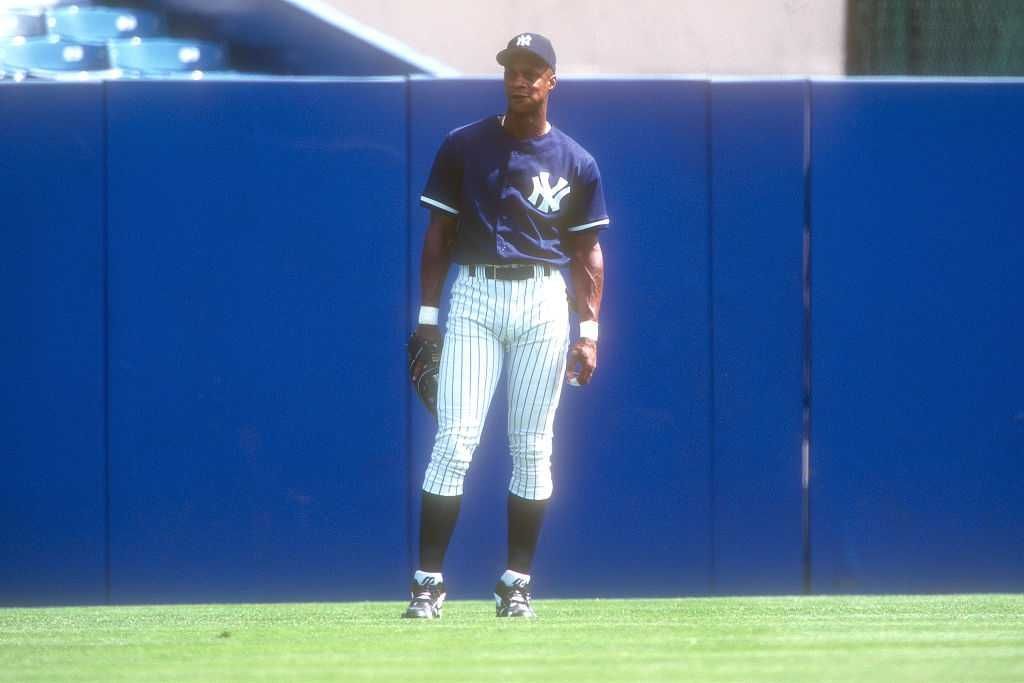

Trump pardons MLB legend and 'Celebrity Apprentice' cast member for 30-year-old tax fraud charges

President Trump has granted a pardon to a cast member from his hit show "Celebrity Apprentice" for the second time this term.

In February, Trump pardoned former Illinois Gov. Rod Blagojevich (D) after commuting the politician's 14-year prison sentence in 2020.

The new pardon again extinguishes charges laid against a member of the Season 3 cast of Trump's hit reality show, this time for a legendary baseball player.

'Mr. Strawberry found faith in Christianity and has been sober for over a decade.'

"President Trump has approved a pardon for Darryl Strawberry, three-time World Series champion and eight-time MLB All-Star," a White House official told the New York Post.

Strawberry had an iconic 17-year career in the majors, spending 13 seasons with teams in New York. He came into the league with the New York Mets and finished his career with the New York Yankees.

Back in 1995, Strawberry pleaded guilty to a single count of tax evasion over a failure to report nearly $500,000 in income from baseball card shows and autograph signings between 1986 and 1990.

As UPI reported at the time, Strawberry was sentenced to three years of probation in April 1995, along with six months of home confinement and $350,000 in restitution for tax evasion

At just 32 years old, Strawberry was also battling substance problems that cost him some opportunities in MLB.

RELATED: Pete Rose still might never get inducted into the Hall of Fame. Here's why.

Strawberry was beloved as a member of the Mets and was hilariously immortalized in the iconic episode of "The Simpsons" titled "Homer at the Bat."

However, the trouble started after he moved back to his home state of California to play for the Los Angeles Dodgers. Following an All-Star campaign in 1991, the outfielder never played a full season again.

Just three days prior to appearing in front of a federal judge for the tax evasion charges in 1995, Strawberry was suspended by MLB and released from his new team, the San Francisco Giants, over his continued use of cocaine.

Months later, Strawberry signed with the Yankees and played well, but only appeared in 32 games. He retired from baseball after the 1999 season.

"Mr. Strawberry served time and paid back taxes after pleading guilty to one count of tax evasion," the recent White House comment added.

"Following his career, Mr. Strawberry found faith in Christianity and has been sober for over a decade — he has become active in ministry and started a recovery center, which still operates today."

Strawberry has been praised in recent years for overcoming his drug-abuse problems and turning to God, and he now preaches alongside his wife.

"There's nothing too hard, there's nothing too big for God," Strawberry was recorded telling a group of prisoners in 2024.

"There's nothing too hard, there's nothing too big for God to fix in your life right here, right now," he preached, as the men rejoiced. "God has not forgot about you. You're not a mistake to God. We've all made mistakes. We have all fallen short. The Bible didn't say some of us. The Bible says all of us have fallen short."

