Nearly half of Americans say inflation has caused them 'financial hardship': Gallup

Inflation is squeezing the pockets of Americans, particularly those who can least afford it. Nearly half of all U.S. households have suffered financial hardship because of rising prices, according to a new poll.

Between November 3-16, Gallup asked 1,598 adults if recent price increases caused them any financial hardship. The survey found that 45% of Americans said they suffered hardship due to inflation. There were 10% who said the financial adversity they experienced was "severe" – meaning "hardship that affects your ability to maintain your current standard of living."

Those who make less than $40,000 in annual income were 71% more likely to experience financial hardship. In contrast, only 29% of those who have an annual salary of $100,000 or more have encountered financial hardships due to inflation.

Based on political lines, 53% of Republicans have endured financial hardship from higher prices, 49% of independents, and 37% of Democrats.

The Bureau of Labor Statistics reported that the Consumer Price Index for October spiked by 6.2% over the last year – the largest increase in prices for consumer goods recorded in more than 30 years.

The Food and Agriculture Organization of the United Nations (FAO) reported on Thursday that global food prices are at their highest level since June 2011. Prices of commonly-traded food commodities were 27.3% higher in November than at this same time last year.

Rabobank – a Dutch multinational banking and financial services company – warns there likely won't be any relief in high food prices in 2022.

Bloomberg reported, "Food prices are likely to stay near record highs next year due to consumers stocking up, high energy and shipping prices, adverse weather and a strong dollar, according to Rabobank."

On Monday, Federal Reserve Chairman Jerome Powell said it's "probably a good time" to end calling inflation "transitory."

On Thursday, U.S. Treasury Secretary Janet Yellen echoed Powell by saying, "I'm ready to retire the word transitory. I can agree that that hasn't been an apt description of what we're dealing with."

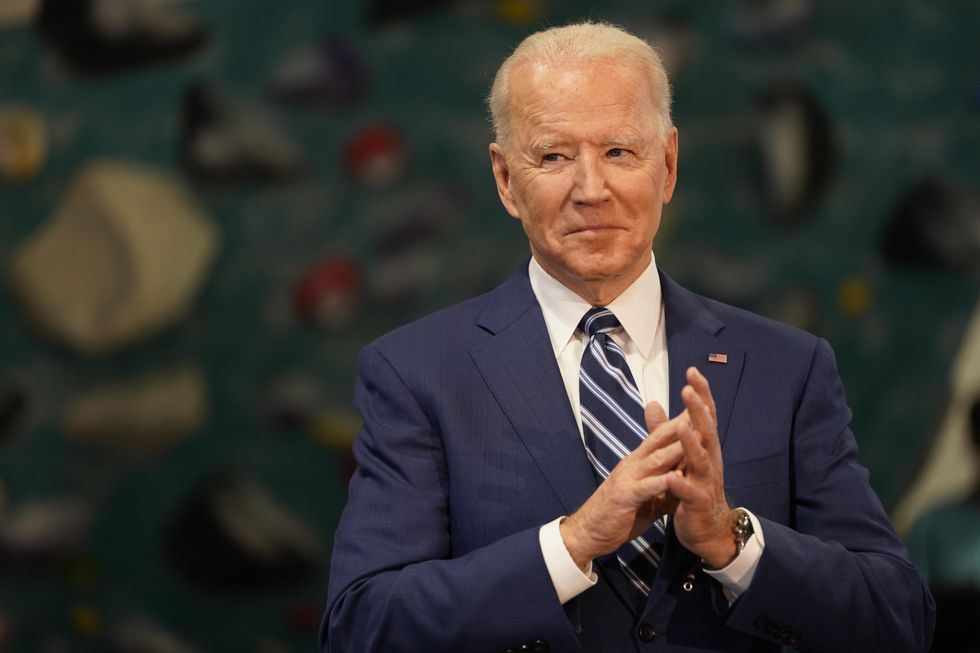

In July, President Joe Biden said, "We’ve seen some price increases. Some folks have raised worries that this could be a sign of persistent inflation. But that’s not our view. Our experts believe and the data shows that most of the price increases we’ve seen are — were expected and expected to be temporary."

