Canada's liberal prime minister gets embarrassed by football fans before country's biggest game

The average football fan is likely not a big supporter of Canada's prime minister.

Amid an ongoing trade and tariff war with President Donald Trump, Canada's Liberal leader, Mark Carney, made an appearance at the Grey Cup, the championship game for the Canadian Football League.

'We were cheered as well.'

On Sunday night, the East Division champion Montreal Alouettes and the West Division champion Saskatchewan Roughriders faced off at the Princess Auto Stadium in Winnipeg, Manitoba, Canada. It was just an eight-point victory for the Roughriders, 25-17, but for Carney, exactly zero winning was had.

During the playing of the national anthem, fans shockingly paused their singing to boo the prime minister as he appeared on camera.

That was not all, though. During the coin toss, the CEO of cryptocurrency platform Coinbase joined the prime minister, and assuming the fans in Winnipeg were not staunch vocal supporters of physical currency, the raucous boos were likely directed at Carney when his name was announced.

About a minute later, Carney was booed even louder as the referee handed him the ceremonial coin and said, "Mr. Prime Minister, would you do us the honor?"

Mainstream Canadian outlet the National Post even described the boos as having "suddenly increased in volume" as Carney tossed the coin into the air.

Another video from the event went viral and appeared to show at least two fans getting vulgar with the Liberal Party leader.

"Carney! Carney!" a person called out, waving to him at first. The wave then turned into a middle finger, while at the same time a second football fan was heard yelling, "Yeah, you f**king commie, eh?!"

The prime minister was asked about the boos on Monday and claimed that at least some in the crowd were his supporters.

"You were booed," a reporter said as he entered Parliament, per the National Post. "What does that show you about Western disaffection?"

Carney responded, "We represent the entire country. We were cheered as well," he claimed.

The Grey Cup brings Canadians together across provinces, territories, and time zones to celebrate the very best of Canadian football — and last night was no exception.

Thanks for having me, Winnipeg, and congrats to the @sskroughriders on the big win. pic.twitter.com/rMEFQPKhBZ

— Mark Carney (@MarkJCarney) November 17, 2025

Carney later posted on X that the national championship "brings Canadians together" and that Sunday's game was "no exception."

Manitoba, where the game was played, voted slightly in favor of the Canadian Conservatives in the 2025 federal election, winning seven seats to the Liberals' six.

Saskatchewan's fans were more than likely conservative, voting the right-wing party in for 13 seats in 2025; the Liberal Party won just one in the province.

While Montreal's fans are very proud of their French culture, the province voted in favor of Liberals in the same election, handing them 44 out of a possible 78 seats.

Meanwhile, Carney recently apologized to President Trump over an ad that used former President Ronald Reagan in an attempt to dig at Trump's tariff policies.

The prime minister placed the blame on Ontario's Progressive-Conservative Premier Doug Ford, saying "I told Ford I did not want to go forward with the ad," which sparks further questions about the Liberal Party leader's relationship with what is supposedly an opposing party.

Like Blaze News? Bypass the censors, sign up for our newsletters, and get stories like this direct to your inbox. Sign up here!

Legal precedent, diplomatic equilibrium, and economic logic point in this same direction — the president can impose tariffs under IEEPA.

Legal precedent, diplomatic equilibrium, and economic logic point in this same direction — the president can impose tariffs under IEEPA. '[T]hese are not things that are thought of as Article II powers, [but] quintessential Article I powers,' said Justice Kagan.

'[T]hese are not things that are thought of as Article II powers, [but] quintessential Article I powers,' said Justice Kagan.

Photo by Scott Olson/Getty Images

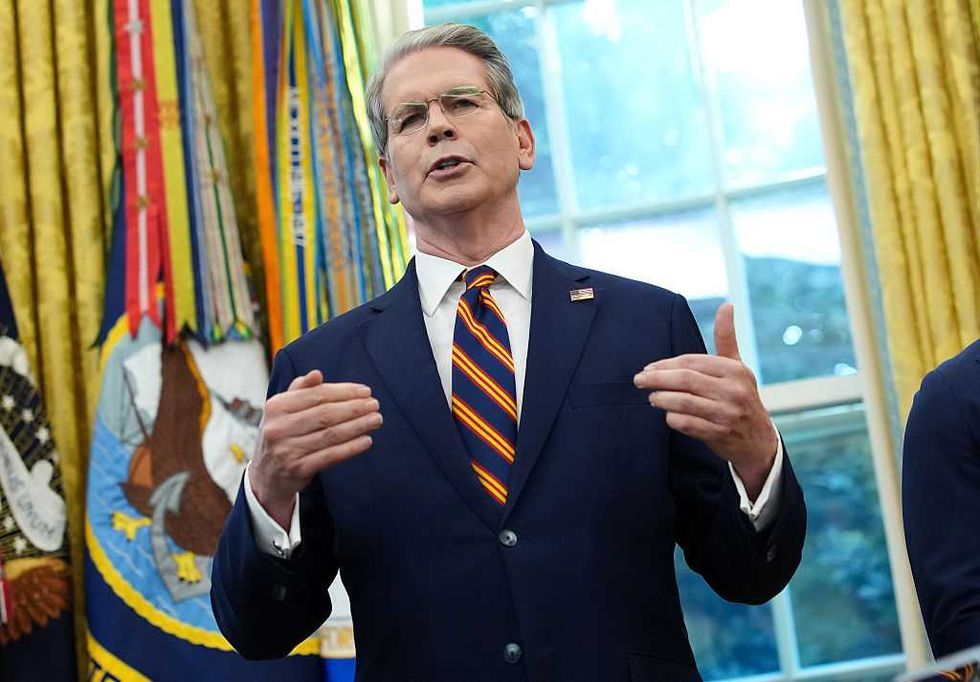

Photo by Scott Olson/Getty Images Treasury Secretary Scott Bessent. Photo by Kevin Dietsch/Getty Images

Treasury Secretary Scott Bessent. Photo by Kevin Dietsch/Getty Images

Photo by Eric Lee/Bloomberg via Getty Images

Photo by Eric Lee/Bloomberg via Getty Images

Photo by EVAN VUCCI/POOL/AFP via Getty Images

Photo by EVAN VUCCI/POOL/AFP via Getty Images

Ontario Premier Doug Ford. Photographer: David Kawai/Bloomberg via Getty Images

Ontario Premier Doug Ford. Photographer: David Kawai/Bloomberg via Getty Images

Photo by Dilara Irem Sancar/Anadolu via Getty Images

Photo by Dilara Irem Sancar/Anadolu via Getty Images

Blaze Media Illustration

Blaze Media Illustration