Democrats Scramble To Fix Consequences Of Their Spending Because It’s Election Year

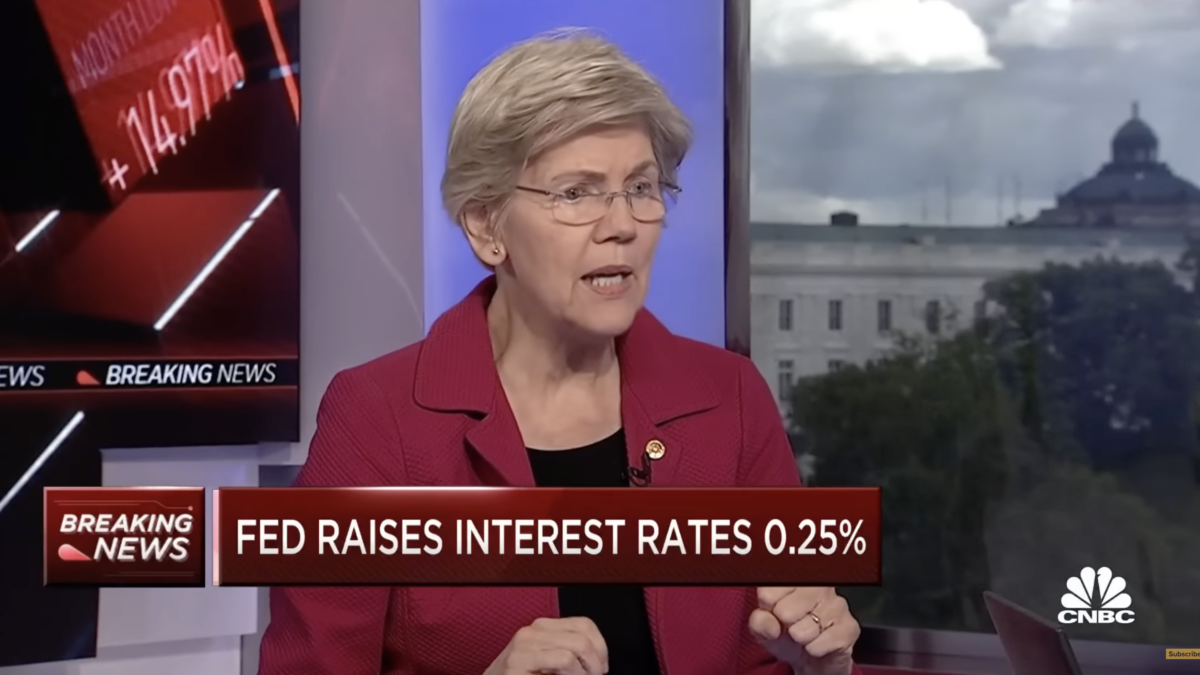

Elizabeth Warren is complaining about high interest rates after creating the very conditions that made rates spike in the first place.

Elizabeth Warren is complaining about high interest rates after creating the very conditions that made rates spike in the first place.The point of having good credit is to be rewarded with better treatment and lower rates, right?

Well, according to the Washington Times, it now is the opposite.

Starting on May 1 under a new Biden rule, Americans with good credit scores will be forced to pay higher mortgage rates than those with poor scores.

Glenn Beck’s co-host Stu comments, calling it a “fundamental reversal of all economic theory.”

Beck calls it “stealing from the rich to give to the poor” and a “redistribution of wealth.”

He then compares it to the financial crisis of 2008.

“Wasn’t there something like this that happened? Two thousand four, five, six, and seven?” He continues, “They were incentivizing banks to give loans to people who couldn’t really afford the houses.”

“Although, at least in that case they weren’t punishing the people who were paying their bills,” Stu adds.

“If you don’t understand the concept that socialism and all of this stuff — it’s not going to make anybody happy. We’re all going to be equally miserable.”

“You won’t own anything. This is how it begins.”

To enjoy more of Glenn’s masterful storytelling, thought-provoking analysis and uncanny ability to make sense of the chaos, subscribe to BlazeTV — the largest multi-platform network of voices who love America, defend the Constitution and live the American dream.