No peace without steel: Why our factories must roar again

Our country is standing at a crossroads. Neither the world nor America’s place in it is what it was a generation ago. The unipolar moment is over. And yet, many in the Republican Party seek to claim the mantle of America First while continuing the same failed adventurism of the past.

National conservatism as a movement agrees that these people and ideas must be stopped. But we have failed to check their influence in the party largely because we have not offered an alternative that both meets the real threats to American security and balances national interest, the deterrent effect, industrial capability, and political will.

We cannot deter our adversaries if we cannot outbuild them.

I outlined a framework for what a genuine America First foreign policy would entail in an essay for the National Interest. I called for developing a doctrine that I dubbed “prioritized deterrence.” That essay was the first step toward forging a set of foreign policy principles that can unite national conservatives and set the agenda for the Republican Party for the next generation.

A key component of prioritized deterrence is industrial capacity. Deterrence depends not only on our military’s technical capability, but also on our industrial capacity — certainly in defense, but particularly in non-defense. Without factories humming, shipyards bustling, and energy production roaring, our ability to deter wanes. We cannot project strength abroad if we cannot produce strength at home.

Prioritized deterrence is not retreat. It is a recalibration. It rejects the fantasy that America can — or should — police every corner of the globe. Instead, it demands that we concretely identify our vital national interests. No more vague talk of values or entering endless nation-building campaigns. This will require open and honest debate.

The days of tarring dissenting voices as unpatriotic should be left in the rearview mirror. In fact, I recently sent a letter to President Donald Trump urging him to award Pat Buchanan the Presidential Medal of Freedom. Buchanan was right about nearly everything 20 years before anyone else realized it, including his recognition that Iraq was not aligned with our strategic national interests. We need serious voices like his in the conversation during these all-important debates.

Prioritized deterrence belongs firmly within the realist school of thought. It rests on restraint and on the quantifiable limits of a nation’s resources and people. Those limits force policymakers to rank threats to the American way of life by urgency and severity.

Deterrence depends on credibility: An aggressor must believe it will pay an unacceptable price for attacking the United States. But not every hostile nation deserves brinkmanship. National constraints and the risk of escalation demand that we focus only on the gravest threats.

Kinetic action must remain credible but reserved as a last resort. The U.S. military exists not only to fight and win wars but, more importantly, to deter them before they begin and ensure American security.

Prioritized deterrence in practice

What does a strategy that contends with these essential questions look like in practice?

Consider the 2020 strike on Qassem Soleimani. A single, precise action eliminated a key architect of Iran’s malign influence, sending a message to Tehran: Kill Americans, and you will pay. No endless wars, no nation-building, just a clear signal backed by lethal force.

Now consider Operation Midnight Hammer. President Trump authorized a precision strike that was executed flawlessly. He rejected calls to further escalate into regime change. As a result, we eliminated a key threat while managing the retaliation from Iran and successfully stepped off the escalation ladder before the region became destabilized. That’s prioritized deterrence in action.

What do these strikes have in common, other than the antagonist? In both cases, the president laid out clear, precise explanations of America’s vital national interest. He aligned the use of force with American goals, and he did so precisely with explicit acknowledgment of our constraints and limitations.

Additionally, both strikes relied on American technological supremacy: drones, stealth bombers, precision munitions, and intelligence — all products of a sophisticated industrial base. However, we cannot just rely on our qualitative military advantage as a silver bullet for deterrence. At a certain point, quantitative advantages become qualitative, which is one of the reasons China’s industrial might has made it so formidable on the world stage.

What is making us less formidable on the world stage is Ukraine. We should not be funding the war in Ukraine, and we should never have been involved in that conflict from the beginning. The proponents of prolonging this conflict seem unable or unwilling to grasp the reality that we do not have the industrial capacity to provide Ukraine with what they need — to say nothing of providing for our own needs here at home.

RELATED: Why won’t American companies build new factories here?

In fact, Ukraine’s defense minister has said his country needs 4 million 155-millimeter artillery shells per year and would use as many as 7 million per year if they were available.

In 2024, then-Senator JD Vance correctly noted that even after drastically ramping up production, the U.S. could still only produce 360,000 shells per year — less than one-tenth of what Ukraine supposedly needs. Vance was also doubtful of expert claims that we could produce 1.2 million rounds per year by the end of 2025. In the end, he was right, and the experts were wrong.

