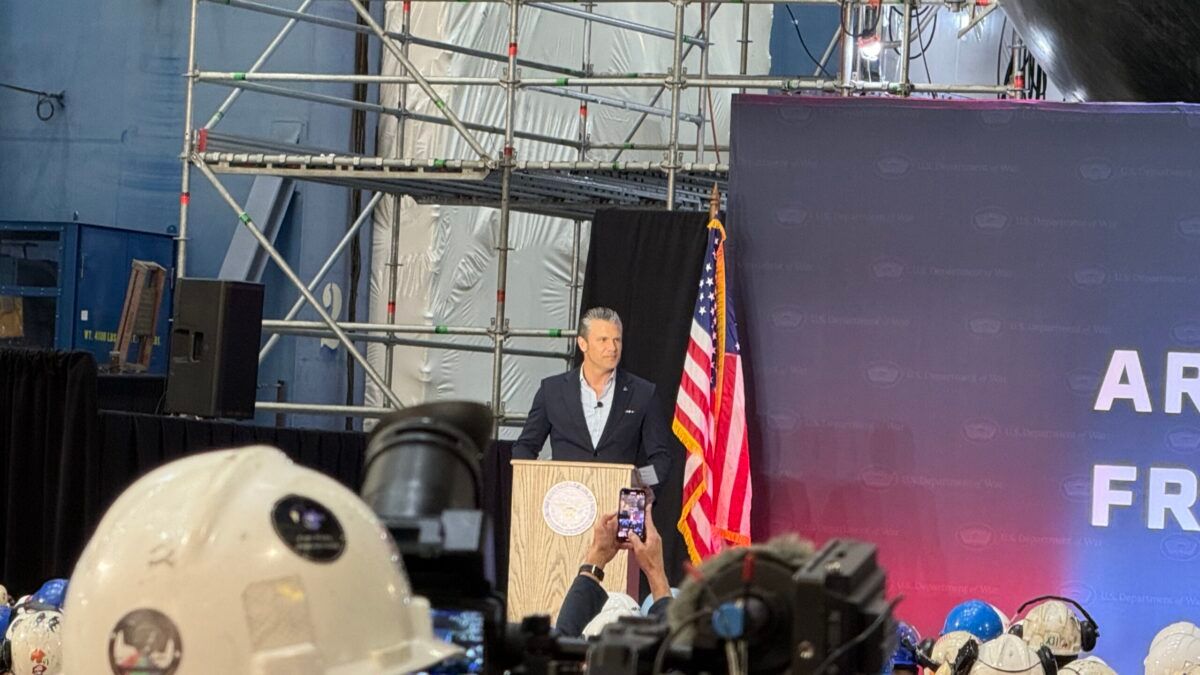

Revitalizing America’s Defense Industrial Base Takes Center Stage In Hegseth’s Address To Shipbuilders

'We've been clear: the era of rewarding delays and cost overruns is over,' said War Secretary Pete Hegseth.

'We've been clear: the era of rewarding delays and cost overruns is over,' said War Secretary Pete Hegseth.Welcome to the techno-feudal state, where citizens are forced to underwrite unnecessary and harmful technology at the expense of the technology they actually need.

The economic story of 2025 is the government-driven build-out of hyperscale AI data centers — sold as innovation, justified as national strategy, and pursued in service of cloud-based chatbot slop and expanded surveillance. This build-out is consuming land, food, water, and energy at enormous scale. As Energy Secretary Chris Wright bluntly put it, “It takes massive amounts of electricity to generate intelligence. The more energy invested, the more intelligence produced.”

Shortages will hit consumers hard in the coming year.

That framing ignores what is being sacrificed — and distorted — in the process.

Beyond the destruction of rural communities and the strain placed on national energy capacity, government favoritism toward AI infrastructure is warping markets. Capital that once sustained the hardware and software ecosystem of the digital economy is being siphoned into subsidized “AI factories,” chasing artificial general intelligence instead of cheaper, more efficient investments in narrow AI.

