Right-wing investor to challenge traditional banking with national crypto bank

A challenger to traditional banking has finally emerged, and it is coming from the right wing.

After billionaire Palmer Luckey was reported to be starting a cryptocurrency venture, it was unclear how big the scope would be and if it would work only in digital currencies.

Now that public filings have emerged, the new project was revealed to have major conservative backing while literally giving traditional banks a run for their money.

'The bank will be a national bank ... providing traditional banking products.'

Blaze News reported last week that Luckey had teamed up with Joe Lonsdale to start the new company; Lonsdale co-founded Palantir Technologies with Luckey and has his own software companies, as well. At the same time, Lonsdale's venture firm 8VC led a $225 million fundraising round for the new company to meet federal regulatory requirements.

The tech entrepreneurs were first thought to be starting a bank that would work primarily on maximizing returns for tech startups, but recent filings revealed much more is in store. According to the Financial Times, the new company has applied for a national bank charter, which would it give license to operate as a typical banking institution.

The Times also revealed a new right-wing mega-donor has joined the mix.

RELATED: Palmer Luckey-led crypto bank promises startups a capital hoard safe from scheming feds

None other than Peter Thiel and his venture capital fund, the Founders Fund, will also be backing the startup, according to two of the Times' sources.

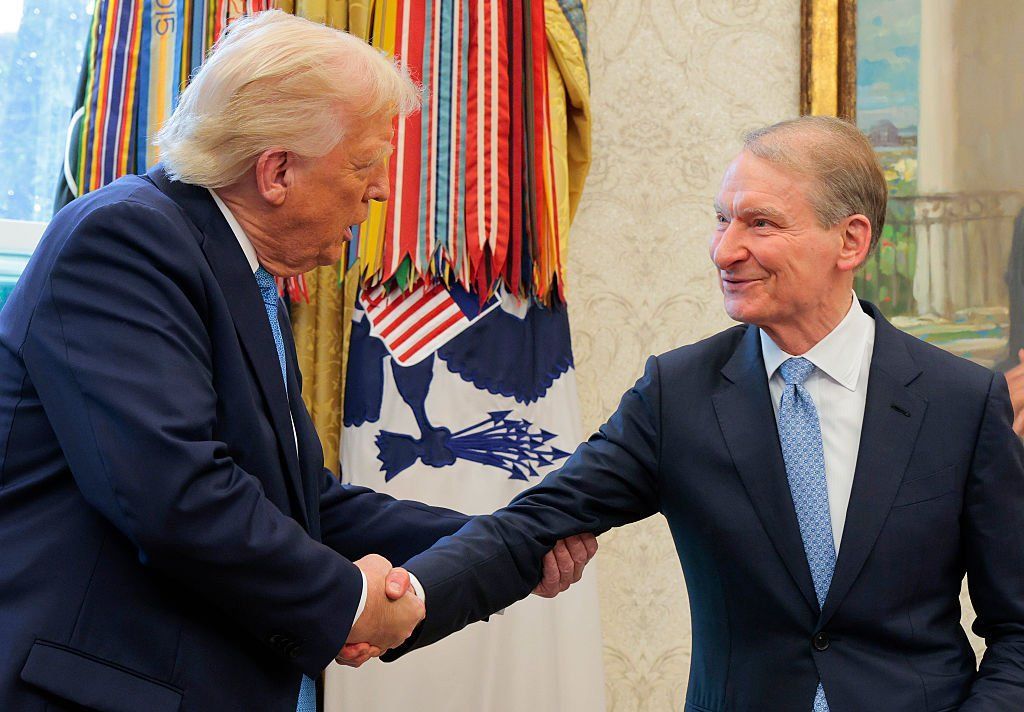

Thiel is, of course, known for giving millions to Republican campaigns over the years, including over a million dollars to President Donald Trump for his 2016 campaign.

This new undertaking, dubbed Erebor, is yet another one of Luckey's companies named after themes found in J.R.R. Tolkien books. This one refers to the mountain in "The Hobbit," where the dragon Smaug hoards his gold. His other companies, Anduril and Palantir, are references to a character's sword and a magical seeing stone, respectively.

Filings revealed, "The bank will be a national bank ... providing traditional banking products, as well as virtual currency-related products and services, for businesses and individuals."

Adding to previous speculation, the target market was listed as businesses that are part of the American "innovation economy," including tech companies focused on virtual currencies, artificial intelligence, or defense manufacturing.

RELATED: The One Big Beautiful Bill Act hides a big, ugly AI betrayal

Erebor will work with stablecoins, cryptocurrency tied to relatively stable assets like the U.S. dollar or gold. This is done to limit the volatility of a coin without sacrificing its benefits, creating investment opportunities far in excess of simply purchasing and holding, say, Bitcoin.

For example, President Trump works with the stablecoin USD1, which is attached to the U.S. dollar.

"Longtime crypto people know it's a fine line between being targeted by government and being co-opted by government," explained Blaze Media's James Poulos. "But it's hard to strike the right balance without risking the worst of both worlds — a crypto economy that regulators tolerate but can destroy or manipulate with the wave of a hand."

Poulos added that the most stable compromise naturally involves figures that Washington relies on in other high-tech industries, "however much freedom-loving 'maxis' wish that weren't the case."

"Regardless, it doesn't matter how perfect a balance the kingpins of crypto and banking might strike if Bitcoin (to take the biggest example) falls short of its potential as a peer-to-peer currency and becomes just another place for established wealth to accrue value," Poulos concluded.

Erebor's filing said it plans on working with non-U.S. companies that are "seeking access to the U.S. banking system," according to the filing, and said it would "differentiate itself" by working with customers who are not well served by "traditional or disruptive financial institutions."

Like Blaze News? Bypass the censors, sign up for our newsletters, and get stories like this direct to your inbox. Sign up here!

Photo by Anna Moneymaker/Getty Images

Photo by Anna Moneymaker/Getty Images

Photo by IAN MAULE/AFP via Getty Images

Photo by IAN MAULE/AFP via Getty Images

Photo by Tom Brenner for the Washington Post via Getty Images

Photo by Tom Brenner for the Washington Post via Getty Images