New York Times makes big admission about Trump's tariffs

President Donald Trump began in April to radically transform how trade is conducted internationally, announcing tariffs on friendly and adversarial nations alike in an effort to settle scores and to exact concessions favorable to the United States, such as those made by Japan and the European Union last month.

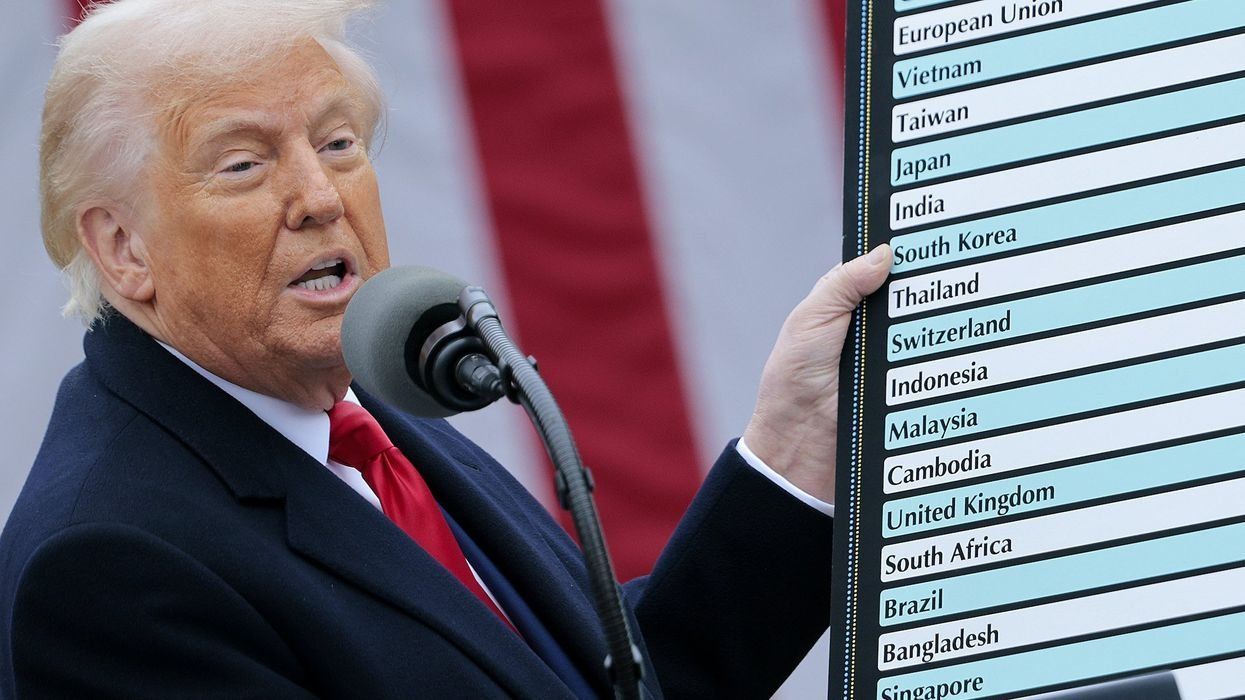

"Our country and its taxpayers have been ripped off for more than 50 years, but it is not going to happen anymore. It's not going to happen," Trump said at the "Liberation Day" ceremony where he announced a sweeping list of tariffs. "This will be, indeed, the golden age of America. It's coming back. And we're going to come back very strongly."

This tariff-driven upheaval has rankled establishmentarians at home and abroad — some of whom have launched legal challenges, issued condemnations, and threatened retaliation. Of course, the media has also worked feverishly to paint the tariffs as reckless and as more grease down the slope to economic ruin.

'Revenue and reciprocity are the twin benefits of the Trump tariffs.'

Nearly four months after the New York Times characterized Trump's approach as a "burn-it-down-first, figure-out-the-consequences-later recklessness," the paper admitted on Sunday that the tariffs are already netting a great deal of money for the government.

The Times' Washington, D.C., tax policy reporter Andrew Duehren confirmed on Sunday that Trump's recent assertion that "Tariffs are bringing Billions of Dollars into the USA!" was correct.

RELATED: Main Street's silent plea: Exempt us from the next tariffs

"Even before the latest tariffs kick in, revenue from taxes collected on imported goods has grown dramatically so far this year," Duehren wrote. "Customs duties, along with some excise taxes, generated $152 billion through July, roughly double the $78 billion netted over the same time period last fiscal year, according to Treasury data."