Thanks to fiscal, monetary, tax, and regulatory favoritism, the result is free chatbot slop and an increasingly scarce, expensive supply of laptops, phones, and consumer hardware.

For decades, consumer electronics stood as one of the greatest deflationary success stories in modern economics. Unlike health care or education — both heavily monopolized by government — the computer industry operated with relatively little distortion. From December 1997 to August 2015, the CPI for “personal computers and peripheral equipment” fell 96%. Over that same period, medical care, housing, and food costs rose between 80% and 200%.

That era is ending.

AI data centers are now crowding out consumer electronics. Major manufacturers such as Dell and Samsung are scaling back or discontinuing entire product lines because they can no longer secure components diverted to AI chip production.

Prices for phones and laptops are rising sharply. Jobs tied to consumer electronics — especially the remaining U.S.-based assembly operations — are being squeezed out in favor of data center hardware that benefits a narrow set of firms.

This is policy-driven distortion, not organic market evolution.

Through initiatives like Stargate and hundreds of billions in capital pushed toward data center expansion, the government has created incentives for companies to abandon consumer hardware in favor of AI infrastructure. The result is shortages that will hit consumers hard in the coming year.

Samsung, SK Hynix, and Micron are retooling factories to prioritize AI-grade silicon for data centers instead of personal devices. DRAM production is being routed almost entirely toward servers because it is far more profitable to leverage $40,000 AI chips than $500-$800 laptops. In the fourth quarter of 2025, contract prices for certain 16GB DDR5 chips rose nearly 300% as supply was diverted. Dell and Lenovo have already imposed 15%-30% price hikes on PCs, citing insatiable AI-sector demand.

The situation is deteriorating quickly. DRAM inventory levels are down 80% year over year, with just three weeks of supply on hand — down from 9.5 weeks in July. SK Hynix expects shortages to persist through late 2027. Samsung has announced it is effectively out of inventory and has more than doubled DDR5 contract prices to roughly $19-$20 per unit. DDR5 is now standard across new consumer and commercial desktops and laptops, including Apple MacBooks.

Samsung has also signaled it may exit the SSD market altogether, deeming it insufficiently glamorous compared with subsidized data center investments. Nvidia has warned it may cut RTX 50 series production by up to 40%, a move that would drive up the cost of entry-level gaming systems.

Shrinkflation is next. Before the data center bubble, the market was approaching a baseline of 16GB of RAM and 1TB SSDs for entry-level laptops. As memory is diverted to enterprise customers, manufacturers will revert to 8GB systems with slower storage to keep prices under $999 — ironically rendering those machines incapable of running the very AI applications they’re working on.

The damage extends beyond prices. Research and development in conventional computing are already suffering. Investment in efficient CPUs, affordable networking equipment, edge computing, and quantum-adjacent technologies has slowed as capital and talent are pulled into AI accelerators.

This is precisely backward. Narrow AI — focused on real-world tasks like logistics, agriculture, port management, and manufacturing — is where genuine productivity gains lie. China understands this and is investing accordingly. The United States is not. Instead, firms like Roomba, which experimented with practical autonomy, are collapsing — only to be acquired by the Chinese!

This is not a free market. Between tax incentives, regulatory favoritism, land-use carve-outs, capital subsidies, and artificially suppressed interest rates, the government has created an arms race for a data center bubble China itself is not pursuing. Each round of monetary easing inflates the same firms’ valuations, enabling further speculative investment divorced from consumer need.

RELATED: China’s AI strategy could turn Americans into data mines

As Charles Hugh Smith recently noted, expanding credit boosts asset prices, which then serve as collateral for still more leverage — allowing capital-rich firms to outbid everyone else while hollowing out the broader economy.

The pattern is familiar. Consider the Ford plant in Glendale, Kentucky, where 1,600 workers were laid off after the collapse of government-favored electric vehicle investments. That facility is now being retooled to produce batteries for data centers. When one subsidy collapses, another replaces it.

We are trading convention for speculation. Conventional technology — reliable hardware, the internet, mobile computing — delivers proven, measurable utility. The current investment surge into artificial general intelligence is based on hypothetical future returns propped up by state power.

