![]()

In 1992, a young Democratic strategist on the Clinton campaign named James Carville coined the now-famous phrase “it’s the economy, stupid.” He directed it to the campaign workers to ensure that they remained laser-focused on kitchen-table issues. In November's elections, voters delivered that same message, loud and clear, in New York City, Virginia, and New Jersey. The results were not surprising — even the margins were roughly in line with 2017, the last off-year elections in those localities when Trump was president.

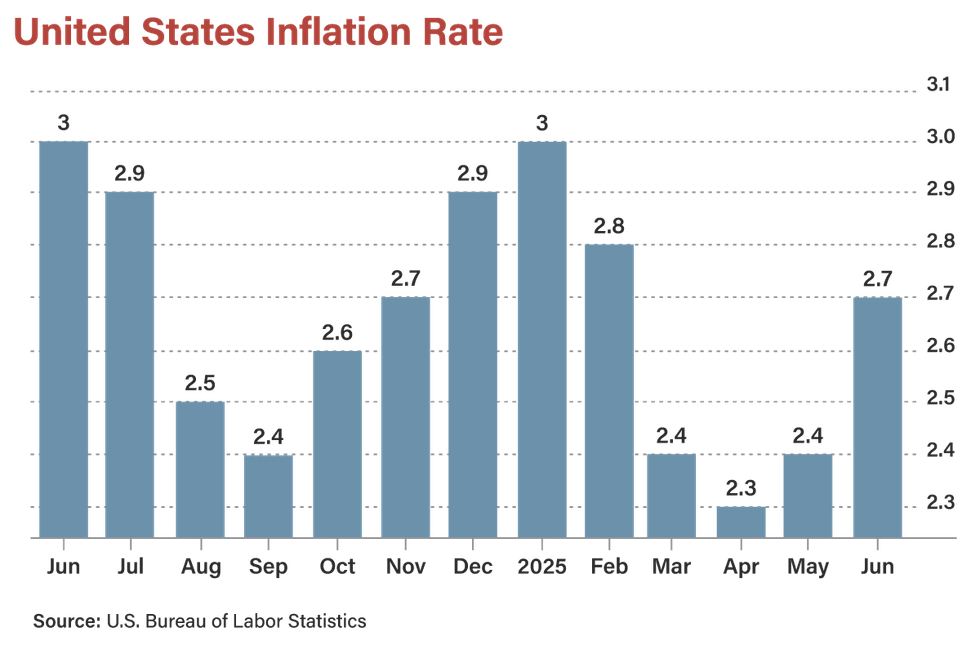

The message was clear: Many young voters are hurting economically. Of course, the Trump administration is well aware of this. The government has been digging out of the economic disaster Joe Biden left behind. Compared to Europe and much of Asia, the U.S. is doing better, but the global macro environment is still challenging — especially for young people.

Once again and as ever: 'It’s the economy, stupid.'

This is why almost immediately after the election, the administration focused on ramping up its communication efforts on the economy. President Trump indicated an urgent need to blow up the filibuster and enact a legislative agenda commensurate with the issues young voters are facing. Trump’s approach was echoed by Vice President JD Vance, who noted, “We’re going to keep working to make a decent life affordable in this country, and that’s the metric by which we’ll ultimately be judged in 2026 and beyond.”

It is useful to do a deep dive into the 2025 election data so that we can learn what happened and how we can be ready with the right political and policy prescriptions to win the much more important midterm elections in 2026.

A coalition of the ‘falling behind’

Contrary to the thinking of most political commentators, Zohran Mamdani’s win in the New York City mayoral race wasn’t about racial identity politics. I’m not saying he doesn’t believe in racial identity politics. It’s quite central to his worldview. After all, this is the guy who tweeted in 2020 that “Black + brown solidarity will overcome white supremacy.” Mamdani’s anti-Israel activities have also been well known and much remarked upon. But that’s not what led his coalition to victory on Nov. 4.

First, Mamdani’s campaign was fundamentally a youth movement. Young women ages 18-29, while a relatively small part of the electorate, gave him 81% of their support. These are staggering numbers. Overall, Mamdani won younger voters under 45 by an incredible 69%-25%, while former New York Gov. Andrew Cuomo (D) won voters over 45 by 51%-39%. Just as importantly, Mamdani actually won white voters by one point. He certainly did well with Muslims and in the South Asian community.

It’s possible that Mamdani may in fact be a Third-Worldist or Muslim supremacist, as some have alleged — but these were peripheral issues in electing him, and a look at his coalition suggests that focusing on them would fracture it.

Likewise, feelings about Israel were overblown. While it was a “major factor” in 38% of voters’ minds, it was essentially a political wash, with Mamdani losing 47%-46% among those who felt passionately about the issue. While Israel may be personally important for him, it was not a driving issue for most of his voters.

