Democrats Take Over State, Immediately Move To Soften Crime Laws

state House's Courts of Justice Committee is weighing soft-on-crime legislation

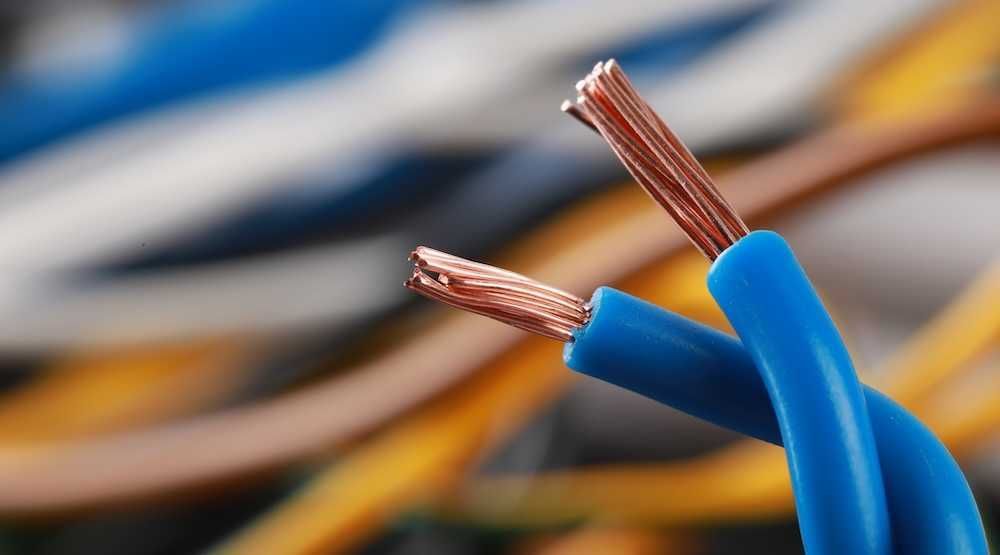

Imagine calling 911 and no one answers. A hospital loses internet access mid-surgery and your child is the patient. You can’t work, access your bank, or contact your doctor — all because a few thieves ripped copper wiring from the ground to sell for scrap.

These aren’t distant hypotheticals. They’re happening across the country right now. In recent weeks alone, copper wire thefts darkened 5,500 streetlights in Tucson, shut down Denver’s A-Line train, and caused $1.25 million in losses in Bakersfield, California, where thieves stripped wiring from electric-vehicle charging stations.

Broadband is critical infrastructure — the digital lifeline of daily American life. Protecting it is not a corporate issue but a consumer one.

The problem isn’t slowing down. Two new reports reveal a stunning rise in theft and vandalism against America’s broadband and wireless networks. Between June 2024 and June 2025, more than 15,000 incidents disrupted service for over 9.5 million customers nationwide. In just the first half of 2025, incidents nearly doubled from the previous six months.

Hospitals, schools, 911 dispatch centers, even military bases have been hit — exposing a growing national vulnerability.

The cost of stolen wire is trivial compared with the damage it causes. Between June and December 2024, theft-related outages cost society between $38 million and $188 million in losses. California and Texas took the biggest hits — $29.3 million and $18.1 million — while smaller states like Kentucky suffered millions too. Every cut cable ripples outward, silencing entire communities.

These aren’t weekend thieves looking for beer money. They’re organized, brazen, and increasingly strategic. Some know exactly which copper or fiber-optic lines to hit. Others destroy fiber cables by mistake, assuming they contain metal. Either way, the result is the same: chaos, cost, and danger.

Consumers pay the price. Each attack disrupts 911 access, paralyzes small businesses, and stalls health care, banking, and remote work. Broadband expansion — especially in rural and underserved areas — slows to a crawl.