The good old laptop is becoming collateral damage in what may prove to be the largest government-induced tech bubble yet.

Autonomous vacuums could go extinct unless they are made in the United States.

This is the harsh reality affecting companies like iRobot, the creator of Roomba, which just filed bankruptcy.

'... with no anticipated disruption to its app functionality.'

Despite the company generating over $680 million in 2024, iRobot has been crippled by U.S. tariffs. Due to a 46% import tariff on Vietnam, iRobot's costs were raised by $23 million in 2025, according to Reuters, which reviewed the court filings.

The court filings also reportedly noted that while Roomba is still dominating in U.S. and Japanese markets, it lost too much money on price reductions and investments in technological upgrades in order to maintain pace with its competitors.

According to the Verge, the company said it will continue to operate "with no anticipated disruption to its app functionality, customer programs, global partners, supply chain relationships, or ongoing product support."

Simply put, after more than 20 years on the market, the Roomba is able to operate without online connectivity.

The bankruptcy will put iRobot under Chinese control moving forward, with the manufacturing company that controls its debt.

RELATED: The ultimate Return guide to escaping the surveillance state

Court documents reportedly showed that Picea, a Chinese manufacturer, purchased iRobot while taking its debt on board, which is estimated to be about $190 million. The vacuum company took on the debt in 2023 to refinance its operations, Reuters claimed.

The debt came even after Amazon paid a $94 million termination fee after backing out of a $1.7 billion acquisition deal in 2024, according to the New York Times.

It has not been that long since iRobot had a massive market value at $3.56 billion in 2021; it is now estimated to be worth just $140 million.

New owners Picea will take 100% ownership of the company and cancel the $190 million in debt, while also canceling a $74 million debt that iRobot owed through a manufacturing agreement.

RELATED: The AI takeover isn't coming — it's already here

Not only did iRobot need to deal with Vietnamese tariffs, other manufacturing that was established in Malaysia in 2019 was also likely affected.

It was not announced that Roomba had cut manufacturing from the country, and if it remained, would likely have been subjected to a 24% tariff rate from the Trump administration, which included taxing machinery and electronics.

Like Blaze News? Bypass the censors, sign up for our newsletters, and get stories like this direct to your inbox. Sign up here!

In a recent interview, President Trump defended his earlier claim that bringing 600,000 Chinese college students into the United States would be good for the country. When the interviewer questioned how that aligned with an America First agenda, Trump replied that without those students, “Half the colleges in America would go out of business.”

To most Trump supporters, that sounds like a win-win — fewer foreign students and fewer left-wing universities to subsidize. But Trump seemed to view the issue as a business transaction: Closing locations is bad, losing revenue is bad, and the substance of those “economic units” doesn’t really matter.

Why should we play Russian roulette with our national security to pad universities’ bottom lines?

His comments revealed a deeper confusion about what America First really means.

America’s relationship with China has long been incoherent. Every Republican politician insists China is our chief geopolitical rival — a totalitarian power bent on unseating the United States as global hegemon. Yet few make any effort to restrict Chinese immigration, investment, or influence. At some point, it becomes difficult to take any of the rhetoric seriously.

The problem is obvious: China has too many people and too much money. The country’s strength lies in what America abandoned: manufacturing. While American corporations chased financial gimmicks and “service economies,” China focused on making tangible goods at scale. That discipline built a vast middle class and positioned Beijing at the center of global production. Now nearly every Western industry — film, retail, education — depends on access to China’s markets.

The result: American institutions bend over backward to please a government they claim to fear. Chinese nationals can buy land, start companies, and enroll by the hundreds of thousands in U.S. universities. It would be funny if it weren’t so corrupt.

Trump knows mass immigration hurts Americans, but he struggles to say no when big money is involved. Foreign students pour billions into universities, and administrators have built their entire business models around them. But counting up dollars isn’t the same as serving the national interest.

Universities are publicly subsidized and supposedly dedicated to educating Americans first and foremost. Instead, they’ve turned into pipelines credentialing foreign elites — and sometimes, spies. Every seat filled by a Chinese student is one less for an American, and every dollar that props up a hostile regime’s protégés deepens our dependence on that regime.

