The American Dream Is Harder To Reach For Millennials And Gen Z: Here’s The Math

A 50-year mortgage, an eight-year car loan, and a forever college payment. Is this the best we can do for our young people?

A 50-year mortgage, an eight-year car loan, and a forever college payment. Is this the best we can do for our young people?The news out of New York this week should outrage anyone who believes in the rule of law. The state’s appellate court tossed out the obscene half-billion-dollar penalty imposed on Donald Trump by state Attorney General Letitia James, yet it still clung to the claim that he committed “fraud” by overstating his real estate portfolio.

From the beginning, this case was political lawfare disguised as “justice.” It criminalized the very elasticity of property valuation that defines high-stakes real estate.

If America tolerates this ruling, the day will come when the crime isn’t fraud at all — it’s being the wrong person with the wrong politics at the wrong time.

Anyone who has bought or sold a home knows “value” isn’t some sacred number. A property is worth only what someone will pay, and until that moment, its worth floats in a haze of market analysis, comparable sales, zoning quirks, and fickle buyer demand. That’s why developers hire licensed professionals — because even they can’t pin down “true” value in advance.

Trump, like every major builder, relied on staff and advisers to draft annual financial statements for lenders and insurers. James labeled his optimistic estimates “fraud.” That leap should terrify every business owner.

New York’s civil fraud statute doesn’t require proof of harm. No bank cried foul. Deutsche Bank and other institutions profited, collecting interest and repayment in full. As even Reuters admitted, sophisticated lenders conducted their own underwriting and discounted Trump’s numbers before loaning a dime. Yet James waved off reality, claiming the real harm was to the “system” — a conveniently nebulous principle that gave her license to weaponize her office against her state’s most famous political enemy.

The trial spotlighted Trump Tower’s penthouse, once valued as if it were three times its actual size, and Mar-a-Lago, valued as if it could be sold tomorrow as a private estate despite deed restrictions that limit it to club use. But what the press rarely notes: Every statement carried disclaimers telling banks to do their own due diligence. That’s not fraud; that’s called salesmanship. What made it criminal, apparently, was Trump’s name.

RELATED: Pot, meet kettle: Is Letitia James guilty of the EXACT SAME fraud she went after Trump for?

The trial court swallowed James’ theory whole, slapping Trump with a penalty that swelled past $500 million with interest. The appellate court rightly found the punishment excessive under the Eighth Amendment. Punishing a man for hundreds of millions when no bank lost a penny was not justice — it was confiscation. Even then, the majority kept the fraud finding alive, while dissenting judges argued liability was never proven, and one urged outright dismissal.

Trump may have dodged financial annihilation, but James’ poison seed remains. If prosecutors can retroactively decide your numbers looked “too rosy,” then every loan application in America becomes a potential indictment. This case was never about protecting banks. It was about showing that the state can destroy anyone it chooses, facts and damages be damned.

And here’s the warning every American should feel in their gut: If the state can do this to a billionaire with armies of lawyers and accountants, imagine what it can do to you. One overly confident estimate on your house, one set of books a bureaucrat decides to “reinterpret,” and suddenly you’re a fraud. Your life’s work? Gone in the name of “justice.”

That isn’t the rule of law. It’s tyranny weaponized through balance sheets. If America tolerates this, the day will come when the crime isn’t fraud at all — it’s being the wrong person with the wrong politics at the wrong time.

California’s wide range of problems — including declining schools, widening inequality, rising housing prices, and a weak job market — shows the urgent need for reform. The larger question is whether there exists a will to change.

Although the state’s remarkable entrepreneurial economy has kept it afloat, a growing number of residents are concluding that the progressive agenda, pushed by public unions and their well-heeled allies, is failing. Most Californians have an exceptional lack of faith in the state’s direction. Only 40% of California voters approve of the legislature, and almost two-thirds have told pollsters the state is heading in the wrong direction. That helps explain why California residents — including about 1.1 million since 2021 — have been fleeing to other states.

California needs a movement that can stitch together a coalition of conservatives, independents, and, most critically, moderate Democrats.

Unhappiness with the one-party state is particularly intense in the inland areas, which are the only locales now growing and may prove critical to any resurgence. More troubling still, over 70% of California parents feel their children will do less well than they did. Four in 10 are considering an exit. By contrast, seniors, thought to be leaving en masse, are the least likely to express a desire to leave.

