Ken Paxton Took Victory Lap Suing Woke ‘Cartel’ He Quietly Invests Fortune In

'quietly sitting upon thousands of shares in mutual funds'

More than 25 state financial officers have drawn a line in the sand with corporate giants including BlackRock and Fidelity.

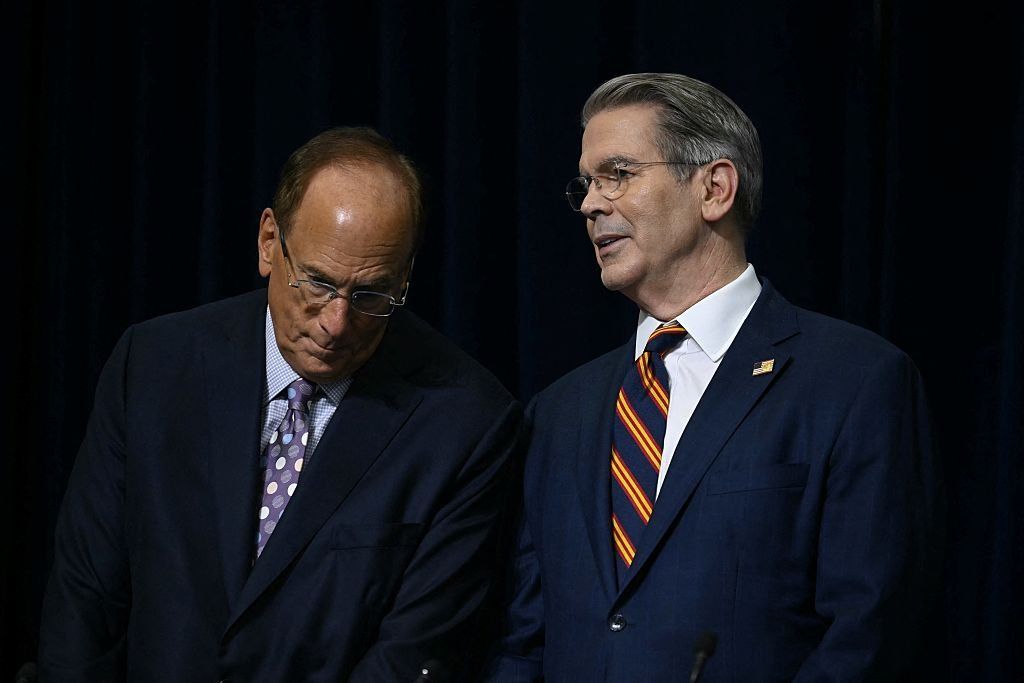

The group, made up of mostly treasurers, represents 21 states, 16 of which are governed by Republicans and five by Democrats. Together, they sent a damning letter to BlackRock CEO Larry Fink, along with other major financial firms like JPMorgan Chase and Vanguard, announcing that their states are willing to cut off ties if certain stipulations are not met.

The letter is in reaction to a recent decision by Texan authorities to remove BlackRock from its state blacklist after the investment firm announced it would roll back its climate change initiatives. The other 21 states say, however, that BlackRock and others have not done enough.

'These financial officers are doing the right thing for their states.'

The state reps, all of whom are Republican, said that these companies must return to a "traditional fiduciary duty" in which they focus 100% on financial return, instead of using capital to advance left-wing social and political agendas.

In their letter to Fink, the financial officers said that while some companies have started moving in the right direction by withdrawing from global climate coalitions, there is still more work to be done.

The treasurers outlined five actions the firms must take to demonstrate a "commitment to a fiduciary model grounded in financial integrity, not political advocacy."

RELATED: BlackRock and friends may soon control your digital wallet

The first term called for the end of "framing deterministic future outcomes as long-term risks to justify immediate ideological interventions through corporate engagement or proxy votes." Climate change initiatives are listed as the most common example of this issue.

Other requirements demanded that companies "abstain from embedding international political agendas" within their company framework, which included "net-zero climate mandates" and the "EU's Corporate Sustainability Reporting Directive (CSRD)."

Additionally, in order to work with these states, firms must also divulge all "affiliations and collaborative initiatives" that could influence investment strategies or priorities.

"Participation in such groups must not compromise a fiduciary's obligation to act solely on behalf of beneficiaries," the state representatives declared.

RELATED: This investor is wiping out white-collar jobs

"Actions always speak louder than words. Requiring America's financial giants to prove their independence from woke ideology with concrete steps before doing business with a state's dollars is fully necessary and just makes sense," OJ Oleka, CEO of State Financial Officers Foundation, said in a statement provided to Blaze News.

Oleka added, "These financial officers are doing the right thing for their states and the taxpayers whose financial security they've been entrusted to protect."