The Department of Justice has charged three Chinese nationals at the University of Michigan for smuggling research materials and stealing technology. Eric Weinstein has even suggested that theoretical physics is being throttled for fear of espionage. Yet the universities — and now, apparently, Trump — seem unfazed.

Propping up higher education with Chinese cash isn’t just shortsighted — it’s insane. Colleges and universities have become leftist seminaries, charging astronomical tuition for courses that teach Americans to despise their parents and their nation. They already receive lavish government subsidies and still demand more.

Trump’s claim that “half the colleges” would collapse without Chinese money is dubious, but if it were true, those institutions deserve to fail. Let them. Destroying the patronage networks that produce radical activists was once a Trumpian goal. Reviving them with foreign money would be an act of political masochism. Why should we play Russian roulette with our national security to pad their bottom line?

RELATED: The ‘China class’ sold out America. Now Trump is calling out the sellouts.

Chinese money poisons more than academia. Nationals and shell companies routinely buy American land — including, alarmingly, property near military bases. One recent purchase of an RV park in Missouri by a Chinese couple just happened to place them next to Whiteman Air Force Base, home of the B-2 stealth bomber fleet. Similar shadowy transactions dot the map.

The pandemic exposed the madness of this dependence. The same regime that unleashed a virus on the world also controlled the supply chains for the medicine and protective gear we needed to fight it. Yet America’s political class still refuses to sever the tie. They are too addicted to Chinese money — and too invested in pretending that dependency equals diplomacy.

If the GOP is serious about confronting China, it must start by cutting every cord of reliance. Banning Chinese students from U.S. universities would be a simple, symbolic first step — and it would strike directly at the heart of the progressive academic machine.

Our country is standing at a crossroads. Neither the world nor America’s place in it is what it was a generation ago. The unipolar moment is over. And yet, many in the Republican Party seek to claim the mantle of America First while continuing the same failed adventurism of the past.

National conservatism as a movement agrees that these people and ideas must be stopped. But we have failed to check their influence in the party largely because we have not offered an alternative that both meets the real threats to American security and balances national interest, the deterrent effect, industrial capability, and political will.

We cannot deter our adversaries if we cannot outbuild them.

I outlined a framework for what a genuine America First foreign policy would entail in an essay for the National Interest. I called for developing a doctrine that I dubbed “prioritized deterrence.” That essay was the first step toward forging a set of foreign policy principles that can unite national conservatives and set the agenda for the Republican Party for the next generation.

A key component of prioritized deterrence is industrial capacity. Deterrence depends not only on our military’s technical capability, but also on our industrial capacity — certainly in defense, but particularly in non-defense. Without factories humming, shipyards bustling, and energy production roaring, our ability to deter wanes. We cannot project strength abroad if we cannot produce strength at home.

Prioritized deterrence is not retreat. It is a recalibration. It rejects the fantasy that America can — or should — police every corner of the globe. Instead, it demands that we concretely identify our vital national interests. No more vague talk of values or entering endless nation-building campaigns. This will require open and honest debate.

The days of tarring dissenting voices as unpatriotic should be left in the rearview mirror. In fact, I recently sent a letter to President Donald Trump urging him to award Pat Buchanan the Presidential Medal of Freedom. Buchanan was right about nearly everything 20 years before anyone else realized it, including his recognition that Iraq was not aligned with our strategic national interests. We need serious voices like his in the conversation during these all-important debates.

Prioritized deterrence belongs firmly within the realist school of thought. It rests on restraint and on the quantifiable limits of a nation’s resources and people. Those limits force policymakers to rank threats to the American way of life by urgency and severity.

Deterrence depends on credibility: An aggressor must believe it will pay an unacceptable price for attacking the United States. But not every hostile nation deserves brinkmanship. National constraints and the risk of escalation demand that we focus only on the gravest threats.

Kinetic action must remain credible but reserved as a last resort. The U.S. military exists not only to fight and win wars but, more importantly, to deter them before they begin and ensure American security.

