![]()

You won’t hear many people object to President Trump’s executive order to ban corporate purchases of residential homes. The idea sounds like common sense. But it targets a minor symptom while leaving the real disease untouched — and in some respects, it risks making that disease worse.

Institutional home-buying already peaked during the COVID-era bubble and has receded since then. In most markets, corporate ownership represents a small share of total inventory. Even at its height, it never explained why housing costs exploded for everyone else. High prices created the opportunity for institutional buyers, not the other way around.

The goal should not be cheaper debt. It should be cheaper homes.

Government policy inflated the housing market. Institutional buyers simply responded.

During COVID, the Federal Reserve pushed interest rates toward zero. Mortgage rates fell below 3%. At the same time, the Fed bought roughly $2.7 trillion in mortgage-backed securities, and HUD expanded “affordable homeownership” programs that widened the pool of subsidized buyers. Those policies produced predictable results.

When the government offers 2.5% interest for 30 years — often paired with minimal down payments backed by the FHA — buyers flood the market. Sellers respond by raising prices. The bubble becomes a feature, not a bug.

Institutional buyers entered that environment because it looked like easy money. Higher home prices also pushed rents up, so developers built more homes for long-term rental. Both trends flowed from the same source: a government-shaped market that made housing unaffordable, then subsidized the unaffordability.

Trump now seems focused on the symptom — corporate buyers — while ignoring the machinery that inflated the market in the first place.

He has spent months fighting Federal Reserve Chairman Jerome Powell to bring rates back down toward zero. Meanwhile, the Federal Reserve still holds about $2.1 trillion in mortgage-backed securities. Trump has also announced a plan for Fannie Mae and Freddie Mac to purchase another $200 billion in MBS. The stated goal is to lower mortgage rates.

But the goal should not be cheaper debt. It should be cheaper homes.

RELATED: ‘Rents will come down’ — but not in sanctuary cities: Loan agent chronicles homes apparently abandoned by illegal aliens

![]() mphillips007 via iStock/Getty Images

mphillips007 via iStock/Getty Images

Artificially lowering rates props up prices and slows correction. Prices in many markets have begun to soften. That correction should continue. Policies designed to suppress rates will keep prices elevated and risk inflating the next bubble.

That brings us back to corporate home-buying. Even at the COVID peak, institutional buyers — defined as entities owning at least 100 single-family homes — owned about 3.1% of the housing stock. That number has since fallen to around 1%. Investors see the market turning, and they have started backing away.

So Trump’s corporate-purchase ban arrives late, targets a relatively small share of the market, and risks becoming cosmetic cover for policies that keep the bubble inflated.

If Trump wants to drive prices down and permanently realign housing with median incomes, he has to reverse the policies that inflated the bubble. That means attacking the structure, not the headline.

Get government out of the mortgage market. Trump’s next Federal Reserve chair must commit to unwinding the Fed’s mortgage-backed securities portfolio. That $2.1 trillion cushion keeps mortgage rates lower than the market would otherwise set. Those artificially low rates inflate home prices.

End universal “homeownership for everyone” policy. The federal government keeps subsidizing buyers who are not ready to buy. Those programs inject cash into housing demand that would not exist in a real market. The goal should align prices with income, not chase a utopian dream of universal ownership. After decades of subsidies, deductions, and federal credit support, the home ownership rate still sits around the mid-60% range.

Stop chasing near-zero interest rates. A 30-year loan at 2% sounds appealing until you realize what it does to prices. Cheap money bids up homes across the board. Buyers pay the price forever even as politicians brag about the “deal.” Trump should let the market set rates. Recent rate cuts have not restored normal home buying either. Sales remain weak because prices remain too high.

End the 30-year fixed mortgage. Instead of floating longer loans — 50 years? Madness! — the country should move in the opposite direction. Before the New Deal era, short-term mortgages, often three to seven years, dominated the market. Federal policy transformed that structure.

Franklin D. Roosevelt signed the National Housing Act of 1934, establishing the Federal Housing Authority. The FHA insured long-term, fully amortizing mortgages with fixed rates, low down payments, and standardized payment schedules. That system moved the market away from short-term balloon loans and laid the foundation for longer terms.

RELATED: America tried to save the planet and forgot to save itself

![]() jhorrocks via iStock/Getty Images

jhorrocks via iStock/Getty Images

Congress eventually authorized the 30-year mortgage in 1954. VA loans under the GI Bill and the expansion of Fannie Mae and Freddie Mac later built a secondary market that made long-term fixed-rate loans attractive to lenders.

Government insurance, guarantees, and liquidity support made 30-year fixed mortgages feasible, which is why they represent 80%-90% of U.S. mortgages today. Without those interventions, lenders would not carry that risk.