In some ways, discontent actually erodes potential support for reform. Conservative voters, notes a recent study, are far more likely to express a desire to move out of the state; the most liberal are the least likely. “Texas is taking away my voters,” laments Shawn Steel, California’s Republican National Committee member.

Given the demographic realities, a successful drive for reform cannot be driven by a marginalized GOP. Instead, what’s needed is a movement that can stitch together a coalition of conservatives, independents (now the state’s second-largest political grouping), and, most critically, moderate Democrats.

Remarkably, this shift has already begun in an unlikely place: the ultra-liberal, overwhelmingly Democratic Bay Area. For years, its most influential residents — billionaires, venture capitalists, and well-paid tech workers — have abetted or tolerated an increasingly ineffective and corrupt regime. Not only was the area poorly governed, but the streets of San Francisco, Oakland, San Jose, and other cities have become scenes of almost Dickensian squalor.

Over the past two years, tech entrepreneurs and professionals concerned about homelessness and crime worked to get rid of progressive prosecutor Chesa Boudin. Last year, they helped elect Dan Lurie, scion of the Levi Strauss fortune, as mayor, as well as some more moderate members to the board of supervisors. Lurie, of course, faces a major challenge to restore San Francisco’s luster against entrenched progressives and their allies in the media, academia, and the state’s bureaucracy.

Similar pushbacks are evident elsewhere. Californians, by large majorities, recently passed bills to strengthen law enforcement, ditching liberalized sentencing laws passed by Democratic lawmakers and defended by Gov. Gavin Newsom (D). Progressive Democrats have been recalled not only in San Francisco but also in Oakland (Alameda County) and Los Angeles, with voters blaming ideology-driven law enforcement for increasing rates of crime and disorder.

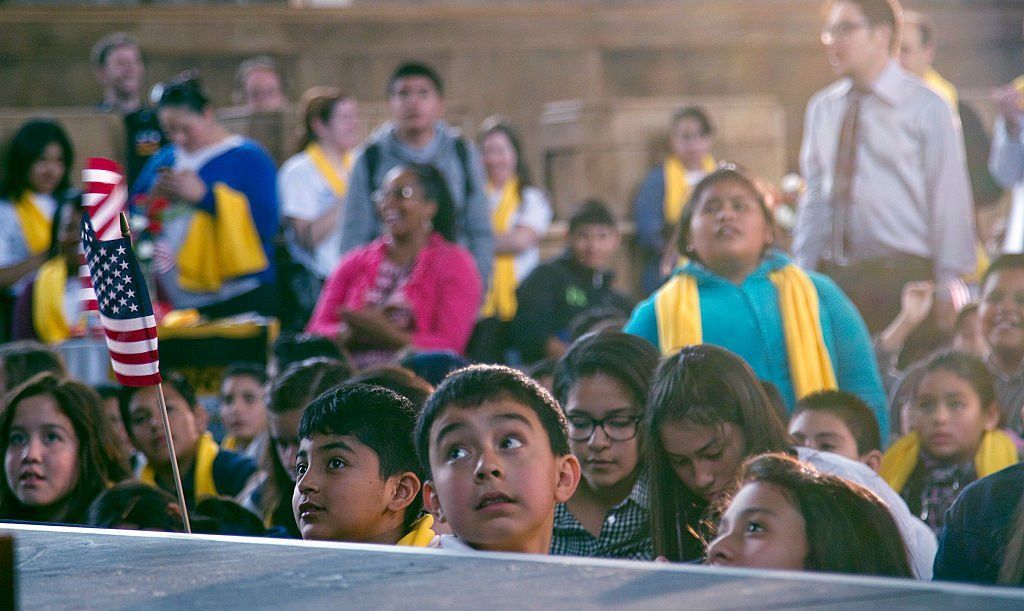

Critically, the liberal elites are not the only ones breaking ranks. Pressure for change is also coming from increasingly conservative Asian voters and Jews — who number more than 1 million in the state and largely are revolted by the anti-Semitism rife among some on the progressive left. Protecting property and economic growth is particularly critical to Latino and Asian immigrants — California is home to five of the 10 American counties with the most immigrants — who are more likely to start businesses than native-born Americans.