What does a strategy that contends with these essential questions look like in practice?

Consider the 2020 strike on Qassem Soleimani. A single, precise action eliminated a key architect of Iran’s malign influence, sending a message to Tehran: Kill Americans, and you will pay. No endless wars, no nation-building, just a clear signal backed by lethal force.

Now consider Operation Midnight Hammer. President Trump authorized a precision strike that was executed flawlessly. He rejected calls to further escalate into regime change. As a result, we eliminated a key threat while managing the retaliation from Iran and successfully stepped off the escalation ladder before the region became destabilized. That’s prioritized deterrence in action.

What do these strikes have in common, other than the antagonist? In both cases, the president laid out clear, precise explanations of America’s vital national interest. He aligned the use of force with American goals, and he did so precisely with explicit acknowledgment of our constraints and limitations.

Additionally, both strikes relied on American technological supremacy: drones, stealth bombers, precision munitions, and intelligence — all products of a sophisticated industrial base. However, we cannot just rely on our qualitative military advantage as a silver bullet for deterrence. At a certain point, quantitative advantages become qualitative, which is one of the reasons China’s industrial might has made it so formidable on the world stage.

What is making us less formidable on the world stage is Ukraine. We should not be funding the war in Ukraine, and we should never have been involved in that conflict from the beginning. The proponents of prolonging this conflict seem unable or unwilling to grasp the reality that we do not have the industrial capacity to provide Ukraine with what they need — to say nothing of providing for our own needs here at home.

RELATED: Why won’t American companies build new factories here?

In fact, Ukraine’s defense minister has said his country needs 4 million 155-millimeter artillery shells per year and would use as many as 7 million per year if they were available.

In 2024, then-Senator JD Vance correctly noted that even after drastically ramping up production, the U.S. could still only produce 360,000 shells per year — less than one-tenth of what Ukraine supposedly needs. Vance was also doubtful of expert claims that we could produce 1.2 million rounds per year by the end of 2025. In the end, he was right, and the experts were wrong.

The Army now confirms that the U.S. is only on pace to produce 480,000 artillery shells per year. These aren’t highly sophisticated guided missiles either. Quantity, not quality, ended up winning the day.

Very simply, we must choose to put America first, as we do not currently have the capacity to both arm Ukraine and defend ourselves should the need arise.

A candid assessment of our industrial capacity is that it’s lagging. The same voices that called for foreign adventurism also hollowed out our heartland and sent our manufacturing jobs overseas. We now face a new choice: Rebuild or be left to the ashes of history.

We cannot deter our adversaries if we cannot outbuild them. Our defense industrial base — shipyards, munitions factories, aerospace plants — lag significantly behind our peers, especially China. This is a far cry from the industrial base that won World War II.

The Virginia-class submarine program, for example, is crucial in countering China. Yet limited shipyard capacity, supply chain bottlenecks, and a shortage of skilled workers have created years-long delays. Chinese shipyards account for more than 50% of global commercial shipbuilding, while the U.S. makes up just 0.1%.

In 2024, a single Chinese shipbuilder constructed more commercial vessels by tonnage than the entire U.S. shipbuilding industry has since World War II. We cannot deter China in this state of industrial atrophy.

Just as critical — perhaps even more so — is the need to rebuild the U.S. industrial base as a whole, not just the defense sector. “If you want peace, prepare for war” means more than building ships. It means strengthening industry, shoring up families, and restoring the backbone of society. That creates jobs, secures supply chains, and projects strength without overextending our forces or wasting resources.

During World War II, the United States retooled civilian manufacturing almost overnight. Ford and General Motors turned out aircraft. Singer Sewing Machine Company built precision cockpit instruments. IBM produced fire-control systems for bombers. Civilian industry became the arsenal of democracy.

That capacity has withered. The COVID-19 pandemic revealed just how hollowed out our domestic base has become. America now relies on China for more than 80% of the active ingredients in pharmaceuticals. That dependence gives Beijing leverage.