April inflation explodes to highest level since 1992 as Biden prepares to announce staggering $6T budget

Inflation in April surged to its highest level since 1992, according to a Friday report from the U.S. government, surpassing economists' predictions.

The report comes as President Joe Biden is poised to introduce a massive $6 trillion budget.

What are the details?

On Friday, New York Times reporter Jeanna Smialek wrote, "The Bureau of Economic Analysis' personal consumption expenditure inflation measure climbed 3.6 percent in April from the prior year — the strongest reading in 13 years and more than the 3.5 percent gain that economists in a Bloomberg survey had expected."

The report continued, "The core price index, which strip out volatile food and fuel prices, rose 3.1 percent in the year through April — the fastest pace since 1992. Prices rose 0.7 percent compared with the prior month, the biggest increase in two decades."

Smialek added, "The pickup in inflation is coming as rebounding demand and supply shortages push costs higher, along with data quirks that are increasing the annual number. The inflation gauge is closely watched because it is the Federal Reserve's favorite, and officials are carefully monitoring the pickup in prices as the economy reopens."

In a note following the release, Paul Ashworth, chief U.S. economist at Capital Economics, wrote, "The combination of falling real consumption and soaring prices last month gives off a faint whiff of stagflation."

The report added, "The figures are the latest to underline that the economy is in for a bumpy ride as it reopens from months of state and local lockdowns meant to contain the coronavirus pandemic."

What else?

On Thursday night, House Minority Leader Kevin McCarthy (R-Calif.) said that Biden's proposed budget was both extreme and expensive.

“Think about what we're saying right here — this is what everyone has ever warned us about," McCarthy told Fox News host Sean Hannity. “That your debt becomes so large, it's more than a hundred percent of your GDP. There's no coming back from that. This sounds like Venezuela or Cuba. Even Obama's economists tell you this is wrong. And when he's doing it is wrong. He's doing it with an economy that's come booming back. So, what's he doing? Creating inflation. He's rewarding people not to work."

He added, “In a short five months, he's put us in a place we haven't seen since Jimmy Carter. If he simply did nothing, he would make America stronger, but by these actions will put into doubt. Everyone will get their taxes increased. Inflation will come. So whatever money you have will be devalued. This is what happened to Venezuela. And before our very eyes, we cannot allow this to go forward."

Indeed, Larry Summers, an economist who worked as an official under both former Democratic Presidents Bill Clinton and Barack Obama, recently said that he believed Biden was overextending the U.S. with the proposed budget, CNN Business reported Thursday, and issued a stark warning.

“We're taking very substantial risks on the inflation side," Summers said in remarks delivered at a recent CoinDesk conference. “The Fed's idea used to be that it removed the punch bowl before the party got good. Now, the Fed's doctrine is that it will only remove the punch bowl after it sees some people staggering around drunk."

Summers pointed out that he supports the president's ambitions in raising the nationwide minimum wage as well as bolstering unions, he believes that such policies can be "inflationary," according to CNBC, which is why he has been "troubled by the policy posture" of Biden's administration.

"Joe Biden has a historic opportunity to be a great president," Summer said. "But I think [the administration] should learn the lesson of the Johnson administration's errors that elected Richard Nixon and the Carter administration's errors that elected Ronald Reagan."

A Biden official told CNN Business on Tuesday that officials "do not see signs of persistent dislocation or long-term inflation."

The official added, "Our team closely monitors inflationary pressures but inflation is first and foremost under the purview of the Federal Reserve."

Anything else?

Biden repeatedly vowed to avoid raising taxes on Americans making less than $400,000. However, the White House changed the threshold to apply to families instead.

The New York Times reported this week that Biden's $6 trillion budget, which he is set to unveil Friday, "would take the United States to its highest sustained levels of federal spending since World War II." The $6 trillion budget is predicted to swell to $8.2 trillion in total annual spending by 2031.

The Times revealed that, in order to pay for the budget, Biden will, indeed, increase taxes on most wage-earners by allowing the Trump tax cuts for low- and middle-income Americans to expire in 2025.