Zohran Mamdani’s war on Trump will bankrupt NYC before liberals wake up

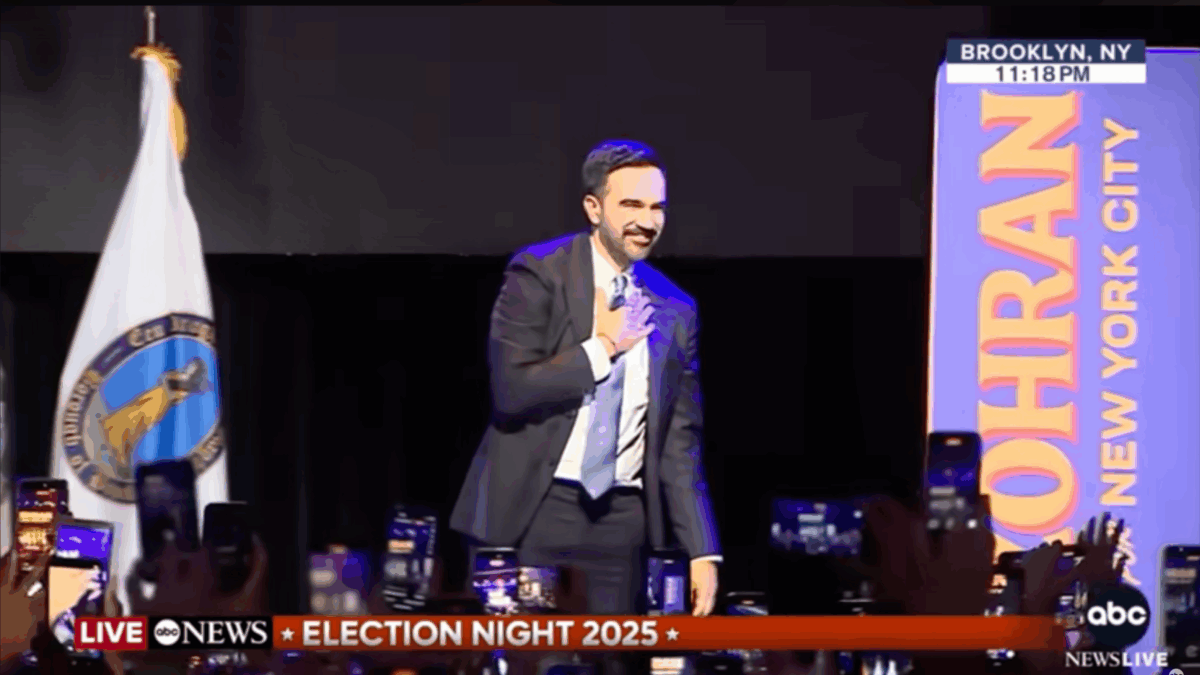

Zohran Mamdani has just taken his place as the mayor of the “most powerful city in the world,” but BlazeTV host Sara Gonzales warns it won’t remain that way for long — especially after his victory speech.

“After victory was declared for him, he was very quick to just declare war with President Trump,” Gonzales says, playing a clip of Mamdani yelling, “So, Donald Trump, since I know you’re watching, I have four words for you: Turn the volume up.”

“To get to any of us, you will have to get through all of us,” he yelled.

“You haven’t actually said anything. ... You’re stringing a bunch of words together, and you think that they sound nice and they sound insightful,” Gonzales scoffs.

“But with this in particular, it’s very cute that this man who is now going to be in charge of New York City wants to wage this war against President Trump when in actuality, you’re going to run out of money, Zohran. You’re going to run out of money,” she continues.

“You can’t pay for these policies that you’ve just promised New Yorkers. And if you think for one second President Trump is going to bail you out with federal funding, you are sorely mistaken,” she adds.

In his speech, Mamdani also went after capitalism, claiming that he plans to tear down the system that allowed President Trump to initially be a thriving businessman in New York City — which is capitalism.

“President Trump has already been very clear that he is not going to give federal tax dollars to bail out these cities, these states that are just doing communism. That’s not going to happen. So, you’re going to find out real quick who is going to win that battle,” Gonzales says.

Gonzales predicts Mamdani’s reign will be much like Joe Biden’s, in that his voters won’t realize, or admit, how awful a job he’s done until much too late.

“We will tell them for years, ‘Guys, this is happening. Guys, this is happening.’ And they will call you crazy. ... They’ll tell you you’re a right-wing nutjob. And then, all of a sudden, when it’s too late, they’re like, ‘God, you know what? It turns out this thing that you guys said was happening the whole time that we denied, it turns out you may be right,” she says.

Even CNN host Van Jones reflected on Mamdani’s crazed speech as a bit of “a character switch,” which Gonzales points to as the first of many liberals who will slowly realize the man they voted for doesn’t exist.

“Uh oh, the peaceful Muslim isn’t so peaceful anymore,” Gonzales mocks.