Our weakness feeds China’s confidence. If defending Taiwan means empty pharmacy shelves across America, would Washington still respond? Beijing is counting on the answer. That calculation could determine whether China invades.

We need a manufacturing renaissance — steel mills, factories, foundries — because a nation that outsources its industry outsources its power.

Taiwan is indicative of another vital manufacturing sector where our capacity is lagging: the semiconductor industry. These chips power everything from smartphones to missile systems, yet the U.S. produces less than 12% of the world’s supply. Meanwhile, Taiwan’s TSMC dominates. If China invades Taiwan, our military and domestic economy will grind to a halt.

This is not theoretical; it’s a ticking time bomb, one that is tied directly to our ability to credibly deter China.

This equation must change. If America produces pharmaceuticals and semiconductors at home, adversaries lose their leverage. Deterrence grows stronger without firing a shot or putting boots on foreign soil.

I think of my home state of West Virginia, where Weirton Steel once stood as one of the largest steel producers in the world. At its peak, it employed 23,000 people.

That steel not only secured American dominance in industry, it sustained families, churches, schools, and communities. A single paycheck could buy a home and support a family. Mothers could raise children and stay active in their schools and churches because one income was enough.

The same bipartisan leaders in Washington who chased short-term gains instead of building a strong industrial base and healthy families signed Weirton Steel’s death warrant. They let China flood the U.S. market with cheap tin plate steel, and Weirton paid the price.

We begged President Joe Biden for tariff relief, but he followed the pattern of his predecessors and did nothing. The result: Weirton’s tin plate mill was idled, thousands of workers lost their jobs, and the community was gutted.

Today, only one blast furnace capable of producing tin plate steel remains in the entire United States. One.

Economic capacity and industrial output are critical in the defense of the nation and create a better quality of life. A strong manufacturing sector is, in itself, a strong deterrent. China understands this.

Its “Made in China 2025” plan, cited in then-Sen. Marco Rubio’s 2019 address at the National Defense University, declared:

Manufacturing is the main pillar of the national economy, the foundation of the country, the tool of transformation, and the basis of prosperity. Since the beginning of industrial civilization in the middle of the 18th century, it has been proven repeatedly by the rise and fall of world powers that without strong manufacturing, there is no national prosperity.

This is obviously true.

China now produces more than half the world’s steel, powering both its infrastructure and its military. Meanwhile, we’ve allowed our own steel industry to wither, importing from abroad while American mills rust. That failure is not only economic. It’s strategic.

We won World War II in part because we built planes, tanks, and ships faster than the Axis powers could destroy them. A robust industrial base — defense and non-defense — is a deterrent in itself. It signals to adversaries: We can outfight you, outbuild you, and outlast you.

We need a manufacturing renaissance — steel mills, factories, foundries — because a nation that outsources its industry outsources its power. Deindustrialization was a choice, a choice with disastrous consequences. We must now make the choice to rebuild and reindustrialize.

RELATED: Read it and weep: Tariffs work, and the numbers prove it

To have manufacturing dominance, we must unleash energy dominance. Factories don’t run on hope; they run on power — reliable, affordable, and abundant power. Wind and solar power are obviously not able to power anything. Thankfully, America’s superpower is the massive quantities of natural resources we have at our fingertips.

We have some of the largest proven reserves of both oil and natural gas of any nation in the world. This is a textbook example of our quantitative advantage becoming a qualitative advantage.

We have the largest proven reserve of coal in the world, nearly double the supply of the next closest country. Our energy potential is unlimited, and we must drastically ramp up our output if we want to meet the energy demands of the future economy.

Fossil fuels have long been the backbone of industrial power, and West Virginia’s coal and natural gas is its beating heart. Yet coal in particular has been under siege, not just from regulations but from corporate environmental, social, and governance policies pushed by firms like BlackRock that waged war on fossil fuels.

As state treasurer of West Virginia, I took a stand. I made West Virginia the first state in the nation to divest our tax dollars from BlackRock. I refused to let Wall Street’s agenda use our own state’s money to kill our coal industry. Today, more than a dozen states have followed our lead, rejecting ESG policies that undermine American energy dominance.