The Army now confirms that the U.S. is only on pace to produce 480,000 artillery shells per year. These aren’t highly sophisticated guided missiles either. Quantity, not quality, ended up winning the day.

Very simply, we must choose to put America first, as we do not currently have the capacity to both arm Ukraine and defend ourselves should the need arise.

Lagging behind

A candid assessment of our industrial capacity is that it’s lagging. The same voices that called for foreign adventurism also hollowed out our heartland and sent our manufacturing jobs overseas. We now face a new choice: Rebuild or be left to the ashes of history.

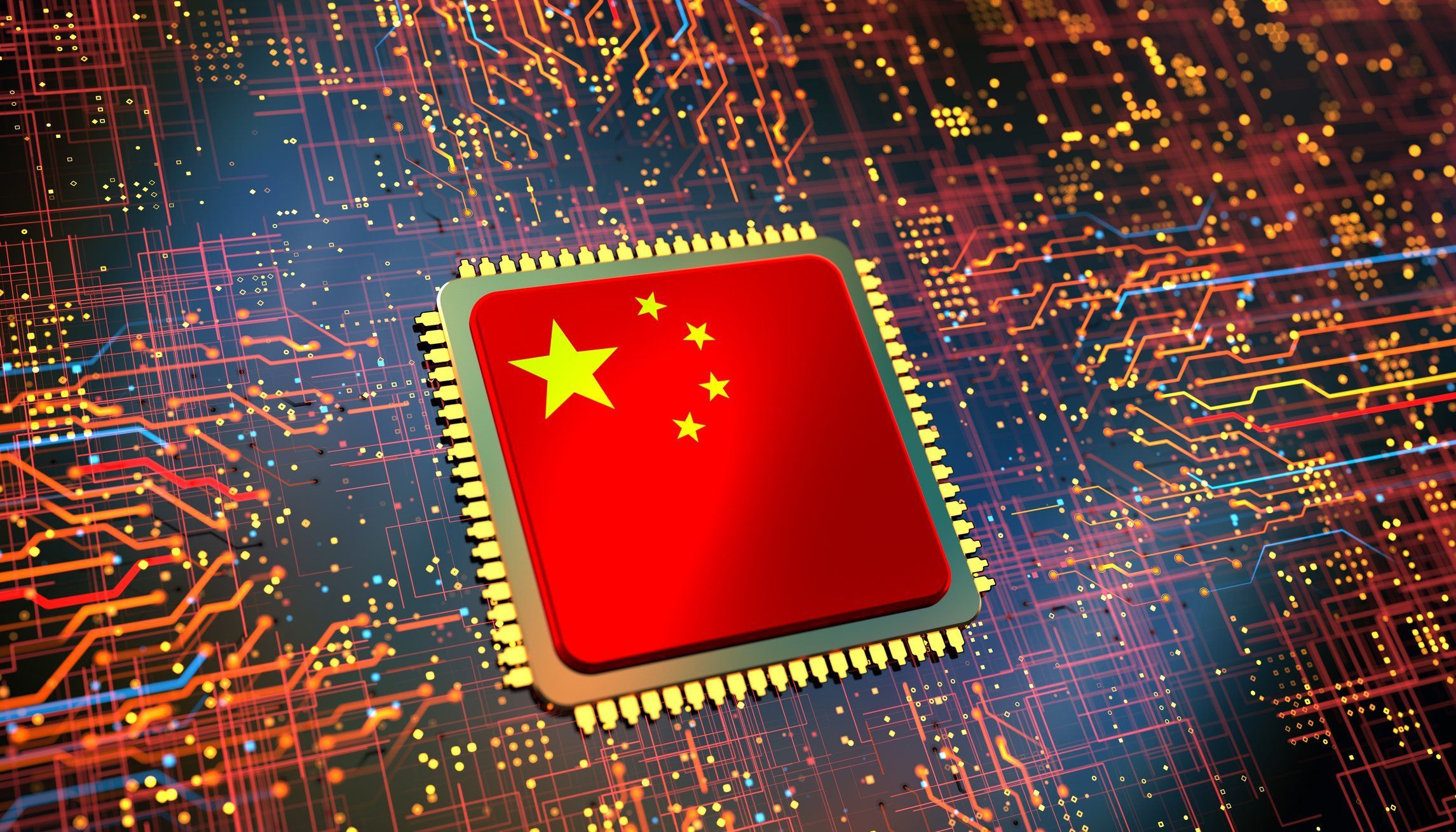

We cannot deter our adversaries if we cannot outbuild them. Our defense industrial base — shipyards, munitions factories, aerospace plants — lag significantly behind our peers, especially China. This is a far cry from the industrial base that won World War II.