These minority entrepreneurs and those working for them are unlikely to share the view of progressive intellectuals, who see crime as an expression of injustice and who often excused or even celebrated looting during the summer of 2020. After all, it was largely people from “communities of color” who have borne the brunt of violent crime in cities such as Los Angeles, Oakland, and San Francisco. Minorities also face special challenges doing business here due to regulations that are especially burdensome on smaller, less capitalized businesses. According to the Small Business Regulation Index, California has the worst business climate for small firms in the nation.

The shift among minority voters could prove a critical game-changer, both within the Democratic Party and the still-weak GOP. In Oakland, for example, many minorities backed the removal of Mayor Sheng Thao (D), a progressive committed to lenient policing in what is now California’s most troubled, if not failed, major city.

Latinos, already the state’s largest ethnic group, constituting about 37.7% of the workforce, with expectations of further growth by 2030, seem to be heading toward the right. In the last presidential election, Trump did well in the heavily Latino inland counties and won the “Inland Empire” — the metropolitan area bordering Los Angeles and Orange Counties – the first time a GOP presidential candidate has achieved this in two decades.

After a generation of relentless virtue-signaling, California’s government needs to focus on the basic needs of its citizens: education, energy, housing, water supply, and public safety. As a widely distributed editorial by a small business owner noted, Californians, especially after highly publicized fire response failures in Los Angeles earlier this year, are increasingly willing to demand competent “basic governance” backed by a “ruthless examination of results” to ensure that their government supports “modest aspirations” for a better life.

California once excelled in basic governance, especially in the 1950s and '60s under Democratic Gov. Edmund G. “Pat” Brown. The state managed to cultivate growth while meeting key environmental challenges, starting in the late 1960s, most notably chronic air pollution. In what is justifiably hailed as a “major success,” California helped pioneer clean air regulatory approaches that have vastly reduced most automotive tailpipe emissions as well as eliminated lead and dramatically cut sulfur levels.

All of this starkly contrasts with the poor planning, execution, and catastrophist science evoked to justify the state’s climate agenda. Even Pat Brown’s son, former Gov. Jerry Brown (D), recognized that California has little effect on climate. Given the global nature of the challenge, reducing one state’s emissions by cutting back on industrial activities accomplishes little if those activities move elsewhere, often to locations with fewer restrictions such as China and India.

Rather than focusing on “climate leadership,” Sacramento needs to tackle the immediate causes of record out-migration, including sluggish economic growth and the nation’s highest levels of poverty and homelessness. The great challenges are not combatting global temperature rises but the housing crisis and the need to diversify the economy and improve the failing education system. As these problems have often been worsened by climate policies, there seems little reason for other states and countries to adopt California’s approach as a model.

California now has the nation’s second-lowest home ownership rate at 55.9%, slightly above New York (55.4%). High interest rates that have helped push home sales to the lowest level in three decades across the country are particularly burdensome in coastal California metros, where prices have risen to nearly 400% above the national average. The government almost owned up to its role in creating the state’s housing crisis — especially through excessive housing regulations and lawfare on developers — earlier this year when Newsom moved to cut red tape so homes could be rebuilt after the Los Angeles fires.

Current state policy — embraced by Yes in My Backyard activists, the greens, and unions — focuses on dense urban development. Projects are held up, for example, for creating too many vehicle miles traveled, even though barely 3.1% of Californians in 2023 took public transit to work, according to the American Community Survey. As a result, much “affordable” development is being steered to densely built areas that have the highest land prices. This is made worse with mandates associated with new projects, such as green building codes and union labor, that raise the price per unit to $1 million or more.

A far more enlightened approach would allow new growth to take place primarily outside city centers in interior areas where land costs are lower and where lower-cost, moderate-density new developments could flourish. These include areas like Riverside/San Bernardino, Yolo County (adjacent to Sacramento), and Solano County, east of San Francisco Bay. This approach would align with the behavior of residents who are already flocking to these areas because they provide lower-income households, often younger black and Latino, with the most favorable home ownership opportunities in the state.Over 71% of all housing units in the Inland Empire are single-family homes, and the aggregate ownership rate is over 63%, far above the state’s dismal 45.8% level.

Without change, the state is socially, fiscally, and economically unsustainable. California needs to return to attracting the young, talented, and ambitious, not just be a magnet for the wealthy or super-educated few.

