Being A Millionaire On Paper Doesn’t Mean You Can Stop Saving For Retirement

These days, a million-dollar 401(k) doesn’t guarantee a cushy retirement.

These days, a million-dollar 401(k) doesn’t guarantee a cushy retirement.Last week, a bipartisan group of senators introduced legislation on drug prices that specifically targets pharmacy benefit managers, exactly as Big Pharma prefers. Pharmaceutical companies have spent years trying to convince the public and policymakers that PBMs are the bad guys in the prescription supply chain, shadowy middlemen inflating prices and hurting innovation. That narrative is convenient, but it is also wrong. PBMs are introducing competition, eliminating waste, and driving down prices.

Which is precisely why Big Pharma wants them out of the way.

The truth is that pharmacy benefit managers are effective. And that is exactly why drugmakers are going after them.

The pharmaceutical industry spends more money than any other sector to sway government policy. In 2024, it poured $90 million into campaign contributions and nearly $400 million into lobbying — much of it through former government officials now on the payroll. Drugmakers also shelled out a whopping $11 billion on advertising, a sum that conveniently buys more than consumer attention. It pressures media outlets to look the other way, a racket the Trump administration is finally moving to rein in.

After the black eye of the opioid crisis and the COVID-19 debacle, Big Pharma needs a scapegoat for high drug prices. It found one in a quiet, little-known player most Americans have never heard of, much less understood.

But the numbers are clear. A recent study shows pharmacy benefit managers deliver at least $145 billion in net value every year, even after costs. Compared with a system where manufacturers dictate prices, PBMs create an additional $192 billion in value across the economy. That money doesn’t vanish into corporate coffers. It flows back into businesses, households, and the wallets of working Americans.

PBMs accomplish this by negotiating directly with manufacturers and pharmacies. They aggregate buying power for millions of people. They secure rebates and discounts that most individual plans could never get on their own. In 2020, PBM-managed rebate structures created $51 billion in value for patients and plan sponsors. That is a competitive market in action.

PBMs are expected to save health plans and consumers about $1.2 trillion over the next 10 years, averaging $1,154 per person per year. And for every dollar spent on PBM services, the system saves $10 in return. By steering patients toward generics and bio-similars, PBMs helped the health system save $445 billion in 2023 alone. That is what efficiency looks like.

Perhaps more importantly, they improve health outcomes. When patients can afford their prescriptions, they are more likely to take them. That means fewer hospitalizations and fewer emergency room visits. PBM-driven programs have led to as much as a 16% increase in medication adherence and a 10% drop in inpatient admissions.

RELATED:How MAHA can really save American lives

It’s an obvious good to have healthier Americans. But it’s also good for a productive economy.

By lowering premiums and drug costs in public programs, PBMs save taxpayers money as well. This alone accounts for $47 billion in annual savings. And by accelerating patient access to new therapies early in the patent cycle, PBMs support pharmaceutical innovation instead of stifling it.

PBMs currently manage 95% of retail prescriptions and serve 91% of plan participants. That’s because they work. Businesses in the free market use services they value. And they value PBMs because they allow employers to offer more affordable coverage without sacrificing quality.

The truth is that PBMs are effective. And that is exactly why drugmakers are going after them. PBMs bring down net prices and demand accountability. That cuts into Big Pharma’s profit margins. So the industry has launched a campaign to reframe PBMs as a problem rather than a solution.

For example, a Biden-era Federal Trade Commission report that painted PBMs in a negative light should be viewed with skepticism. Even FTC Commissioner Melissa Holyoak emphasized that the report ignores the hard evidence of PBM-driven savings and warned that it was “a premature and deficient report,” adding, “Our job is not to score cheap points for transient political favor.”

“Though facile arguments that rely on ideologically loaded buzzwords such as ‘control’ or ‘power’ may stir emotions and make for entertaining social media posts and television interviews, ideological buzzwords are no substitute for rational, evidence-based research,” Holyoak said.