Some of these attacks are so severe that investigators now treat them as potential acts of domestic terrorism. Charter Communications reports a 200% increase in felony attacks on its Missouri fiber network this year. In Van Nuys, California, vandals cut 13 fiber lines in one night, knocking out 911 dispatch, a military base, and hospitals for 30 hours. These were no petty crimes. They were coordinated strikes that endangered lives.

Businesses, taxpayers, and consumers have invested billions to build these networks. Letting criminals dismantle them for pocket change is unacceptable.

Yet under current federal law, destroying broadband infrastructure isn’t punished like attacks on pipelines, railways, or power grids. In many states, penalties are outdated or nonexistent — effectively giving vandals a free pass to cripple critical systems.

Congress has begun to respond. Reps. Laurel Lee (R-Fla.) and Marc Veasey (D-Texas) have introduced H.R. 2784, the bipartisan Stopping the Theft and Destruction of Broadband Act. The bill would amend federal law to explicitly criminalize the destruction of broadband infrastructure, giving law enforcement the tools needed to act.

Adding broadband systems to the list of protected critical assets under Title 18 of the U.S. Code would send a clear message: This isn’t scrap-metal scavenging — it’s sabotage, and it will be prosecuted as such.

RELATED: China rules the resources we need to build the future. Now what?

To defend consumers and our connected economy, lawmakers must:

States like Florida, South Carolina, and North Carolina have already moved to deter these crimes. Congress should follow their lead.

Broadband is critical infrastructure — the digital lifeline of daily American life. Protecting it is not a corporate issue but a consumer one. Americans shouldn’t have to wonder whether their connection will work when they need it most.

We built the connected economy. Now we must defend it — before the vandals win.

The integrity of sports is in trouble again, or so the headlines say. The FBI last week arrested more than 30 people in a wide-ranging gambling probe that ensnared Portland Trail Blazers head coach Chauncey Billups and Miami Heat guard Terry Rozier.

A former Cleveland Cavaliers player, Damon Jones, was also charged in two separate cases — one involving sports betting improprieties, the other tied to Billups’ alleged participation in an illegal poker ring linked to the mafia.

Cheating is illegal. Addiction is tragic. But gambling itself isn’t a sin against the republic.

Given the timing — amid public debate over legalized sports wagering since 2018 — the FBI’s sweep might look like vindication for critics of betting. It isn’t.

When federal agents arrest millionaire athletes and coaches for gambling crimes, it raises an obvious question: Is legalized sports betting really to blame?

Rozier’s salary cap for the 2025-26 season is $26.6 million. His career earnings total more than $160 million. Billups made $4.7 million during the 2024-25 NBA season. Disgraced Toronto Raptors player Jontay Porter, 25, had earned $2.7 million before his ban for sharing medical information to steer bets.

When people earn sums that most Americans can’t even imagine, they often invent new ways to ruin themselves. The average NBA salary in 1991 was $800,000; today it’s more than $8 million. As David Cone of Crain and Company observed, “Even if you’re just on a roster, you make more than doctors make. There’s no excuse.”

There really isn’t. This scandal is less about gambling and more about human nature — about greed, self-destruction, and the moral rot that wealth alone can’t fix. The Supreme Court’s decision to legalize small wagers didn’t make multimillionaires betray their sport for a few illegal dollars. They did that on their own.

When infielder Fred McMullin went down in the 1919 “Black Sox” scandal, he earned $3,500 a year — roughly $67,000 in today’s money. Those players were underpaid and easily tempted. No one can say that about professional athletes or coaches today.

Legalized betting didn’t create this corruption, and FBI Director Kash Patel said as much during an interview with Laura Ingraham on Fox News.

A video clip from ESPN’s “Get Up” made the rounds this week after producers hastily removed an on-screen ad for ESPN Bet during coverage of the scandal. The network’s discomfort spurred an online feeding frenzy from the right’s new morality police, who pounced on the moment as proof of hypocrisy.

Saagar Enjeti circled the ad and captioned it, “Spot the problem.” But the real problem isn’t the ad; it’s addiction and bad character. Billups apparently got hooked on poker. Rozier and Jones broke the law and got caught in an era when every transaction and text leaves a trail.