China, meanwhile, builds coal plants at a breakneck pace, powering its industrial juggernaut. They use coal to fuel their steel production while we let our own mines and mills idle. We cannot let this continue.

Thanks to President Trump, we’ve begun to change course. For the first time in my lifetime, a president took a stand for coal, signing executive orders promoting domestic coal production. But we need to go further. We must become a global juggernaut with an “all of the below” approach to energy — coal, oil, natural gas, and nuclear must power our path to energy dominance.

America cannot do everything, everywhere, all at once. We are not a nation of infinite industrial capacity, infinite goods, or infinite will. Scarcity — of materials, of capacity, of resolve — forces us to choose. Prioritized deterrence is a framework for grappling with those choices.

It is a commitment to focusing our energies, rebuilding our industrial might, and unleashing the energy to power a 21st-century industrial base. It’s a rejection of overreach in favor of strength, of focus instead of distraction.

Leaders on both sides of the aisle over the last 40 years squandered the inheritance of peace, security, and industrial might in favor of globalization and foreign adventurism. We cannot afford to continue down that path. Correcting course will require open, honest, and sometimes intense debate.

It will require serious investments from business leaders in American manufacturing and public policies that assist in this reorientation. It demands that we do more to appropriately train and equip a skilled workforce.

But we must start now. America will build again, power again, and deter again. Not everywhere, not always — but where it matters most, with a strength that none can match.

Editor’s note: This article has been adapted from a speech delivered on Tuesday, Sept. 2, to the fifth National Conservatism Conference (NatCon 5) in Washington, D.C.

“They’re coming home — they’re all coming home.”

That’s how President Donald Trump described Apple’s decision to invest $600 billion in the American economy, $100 billion more than initially expected.

For decades, corporate America packed up and left. Under President Trump, companies are coming back.

Standing alongside Apple CEO Tim Cook, President Trump declared: “These investments will directly create more than 20,000 brand-new American jobs and many thousands more at Apple suppliers like Corning, Broadcom, Texas Instruments, and Samsung.”

This is proof that the America First agenda is working.

America First isn’t just a campaign slogan. It’s a movement rooted in economic patriotism. For decades, global corporations were incentivized to offshore jobs and close American factories, leaving once-thriving towns in economic ruin.

President Trump is reversing that damage. His America First agenda creates the conditions for companies to thrive here at home — cutting taxes, slashing red tape, rebuilding infrastructure, and putting American workers first in trade deals and policy decisions.

Apple’s investment is just the latest example. From Silicon Valley to the Rust Belt, companies are responding favorably to the president’s policies, which are rewarding their investments on U.S. soil.

In the past six months alone, more than $17 trillion in new investment, factories, and infrastructure projects have been announced. From semiconductor plants in Arizona to advanced steel manufacturing in Pennsylvania, we are witnessing the rebirth of American manufacturing.

And America First doesn’t stop at building new factories. It also means building the capacity to win strategic fights — including the tech war with China.

One example is the Trump administration’s recent decision toheed U.S. intelligence experts and greenlight the merger between Hewlett Packard Enterprise and Juniper Networks.

For years, national security experts have warned about Huawei, the Chinese tech giant with deep ties to the Chinese Communist Party. Huawei’s global dominance in 5G and enterprise networking poses a serious threat to cybersecurity, national defense, and communications freedom. The problem wasn’t identifying the threat. The problem was that no U.S. company could match Huawei — that is, until now. Trump and Attorney General Pam Bondi are helping the U.S. finally compete in this industry.

Another example is President Trump’s executive order jump-starting America’s rare-earth and critical mineral supply chains — an industry China has dominated for years. From electric vehicles to advanced weapons systems, the modern economy runs on rare-earths. Yet for too long, America depended on Chinese exports to power everything from smartphones to fighter jets.

That is changing under President Trump, who signed an executive order cutting red tape, fast-tracking permits, and directing federal agencies to prioritize American sourcing and refining of rare-earth and critical minerals. As a result, U.S. companies are now increasingly investing in domestic mining operations in America, laying the foundation for greater American economic independence.

