![]()

“Don’t eat your seed corn.” Every farmer gets it. Every American with common sense gets it. The only people who don’t? The people who run corporate America.

A farmer keeps part of this year’s crop for planting next year. He could sell it now and pocket more cash — but then there’s nothing to plant, nothing to harvest, nothing to live on later. That’s obvious to anyone who works the land.

Capitalism creates wealth. But when wealth is extracted at the expense of the product, the people, and the future — that’s not capitalism. That’s predatory ransacking.

But in today’s boardrooms, the rule is reversed. Short-term profit is all that matters. Strip the future bare, cash out, and leave the mess for someone else to clean up.

The rewards for this corporate vandalism are massive: fat bonuses, stock windfalls, golden parachutes. The damage — lost jobs, gutted industries, shoddy products — is someone else’s problem.

And the fastest way to pull it off? Slash costs to the bone. Ship jobs overseas. Push out the people who know the business best. Wreck customer service. Kill innovation. Downgrade quality until the product barely passes as the same thing you used to make.

Private equity and corporate strategists have a new trick for squeezing customers dry: “revenue mining.” That means cross-selling, upselling, jacking up prices, and hiding the real costs in creative contracts.

At first, it works. Existing customers tend to stick around — inertia keeps them from bolting right away. But each gimmick drives off a slice of loyal business. Combine that with lower service quality and cheaper products, and the exodus accelerates. Before long, the company is stuck with an overpriced product, lousy service, and no easy way to attract new customers.

I’ve watched this play out in my own life. My exterminator. My alarm company. My HVAC service. All wrecked by the same formula. The local phone number? Redirected to a call center overseas — if I can navigate the phone tree. The people I used to know? Gone. The contract? Suddenly much more expensive.

The service I get for my trouble? Less than before. And when the tech finally arrives, all he says is, “Things are much different now.” They might wring one more payment out of me, but I’m already shopping for a local outfit that treats me like a customer instead of prey.

In short, they ate their seed corn. They got one fat harvest out of me, then pushed me straight into the arms of their competition — for good.

At least my dentist is still a one-man shop who owns his own business. But even dentistry is under siege. Private equity-backed dental chains are giving dentistry a bad name, pushing unnecessary procedures just to meet revenue targets.

A USA Today investigation titled “Dentists under pressure to drill ‘healthy teeth’ for profit” uncovered one such example:

Dental Express was part of North American Dental Group, a chain backed by private-equity investors. At least a year earlier, the company had told dentists like Griesmer to meet aggressive revenue targets or risk being kicked out of the chain. Those targets ratcheted up pressure to find problems that might not even exist.

In my professional career, I have seen too many examples of the same pattern: private equity buying and destroying great businesses that had loyal customer bases. To be fair, I have also seen examples of private equity groups buying a business, embracing its product, and continuing to provide good service. I wish it weren’t the exception, though.

More often, private equity groups treat the acquisition as a mine: extract the capital through dividends and existing customers while accruing significant debt. In fact, the funds used to purchase the business are often borrowed and never even repaid.

Dig until empty, leave a crater, and move on.

An X user put it perfectly:

Some private equity is genuinely investing in the business to grow a solid business. This is good, full stop.

Some private equity buys up dying businesses, breaks them up, sells off the valuable bits and sometimes lets the worthless bits go through bankruptcy, taking advantage of bankruptcy laws to profit. This is good, actually, as it recycles the resources of dying businesses into good businesses.

The third type of private equity buys good businesses that are doing OK or even doing well. Then they sell off all the assets, load the company up on as much debt as they can, pay themselves giant dividends, and then take advantage of the same bankruptcy laws to discharge all the debt so they never have to pay it back. This is really bad.

This isn’t just happening to small companies. It’s hitting America’s industrial backbone.

I’ve written before about how Carlos Tavares, the former CEO of Stellantis (corporate parent of Chrysler, Dodge, and Jeep), awarded himself a $39 million compensation package for making short-term decisions that briefly maximized profit before revenue and sales collapsed, leaving dealers with overpriced, outdated inventory. He made off with the profits, then left behind a hollow pipeline for the dealers truly committed to Stellantis.

RELATED: Private equity’s losing streak is coming for your 401(k)

![]() Greenseas via iStock/Getty Images

Greenseas via iStock/Getty Images

I also covered Boeing’s disastrous $43 billion stock buyback binge. The short-term boost to its share price came at the expense of critical investment in its products — and has cost the aerospace giant $35 billion since 2019. To plug the hole, Boeing had to raise another $15 billion in capital and push back the already overdue launch of the 777, citing “negligent engineering.”