The Virginia-class submarine program, for example, is crucial in countering China. Yet limited shipyard capacity, supply chain bottlenecks, and a shortage of skilled workers have created years-long delays. Chinese shipyards account for more than 50% of global commercial shipbuilding, while the U.S. makes up just 0.1%.

In 2024, a single Chinese shipbuilder constructed more commercial vessels by tonnage than the entire U.S. shipbuilding industry has since World War II. We cannot deter China in this state of industrial atrophy.

Reviving the entire industrial base

Just as critical — perhaps even more so — is the need to rebuild the U.S. industrial base as a whole, not just the defense sector. “If you want peace, prepare for war” means more than building ships. It means strengthening industry, shoring up families, and restoring the backbone of society. That creates jobs, secures supply chains, and projects strength without overextending our forces or wasting resources.

During World War II, the United States retooled civilian manufacturing almost overnight. Ford and General Motors turned out aircraft. Singer Sewing Machine Company built precision cockpit instruments. IBM produced fire-control systems for bombers. Civilian industry became the arsenal of democracy.

That capacity has withered. The COVID-19 pandemic revealed just how hollowed out our domestic base has become. America now relies on China for more than 80% of the active ingredients in pharmaceuticals. That dependence gives Beijing leverage.

Our weakness feeds China’s confidence. If defending Taiwan means empty pharmacy shelves across America, would Washington still respond? Beijing is counting on the answer. That calculation could determine whether China invades.

We need a manufacturing renaissance — steel mills, factories, foundries — because a nation that outsources its industry outsources its power.

Taiwan is indicative of another vital manufacturing sector where our capacity is lagging: the semiconductor industry. These chips power everything from smartphones to missile systems, yet the U.S. produces less than 12% of the world’s supply. Meanwhile, Taiwan’s TSMC dominates. If China invades Taiwan, our military and domestic economy will grind to a halt.

This is not theoretical; it’s a ticking time bomb, one that is tied directly to our ability to credibly deter China.

This equation must change. If America produces pharmaceuticals and semiconductors at home, adversaries lose their leverage. Deterrence grows stronger without firing a shot or putting boots on foreign soil.

I think of my home state of West Virginia, where Weirton Steel once stood as one of the largest steel producers in the world. At its peak, it employed 23,000 people.

That steel not only secured American dominance in industry, it sustained families, churches, schools, and communities. A single paycheck could buy a home and support a family. Mothers could raise children and stay active in their schools and churches because one income was enough.

The same bipartisan leaders in Washington who chased short-term gains instead of building a strong industrial base and healthy families signed Weirton Steel’s death warrant. They let China flood the U.S. market with cheap tin plate steel, and Weirton paid the price.

We begged President Joe Biden for tariff relief, but he followed the pattern of his predecessors and did nothing. The result: Weirton’s tin plate mill was idled, thousands of workers lost their jobs, and the community was gutted.

Today, only one blast furnace capable of producing tin plate steel remains in the entire United States. One.

China’s gotten the picture

Economic capacity and industrial output are critical in the defense of the nation and create a better quality of life. A strong manufacturing sector is, in itself, a strong deterrent. China understands this.

Its “Made in China 2025” plan, cited in then-Sen. Marco Rubio’s 2019 address at the National Defense University, declared:

Manufacturing is the main pillar of the national economy, the foundation of the country, the tool of transformation, and the basis of prosperity. Since the beginning of industrial civilization in the middle of the 18th century, it has been proven repeatedly by the rise and fall of world powers that without strong manufacturing, there is no national prosperity.

This is obviously true.

China now produces more than half the world’s steel, powering both its infrastructure and its military. Meanwhile, we’ve allowed our own steel industry to wither, importing from abroad while American mills rust. That failure is not only economic. It’s strategic.