In June, Trump even signed an agreement with China to resume exports of U.S. rare-earth minerals. The global tide on U.S. exports is now turning.

RELATED: The founder betting big on American manufacturing

America First means just that: America first. Whether it’s encouraging companies such as Apple to invest here at home or ensuring that U.S. tech companies can go toe to toe with China, President Trump is delivering real results.

For decades, corporate America packed up and left. Under President Trump, companies are coming back. They’re investing in our people, our cities, and our future. That’s not just good policy. That’s what winning looks like.

The Department of Labor reported on August 1 that the U.S. unemployment rate ticked up slightly in July to 4.2%. Employers added just 73,000 jobs — well below the 110,000 economists had projected.

Democrats pounced immediately.

This isn’t economic chaos. It’s called a comeback.

Senate Minority Leader Chuck Schumer (D-N.Y.) claimed the report showed Americans are “paying the price” for “Donald Trump’s destructive trade war.” He called the data an illustration of “economic chaos.”

California Gov. Gavin Newsom (D) — already positioning himself for a 2028 presidential run — declared that Trump is “crashing our economy” and insisted, “We haven’t seen conditions like these since 2020.”

Sen. Chris Murphy (D) of Connecticut said the economy was “chaotic and full of corruption.” He later wrote on X: “Companies don’t want to create jobs in Trump’s chaos economy with weakening rule of law and rampant corruption.”

But the reality is far less dramatic than the rhetoric.

Yes, the July jobs report was underwhelming. But it was far from catastrophic.

The 4.2% unemployment rate in July 2025 is the same as it was in July 2024 — and in March, April, May, August, and November of last year. The rate has held steady for months. In what way is that “crashing our economy”? That’s called consistency.

By contrast, unemployment rose significantly during President Biden’s final year in office. In July 2023, the rate was 3.5%. A year later, just before Biden dropped out of the 2024 race, it had climbed to 4.2%.

The fact is, Trump didn’t inherit a strong economy. He got Biden’s inflation, stagnation, and policy uncertainty. So what we’re seeing now is more of a course correction, not a crash.

According to the Bureau of Labor Statistics, full-time employment has grown by 1.1 million over the past 12 months. Layoffs in July were down 15% year over year.

Gross domestic product also rebounded. The Commerce Department reports that U.S. economic output rose 3% in the second quarter of 2025, reversing a 0.5% contraction in the first.

None of this suggests economic free fall. It suggests recovery.

Meanwhile, the Trump administration has brokered major trade agreements with key global players and secured historic investment deals — moves that will pay off in the years ahead.

Japan pledged to invest $550 billion in U.S. industries, and Saudi Arabia agreed to $600 billion in new investments. In May, the United Arab Emirates agreed to more than $200 billion in commercial deals, on top of a $1.4 trillion commitment earlier this year to back emerging technologies.

American companies are also stepping up in response to Trump’s pro-business regulatory agenda.

Apple this week reached an agreement with the White House to commit another $100 million to domestic manufacturing. This follows the tech giant’s announcement in February of plans to spend more than $500 billion in the U.S. over four years, focusing on operations in Arizona, California, Iowa, Michigan, Nevada, and North Carolina.

IBM pledged $150 billion over five years.

RELATED: Powell’s tight money policy is strangling the US economy

Eli Lilly in February committed $27 billion for new domestic manufacturing, including four new plants. That initiative alone will create more than 3,000 permanent jobs and 10,000 construction jobs.

These investments are not instant, but they are real — and they will reshape America’s economy.

The Democrats’ sudden alarm over a flat unemployment rate reveals more about their political fears than economic facts. A strengthening Trump economy threatens their narrative — and their electoral strategy.

They’re hoping manufactured panic can drown out progress. But Americans can see what’s really happening.

The July jobs report may have missed expectations, but the broader trend is unmistakable. Trump is rebuilding what Biden’s policies eroded. Jobs are returning. Investment is growing. Stability is taking root.

This isn’t economic chaos. It’s called a comeback.

Stu REACTS to last night’s GOP debate – see what you missed!