More than anything, California needs a housing policy that syncs with the needs and preferences of its people, particularly young families. Rather than being consigned to apartments, 70% of Californians prefer single-family residences. The vast majority oppose legislation written by Yes in My Backyard hero Democratic state Sen. Scott Wiener banning single-family zoning in much of the state.

Investment in the interior is critical for recreating the old California dream for millions of aspiring households, particularly among minorities who are being driven out of the home ownership market in the coastal metropolitan areas. The only California metropolitan area ranked by the National Association of Realtors as a top 10 pick for Millennials was not hip San Francisco or glamorous Los Angeles, but the more affordable historically “redneck” valley community of Bakersfield.

The numerous housing bills passed by Sacramento have not improved the situation. From 2010 to 2023, permits for single-family homes in California fell to a monthly average of 3,957 units from 8,529 during 1993-2006. California’s housing stock rose by just 7.9% between 2010 and 2023, lower than the national increase (10.3%) and well below housing growth in Arizona (13.8%), Nevada (14.7%), Texas (24%), and Florida (16.2%).

A more successful model can be seen in Texas, which generally advances market-oriented policies that have generated prodigious growth in both single-family and multi-family housing. This has helped the Lone Star State meet the housing needs of its far faster-growing population. A building boom has slowed, and there’s been some healthy decrease in prices in hot markets like Austin. Opening up leased grazing land in state and federal parks — roughly half the state land is owned by governments — could also relieve pressure on land prices. Until California allows for housing that people prefer, high prices and out-migration will continue into the foreseeable future.

Ultimately, California has room to grow, despite the suggestions by some academics that the state is largely “built out.”In reality, California is not “land short,” either in its cities or across its vast interior. Urbanization covers only 5.3% of the state, according to U.S. Census Bureau data, while parks, agricultural land, deserts, and forests make up the bulk of the area.

Even Jerry Brown has remarked that the “Johnny one note” tech economy the state’s tax base depends on could stumble. This would reduce the huge returns on capital gains from the top 1% of filers, who now account for roughly half of all state income tax revenues. This overreliance may be particularly troublesome in the era of artificial intelligence, where tech companies may continue to expand but have less need for people. Indeed, San Francisco County, which boasts many tech jobs, experienced the nation’s largest drop in average weekly wages, 22.6%, between 2021 and 2022.

To expand opportunity and, hence, its tax base, California has to make more of the state attractive to employers. The best prospects, again, will be in inland areas.Today, when firms want to build spaceships, a clear growth industry where California retains significant leadership, as well as battery plants and high-tech and food processing facilities, they often opt to go to Nevada, Arizona, Tennessee, and Texas. Given lower land and housing costs, San Bernardino and Riverside Counties, as well as spots on the Central Coast, should be ideally situated to compete for those jobs.

The current economic pattern creates a situation where AI developers, elite engineers, and venture capitalists may enjoy unprecedented profits, but relatively little trickles down to the mass of Californians. Not all Californians have wealthy parents to subsidize their lifestyle, and few are likely to thrive as AI engineers. To address the dilemmas facing the next generation of Californians, the state needs to focus not just on ephemera, software, and entertainment but on bringing back some of the basic industries that once forged the California dream. In this way, President Trump’s policies could actually help the state, particularly in fields like high-tech defense and space.

In the 1940s, California played a key role in the American “arsenal of democracy.” Today, it could do the same, not so much by producing planes and Liberty ships, but drones, rockets, and space-based defense systems. Indeed, there are now discussions of reviving the state’s once-vaunted shipbuilding industry that buoyed the economy of Solano County — something sure to inspire the ire of the Bay Area’s rich and powerful environmental lobby.

Climate and environmentalism are not the only barriers to California’s revival. No problem is more pressing and consequential than the state’s failure to educate California’s 5.9 million public school children. In fiscal year 2023-2024, California will spend about $128 billion on K-12 public education — an amount exceeding the entire budget of every other state except New York. Despite this level of spending, about 75% of California students lack proficiency in core subject areas based on federal education standards.

Two out of three California students do not meet math standards, and more than half do not meet English standards on state assessments. Overall, less than half of California public school students performed at or above grade level for English language arts (reading, writing, etc.), while only 34.62% met or exceeded the math standard on the Smarter Balanced 2023 tests. The failures are particularly clear among minority students. According to the latest California testing results, only 36.08% of Latino students met or exceeded proficiency standards for English language arts. Only 22.69% met or exceeded proficiency standards in math. Latino students, for example, in Florida and Texas do somewhat better in both math and English, even though both states spend less per capita on education than California.