In total, 18 companies received a letter from the state financial officers: Amundi, BlackRock Inc., BNY Mellon, Capital Group, Fidelity Investments, Franklin Templeton Investments, Geode Capital Management, Goldman Sachs, Invesco, JPMorgan Chase, Legal & General, Morgan Stanley, Northern Trust, Nuveen, State Street Corporation, T. Rowe Price, Vanguard, and Wellington Management Company.

The states represented in the letter to investment firms were as follows: Alabama, Alaska, Arizona, Idaho, Indiana, Iowa, Kansas, Kentucky, Louisiana, Mississippi, Missouri, Nebraska, North Carolina, North Dakota, Oklahoma, Pennsylvania, South Carolina, South Dakota, Utah, West Virginia, and Wyoming.

Like Blaze News? Bypass the censors, sign up for our newsletters, and get stories like this direct to your inbox. Sign up here!

A coalition of 11 Republican-led states filed a lawsuit on Wednesday against BlackRock, Vanguard Group, and State Street Corporation, accusing the three asset managers of violating antitrust laws.

According to the complaint, the companies' promotion of environmental, social, and governance standards resulted in less coal production and higher energy prices.

Companies 'formed a cartel to rig the coal market.'

The lawsuit stated that the financial institutions "artificially constrained the supply of coal, significantly diminished competition in the markets for coal, increased energy prices for American consumers, and produced cartel-level profits" for themselves by leveraging their power.

Reuters reported that the three financial institutions have more than $26 trillion in assets under their management.

The companies have pressured coal companies to reduce their carbon emission by more than 50% by 2030, the complaint noted.

"Competitive markets — not the dictates of far-flung asset managers — should determine the price Americans pay for electricity," it read.

The coalition of states — including Alabama, Arkansas, Indiana, Iowa, Kansas, Missouri, Montana, Nebraska, West Virginia, and Wyoming — was led by Texas Attorney General Ken Paxton (R).

Paxton accused the asset managers of "illegally conspiring to manipulate energy markets."

"These firms also deceived thousands of investors who elected to invest in non-ESG funds to maximize their profits. Yet these funds pursued ESG strategies notwithstanding the defendants' representations to the contrary," he claimed.

The lawsuit accused BlackRock of "actively deceiving investors about the nature of its funds" by using all of its holdings, even those in non-ESG funds, to advance its climate goals.

Paxton told Turning Point USA founder and CEO Charlie Kirk that the reduced coal production forces the U.S. to purchase more energy overseas.

"It's affecting consumers in all kinds of ways," he said.

Paxton wrote in a post on X, "Texas will not tolerate the illegal weaponization of the financial industry in service of a destructive, politicized 'environmental' agenda. BlackRock, Vanguard, and State Street formed a cartel to rig the coal market, artificially reduce the energy supply, and raise prices. Their conspiracy has harmed American energy production and hurt consumers. This is a stunning violation of State and federal law."

BlackRock said in a statement to Bloomberg that the lawsuit "undermines Texas' pro-business reputation."

"The suggestion that BlackRock invested money in companies with the goal of harming those companies is baseless and defies common sense," the company said.

Vanguard Group and State Street Corporation did not respond to a request for comment from Reuters or Bloomberg.

Like Blaze News? Bypass the censors, sign up for our newsletters, and get stories like this direct to your inbox. Sign up here!

CrowdStrike's massive blunder, which resulted in worldwide outages, has brought the company back on the radar of the American citizenry, who now remembers its work with the World Economic Forum, Vanguard, and the Democratic Party.

On July 19, 2024, CrowdStrike CEO George Kurtz said that a "defect found in a single content update for Windows hosts" had led to a major breakdown in Microsoft operations.

This resulted in more than 18,000 flights being grounded across the globe, including 1,200 in the United States.

What's more, the crash brings the company back into the spotlight for yet another negative reason: The company has been synonymous with the political sphere for the better part of the last decade.

'Why didn't they allow the FBI in to investigate the server? I mean, there is so many things that nobody writes about.'

Many will remember CrowdStrike's appearance in headlines during the 2016 electoral campaign when the cyber-security company was called upon to investigate the alleged hacks of the DNC servers. The timeline of its collaboration with government entities is just as troubling today as it was then.

According to CrowdStrike's own timeline, "Russian intelligence gained access" to DNC networks at the "beginning of July 2015."

On July 13, 2015, CrowdStrike announced a $100 million investment led by firm Google Capital.

In September 2015, the FBI allegedly contacted the DNC to inform Democrats of a hack.

Months later, in 2016, CrowdStrike said it was hired by the Democratic Party to investigate an alleged hack that resulted in the release of the John Podesta emails, revealing Hillary Clinton's email server. By this point, the company already had former FBI employees on its payroll for some time.

This included Shawn Henry, executive assistant director of the Criminal, Cyber, Response, and Services Branch, who joined CrowdStrike in 2012.

