The American dream now comes with 23% interest

You may not know Steve Eisman’s name, but you should. He was the investor who bet against Wall Street in 2008 and won big — to the tune of $800 million, with a current net worth in the neighborhood of $1.5 billion. If you saw “The Big Short,” Steve Carell played him as Mark Baum.

Americans are past living paycheck to paycheck. They’re living loan to loan.

These days, Eisman hosts “The Real Eisman Playbook” on YouTube. And like in 2007, he’s warning again — this time about the fragile state of the American consumer.

He isn’t alone. In a recent episode, Eisman spoke with Lakshmi Ganapathi of Unicus Research, who shares her grim view of the U.S. economy. Their conversation, combined with the data, paints a picture more alarming than most headlines dare admit.

Consumers are broke

“If you deduct the AI expenditures,” Eisman said, “... the U.S. economy is not even growing, really, 50 basis points, outside of AI.” In plain English: Without the artificial-intelligence boom, growth would be nearly flat at around 0.5% growth — likely even lower — not the 3.8% the Bureau of Economic Analysis reported for the second quarter of 2025.

Ganapathi didn’t mince words either. “Consumers are broke,” she said. “The monthly budget math no longer works.”

That’s what happens when Washington spends decades pretending math doesn’t matter. During COVID, federal “stimulus” checks poured roughly $800 billion into households. The cash wave briefly made millions look creditworthy — even as the underlying economy collapsed.

“Subprime consumers became prime,” Ganapathi explained. With reporting on student-loan and credit-card delinquencies suspended, millions suddenly looked like perfect borrowers. Credit scores soared to 700 and 800.

“They got a check that made them look richer than they actually were,” Eisman noted.

Banks then bundled those inflated loans into asset-backed securities — the same shell game that fueled the 2008 meltdown. The illusion of “prime credit” returned, this time wrapped in COVID relief and moral hazard.

The debt pyramid

Ganapathi described auto loans now stretching to 84 months — seven years — at 22% to 23% interest, which is credit-card territory. Americans collectively carry $1.2 trillion in card debt and $676 billion in car loans.

Add mortgages and student loans, and the numbers turn grotesque. Americans owe $20.83 trillion on homes, with an average interest rate of 6.37% on a 30-year note, and $1.81 trillion on student loans. We pay roughly $1.6 trillion a year in interest alone.

And since Washington nationalized student lending under Obama, it can now garnish wages indefinitely. “If you file for bankruptcy,” Eisman said, “your student loan stays with you.” A debt you can never escape — courtesy of your government.

The federal government owes $38 trillion but somehow pays a third less in interest. Fairness, D.C.-style.

Kicking cans and eating debt

Ganapathi noted that 90-day-plus credit-card delinquencies have doubled since 2021. Consumers are defaulting on car loans. Banks, desperate to avoid repossession losses, simply “modify” the loans and call them current — the same can-kicking that defines Washington’s budget process.

At this point, 69% of Americans live paycheck to paycheck. Nearly a quarter of them now use “buy now, pay later” services to pay for their groceries.

RELATED: Jerome Powell proves the Fed’s ‘independence’ is a myth

Yes — groceries.

Eisman spelled it out: People are literally financing food. They buy a week’s worth of groceries, then spend the next two or three months paying for them — often at interest rates that can hit 36% after a single missed payment.

Americans are past living paycheck to paycheck. They’re living loan to loan.

The illusion of prosperity

This is the real economy hiding beneath Washington’s sunny numbers — an economy where debt props up demand and borrowed time props up debt. It’s 2008 in slow motion, but this time it’s ordinary households, not hedge funds, holding the toxic paper.

When the middle class needs “by now, pay later” to eat, the “strong economy” line collapses into farce.

America’s consumers are tapped out, overleveraged, and fresh out of illusions. The only question left is how long the lenders — and leaders in Washington — can pretend otherwise.

Photo by Spencer Platt/Getty Images

Photo by Spencer Platt/Getty Images

Ployker via iStock/Getty Images

Ployker via iStock/Getty Images  It’s long past time for taxpayers to stop subsidizing woke indoctrination that doesn’t make students smarter — or richer.

It’s long past time for taxpayers to stop subsidizing woke indoctrination that doesn’t make students smarter — or richer. America’s youth are being pushed into a one-size-fits-all college track that saddles many with debt — without preparing them for careers.

America’s youth are being pushed into a one-size-fits-all college track that saddles many with debt — without preparing them for careers. After seeing Biden's illegal loan forgiveness scheme, can anyone blame the would-be jihadis on campus for their entitlement to break the law?

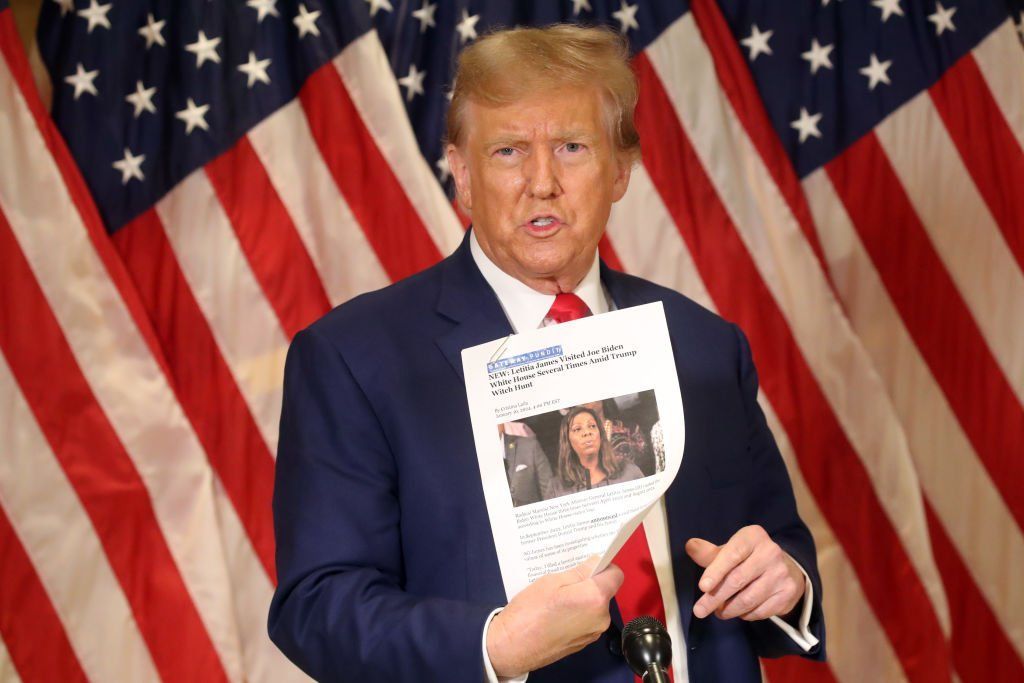

After seeing Biden's illegal loan forgiveness scheme, can anyone blame the would-be jihadis on campus for their entitlement to break the law? Engoron overvalues Trump’s alleged savings and profits to such a preposterously false extent, it should be a crime itself.

Engoron overvalues Trump’s alleged savings and profits to such a preposterously false extent, it should be a crime itself.

A Wall Street Journal investigation of public universities found massive increases in spending over the past two decades.

A Wall Street Journal investigation of public universities found massive increases in spending over the past two decades. Normal people should be furious. Once again, the government changed the rules everyone lives by for a small, extremely wealthy, and politically connected group of people.

Normal people should be furious. Once again, the government changed the rules everyone lives by for a small, extremely wealthy, and politically connected group of people.