Democrats reject ‘current policy’ — unless it pays their base

Washington’s latest fights make one thing unmistakable: Democrats shift their arguments as needed, but always in service of higher taxes, higher spending, and a bigger federal footprint. When the question earlier this year was whether to keep current tax policy and avoid a massive tax hike, Democrats fought against keeping current policy.

Now, after forcing a government shutdown, they claim they must preserve current — but temporary — Obamacare subsidies. Two opposite stances, one consistent goal: bigger government.

On taxes, ‘current policy’ doesn’t count. On spending, ‘current policy’ functions like holy writ.

Earlier this year, Congress faced a hard deadline. Lawmakers had to choose between extending the 2017 American Job Creation Act tax rates or letting them snap back to pre-2017 levels — a $4 trillion tax increase across income brackets. Republicans pushed to retain the lower rates. Democrats pushed for the tax hike.

Democrats insisted the looming deadline was Republicans’ fault and said the surge in revenue would help slow growth in deficits and debt. Republicans ultimately prevailed and passed the One Big Beautiful Bill Act. Democrats erupted.

We all know what happened next. Less than three months later, Congress approached the September 30 deadline for annual appropriations. With negotiations still incomplete, Republicans advanced a clean, short-term extension to keep the government open. The House passed it. President Trump signaled he would sign it. Senate Democrats filibustered it.

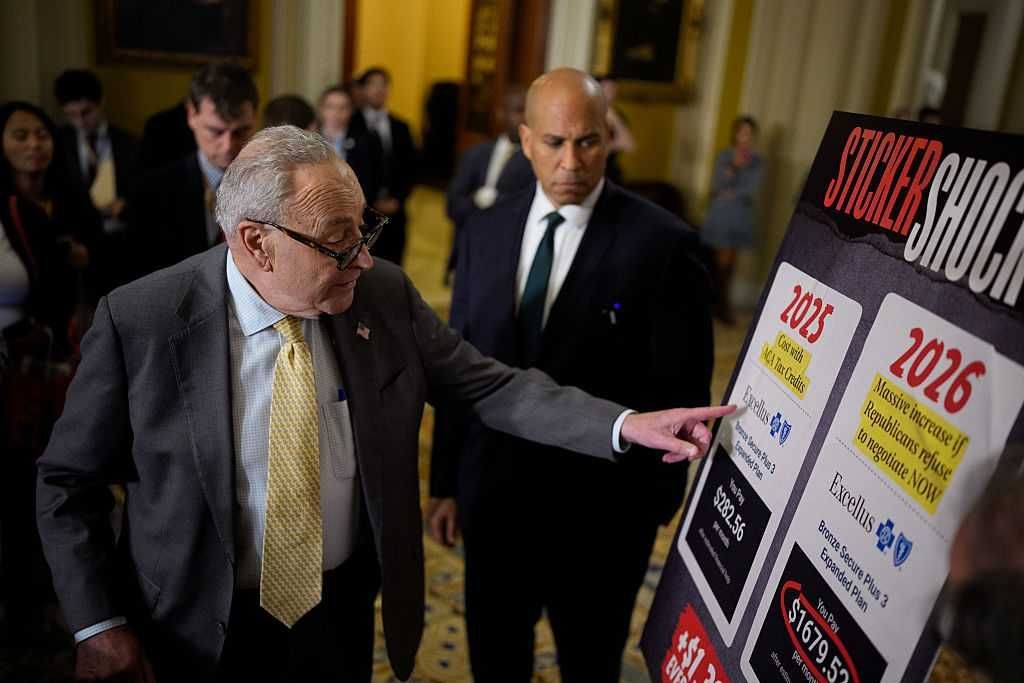

Republicans tried over a dozen times to reopen the government. Senate Democrats blocked them every time — until this week. Their central demand: extend the temporary “emergency” premium subsidies that Democrats expanded during the pandemic. Those subsidies, scheduled to expire, broadened eligibility beyond 400% of the federal poverty line and boosted benefits for those below it. Democrats already extended them once through 2025.

Now, with the pandemic long over — President Biden signed the resolution ending it on April 10, 2023 — Senate Democrats want the emergency expansions made permanent.

The inconsistency could not be clearer.

When expiring tax law meant taxes would rise, Democrats described preventing that increase as a tax cut — even though extending the law simply kept existing policy in place. The fact that the policy had been the law for eight years meant nothing.

But when expiring pandemic-era subsidies would return Obamacare to its original structure, Democrats suddenly insist that current policy must prevail. They now treat temporary emergency expansions — linked explicitly to COVID, extended once already, disproportionately benefiting upper-income households — as untouchable programs that must become permanent.

On taxes, “current policy” doesn’t count. On spending, “current policy” functions like holy writ.

RELATED: Trump officially ends ‘pathetic’ Democrats’ record-breaking shutdown

The reasoning shifts, but the outcome never does: Democrats always land on whatever argument leads to more government. Their broader shutdown demands confirm it — ending Medicaid reforms and restoring spending levels President Trump and Republicans reduced. Every item points in the same direction: more federal dollars out the door.

Democrats note that Republicans, too, support keeping some expiring policies. True. Which makes the underlying purpose even more important to identify.

Republicans fought to maintain 2017 tax levels so Americans could keep more of what they earn — and keep that income out of Washington’s hands. Democrats want permanent expansion of Obamacare subsidies to preserve and grow benefits for people who were never intended to receive them, locking in a larger federal role.

Future fights will come; today’s climate guarantees them. One more thing is just as guaranteed: Democrats’ arguments will continue to change as needed, and their demands for higher taxes, higher spending, and a larger federal government will not.

Photo by Chip Somodevilla/Getty Images

Photo by Chip Somodevilla/Getty Images

CBO is projecting historically large deficits even after one of the largest tax increases in American history takes effect in 2026.

CBO is projecting historically large deficits even after one of the largest tax increases in American history takes effect in 2026. While the Democrats’ so-called Inflation Reduction Act will use taxpayer dollars to pack the Internal Revenue Service with 87,000 new agents, White House Press Secretary Karine Jean-Pierre claimed there won’t be any new audits on people making less than $400,000 a year. The claim is ridiculous on its face. Over 99 percent of Americans make […]

While the Democrats’ so-called Inflation Reduction Act will use taxpayer dollars to pack the Internal Revenue Service with 87,000 new agents, White House Press Secretary Karine Jean-Pierre claimed there won’t be any new audits on people making less than $400,000 a year. The claim is ridiculous on its face. Over 99 percent of Americans make […]