We won World War II in part because we built planes, tanks, and ships faster than the Axis powers could destroy them. A robust industrial base — defense and non-defense — is a deterrent in itself. It signals to adversaries: We can outfight you, outbuild you, and outlast you.

We need a manufacturing renaissance — steel mills, factories, foundries — because a nation that outsources its industry outsources its power. Deindustrialization was a choice, a choice with disastrous consequences. We must now make the choice to rebuild and reindustrialize.

RELATED: Read it and weep: Tariffs work, and the numbers prove it

Unleashing American energy

To have manufacturing dominance, we must unleash energy dominance. Factories don’t run on hope; they run on power — reliable, affordable, and abundant power. Wind and solar power are obviously not able to power anything. Thankfully, America’s superpower is the massive quantities of natural resources we have at our fingertips.

We have some of the largest proven reserves of both oil and natural gas of any nation in the world. This is a textbook example of our quantitative advantage becoming a qualitative advantage.

We have the largest proven reserve of coal in the world, nearly double the supply of the next closest country. Our energy potential is unlimited, and we must drastically ramp up our output if we want to meet the energy demands of the future economy.

Fossil fuels have long been the backbone of industrial power, and West Virginia’s coal and natural gas is its beating heart. Yet coal in particular has been under siege, not just from regulations but from corporate environmental, social, and governance policies pushed by firms like BlackRock that waged war on fossil fuels.

As state treasurer of West Virginia, I took a stand. I made West Virginia the first state in the nation to divest our tax dollars from BlackRock. I refused to let Wall Street’s agenda use our own state’s money to kill our coal industry. Today, more than a dozen states have followed our lead, rejecting ESG policies that undermine American energy dominance.

China, meanwhile, builds coal plants at a breakneck pace, powering its industrial juggernaut. They use coal to fuel their steel production while we let our own mines and mills idle. We cannot let this continue.

Thanks to President Trump, we’ve begun to change course. For the first time in my lifetime, a president took a stand for coal, signing executive orders promoting domestic coal production. But we need to go further. We must become a global juggernaut with an “all of the below” approach to energy — coal, oil, natural gas, and nuclear must power our path to energy dominance.

Prioritizing America, deterring aggressors

America cannot do everything, everywhere, all at once. We are not a nation of infinite industrial capacity, infinite goods, or infinite will. Scarcity — of materials, of capacity, of resolve — forces us to choose. Prioritized deterrence is a framework for grappling with those choices.

It is a commitment to focusing our energies, rebuilding our industrial might, and unleashing the energy to power a 21st-century industrial base. It’s a rejection of overreach in favor of strength, of focus instead of distraction.

Leaders on both sides of the aisle over the last 40 years squandered the inheritance of peace, security, and industrial might in favor of globalization and foreign adventurism. We cannot afford to continue down that path. Correcting course will require open, honest, and sometimes intense debate.

It will require serious investments from business leaders in American manufacturing and public policies that assist in this reorientation. It demands that we do more to appropriately train and equip a skilled workforce.

But we must start now. America will build again, power again, and deter again. Not everywhere, not always — but where it matters most, with a strength that none can match.

Editor’s note: This article has been adapted from a speech delivered on Tuesday, Sept. 2, to the fifth National Conservatism Conference (NatCon 5) in Washington, D.C.

joebelanger/iStock/Getty Images Plus

joebelanger/iStock/Getty Images Plus MF3d/Getty Images Plus

MF3d/Getty Images Plus The existence of duplicate payments demonstrates the left’s desire to make all Americans dependent upon government.

The existence of duplicate payments demonstrates the left’s desire to make all Americans dependent upon government.