Mamdani’s coalition is spiritually and geographically rootless. While he did strongly among Muslims (presumably a significant chunk of the 14% of voters of “other religions” that he took 70% of), far more powerful was the 75% he took among the 24% of voters who claimed no religion. For those who have made politics their god, Mamdani is a comforting idol and socialism a powerful liturgy.

RELATED: Mao tried this first — New Yorkers will not like the ending ![]() Photo by Michael M. Santiago/Getty Images

Photo by Michael M. Santiago/Getty Images

His is also a coalition of the mobile, anchored by those with shallow roots in New York — and, one might suspect, America. Mamdani dominated among newer arrivals, winning a staggering 82% among those who have lived in New York City for less than 10 years. Cuomo, meanwhile, carried the NYC-born 50%-38%, but that group comprised just 45% of the electorate. Likewise, Mamdani racked up a 59%-34% margin among renters.

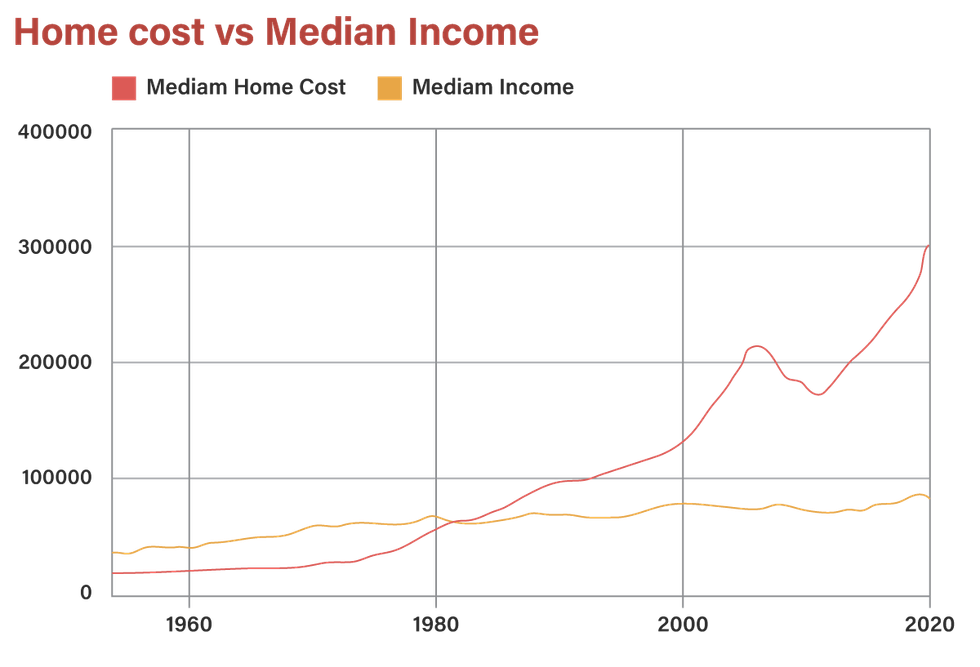

The fundamental point that anchored Mamdani’s coalition was the economy: 25% of voters described themselves as democratic socialists, and he won 86% of them. And many appear to have been motivated by jealousy or frustration. He actually won 59% among those who thought the NYC economy was good, but also 59%-34% among those who felt they were personally falling behind. If you were among the one-third of voters who looked around and saw everyone else getting ahead but you, Mamdani was your candidate.

Fifty-six percent of voters said the cost of living was the most critical issue, and Mamdani won 66% of them. If he had only won these voters, Mamdani still would have come within a few percentage points of beating Cuomo (41%-37%). This is an essential message for the GOP to internalize if it wants to win back these voters at the 2026 midterms.

Of the 34% of voters who supported raising taxes, an incredible 86% were for Mamdani. But his coalition is not a working-class coalition. White voters with a degree supported Mamdani 57%-40%, while he took just 26% of white voters without a degree — a group that would have comprised eight out of ten voters in 1950 but just 14% today. Nor was it truly a coalition of the financial elite: Cuomo won 62%-33% among families earning over $300,000 per year.

Kitchen-table issues, again

While the circumstances in New York City were somewhat unique, the story in Virginia was more typical. There was a huge gender gap — which is really a marriage gap — though unfortunately, we have only the gender breakdown since pollsters, for whatever reason, didn’t ask about marital status, despite its enormous effect on women’s votes in particular. Republican Winsome Earle-Sears actually won men 51%-38%, but Abigail Spanberger crushed her among women, 65%-35%. If gender gap patterns here are similar to 2024, Spanberger took approximately 72% of single women’s votes.

Also notable is the incredible failure of tokenistic identity politics to appeal to left-wing identity groups. Earle-Sears, a black woman, took just 7% of the black vote — and, incredibly, just 3% of black women’s votes. Meanwhile, she took 61% of white men’s votes, even while losing by 14.5 points overall.