Sadly, some lawmakers are swallowing Big Pharma’s spin. Bills moving at both the federal and state level would gut PBMs — and hand drugmakers exactly what they want. Even a Brookings Institution analysis found that targeting PBMs won’t lower costs and would only weaken bargaining power against manufacturers.

That isn’t reform. It’s malpractice. Weakening the only players who force price discipline amounts to doing Big Pharma’s bidding at the expense of patients.

This fight isn’t about patients versus middlemen. It’s about competition versus monopoly. It’s about market discipline versus unchecked corporate power.

PBMs work because they negotiate, they drive better drug choices, and they deliver real value. When the most powerful industry in America is desperate to kill them off, you don’t need a think tank study to see what’s at stake. That fact alone tells you everything you need to know.

One of the late comedian George Carlin’s most famous rants gave us the line, "It's a big club ... and you ain't in it.” That sentiment rings especially true when it comes to the financial services industry, where wealthy investors and insiders gatekeep the most lucrative opportunities for themselves and their friends.

So what should you think when they suddenly want to let you in?

The private equity party is a bit dim right now, and that’s why they are sending out more invitations. Be careful before you RSVP.

There's no red flag bigger than when someone wants to let you in on something very exclusive — especially if it’s from people who’ve spent decades keeping you out of the club.

Case in point: the private equity industry’s latest push to open its funds to everyday retail investors.

The private equity world is one I know well, as a recovering investment banker who works with a firm to evaluate deals. My husband also worked in the sector. Like any other industry, it has both good and bad players.

Private equity involves deploying capital to buy ownership stakes in private companies, distinct from equity invested through the public markets in publicly traded companies. These firms are often actively involved with the company, as opposed to the more passive investing in public market companies. Their stakes are typically substantial, often including majority ownership.

The good players in private equity provide capital, professionalization of businesses, governance, business insights, and capital for growth. They may reward employees with an ownership stake to align incentives.

Some private equity players, however, focus on financialization — that is, playing around with the capital structure of a company and not adding a lot of value otherwise. Private equity is rife with examples of firms that have ruined businesses with too much leverage and engaged in a variety of greedy — and often, outright abhorrent — behaviors.

But this latest trend isn’t about good firms versus bad firms. It’s about the broader industry’s poor performance — and desperation.

Private equity has a problem. Too much money has flooded the space in recent years, driving up valuations and pushing down returns. Funds are struggling to find new investors to cover their high management fees. So now they’re turning to you.

They aren’t suddenly being generous. They’re just trying to survive.