Not surprisingly, many parents object to a system where half of the state’s high school students barely read at grade level. One illustration of discontent has been the growth of the charter school movement. Today, one in nine California schoolchildren attend charter schools (including my younger daughter). The state’s largest school district, the heavily union-dominated Los Angeles Unified School District, has lost roughly 40% of its enrollment over two decades, while the number of students in charters grew from 140,000 in 2010 to 207,000 in 2022.

In addition to removing obstacles to charters, homeschoolers are part of the solution. California homeschool enrollment jumped by 78% in the five-year period before the pandemic and in the Los Angeles Unified School District by 89%. Equally important, some public districts and associated community colleges, as in Long Beach, have already shifted toward a more skills-based approach. Public officials understand that to keep a competitive edge, they need to supply industrial employers with skilled workers. This is all the more crucial as the aerospace workforce is aging — as much as 50% of Boeing’s workforce will be eligible for retirement in five years. In its quest for relevance, Long Beach’s educational partnership addresses the needs of the city’s industrial and trade sectors.

This approach contrasts with the state’s big push to make students take an ethnic studies course designed to promote a progressive and somewhat anti-capitalist, multicultural agenda. They will also be required to embrace the ideology of man-made climate change even if their grasp of basic science is minimal. A “woke” consciousness or deeper ethnic affiliations will not lead to student success later in life. What will count for the students and for California’s economy is gaining the skills that are in demand. You cannot run a high-tech lathe, manage logistics, or design programs for space vehicles with ideology.

Conventional wisdom on the right considers California to be on the road to inexorable decline. Progressives, not surprisingly, embrace the Golden State as a model while ignoring the regressive, ineffective policies that have driven the state toward a feudal future.

Yet both sides are wrong. California’s current progressive policies have failed, but if the state were governed correctly, it could resurge in ways that would astound the rest of the country and the world. Change is not impossible. As recent elections showed, Californians do not reflexively vote for progressives if they feel their safety or economic interests are on the line.

If change is to come in California, it may not be primarily driven by libertarian or conservative ideologies but by stark realities. Over two-thirds of California cities do not have any funds set aside for retiree health care and other expenses. Twelve of the state’s 15 large cities are in the red, and for many, it is only getting worse. The state overall suffers $1 trillion in pension debt, notes former Democratic state Rep. Joe Nation. U.S. News and World Report places California, despite the tech boom, 42nd in fiscal health among the states. This pension shortfall makes paying for infrastructure, or even teacher salaries, extraordinarily difficult at the state and local levels.

Without change, the state is socially, fiscally, and economically unsustainable, even if a handful of people get very rich and the older homeowners, public employees, and high-end professionals thrive. California needs to return to attracting the young, talented, and ambitious, not just be a magnet for the wealthy or super-educated few.

This can only happen if the state unleashes the animal spirits that long drove its ascendancy. The other alternative may be a more racial, class-based radicalism promoted by the Democratic Socialists of America and their allies. They have their own “cure” for California’s ills. We see this in debates over rebuilding Los Angeles, with progressives pushing for heavily subsidized housing, as with the case of the redevelopment of the Jordan Downs public housing complex, while seeking to densify and expand subsidized housing to once solidly affluent areas like the Palisades.

California has survived past crises — earthquakes and the defense and dot-com busts — and always has managed to reinvent itself. The key elements for success — its astounding physical environment, mild climate, and a tradition for relentless innovation — remain in place, ready to be released once the political constraints are loosened.

Fifty years ago, in her song “California,” Canada-reared Joni Mitchell captured the universal appeal of our remarkable state, not just its sunshine, mountains, and beaches, but also how it gave its residents an unprecedented chance to meet their fondest aspirations. Contrasting her adopted home with the sheer grayness of life elsewhere, she wrote, “My heart cried out for you, California / Oh California, I’m coming home.”

Editor’s note: This article was originally published by RealClearInvestigations and made available via RealClearWire.

A Virginia realtor has been accused of "hate speech" for posting a Bible verse on Facebook in 2015. The realtor — who is also a pastor — faces the possibility of being hit with fines or could lose his license, which would jeopardize his long-time real estate career.

