and stands for.”

“We gotta stand up to this ESG situation, this diversity and equity garbage,” he continues.

“BlackRock, Vanguard, State Street – I mean, those are the companies that … run the show,” adds Keith Malinak.

Want more from Pat Gray?

To enjoy more of Pat's biting analysis and signature wit as he restores common sense to a senseless world, subscribe to BlazeTV — the largest multi-platform network of voices who love America, defend the Constitution, and live the American dream.