Strawberry concluded, "So you gentlemen need to know that today I stand up here; there's nothing great about me. I was a liar. I was a cheater. I was a womanizer. I was an alcoholic. I was a drug addict, and I was a sinner, saved by grace."

Like Blaze News? Bypass the censors, sign up for our newsletters, and get stories like this direct to your inbox. Sign up here!

Photo by Tasos Katopodis/Getty Images

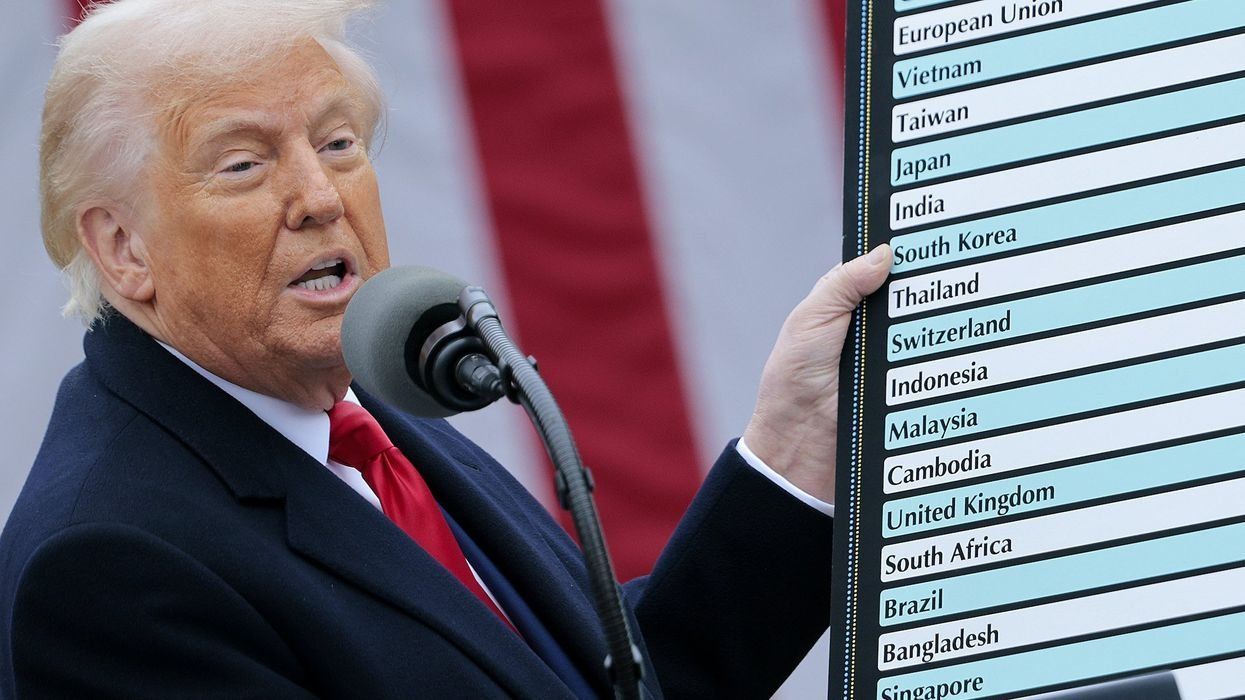

Photo by Tasos Katopodis/Getty Images Photo by Chip Somodevilla/Getty Images

Photo by Chip Somodevilla/Getty Images

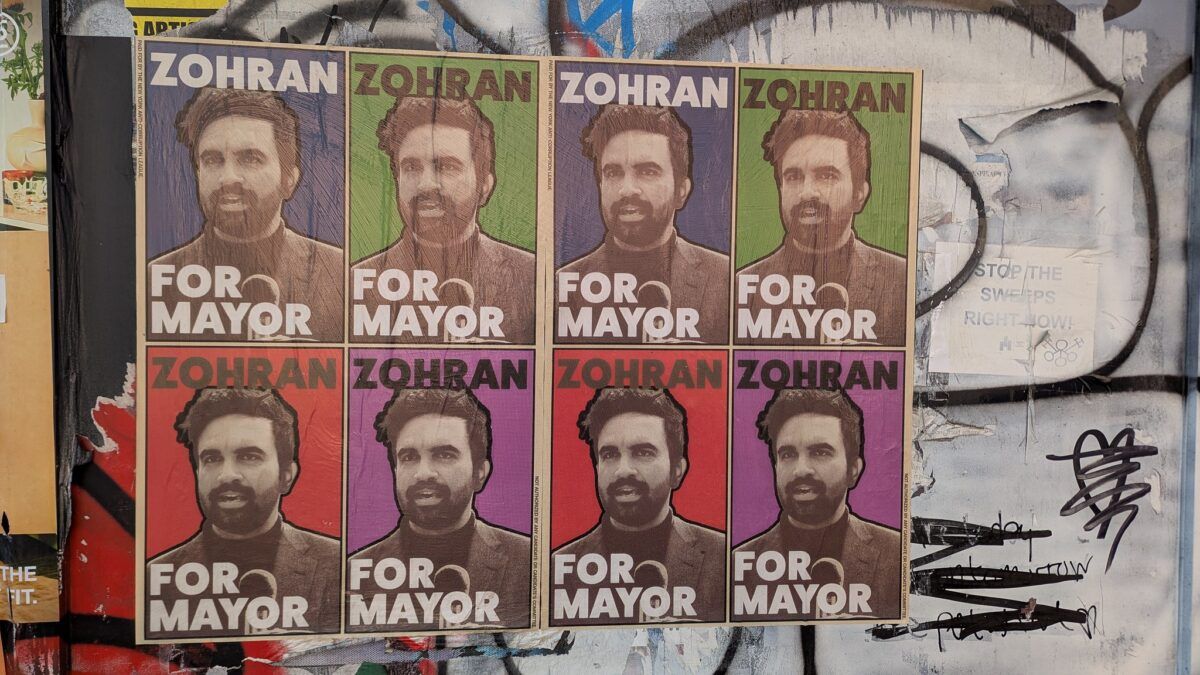

The Washington Post/Getty Images

The Washington Post/Getty Images Any serious nation with an interest in self-preservation would immediately denaturalize and deport Mamdani.

Any serious nation with an interest in self-preservation would immediately denaturalize and deport Mamdani.

Blaze Media Illustration