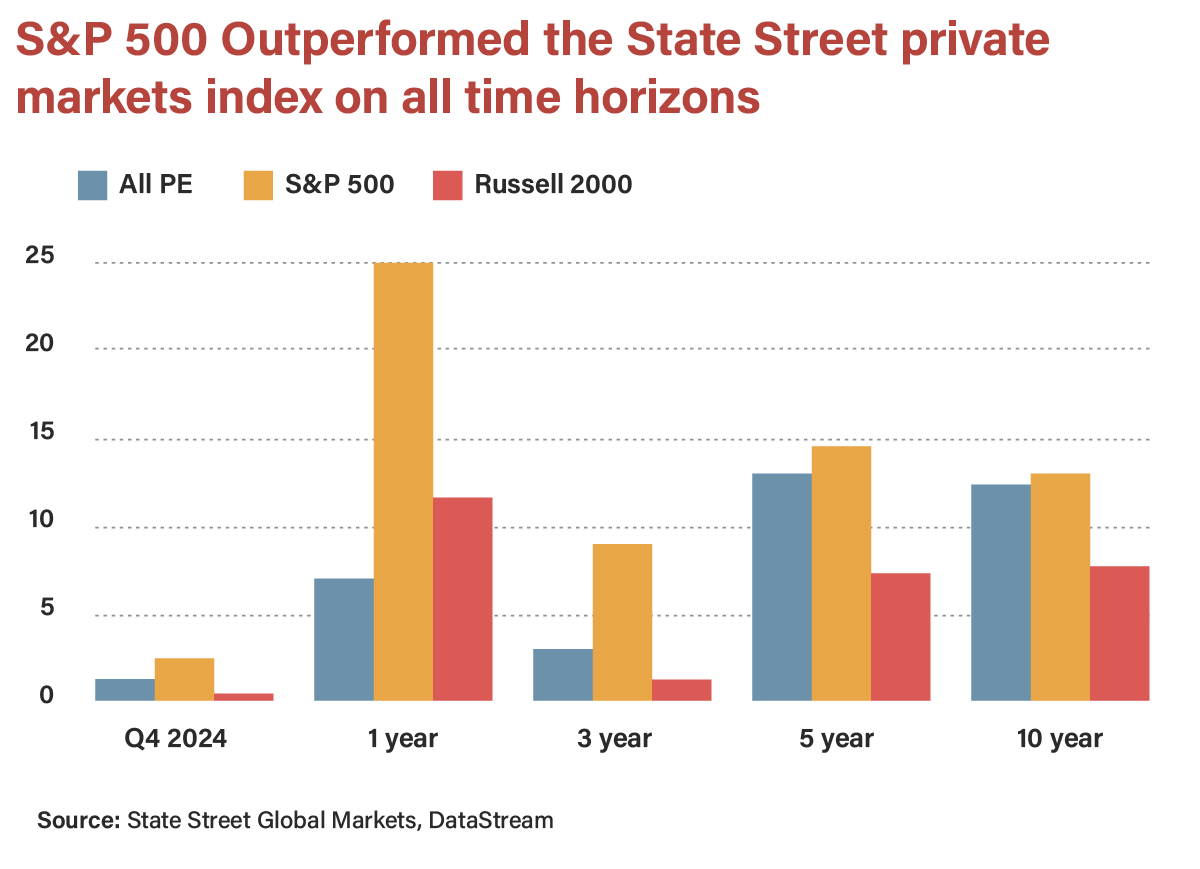

According to the Financial Times, a major private market index has underperformed the S&P 500 over the past one-, three-, five-, and 10-year periods. Any outperformance was skewed toward earlier years — and even then, it came with significantly higher fees and far less liquidity.

This underperformance comes with heavy fees and a lack of liquidity for your investment. It's not a coincidence that you are seeing private equity opening up to retail now when it is struggling from deal competition, higher valuations, higher capital costs, and slower deal exits.

RELATED: Red states get it: Economic freedom beats blue-state gimmicks

Speaking of slower exits, the Wall Street Journal noted that “private equity remains the biggest fee generator for the broader Wall Street ecosystem of banks and advisers” and that private equity firms are sitting on a record number of companies that they are waiting to exit — that is, sell and record a profit ... or a loss. Longer hold times for private equity firms mean they are not returning capital to their investors, and, in turn, the investors are not reinvesting in the latest and greatest fund.

Whether it’s the new push to allow private investments into your 401(k) or your financial planner calling you with “new, exciting alternative investment opportunities,” please be appropriately skeptical. Always probe a fund’s track record (especially over the past several years), fee structure, and whether it is a fit for your objectives and goals.

The private equity party is a bit dim right now, and that’s why they are sending out more invitations. Be careful before you RSVP.

Unsold inventory has car dealers feeling the pinch — which means there's never been a better time to buy.

Before 2020, it was unusual for a new car to sit on a lot for more than 200 days. Now we're seeing cars not move for 500, 600, and even 700 days — thanks to a combination of car supplies returning to pre-COVID levels and rising prices.

As a dealer trainer for different brands and dealership groups, I've seen the problems excess inventory causes up close — and it's not pretty.