The lesson for the GOP is simple: Voters want tangible results on immigration, jobs, and affordability.

Spanberger was similarly dominant among youth, winning the under-45 vote 65%-34%, as opposed to a much narrower 53%-47% margin among the 45-and-over crowd. Similarly, we see how much the Democrats have become the party of the elite, with Spanberger winning 68%-32% among those with advanced degrees. Earle-Sears, meanwhile, won 2-1 among the one-third of Virginia voters who are white and do not have college degrees and 80% of white born-again Christians, who made up 28% of the voters.

Earle-Sears won 61%-37% among the 37% who are not affected financially by the shutdowns, while the 20% who are affected went for Spanberger 82%-18%. If you look at those Virginia voters who are only a little or not at all financially affected by federal cuts, Spanberger eked out only the narrowest victory over Earle-Sears. Almost her entire positive margin came from those 20% of voters who are substantially financially affected by federal job cuts. This illustrates in dramatic fashion how much Virginia has become a company town for the federal government, with politics that reflect that fact.

By a 58%-40% margin, Virginians said that the economy was good, but Spanberger won among the 23% who felt they were falling behind, by a 76%-24% margin. Again, we see that those who are unhappy with their place in the current economy went overwhelmingly for the Democrats.

Spanberger also won on kitchen-table issues. Among the 48% who felt the economy was the most important issue, she won 63% to 36%. And among the 21% who said health care was the most important issue, she won an incredible 81% to 18%.

By contrast, Earle-Sears had only a narrow advantage (50%-47%) on the transgender issue despite having made men in women’s or girls’ bathrooms and similar matters a centerpiece of her campaign. While it’s very likely that particular issue had a larger gap when related to men in women’s locker rooms than transgenderism as a whole, as insane as transgenderism is to most Republicans, it does not trump the economy for most swing voters.

RELATED: Accountability or bust: Trump’s second term test

![]() Photo by Anna Moneymaker/Getty Images

Photo by Anna Moneymaker/Getty Images

Carville’s maxim

In New Jersey, once again, we saw economic anxieties come to the fore. Like New York, most people in the Garden State said the economy was not good. But they did not blame the extended period of Democrat governance, including a two-term Democrat governor. Instead, they blamed the Republicans who have been in power for less than a year. Indeed, among the 24% of voters who felt they were economically falling behind, they went 69%-31% for Democrat Mikie Sherrill.

GOP candidate Jack Ciattarelli barely won white voters, 52%-47%, while 68% of Latinos and 82% of Asian Americans voted for Sherrill. For both Spanberger and Sherrill, the Democrats were gifted with almost ideal candidates — experienced, elected congresswomen — given their potential coalition: relatively moderate, affluent white women who could deliver enough red meat to their minority base to turn out most of them while feeling very safe for moderate white suburbanites. Notably, both Sherrill, a Naval Academy graduate and veteran, and Spanberger, a former CIA officer, are married suburban moms, which makes it hard for your average independent voter to portray them as unpatriotic.

One encouraging point was that these results may say less about Republicans and Democrats than one might think. Among a much more Democrat-skewed electorate than in 2024, party favorability for the GOP in New Jersey was only five points under water (46%-51%), while the Democrats (49%-48%) were barely viewed favorably. But a staggering 23% of those with a somewhat favorable view of the Republican Party voted for Sherrill, speaking to her ability to win independent voters.

The GOP retained some gains it made among Hispanic voters in 2024, but overall, 18% of Hispanic voters who voted GOP in 2024 switched to the Democrats in this election. This still represented a significant gain in Hispanic votes for the GOP compared to the last governor’s race in 2021, but it was not enough to keep the race close.

A silver lining

One bright spot from the exit polls after a tough evening for the GOP is that immigration remains a solid issue for Republicans, even with Democrat intransigence. The Trump administration’s aggressive actions haven’t soured voters. Winsome Earle-Sears won 88% among those who considered immigration the most critical issue in Virginia (unfortunately, only 11% of the electorate). Jack Ciattarelli won 72% among voters who cared most about immigration (but again, just 7%).