Enjeti calls this “uncontrolled.” Tell that to the players facing federal indictments. Gambling today is more visible, traceable, and regulated than ever before. The temptation hasn’t changed — the surveillance has.

RELATED: The myth of the online gambling ‘epidemic’

Critics say the explosion of legal sportsbooks has opened new avenues for corruption. Maybe. But it has also pulled a massive shadow economy into the light. Americans didn’t wait for the Supreme Court’s permission to wager; by 2015, they were already betting an estimated $150 billion a year on illegal offshore sites.

Yes, the sector’s growth has been explosive. And yes, it’s unsettling to see leagues, networks, and sportsbooks growing so intertwined. But that doesn’t make moral crusaders the saviors of integrity.

Take Illinois Gov. JB Pritzker, who reportedly won $1.4 million playing blackjack in Las Vegas last year — less than 1% of his net worth. Critics didn’t call that a moral crisis.

The point is simple: People should be free to spend their discretionary income as they choose. Cheating is illegal. Addiction is tragic. But gambling itself isn’t a sin against the republic.

The latest pro sports scandal offers a moral lesson, but not the one the prohibitionists want to hear. Legalized betting didn’t corrupt sports — people did. And no law can outlaw greed.

President Trump is right: It’s a disgrace that violent criminals and gangs roam freely through the nation’s capital — even in neighborhoods housing top government officials. Federalizing control over D.C. law enforcement and deploying the National Guard makes sense. But the deeper rot isn’t a lack of police presence. It’s the collapse of deterrence through weak sentencing and a revolving door for repeat offenders, especially juveniles.

If Trump truly wants to make Washington safe — and follow El Salvador’s tough-on-crime model — he must break from the “criminal justice reform” movement he once embraced. Those same policies have turned D.C. into a carjacker’s paradise.

The bipartisan experiment with leniency has failed. The bipartisan demand for safety is loud and clear.

No cherry-picked statistics can hide the reality: Lawmakers, staffers, and high-ranking officials fear walking around parts of the city, including Capitol Hill, even during the day. The recent attack on DOGE official Edward Coristine by a pack of 10 juveniles attempting to steal a woman’s car says everything. In 2023, D.C.’s carjacking rate hit 142.8 per 100,000 people, up 565% since 2019. Juveniles committed 63% of those crimes, with guns involved in more than three-quarters of cases.

The crime wave wasn’t random. In 2018, the D.C. Council passed the Youth Rehabilitation Act Amendment, allowing most offenders under 25 to get reduced sentences and sealed records. Repeat armed carjackers face little risk of long-term prison time. Even FBI agents have been victims. Mayor Muriel Bowser admitted some juvenile carjackers have six or seven priors — and still walk free.

Other “reform” laws stacked the deck. The Incarceration Reduction Amendment Act allowed resentencing for crimes committed before age 18. The Second Look Amendment of 2020 expanded that leniency to criminals sentenced before the age of 25 — prime time for violent crime. These measures all but erased the deterrent effect of sentencing.

And this isn’t just a problem for left-wing dystopian cities and states. Republican lawmakers in red states have pushed softer juvenile laws, too. Florida Gov. Ron DeSantis (R) had to veto several leniency bills. He remains one of the few willing to confront the bipartisan jailbreak agenda.

Over the past decade, leaders in both parties have embraced the “decarceration” canard. They’ve reduced sentences, ignored parole violations, and wiped criminal records — all in the name of shrinking prison populations.

The result? Predictable chaos.

RELATED: The capital of the free world cannot be lawless

President Reagan’s Task Force on Victims of Crime saw it coming four decades ago: “Juveniles too often are not held accountable for their conduct, and the system perpetuates this lack of accountability.”

Trump himself backed the First Step Act, which released dangerous offenders early. One of them — Glynn Neal, with a long record of violent crime — walked free just one day before stabbing a staffer for Sen. Rand Paul (R-Ky).

