State Financial Officers Foundation CEO joins chorus calling on SEC to crack down on CCP's 'malign influence' on US markets

Two dozen elected officials have come forward to recommend harsher rules against China and other foreign countries to protect U.S. markets.

Twenty-four state treasurers, comptrollers, and auditors submitted a letter urging the Securities and Exchange Commission "to make change to the qualifications for foreign private issuer (FPI) status by prohibiting any issuer based in a country designated by the United States government as a foreign adversary, including the People's Republic of China."

'There are significant risks for US investors in China-based companies, including Chinese companies’ roles in furthering the Chinese Communist Party’s “military-civil fusion” strategy.'

"This letter is a matter of common sense and urgency. Adversaries of America should not be allowed to exploit our markets. With China accounting for the largest share of opaque foreign listings, the Chinese Communist Party poses a direct threat to U.S. investors," Utah Treasurer Marlo Oaks said in a statement obtained by Blaze News. "The SEC must act decisively to protect American citizens."

The request to the SEC takes aim at the "most common foreign private issuer (FPI) filers" who "are no longer incorporated and headquartered in Canada and the United Kingdom, but rather are incorporated in the Cayman Islands with their headquarters in China."

RELATED: Red states deal huge blow to BlackRock and Vanguard, impose strict rules on investment firms

The secretary of commerce lists China, Cuba, Iran, North Korea, Russia, and "Venezuela's Madura regime" as "foreign adversaries."

This shift, the letter argues, underscores concerns that U.S. investors are not being protected: "There are significant risks for U.S. investors in China-based companies, including Chinese companies’ roles in furthering the Chinese Communist Party’s 'military-civil fusion' strategy and the risks that China-based issuers will violate the disclosure, auditing, or other antifraud provisions of the Securities Exchange Act due to the Chinese government’s actions to prevent transparency."

In a statement obtained exclusively by Blaze News, State Financial Officers Foundation CEO OJ Oleka said: "The SEC should accept these recommendations without delay. We already know the CCP will exploit every opportunity to spread its malign influence. At the very least, companies based in adversarial nations like China should have to follow the same rules and requirements as American companies. This is about protecting the American people from those we know mean us harm."

"FPI status allows select issuers to follow loose regulatory guidelines, and so it makes no sense at all to grant this relaxed status to issuers based in countries that are our adversaries, like China. The last thing we should do is make it easier for the CCP to wage its war on us," Oleka said in another statement.

Michael Lucci, founder and CEO of State Armor, emphasized the harm that the CCP has done to U.S. markets: "The Chinese Communist Party has infected the U.S. financial system with systemic risks that can no longer be ignored. They violate the disclosure, auditing, or other antifraud provisions of the Securities Exchange Act, and should no longer enjoy the privileges of being a Foreign Private Issuer in our markets."

Signatories include the treasurers from Arizona, Indiana, Kansas, Kentucky, Louisiana, Mississippi, Missouri, Nebraska, North Dakota, Ohio, Oklahoma, Pennsylvania, South Carolina, South Dakota, Utah, West Virginia, Wisconsin, and Wyoming; the auditors from Kentucky, Missouri, Montana, Utah, and Wyoming; and the comptroller from Indiana. Nineteen states are represented in the letter.

Like Blaze News? Bypass the censors, sign up for our newsletters, and get stories like this direct to your inbox. Sign up here!

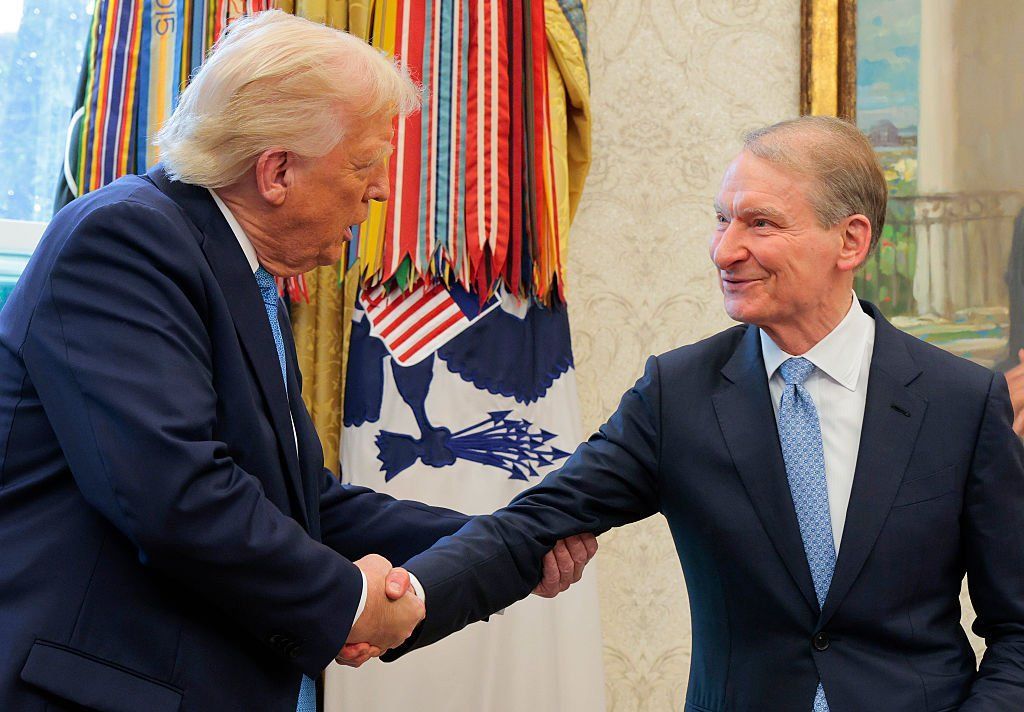

Photo by Tom Brenner for the Washington Post via Getty Images

Photo by Tom Brenner for the Washington Post via Getty Images 'This is the beginning of a conversation, and it's going to be a long one, until we see the changes that we want from this company.'

'This is the beginning of a conversation, and it's going to be a long one, until we see the changes that we want from this company.' In stark contrast to the Biden-Harris administration’s approach toward cryptocurrency, Trump’s platform would invigorate the crypto industry and promote its growth.

In stark contrast to the Biden-Harris administration’s approach toward cryptocurrency, Trump’s platform would invigorate the crypto industry and promote its growth. Justice Sonia Sotomayor, dissenting, lamented that the ruling would hinder the administrative state.

Justice Sonia Sotomayor, dissenting, lamented that the ruling would hinder the administrative state.

An MSNBC panel on called on the SEC to wage its own lawfare campaign against Trump for having a successful trading day.

An MSNBC panel on called on the SEC to wage its own lawfare campaign against Trump for having a successful trading day.