CrowdStrike also announced on April 18, 2024, that it had hired Steven Chabinsky, a former deputy assistant director of the FBI Cyber Division, as its general counsel and chief risk officer.

CrowdStrike said it was contacted by the DNC on April 30, 2016, to collect intelligence and analyze the breach. The company added that the DNC was alerted about the hack by the FBI, but CrowdStrike was hired because the FBI doesn't "perform incident response or network remediation services when organizations need to get back to business."

CrowdStrike concluded on June 14, 2016, that Russia was "behind the DNC hack" and that its claim was "supported by the U.S. Intelligence community and also by independent Congressional reports."

This, of course, led to the "Russia, Russia, Russia" investigation into Donald Trump by a special counsel headed by Robert Mueller.

Trump was asked about CrowdStrike in April 2017 surrounding the leak of the Podesta emails. The implication was that Ukraine possibly possessed information that would clear Russia of any wrongdoing in relation to the hacks.

"They shouldn't have allowed it to get out. If they had the proper defensive devices on their internet, you know, equipment, they wouldn't even allow the FBI," Trump said. He then questioned why the FBI didn't investigate the hacks themselves.

"How about this — they get hacked, and the FBI goes to see them, and they won't let the FBI see their server. But do you understand, nobody ever writes it. Why wouldn't (former Hillary Clinton campaign chairman John) Podesta and Hillary Clinton allow the FBI to see the server? They brought in another company that I hear is Ukrainian-based."

"CrowdStrike?" an Associated Press reporter asked.

"That's what I heard. I heard it’s owned by a very rich Ukrainian, that’s what I heard. But they brought in another company to investigate the server. Why didn't they allow the FBI in to investigate the server? I mean, there is so many things that nobody writes about. It's incredible."

Then-President Trump mentioned the company by name in his phone call with Ukrainian President Volodymyr Zelenskyy, the same phone call that led to his impeachment.

"I would like you to find out what happened with this whole situation with Ukraine; they say CrowdStrike ... I guess you have one of your wealthy people. ... The server, they say Ukraine has it," Trump said according to CNN. "[William Barr will call] you or your people and I would like you to get to the bottom of it," Trump added.

— (@)

'I wish I could say I was surprised, but I'm not.'

Not to be forgotten, CrowdStrike has been involved with the World Economic Forum for some time.

In August 2015, the WEF named it a "Technology Pioneer" for "driving visionary leadership and long-standing market value."

In 2020, the WEF started its partnership against cybercrime with a stated goal of "harness[ing] AI to Combat Cybercrime."

CrowdStrike is one of the companies involved in the partnership.

— (@)

Also, Americans may be interested in learning that investment giant Vanguard is the largest shareholder of CrowdStrike shares, with a combined 12.41% ownership between Vanguard and Vanguard Index Funds. BlackRock also has ownership but at less than 1%.

“I wish I could say I was surprised, but I'm not," Return's Peter Gietl said of Vanguard's ownership. "Unfortunately BlackRock and Vanguard have bought up large stakes in many of the most important companies around the world. It becomes more and more clear that the 'free market' is a mirage on the macro level, and a few select, deep state approved companies have captured control of most industries," Gietl continued.

"What's particularly concerning about this outage is that CrowdStrike had kernel access to most of the systems around the world. This seems very dangerous, allowing a hacker or an accident to crash systems around the world. Never mind that a WEF partner has that level of system access," he added.

It should also be noted that Nancy Pelosi owns significant shares in CrowdStrike, having purchased between $500,000 and $1,000,000 worth of shares in 2020.

A page called Nancy Pelosi Stock Tracker, which monitors the politician's extremely profitable trading, claimed that she owns "millions in Crowdstrike."

Friendly reminder, Pelosi owns millions in Crowdstrike 💅

— Nancy Pelosi Stock Tracker ♟ (@PelosiTracker_) July 19, 2024

Like Blaze News? Bypass the censors, sign up for our newsletters, and get stories like this directly to your inbox. Sign up here!

It’s no secret that the housing market in the U.S. is a giant disaster. Interest rates have skyrocketed, prices have quadrupled, and these mysterious entities seem to swoop in with cash offers and buy up many of the available homes on the market.

What’s going on?

Democratic candidate RFK Jr. recently addressed these issues on the "Tim Dillon Show."

“Not only are we, you know, suffering inflation from the constant wars,” but “also you have these three giant companies – BlackRock, State Street, and Vanguard,” who “ already own everything, and now they've decided they're going to buy every single-family home in America.”

“They're on track now to control, to own … 60% of the single-family homes in America within six years,” he explains.

It’s no wonder young people feel so discouraged these days. This is a death sentence to many people’s dreams of owning a home.