Nuthawut Somsuk via iStock/Getty Images

Nuthawut Somsuk via iStock/Getty Images

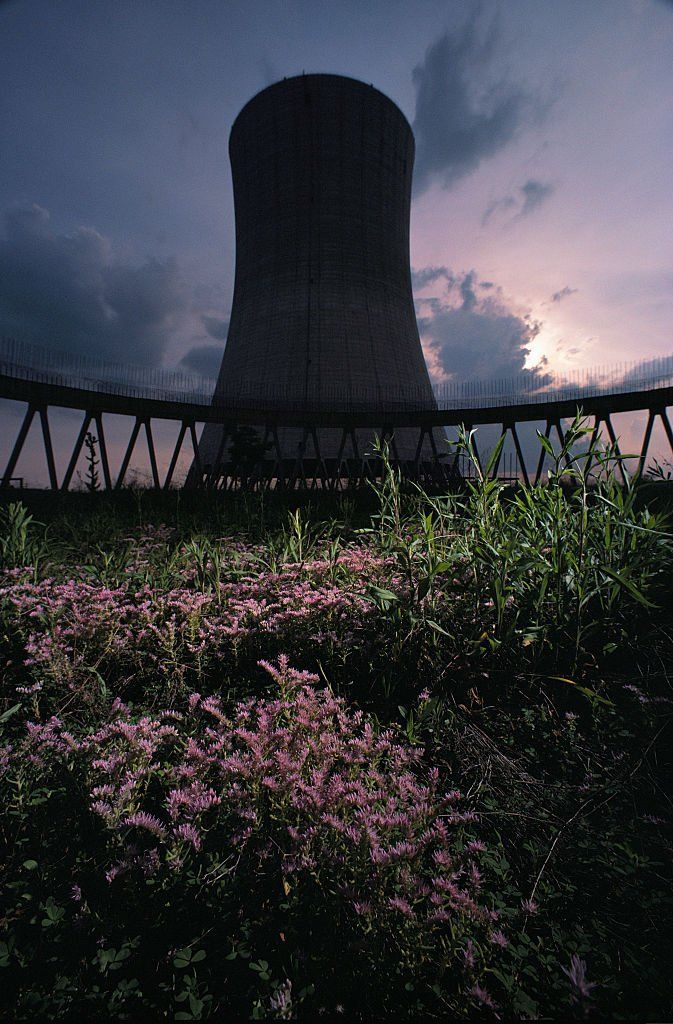

If completed, the four-unit Hartsville facility would have been the largest nuclear power plant in the world.Photo by Karen Kasmauski/Corbis via Getty Images

If completed, the four-unit Hartsville facility would have been the largest nuclear power plant in the world.Photo by Karen Kasmauski/Corbis via Getty Images adventtr via iStock/Getty Images

adventtr via iStock/Getty Images

halbergman via iStock/Getty Images

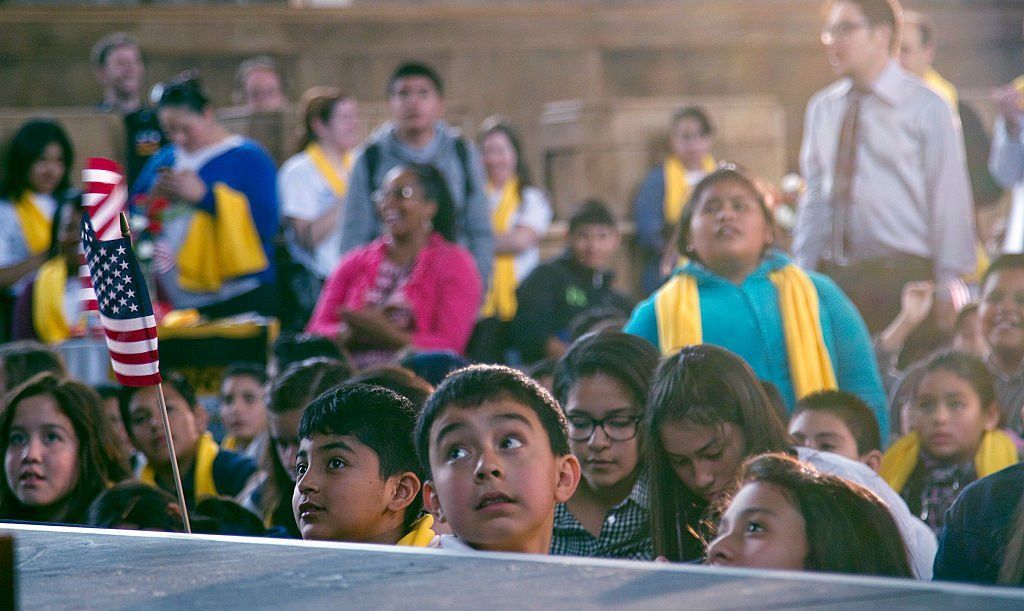

halbergman via iStock/Getty Images  Photo by Gina Ferazzi/Los Angeles Times via Getty Images

Photo by Gina Ferazzi/Los Angeles Times via Getty Images