Documents: Letitia James Lied To Bank, Insurer In Alleged Mortgage Fraud Scheme

The timeline of James' claims suggest she knew her claims were false when she made them.

The timeline of James' claims suggest she knew her claims were false when she made them.It’s never been more unaffordable to buy and finance a home in America. And yet, government officials seem confused about the cause, chasing “solutions” that will only make things worse. They want more building, lower rates, and more subsidies. But none of that fixes the core problem.

We don’t have a shortage of homes. We have an affordability crisis driven by government intervention — one that’s inflated yet another asset bubble. Housing, like education and health care, has been hijacked by easy money, fake pricing signals, and federal subsidies designed to mask structural rot.

You can’t paper over decades of distortion with another round of Fed intervention.

The solution isn’t more easy money. It’s pulling the plug on government policies that distort markets. Enough with near-zero interest rates. Enough with the Federal Reserve buying mortgage-backed securities. Enough with Fannie, Freddie, and the FHA inflating demand that the market can’t sustain.

Remember the late ’90s? Mortgage rates sat between 7% and 8%. Nobody panicked or complained much about the cost of living. People bought homes. Prices were reasonable. Inflation was low because deficits were shrinking and money wasn’t being printed into oblivion.

Then came the dot-com crash, George W. Bush’s post-9/11 spending spree, and the Clinton-era “affordable housing” schemes coming due. The Department of Housing and Urban Development’s footprint expanded. The Fed, under Chairman Alan Greenspan, dropped rates to near zero — the same path Trump wants now — and we inflated the first major housing bubble of the 21st century.

From 2001 to 2006, Washington juiced the market at every turn. M2 money supply growth topped 10% and stayed above 8% into 2003. The Fed funds rate plummeted from 6.25% to 1%, where it stayed for a full year. Real rates were negative for two and a half years.

No surprise what followed: Real estate loans at commercial banks surged at a compound annual rate of 12.26%. Cheap money and inflated supply pushed prices through the roof. The result was a bubble built not on demand but distortion.

Then came the collapse.

And what did Washington do? Bailouts for big banks. Bailouts for Fannie and Freddie. Dodd-Frank. Obamacare. Trillions in new debt. The Fed held rates near zero for six more years, planting the seeds for the next wave of asset inflation — especially in housing.

Then came COVID.

The government printed $7 trillion and subsidized nearly everything. Rates dropped back near zero. The Fed bought trillions more in mortgage-backed securities. Freddie, Fannie, and the FHA expanded their subsidies even further. By 2021, we had the biggest housing bubble in American history.

Now, we’ve hit the wall. The Fed had to raise rates to fight inflation. That created a generational rate cliff. Sellers don’t want to give up their 2% and 3% mortgages. Buyers can’t afford homes at today’s prices — prices that are still artificially high thanks to 15 years of easy money and government meddling.

And yet, housing starts have held up decently. The problem isn’t inventory — it’s liquidity and affordability.

In June, existing home sales dropped to their slowest pace since 2009. But it’s not because no one’s selling. Redfin reports 500,000 more sellers than buyers — a 33.7% gap, the widest since 2005. Total inventory rose to 1.53 million units, up nearly 16% from last year. Vacancies have spiked 28% since the second quarter of 2022. New home supply has ballooned to 9.8 months.

RELATED: Government broke the housing market — only this will fix it

In a real free market, prices would drop sharply. But when government, either directly or indirectly, backs 90% of the U.S. mortgage market, that’s not how it works. Subsidized mortgages and distorted demand keep prices frozen — even as sales crater.

Sellers want prices buyers can’t afford. According to the Atlanta Fed, a household now needs $124,150 in “qualified income” to afford the median home. But the median household income is just $79,223.

Lowering interest rates again won’t fix this. It’ll just stoke inflation and feed the next bubble. And with the Treasury dumping trillions in debt onto the market, 10-year yields — and therefore 30-year mortgage rates — aren’t coming down anytime soon.

Absent a 2008-level crash, housing prices aren’t dropping meaningfully. We’re stuck.

If you want rates to fall, slash spending and debt. That’s how you bring prices down. You can’t paper over decades of distortion with another round of Fed intervention.

Live by Fed money printing, die by Fed money printing.

The tides may have turned for President Donald Trump and New York Attorney General Letitia James, who once went after him for fraud, after some documents connected with a house in Virginia revealed James may now be the one in hot water.

Late Sunday night, Trump posted an ominous message to Truth Social: "Letitia James, a totally corrupt politician, should resign from her position as New York State Attorney General, IMMEDIATELY. Everyone is trying to MAKE NEW YORK GREAT AGAIN, and it can never be done with this wacky crook in office."

Trump's social media post also included a link to a report about a house in Norfolk, Virginia, that James and Shamice Thompson-Hairston, described as a relative of James, apparently purchased together in August 2023.

The house is a rather unremarkable three-bedroom, one-bathroom residence built in 1947. The women apparently purchased it for $240,000, securing a mortgage for just under $220,000.