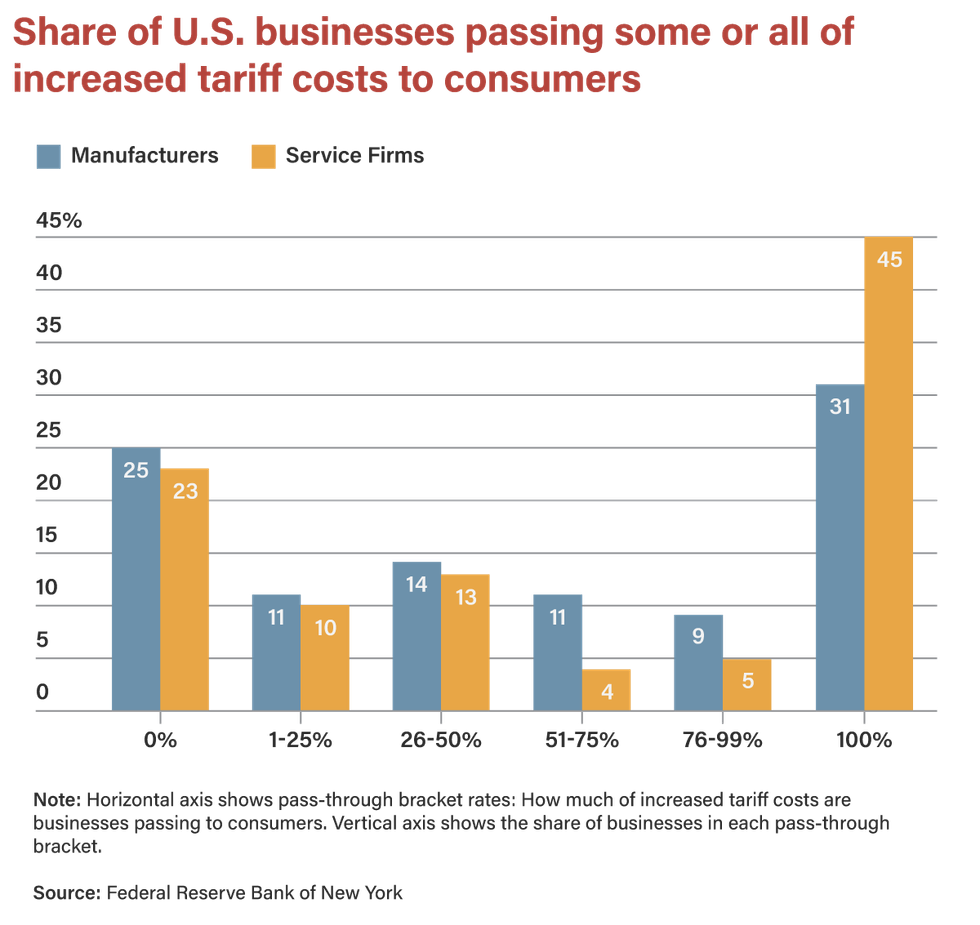

The economy is the dominant issue, which is why it’s essential to spend more time talking about deporting illegal aliens as a kitchen-table issue that frees up jobs and housing for citizens, while reducing the tax burden on social services.

In each of these constituencies — New York City, Virginia, and New Jersey — Trump’s immigration policies were more opposed than supported. But these are all liberal constituencies in a Democrat wave election. If Trump’s policies polled this well among these constituencies during this election, they still retain solid popular support nationwide.

In New Jersey, 47% said the next governor should cooperate with the president on immigration, versus 49% who said she should not, a virtual tie in a state where the GOP gubernatorial candidate lost by 13 points. By a 15-point margin, Virginians opposed Trump’s immigration policies, identical to the gap in the governor’s race. Even in NYC, 34% of voters wanted the city to cooperate with the Trump administration on immigration enforcement, versus 61% opposed. That 34% number is several points higher than the 30% Trump won in the city in 2024, which represented the highest vote total for a GOP candidate in NYC since 1988.

The lesson for the GOP is simple: Voters want tangible results on immigration, jobs, and affordability. Recent polling suggests that these are the top three issues for 60% of low-propensity voters. If the GOP delivers on these points, it can have a great 2026 midterm election. If not, 2026 will look a lot like 2025.

Once again and as ever: “It’s the economy, stupid.”

Editor’s note: A version of this article appeared originally at the American Mind.

Photo by Kevin Carter/Getty Images

Photo by Kevin Carter/Getty Images Conservatives should focus like a laser beam on making life better for the middle class.

Conservatives should focus like a laser beam on making life better for the middle class.

Photo by Michael M. Santiago/Getty Images

Photo by Michael M. Santiago/Getty Images Photo by Anna Moneymaker/Getty Images

Photo by Anna Moneymaker/Getty Images

Photo by Jack Taylor/Getty Images

Photo by Jack Taylor/Getty Images

Photo by Chip Somodevilla/Getty Images

Photo by Chip Somodevilla/Getty Images Photo by Tim Grist Photography via Getty Images

Photo by Tim Grist Photography via Getty Images

Greenseas via iStock/Getty Images

Greenseas via iStock/Getty Images

Photo by Andrej Ivanov / Contributor via Getty Images

Photo by Andrej Ivanov / Contributor via Getty Images

Photo by PEDRO MATTEY/AFP via Getty Images

Photo by PEDRO MATTEY/AFP via Getty Images