Wilson Fauber is a 70-year-old realtor who has "faithfully served his community as a real estate agent and broker for over 40 years," according to the Founding Freedoms Law Center. Fauber is a member of the National Association of Realtors and has held this membership throughout his career.

'But what's incredible here is the post that Wilson made was in 2015, five years before that rule even existed.'

However, Fauber's real estate career could be in peril over sharing a Bible verse on Facebook in 2015.

Last year, two Staunton realtors — including an openly gay man — filed a complaint against Fauber with the Virginia Association of Realtors, according to CBN. The complaint accused Fauber of "hate speech."

The alleged "hate speech" was a social media post that Fauber shared on his personal Facebook account in 2015. Fauber reportedly reposted a scripture from Rev. Franklin Graham that stated homosexual sex is a sin, based on Leviticus 18:22.

Fauber stated, “If I were to read a scripture such as Leviticus 18:22 and just close the Bible and not make any comment at all, if someone — and I’m a realtor and a minister — and if someone is offended by that, even if they’re not in the service but someone tells them that I read that passage of scripture, then any person, you don’t have to be a realtor, any person can file a complaint against that minister-realtor and be in the same shoes that I’m in right now. And that should not be; that’s an invasion of my privacy."

The complaint argued Fauber's post violated the National Association of Realtors’ Standard of Practice 10-5.

"Realtors must not use harassing speech, hate speech, epithets, or slurs based on race, color, religion, sex, disability, familial status, national origin, sexual orientation, or gender identity," the code of ethics and standards of practice states.

However, the hate speech policy did not go into effect until Nov. 13, 2020.

Fauber's attorney — Michael Sylvester of the Founding Freedoms Law Center — told CBN, "So it all changed in 2020 when the National Association of Realtors adopted a rule that prohibits anybody from speaking what they deem 'hate speech' against certain protected classes such as sexual orientation or gender identity. But what's incredible here is the post that Wilson made was in 2015, five years before that rule even existed. He simply was presenting his religious views about marriage that should not qualify for a hate speech charge."

Fauber added, "Christians don't have rights, and this is just totally wrong. And the National Association of Realtors being the largest trade organization in America, they have set a precedent by adopting this policy. If I'm guilty because I post my religious beliefs in a meme or a scripture on my Facebook or social media accounts, and if that's guilty of 'hate speech' ... there are millions and millions of Christians that agree with my position, and we don't have a voice."

On Dec. 11, the Virginia Association of Realtors ruled that Fauber violated the ethics code that prohibits realtors from "certain religious expressions."

Fauber is expected to appeal the ruling.

If the guilty ruling stands, Fauber could face fines between $5,000 and $15,000.

Even worse, Fauber could possibly have his realtor license revoked, which could end his real estate career.

A real estate agent must be a member of the National Association of Realtors to access the Multiple Listing Service, a critical tool for realtors.

Sylvester described the Multiple Listing Service as "the database that real estate agents go to find out all kinds of information about houses that are up for sale and to list houses for sale." He added that having the MLS access revoked "would be career-ending for so many real estate agents."

Fauber noted, "If you do not have access to the Multiple Listing Service, you’re out of business."

When asked why he believes these allegations are arriving years later, Fauber told CBN, "Because the National Association of Realtors is woke. The leadership of the National Association of Realtors has made it very clear about their involvement in endorsing and approving of the LGBTQ community, and just recently, just a few weeks ago actually, in Charlottesville, Virginia, the National Association of Realtors provided funding for a drag queen show."

The Diversity, Equity, and Inclusion Committee of the Charlottesville Area Association of Realtors held an "Inclusivity & Celebration: Fair Housing Symposium with Drag Show & Fireside Chat" on Nov. 15.

The description of the LGBTQ event states:

This event will spotlight housing discrimination, particularly affecting individuals who identify as Lesbian, Gay, Bisexual, Transgender, and/or Queer/Questing (LGBTQ+). Attendees will gain insights into the Fair Housing Act, hear from a local LGBTQ+ activist, participate in educational segments on the LGBTQ+ community (i.e., pronouns, creating a safe environment, understanding the Stop Hate in Real Estate Pledge, etc.), and engage in a dialog with the performers who will share their own housing discrimination experiences. This event will create opportunities for realtors to actively listen, deepen their understanding of the LBGTQ+ community, and build relationships that positively impact both our industry and the communities we serve.