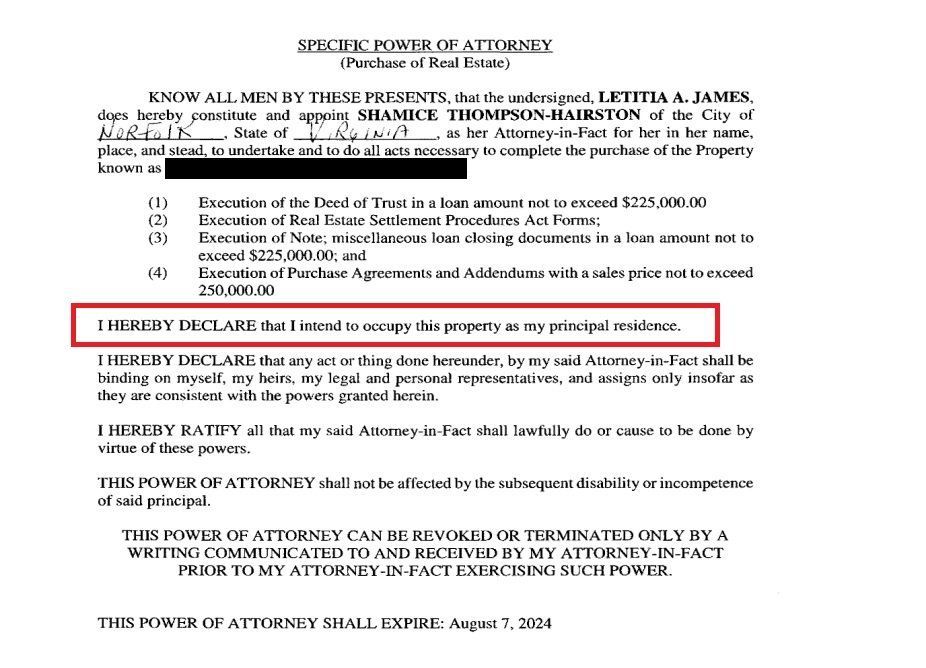

The Virginia land records about the purchase include a "specific power of attorney" document authorizing Thompson-Hairston to act as James' attorney-in-fact. In this document, James states: "I HEREBY DECLARE that I intend to occupy this property as my principal residence."

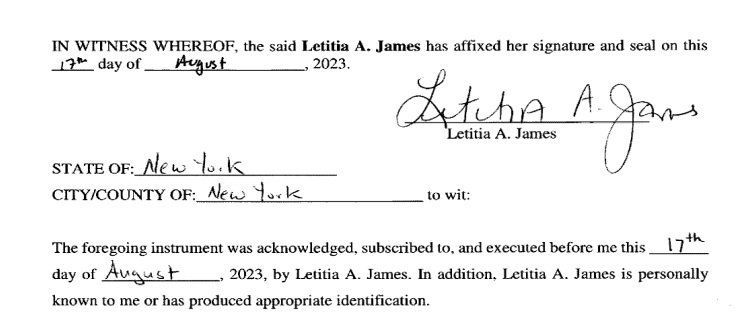

The "specific power of attorney" document was signed and notarized on August 17, 2023. Except for the inclusion of her middle initial, the signature that appears on it seems to match the signature James regularly stamps on New York documents.

On August 31, 2023, Thompson-Hairston signed a statement claiming that she would serve as James' attorney-in-fact. Another document included in the land record obligates both women to "occupy, establish, and use" the Norfolk home as their "principal residence" within 60 days and to keep it their "principal residence" for at least one year.

If these Virginia documents are authentic, then James appears to be in a double bind.

At the time they were signed, James had already been the attorney general of New York for four years. Funded in part by billionaire financier George Soros, James campaigned in 2018 on a promise of "getting" Trump and later publicly fantasized about "suing" him.

Since she elevated to executive statewide office, she is required to reside in New York. According to New York law, once a state executive "ceas[es] to be an inhabitant of the state," the office is considered vacant.

'Can she document continued New York residency during this period sufficient to maintain her legal authority as Attorney General?'

In October 2023, just two months after the documents were signed, James filed a civil lawsuit against Trump, accusing him and others affiliated with the Trump Organization of overvaluing properties to negotiate better deals with banks and insurance companies. A jury agreed and slapped the organization with a staggering $455 million judgment.

The judgment is currently under appeal, and members of a New York appeals court already signaled support for overturning or at least reducing it.

If James' primary residence in 2023 and 2024 was actually in Virginia, her standing as attorney general — and in the Trump case as well as others — is dubious.

Moreover, a possible motive for declaring a property to be an owner's primary residence would be to secure a lower interest rate on a mortgage. If James misrepresented the Virginia property as her "principal residence," she could have committed the same type of fraud she accused the Trump organization of perpetrating.

In fact, reports have speculated that such false statements could even be considered federal wire fraud, a charge that carries decades in prison and fines of up to $1 million. The Department of Justice, now under Trump's purview, would be in a position to file such charges, if leaders are so inclined.