Troops on the street can help. But this is more than a policing problem — it’s a policy problem. Trump’s second term should reject the leniency consensus and restore deterrence, starting with nullifying D.C.’s soft-on-crime laws.

If he wants to win the public’s trust on crime, he must trade “criminal justice reform” for criminal justice enforcement. The bipartisan experiment with leniency has failed. The bipartisan demand for safety is loud and clear.

The Supreme Court’s recent ruling greenlighting mass layoffs at the Department of Education sends a clear message: The courts no longer belong to the Democrats.

For decades, Democrats relied on judges to impose policies they couldn’t pass through Congress. But that strategy has collapsed. With a conservative majority now on the bench, the judicial workaround has given way to constitutional limits — and the left is losing.

Every time Democrats sue to block Trump’s orders, they hand him another opportunity — and this court is more than ready to lock in conservative victories for a generation.

In the final week of its 2024-2025 term, the high court:

In high-stakes emergency cases, Trump keeps winning — notching victories in nearly all 18 Supreme Court petitions. That includes greenlights to deport migrants to third countries and enforce the transgender military ban.

Democrats thought they could run out the clock with courtroom delay tactics. Instead, they handed Trump a fast pass to the one branch he dominates.

Only one branch of government speaks with a single, constitutionally defined voice — the executive. And right now, that voice belongs to the president, no matter how loudly the deep state screams.

Unlike the executive, Congress isn’t built for speed. It’s a fractured, slow-moving body by design — hundreds of voices split by region, party, and ego. The judiciary can splinter, too, with power scattered across lower courts nationwide.

But the Supreme Court? That’s a different story.

With a 6-3 conservative majority, Trump holds a 2-to-1 advantage. Imagine if Republicans had that kind of dominance in Congress.

Trump wouldn’t be scraping by with a razor-thin 220-212 majority in the House. His agenda would cruise through. In the Senate, forget the 60-vote filibuster firewall — Trump’s bills would pass outright.

Reconciliation wouldn’t be a high-wire act. It would be routine. No more watching the Senate parliamentarian gut key provisions from his One Big Beautiful Bill Act.

Granted, the Supreme Court can’t launch policy offensives like Congress or the White House. It waits for cases to land.

But thanks to Democrats, those cases keep coming. Every time they sue to block Trump’s executive orders, they hand him another opportunity — and this court is more than ready to lock in conservative victories for a generation.

For decades, Democrats treated the courts as a shortcut to power. When they couldn’t pass laws, they let judges do the work. Roe v. Wade was the crown jewel — a sweeping federal abortion mandate they never could have gotten through Congress. Even Ruth Bader Ginsburg admitted the legal reasoning was flimsy.

They used the same playbook to expand the welfare state and rewrite social policy from the bench. Judicial activism became the norm, and both sides played the game. But Democrats played it harder — and now the rules are turning against them.

What once looked like a string of permanent victories has turned into a pipeline of defeats. Every lawsuit they file hands Trump’s Supreme Court another shot at affirming his agenda. Even when he technically loses, the rulings often leave behind a roadmap showing exactly how to win the next round.

RELATED: Supreme Court grants massive victory to Trump administration on cutting down Department of Education

Democrats’ Supreme Court problem could get a lot worse. Justice Sonia Sotomayor, the court’s oldest liberal at 71, has Type 1 diabetes and a history of health problems. If she steps down during Trump’s term, he could lock in a 7-2 conservative majority.

And if either Clarence Thomas, 77, or Samuel Alito, 75, decides to retire, Trump could replace them with younger conservatives — extending the court’s rightward tilt for decades.

Trump has every incentive to issue bold executive orders. Each lawsuit the left files creates another opening for the Court to back him — and turn temporary wins into permanent precedent.

By chasing headlines and placating the base with short-term court fights, Democrats are handing Trump the long game. Their decades of judicial overreach have backfired. The courts they once controlled now serve as Trump’s most powerful weapon.