“Think about this for a second,” says Dave Rubin. “They're telling us and have been telling us for years: ‘You will owe nothing and be happy.”’

“Now the banks have gone from 2.5%-3% interest rates” to “around 9%, so the average person now if every month you have to pay 9% on that mortgage, now you're paying an awful lot,” Dave explains, “and suddenly you can't get that mortgage, you can't buy that house, and then what happens?”

“You have to end up renting,” which means “you're getting no equity, you're not building wealth over time,” and most importantly, you’re not owning anything, which is exactly what these mega corporations want.

“You can see the connection,” Dave says. “If the banks raise interest rates high enough, the average person is like, ‘I can't take out the loan’…and then BlackRock and Vanguard and these other companies come in … and they just buy the house for cash.”

Once they acquire the house, “they let it be empty … or they then allow it to be rented,” meaning they own everything, while people own nothing, which is exactly what they’ve said their plan is.

“So you see how the banks are connected to exactly what BlackRock is doing,” Dave concludes.

To enjoy more honest conversations, free speech, and big ideas with Dave Rubin, subscribe to BlazeTV — the largest multi-platform network of voices who love America, defend the Constitution, and live the American dream.

Woke agendas have cost Anheuser-Busch and Target billions in market value. However, major corporations are being pressured to push progressive causes by powerful investment firms, according to an ex-Anheuser-Busch exec.

Anheuser-Busch InBev has reportedly lost $27 billion in market value following the Bud Light promotion with LGBTQ activist Dylan Mulvaney and subsequent boycotts.

Boycotts of Target erupted after the national retailer promoted Pride month with "tuck-friendly" bathing suits, LGBTQ onesies for babies, and products from a transgender designer promoting Satanism. The boycotts caused JPMorgan to downgrade Target's stock, and the retail chain's share price dropped 14%.

Dominant investment firms are strong-arming companies to promote progressive values despite alienating large swaths of their customer base says Anson Frericks – former president of Anheuser-Busch sales and distribution.

"You just have to follow the money," Frericks said during an appearance on "Jesse Watters Primetime." "You take a look at BlackRock, State Street, Vanguard – they manage $20 trillion worth of capital."

Frericks noted that these impactful investment firms manage massive pension funds, such as the state of California's pension fund – the largest in the country. Frericks said that California politicians wield influence on which companies these firms invest in.

"In California, for example, they recently have mandated those large pension funds that they divest from things like fossil fuels and oil and gas, and then when Bill de Blasio, [former] mayor of New York, was there, he did the same thing," he said.

Frericks added, "But they also tell BlackRock, State Street, and Vanguard if they're going to manage their money, they have to commit to things like ESG — diversity, equity, inclusion — and adopt firm-wide commitments that they therefore then force onto all the major companies in corporate America."

Frericks said he left Anheuser-Busch because large companies began engaging in politics and telling customers "how to live their lives."

He pointed to Georgia legislators passing election integrity laws, then BlackRock, Coca-Cola, Delta Airlines, and MLB publicly opposing the law that didn't directly affect them.

Frericks told Fox News host Jesse Watters, "But what was crazy to me was that after the fact, BlackRock came out and they said, 'We're against this law. We think this is bad for democracy, this is bad for society,' and they basically then had companies like Coca-Cola, like Delta and heck — even Major League Baseball, they canceled an All-Star Game over this."

\u201cFmr. Anheuser-Busch Exec. on How BlackRock, State Street, & Vanguard Force Companies to Go Woke\n\n\u201cCitizens should be able to decide these things through free and fair elections, not necessarily with a small group of asset managers and CEOs that are telling individuals how to live\u2026\u201d— Chief Nerd (@Chief Nerd) 1685880006

Frericks warned that BlackRock, State Street, and Vanguard – known as the "Big Three" – are "proponents of what's called 'stakeholder capitalism,' which is a belief that businesses should be run not only to increase value to shareholders, but to serve all stakeholders, including government agencies, activists, and non-governmental organizations."

"The Big Three began to issue guidelines on how they expected their portfolio companies to honor this 'commitment' by implementing so-called Environmental, Social, and Governance, or ESG, targets, and scores," Frericks wrote in the Daily Mail. "To encourage compliance, the Big Three uses their power as shareholders to influence who sits on corporate boards."

He added, "The Big Three also wield enormous influence when it comes to executive pay. According to one study, a shocking 73% of S&P 500 companies now tie executive compensation to ESG measures. If a CEO doesn't weigh in on the latest social issue quickly enough, his or her bonus could be in jeopardy."

Frericks wrote that political and cultural issues "should be settled at the ballot box, not in the board room."

Previously, Glenn Beck warned of the dangers of ESG and how it could fundamentally transform the entire western world on BlazeTV.

How TERRIFYING new ESG rules will transform the ENTIRE WORLD www.youtube.com