For now, the most significant drawback to the allegations against James is the fact that they were first raised in the blog White Collar Fraud by convicted fraudster Sam Antar. In the late 1980s, Antar was the CFO of Crazy Eddie, a Brooklyn-based electronics chain that went under after serious financial corruption was exposed.

Antar managed to escape prison time by copping a plea deal. He then made a "Catch Me If You Can" turnaround of sorts and became an investigator of white-collar financial crime.

In addition to publishing the Virginia land documents and explaining their relevance, Antar posed four important questions regarding James and her political future:

Why did James explicitly declare her intent to make Virginia her principal residence while serving as New York’s Attorney General?

Did she fulfill the 60-day occupancy requirement in her mortgage while simultaneously appearing in New York courts?

Can she document continued New York residency during this period sufficient to maintain her legal authority as Attorney General?

Will this affect her eligibility to run for re-election, which requires uninterrupted New York residency?

Joe Biden clearly isn’t great at debating, but he apparently is good at using his personal property like an ATM.

President Joe Biden and first lady Jill Biden have reportedly taken out several mortgages and refinanced their home 35 times.

A report has just been released by the Daily Mail that claims Joe and Jill Biden “have been using their Delaware house for fast cash.”

The pair have reportedly refinanced their home 20 times with loans totaling $4.2 million since buying the $350,000 home. The Bidens borrowed a total sum of $6 million on their two properties and still have an outstanding $541,000 mortgage on their current Wilmington mansion nearly 30 years after the original purchase.

The Biden’s have a reported net worth of $10 million that the president claims is from “book deals,” so the constant refinancing is raising questions.

“There’s no record of him ever getting payment except for the signing bonus because nobody reads the books,” Glenn Beck says, confused.

While it’s not likely Biden will give an honest answer as to why he’s been constantly refinancing his home, ChatGPT has some theories.

“This is what ChatGPT came up with,” Glenn says, “and I think I’m going to start with the least likely, number five.”

“Constant refinancing can be a method to manipulate debt and create the appearance of legitimate financial activity. This could help in justifying the large sums of money received and repaid,” Glenn reads.

Number four, ChatGPT guesses, is tax evasion.

“Refinancing can provide a way to manipulate table income and avoid taxes on illicit funds by cycling mortgages. The president could claim interest deductions and reduce their overall taxable income,” Glenn explains via the AI bot before reading number three.

“Hiding assets. Frequent refinancing can be used to mask the true financial status and hide assets from investigators or regulatory authorities. This can help in evading detection of illicit funds,” he reads.

Number two is “creating a paper trail.”

“Mortgage cycling can create a complex financial paper trail that makes it difficult for investigators to track the true source and destination of money. This can also help hide illegal financial financial activities,” Glenn continues.

ChatGPT’s number one reason for the president continuously refinancing his house is that “it can be a method to launder illicit funds.”

“ChatGPT didn’t come up with a single non-nefarious reason,” Glenn says, unphased.

To enjoy more of Glenn’s masterful storytelling, thought-provoking analysis, and uncanny ability to make sense of the chaos, subscribe to BlazeTV — the largest multi-platform network of voices who love America, defend the Constitution, and live the American dream.

The idea that “you will own nothing and be happy” is coming to fruition.

Glenn Beck long warned that government elites have been planning to push people out of homeownership and into renting, and it seems their new American dream is finally coming true.

Not only are they attempting to rid Americans of all their earthly possessions, but they’re blaming them for wanting those possessions in the first place.

Glenn references a recent article from Axios, titled "The Problem With America’s High Homeownership Rate," which claims that “America’s decades-long love affair with home ownership is holding back the economy and hobbling the Federal Reserve and exacerbating a national housing crisis.”

“We got into the ‘08 crisis because the government was pushing home ownership. Everybody became overextended. Now, they’re pushing for you to get rid of your home,” Glenn says, adding, “I think this is the first shot of the government trying to get people out of their homes.”

Former investment banker Carol Roth believes it's actually the “second shot.”

After the 2008 crisis, “Americans lost about 6 million homes to foreclosures and short sales,” Roth says.

“And then they went out because they had so much money, had to do something with it, they bought up homes,” Glenn says, finishing Roth’s point.

Roth notes that at the end of 2022, one in every five homes in America was being bought by a corporate entity.

“Now you have this gentleman from Axios, who is one of the economic media darlings, if you will, coming out and not only saying, ‘Oh, it’s really a problem that you own your home, it’s really a problem that you have this asset that’s creating legacy wealth for you and your family,’” Roth tells Glenn.

“The mental gymnastics it took for him to get there. ‘Oh, this is holding back the economy, and this is crippling the FED,’ as if it wasn’t FED policy and the government policy that got us here in the first place,” Roth adds.

“The idea that they’re blaming you for creating wealth instead of blaming the arsonists who burnt down the economy — the government and the FED — is absolutely despicable.”

To enjoy more of Glenn’s masterful storytelling, thought-provoking analysis and uncanny ability to make sense of the chaos, subscribe to BlazeTV — the largest multi-platform network of voices who love America, defend the Constitution and live the American dream.