Quite a change from just a few years ago, when many dealerships took advantage of the chip shortage (and the ensuing vehicle scarcity) to charge as much as $15,000 over sticker price.

The tables have turned — and no automaker is exempt. Ford, Honda, Kia, Chevrolet, even Ferrari: You name the brand, and you'll find dealerships stuck with vehicles from 2022, 2023, and even 2024.

With 2025 models arriving, this is a problem.

As a dealer trainer for different brands and dealership groups, I've seen the problems excess inventory causes up close — and it's not pretty.

Car dealers purchase vehicles on a floor plan, essentially a revolving line of credit. This can be interest-free for the first 60 to 90 days. Ideally, you sell within that period. If you don't, rates get pretty high, and it all adds up quickly when you're talking about inventory totaling hundreds of thousands or millions of dollars.

Dealers are highly motivated to get these mobile money pits off of their books. They'll offer incentives (or "spiffs") to the sales team to get them sold. And salespeople will offer potential buyers spiffs of $500 to $1,000.

If that doesn't work, the dealership will often simply pay off the car to relieve the debt. Many times the dealer principals will drive an unsold car for a few years, then sell it at auction for a fraction of the price or even donate it to charity.

Sometimes taking a loss is the smartest business decision — every so often. But 10 or 20 losses are a different story.

Alternatively, the dealership could also use such a car as a demo vehicle or as a loaner car for the service department. Although with this option, rising insurance costs are still a burden.

So what does all this mean for you? In short: big savings.

Remember: Dealers are highly motivated to sell their inventory. Alway ask for the deal — loyalty or conquest discounts could mean between $500 to $2,500, depending on the cost of the vehicle. You can pay less than MSRP on even the most in-demand models, so look around. And don't be afraid to drive out of state to buy — it could mean saving thousands of dollars.

And if you're not picky, look for cars in unpopular colors or trims or older model years. Or consider picking up a demo car or a service loaner.

It's a buyers' market, so negotiate with confidence. And that includes dealer fees — they're not set in stone either.

As inflation spirals out of control and pandemic-related stimulus runs dry, Americans are increasingly finding it hard to save money.

This past April, the U.S. personal savings rate fell to 4.4%. According to data from the U.S. Commerce Department, this is the lowest this metric has been since September 2008, Yahoo Finance reported.

“In a typical cycle, a sharp drop in the savings rate would be a warning sign about the sustainability of spending,” Wells Fargo economists, led by Tim Quinlan, wrote in a public note this past week.

The note continued, “Because balance sheets are in such better shape, we see less cause for concern for today. In fact, it is actually our baseline forecast for the saving rate to fall below its prior-cycle average of 7.2% through the end of 2023.”

The personal savings rate is a data series that is one of the most inversely impacted by the government’s efforts to bolster the economy through the COVID-19 pandemic. A steep decline in the amount of money Americans have been able to save has been expected for some time.

In April 2020, the savings rate hit a record 33.8% as stimulus checks from the government provided consumers with much needed relief as the nationwide response to COVID-19 kept many people at home and forced businesses to close.

Economists believe that there are trillions of dollars in unused savings that Americans can use to keep themselves afloat despite a rapidly increasing number of Americans not being able to contribute to their savings and grow their nest eggs.

Ian Shepherdson at Pantheon Macroeconomics said that Americans becoming unable to save their earnings is “no big deal.”

The macroeconomist said, “The stock of excess savings is still $2.2 [trillion], and the rundown over the past three months has averaged only $41 [billion] per month.”

Shepherdson continued, “This can continue for a long time yet, but that won’t be necessary as real incomes will start to rise again in the second half [of 2022].”

Wells Fargo economists recently estimated that U.S. consumers have around $2.3 trillion of savings they labeled “excess savings.” This label denotes savings above and beyond wheat pre-pandemic trends showed the American public being able to save.