“Have you been paying attention at all? Because there are videos that have existed, that have been posted all over social media, that have shown this guy, again, code-switching, changing his accents depending on who he’s with, which is, we know, what Democrats do all the time,” she continues.

“Van Jones is apparently just catching wind that this guy may not be exactly who he portrayed himself to be, even though videos like this already existed,” she adds.

Want more from Sara Gonzales?

To enjoy more of Sara's no-holds-barred takes on news and culture, subscribe to BlazeTV — the largest multi-platform network of voices who love America, defend the Constitution, and live the American dream.

Photo by Angela Weiss / Contributor via Getty Images

Photo by Angela Weiss / Contributor via Getty Images

New York City elected a communist to be its next mayor on Tuesday. Uganda-born Zohran Mamdani is projected to win more than 50 percent of the Big Apple. Over the next few days, professional Republicans will shake their heads and lament the outcome of the race. But few, if any, will acknowledge the truth: Mamdani’s […]

New York City elected a communist to be its next mayor on Tuesday. Uganda-born Zohran Mamdani is projected to win more than 50 percent of the Big Apple. Over the next few days, professional Republicans will shake their heads and lament the outcome of the race. But few, if any, will acknowledge the truth: Mamdani’s […] Furthering the Big Apple’s descent into communism, New York City voters elected radical Democrat Zohran Mamdani to be their next mayor on Tuesday. According to several media outlets, the Ugandan-born Mamdani is projected to defeat former New York Gov. Andrew Cuomo and Republican Curtis Sliwa in the race to lead one of America’s most populous […]

Furthering the Big Apple’s descent into communism, New York City voters elected radical Democrat Zohran Mamdani to be their next mayor on Tuesday. According to several media outlets, the Ugandan-born Mamdani is projected to defeat former New York Gov. Andrew Cuomo and Republican Curtis Sliwa in the race to lead one of America’s most populous […]

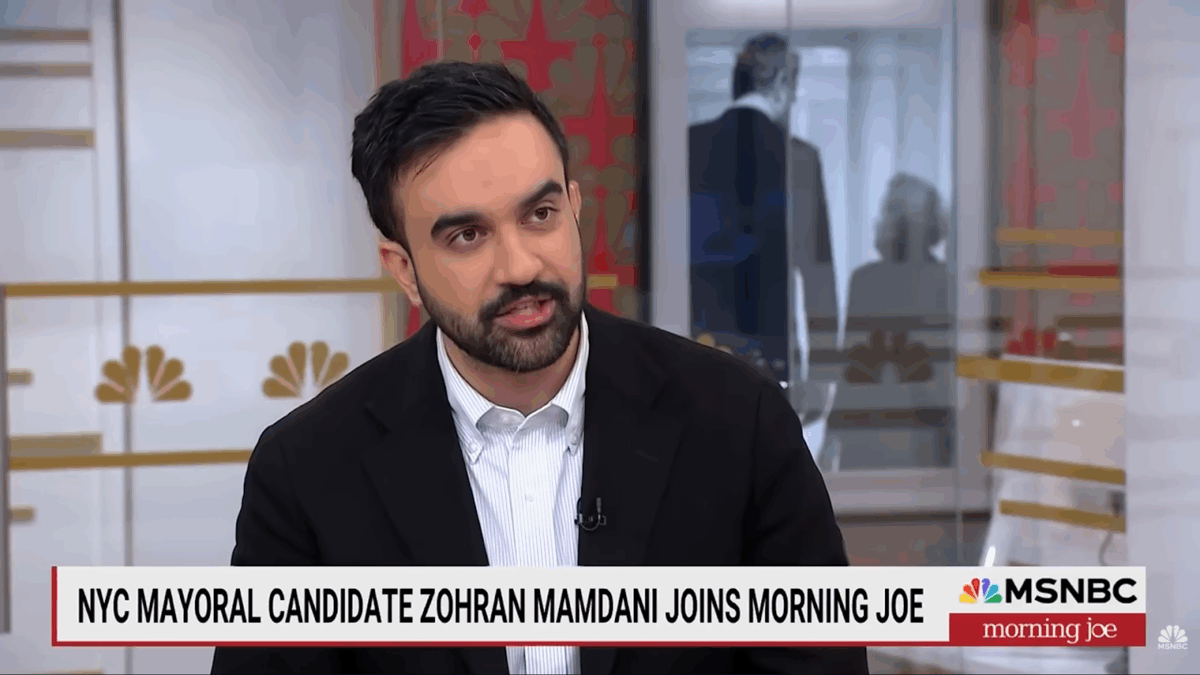

Photo by Hiroko Masuike-Pool/Getty Images

Photo by Hiroko Masuike-Pool/Getty Images Photo by Michael M. Santiago/Getty Images

Photo by Michael M. Santiago/Getty Images