That phrase used to be unthinkable in the aerospace industry. Boeing made it possible by gutting its engineering and technical staff to feed Wall Street.

The consequences keep coming. This month, United Airlines grounded much of its fleet after a failure in its proprietary “Unimatic” flight system. The airline claims it doesn’t know what caused the failure.

But I have a strong suspicion.

In recent years, United has aggressively outsourced its technical operations to contractors using foreign labor — often H-1B visa workers — at lower cost. One subcontractor, Vista Applied Solutions Group, boasts that it helps clients “increase productivity” while achieving “considerable cost savings.”

That’s great — until the system fails and planes can’t fly. United may have saved on salaries. The short-term reduction in salary expense has eaten United’s seed corn, leaving the company with a technology system that can’t keep its planes in the air.

It is imperative for those of us who defend capitalism to also repudiate those engaged in practices that give it a bad name. Capitalism creates wealth. But when wealth is extracted at the expense of the product, the people, and the future — that’s not capitalism. That’s predatory ransacking.

And it deserves our scorn.

If Lafayette, William Penn, and Winston Churchill were subject to individualized examination before a grant of honorary citizenship, then certainly the same should apply to the millions of aliens who wish to become Americans today.

If Lafayette, William Penn, and Winston Churchill were subject to individualized examination before a grant of honorary citizenship, then certainly the same should apply to the millions of aliens who wish to become Americans today.

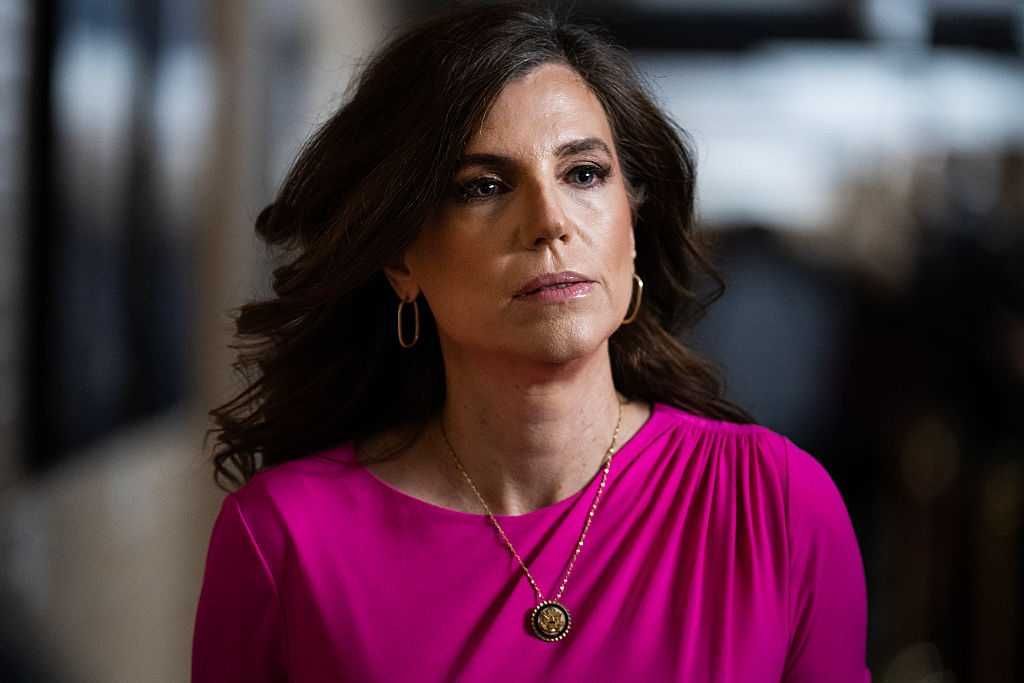

Photo by Chip Somodevilla/Getty Images

Photo by Chip Somodevilla/Getty Images Photo by Tim Grist Photography via Getty Images

Photo by Tim Grist Photography via Getty Images

Greenseas via iStock/Getty Images

Greenseas via iStock/Getty Images Gratuitous public displays of family betrayal are part of the fallout of the Democrat Party’s constant promotion of identity politics and political correctness.

Gratuitous public displays of family betrayal are part of the fallout of the Democrat Party’s constant promotion of identity politics and political correctness. There is nothing alarming about a president who expects loyalty from the people he selects to implement his agenda. Voters chose it.

There is nothing alarming about a president who expects loyalty from the people he selects to implement his agenda. Voters chose it.