These economists noted, “Households have accumulated an estimated that $2.3 trillion (not annualized) on their balance sheets and household net worth rose about 30% over the past two years through the fourth quarter. This overall rise in net worth is true across wealth percentiles and leaves households in a relatively better financial position than after past recessions.”

American families are paying, quite literally, for the reckless monetary, fiscal, and other policies enabled by government over the past two years. That cost is estimated by some economists to be an additional $5,200 per year, not exactly the kind of money most Americans have lying around. Even if you do, you would rather be investing that money than seeing your purchasing power erode.

I have been asking people the kinds of things they are doing to save money and help their families thrive, or at least survive financially, during this incredibly difficult economic time. I hope that you may find one or more tips you can apply to make your financial situation better as costs remain elevated.

Inflation means that your money buys fewer goods and services as prices increase or what you buy decreases in volume (also known as “shrinkflation”). For items you believe will continue to go up in price, try to lock in pricing today, so you aren’t paying even higher prices in the future. Talk to goods and service providers and see if they will give you a discount for bulk purchases or paying in full today. Just make sure that your goods aren’t perishable or that you can store them. For any ongoing services you pre-buy, make sure they are from companies you believe will still be in business when you need to use them.

Many of my Twitter followers responded that they are cutting out the grocery store and going straight to the farmers. Some are finding friends and families to split a cow for meat, freezing as much as they can to secure better pricing. Others, with the ability to care for them, are getting chickens for eggs.

Also, many individuals are planting or canning vegetables. Dealing directly with local farmers, via the farmer’s market or contacting them directly, is helping to keep important food prices down.

One of my Twitter followers, Joe Roberts (@joereform), offered the following:

“In December, I established a local Liberty Urban Homestead Market group on Facebook. The goal is to set aside some space we have in our urban and suburban homes to grow or raise something and to exchange with others. Completely voluntary, decentralized, and P2P.”

Speaking of P2P (peer-to-peer), bartering can be an excellent way to help in tough economic times. As mentioned above, goods, including food products, can be bartered. Or, if you have a skill or a service you can offer, that is a good way for community members to work together against the inflationary environment. If you go the barter route, make sure you are very clear about the expectations of both parties (having something written down helps to avoid confusion). Also note that barter transactions are taxable (of course, the government needs to have its hands in everything!). Make sure to keep track of your bartering and speak with your accountant for guidance on how to account for this and evaluate the tax implications vs. your potential savings.

Certainly not everyone will have the opportunity reduce or cut gas usage out of their lives, but for some, with work-from-home being more accepted (if you have the type of job that allows for that), it could engender savings. Consider working from home one or more days a week if that is available to you.

Also, consider, as suggested to me by several people, rerouting your time in the car to use it more efficiently.

Ruben Sanchez, who works as in-flight crew for a major airline, now walks back and forth to the Los Angeles LAX airport, about 4.7 miles, for cost savings.

If you are going to give up driving on one or more vehicles and have a safe storage location, you may want to consider calling your car insurance company to see if you can save costs, as another of my Twitter followers suggested.

Go through your expenses and cut out anything that isn’t necessary or find another way to approach it. One of my Twitter followers said the family is doing a “staycation” instead of a traditional vacation this year. Subscriptions are often things we forget about, so go through your bank and credit card statements for the last 18 months and see where there are expenses you can cut out for the time being.

I don’t say this lightly, as moving is a serious consideration that encompasses family, work, and more. However, many people have told me that inflation is the final straw that is pushing them to take this step. One of my Twitter followers said he just sold his house in Illinois and is moving to Tennessee, where he is expecting to save a whopping $20,000 in taxes, $1,000 on car insurance, and additional cost savings as well.

This option is definitely not for everyone, but for those who may have considered it for other reasons, inflation may provide another nudge to do so.

While it is a burden we unfortunately have to bear for the time being, hopefully some careful planning and action can help you and your family lighten that inflation burden over the coming months.