Last year, the National Association of Realtors announced a partnership with the LGBTQ+ Real Estate Alliance that "fortifies our ability to advocate for equitable policies and the continued development of LGBTQ+ leaders."

The National Association of Realtors did not respond to a request for comment by the Christian Broadcasting Network.

Like Blaze News? Bypass the censors, sign up for our newsletters, and get stories like this direct to your inbox. Sign up here!

A Democratic judge sided with New York Attorney General Letitia James last year, claiming former President Donald Trump and his company committed fraud by overstating the value of their assets.

On "The Daily Show" Monday, former comedian Jon Stewart discussed where Trump's civil fraud case presently stands, zeroing in on the Republican front-runner's appeal and corresponding multi-million-dollar bond.

Stewart argued that Trump's supposed overvaluation of his properties was "not victimless," intimating further that those who do likewise in pursuit of profit are immoral if not outright criminal.

The New York Post and critics online intimated this week that Stewart might have some phantasmal victims of his own.

In response to accusations of hypocrisy, Stewart lashed out Wednesday; however, his defense fell flat absent an adoring audience ready to laugh on cue.

"What did Trump actually do to earn this penalty?" Stewart said Monday, referencing Trump's $454 million appeal bond, which a state appeals court knocked down to $175 million this week.

"Well, it turns out that for a decade, whenever Trump wanted to get a loan or make a deal, he would illegally inflate the value of his real estate. For instance, suggesting that his 11,000-square-foot penthouse was a 30,000-square-foot-penthouse," continued Stewart. "We all do it. I mean, on my license I'm not listed as 5'7''. I'm listed as 30,000 square feet."

Stewart said that Letitia James "knew that Trump's property values were inflated because when it came time to pay taxes, Trump undervalued the very same properties. It was all part of a very sophisticated real estate practice known as lying."

The host stressed that overvaluations "are not victimless crimes."

Stewart suggested that the banks were victimized, having apparently been paid back at lower interest rates. He also suggested that since "money isn't infinite," persons seeking loans who might have given "a more honest evaluation" could hypothetically have lost out.

According to the host, when it comes to the investment community, "In pursuit of profit, there is no rule that cannot be bent, there is no principle that cannot be undercut, as long as you and your f**king friends [are] making money."

For those who did not watch what Jon Stewart said, here it is. But keep in mind that it has now been found that he overvalued his NYC home by 829% after slamming Trump\u2019s civil case as \u2018not victimless.\u2019 WATCH and then read his story here by @nypost: https://t.co/ebZz6E5weS— (@)

On Tuesday, podcast host Tim Pool dug up a 2014 New York Times article concerning Stewart's sale of a 6,280-square-foot New York City penthouse to financier Parag Pande for $17.5 million. The article noted that Stewart bought the apartment for $5.8 million in 2005.

Pool tweeted, "Did @jonstewart commit fraud when he sold his penthouse for $17.5M? NY listed its market value at $1.8M [and] AV around 800k."

The New York Post seized upon Pool's suggestion and obtained assessor records from the year of sale, which indicated the property's estimated market value was only $1.88 million. According to the Post, the actual assessor valuation was even lower, at $847,174.

The Post alleged that Stewart had done precisely what he accused Trump Monday of doing: paying "significantly lower property taxes, which were calculated based on that assessor valuation price."

The Post noted that the New York assessor valuation on Stewart's former penthouse "is the exact same citation method and metric that New York Attorney General Letitia James used to value Trump's private and personal properties, and then sued him for inflating those assets."

Parag Pande apparently sold the property in 2021 at just over $13 million at roughly a 26% loss.

Sarah Rumpf of Mediaite suggested that it was unfair to suggest Stewart had "overvalued his property," certainly not by "a staggering 829%."

Rumpf claimed the Post and other critics were conflating different types of real estate values — the actual market value of a property, the property's taxable value, and "documentation about a property's value submitted to a lender for the purposes of securing a loan" — perhaps with the intention to mislead.

Rumpf argued further that it is common for there to be a significant delta between assessed and actual market values, stressing that in Stewart's case, a buyer was willing to pay $17.5 million.

The Post has since changed the title of its article from "Jon Stewart found to have overvalued his NYC home by 829% after slamming Trump's civil case as 'not victimless'" to "Jon Stewart benefited by 829% 'overvalue' of his NYC home even as he labels Trump’s civil case 'not victimless.'"