Blaze Media Illustration Democrats are forever working against Trump instead of for voters. They would rather win a political battle than let Americans keep tax breaks.

Democrats are forever working against Trump instead of for voters. They would rather win a political battle than let Americans keep tax breaks.

Chip Somodevilla/Getty Images

Chip Somodevilla/Getty Images The Biden-era chaos posed ramifications far beyond our southern border, and Washington must take every effort to ensure that it never recurs.

The Biden-era chaos posed ramifications far beyond our southern border, and Washington must take every effort to ensure that it never recurs.

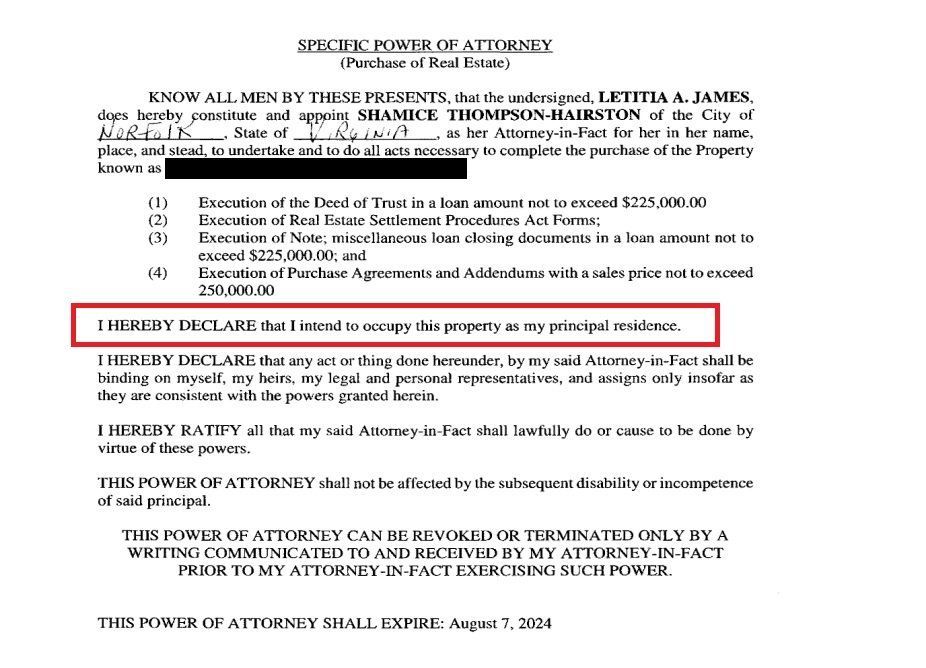

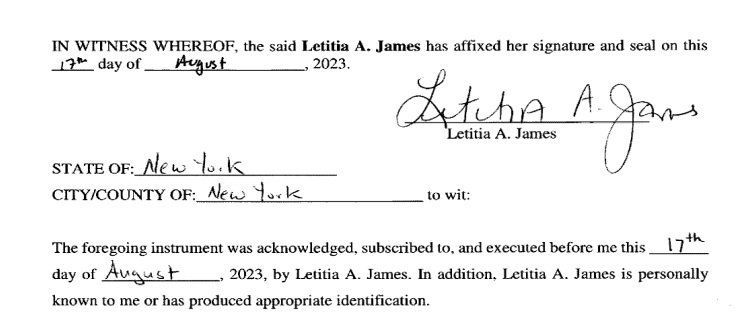

Screenshot of land record

Screenshot of land record Screenshot of land record

Screenshot of land record Screenshot of New York state website

Screenshot of New York state website