Citing data from the U.S. Treasury Department, the Times indicated that tariffs brought in over $29 billion in the month of July alone.

Analysts reportedly estimated that the tariffs could be worth well over $2 trillion in additional revenue if left untouched over the next 10 years.

"Tariffs are not going to be a huge source of revenue, couple trillion over a decade, but not trivial at all," Christopher Whalen, chairman of Whalen Global Advisors, told Blaze News in a statement. "But the tariffs are appropriate and are a way to get the world to give at least equal treatment to American goods. Revenue and reciprocity are the twin benefits of the Trump tariffs."

'I do not think this is a true source of revenue, only a substitution and reordering of taxes.'

While the tariffs are bringing in boatloads of cash, some critics have noted that Americans are the ones ultimately paying the price — something that might be more tolerable if Trump's idea to scrap American income tax and lean instead on tariffs as the main source of federal revenue were implemented.

Economic expert and Blaze Media contributor Carol Roth said in a statement to Blaze News, "When you think of the word 'revenue' when it comes to the federal government, you should think taxes because that's the primary source of government revenue. When it comes to revenue from tariffs, it is no different."

"The majority of the tariff burden is coming not from foreign exporters, but rather from U.S. consumers and U.S. businesses," Roth said, alluding to a Goldman Sachs analysis that estimated foreign exporters were only absorbing 20% of the higher costs from tariffs.

RELATED: Tariffs vs. free trade: Which is BETTER for the American auto industry?

Goldman Sachs economists reportedly indicated that eventually, 70% of the direct cost of tariffs would be kicked to consumers through higher prices.

"This means tariffs are mostly revenue that is moving from one pocket to the other, so to speak, as businesses and consumers that pay tariffs then have less money to contribute otherwise to the economy, impacting other tax or government 'revenue' collection," Roth continued. "Unless we fundamentally reorder how taxes are paid (as well as spending) to something that is focused on a consumption tax (which I personally do not think is a good idea given how our economy functions today), I do not think this is a true source of revenue, only a substitution and reordering of taxes."

'I think this is addictive.'

"We all know that making the [Tax Cuts and Jobs Act of 2017] tax cuts permanent through the [One Big Beautiful Bill Act] was important to the economy, so why would anyone think that adding in the equivalent of more taxes through tariffs is a good idea?" Roth added. "Also, given that cost of living remains a top issue for Americans, adding costs — even if it is only in certain areas of the economy — is in conflict with the administration's agenda."

Regardless of where the money is coming from, there are concerns that the U.S. government might become overly reliant on tariffs as a revenue stream.

"I think this is addictive," Joao Gomes, a finance and economics professor at the University of Pennsylvania's Wharton School, told the Times. "I think a source of revenue is very hard to turn away from when the debt and deficit are what they are."

The national deficit is presently $1.33 trillion, and the national debt is $36.91 trillion.

Despite Democratic complaints over the tariffs, Ernie Tedeschi, director of economics at the Yale Budget Lab, suggested that there may be hesitance among both Republicans and Democrats to roll back the tariffs if that would mean a greater federal debt load.

"Congress may not be excited about taking such a politically risky vote when they didn't have to vote on tariffs in the first place," Tedeschi told the Times.

Rather than scrap the tariffs, Democrats are apparently thinking about ways in which they can blow the money.

Democratic strategist Tyson Brody noted, "The way that Democrats are starting to think about it is not that 'these will be impossible to withdraw.' It's: 'Oh look, there's now going to be a large pot of money to use and reprogram.'"

Some Republicans also have a mind to redistribute the funds.

Sen. Josh Hawley (R-Mo.) introduced legislation last week that would send tariff rebate checks to Americans. The amount of the rebate would be at least $600 per adult and dependent child, or more if tariff revenue exceeds current projections for 2025.

Like Blaze News? Bypass the censors, sign up for our newsletters, and get stories like this direct to your inbox. Sign up here!

Chip Somodevilla/Getty Images

Chip Somodevilla/Getty Images

There's no question Trump's economic policies are better than Harris', but if he wins the election, these are areas he should reconsider.

There's no question Trump's economic policies are better than Harris', but if he wins the election, these are areas he should reconsider.