While "The Daily Show" host's representatives did not respond to the Post's requests for comment, Stewart tweeted Wednesday evening, "OMG!! I've been caught doing something not remotely similar to Trump!"

"I guess all I need to do now is start a fraud college, steal classified docs, bankrupt casinos, pay hush money, grab pussies, discriminate in housing, cheat at golf and foment insurrection and you'll revere me!" added Stewart.

After Stewart threw more rocks from his glass house, critics pounced.

@jonstewart This you?— (@)

Tim Pool doubled down, writing, "My brother[.] You sold a property NY valued at 1.8M to someone for 17.5M and they lost 4M because of it[.] And you paid taxes on a valuation of 748k. 'When it came time to pay taxes he undervalued his property.'"

Blaze TV host Mark Levin tweeted, "Caught red-handed and you make a dumb-ass argument. According to YOU, you are a liar, a fraud, a hypocrite, and you're arrogant about it. Sound familiar, Johnny?"

"They told us that others need to pay their 'fair share,'" wrote investigative reporter James O'Keefe. "Oh what a tangled web they weave!"

Like Blaze News? Bypass the censors, sign up for our newsletters, and get stories like this direct to your inbox. Sign up here!

Oklahoma City is among America's 20 largest cities and on track to keep on growing. Although the city of roughly 700,000 does not presently have a problem with density and has plenty of room left for sprawl, a California real estate developer nevertheless has a hankering to extend the Big Friendly skyward.

Matteson Capital, a firm headquartered in Newport Beach, California, and architecture firm AO announced Friday they were seeking greater latitude from the City of Oklahoma concerning the height of one of the towers in its proposed development dubbed the Boardwalk at Bricktown. If it gets its way, then Oklahoma City might soon become home to America's tallest building.

Oklahoma City Free Press reported that the original zoning application requested that the Legends Tower be 1,750 feet all. However, the developer is now seeking to build its so-called Legends Tower 1,907 feet high — 131 feet taller than One World Trade Center in New York City.

Apparently, 1,907 is not an arbitrary number but rather a symbolic gesture to commemorate the year Oklahoma entered the Union.

There is a problem, however, with the developer's request and its corresponding announcement.

Kristy Yager, public information officer for the city and a staff member of zoning, told the Free Press, "To clarify, they would need to rezone, not seek a variance. Their existing SPUD was specifically negotiated, including the building height ('Maximum height of any building shall be 300 feet with the exception that height will be limited to 90 feet within 20 feet of the northern SPUD boundary.')"

Yager added, "We understand the applicant's representative is preparing a new SPUD application, which would go to Planning Commission for a recommendation and City Council for final decision."

Scot Matteson, the CEO of Matteson Capital, told KOCO-TV in late December, "We're going to build it in phases. We assess the market demand and the growth of population and employment."

The developer indicated further that the tower can be shortened if demand turns out to be lower.

The developer plans to erect three additional towers at the base of the skyscraper, each 345 feet tall.

Altogether, the development would span roughly 5 million square feet and include a 480-room Hyatt hotel with 85 residential condominiums; 1,776 residential units; and 110,000 feet of commercial and community space.

Matteson said in a statement Friday, "Oklahoma City is experiencing a significant period of growth and transformation, making it well-positioned to support large-scale projects like the one envisioned for Bricktown."

"We believe that this development will be an iconic destination for the city, further driving the expansion and diversification of the growing economy, drawing in investment, new businesses, and jobs," continued Matteson. "It's a dynamic environment and we hope to see The Boardwalk at Bricktown stand as the pride of Oklahoma City."

Rob Budetti, managing partner of AO, said, "Crafting a project of this significance is an honor, and the collaborative process with the City, Matteson Capital, Hensel Phelps, and a top-notch team of engineers, consultants, and development partners has been exceptional. Managing the intricacies of such a project, ensuring seamless integration of all components, is a significant challenge."

The location for the ambitious development is presently occupied by an L-shaped parking lot in Bricktown nearby the Paycom Center, home to the Oklahoma City Thunder; the Amtrak station; a movie theater; and a planned soccer stadium.

Like Blaze News? Bypass the censors, sign up for our newsletters, and get stories like this direct to your inbox. Sign up here!