The larger point remains simple: Sellers can’t charge prices buyers can’t pay. Prices explode only when government subsidies and government-backed long-term debt expand what buyers can “afford” on paper.

Unwind the subsidies. Unwind the guarantees. Unwind the cheap-money machinery. Let incomes, not federal policy, set the ceiling.

Housing should function like other consumer markets, not be engineered by Washington. Prices should reflect what people earn.

That’s the fix. Everything else treats symptoms and pretends to solve the problem.

Tierney L. Cross/Bloomberg via Getty Images

Tierney L. Cross/Bloomberg via Getty Images Photo by Kevin Dietsch/Getty Images

Photo by Kevin Dietsch/Getty Images 'I don't see how the front-line position really can be ... the final position without ... kind of tilting the balance here too far the other direction from where the solicitor general is,' said Justice Kavanaugh.

'I don't see how the front-line position really can be ... the final position without ... kind of tilting the balance here too far the other direction from where the solicitor general is,' said Justice Kavanaugh. In a stunning admission, Democrat Lisa Cook’s attorney conceded that President Trump possesses the legal authority to remove his client from her role as a member of the Federal Reserve Board of Governors. The moment came during Wednesday’s Supreme Court oral arguments in Trump v. Cook, which centers around a request brought by the Trump […]

In a stunning admission, Democrat Lisa Cook’s attorney conceded that President Trump possesses the legal authority to remove his client from her role as a member of the Federal Reserve Board of Governors. The moment came during Wednesday’s Supreme Court oral arguments in Trump v. Cook, which centers around a request brought by the Trump […]

mphillips007 via iStock/Getty Images

mphillips007 via iStock/Getty Images jhorrocks via iStock/Getty Images

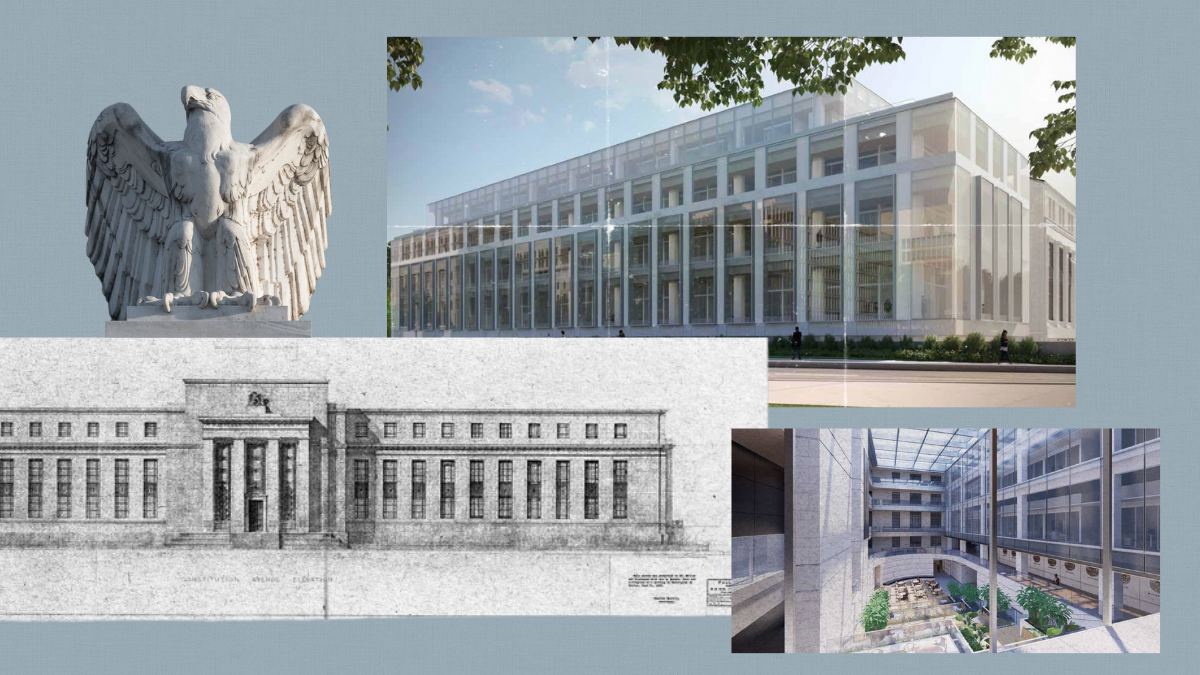

jhorrocks via iStock/Getty Images If we're going to build palaces for our bureaucrats, can they at least be pretty?

If we're going to build palaces for our bureaucrats, can they at least be pretty?